Real Estate Transfer Tax Templates

Are you looking to buy or sell property? Are you aware of the real estate transfer tax? This tax is an important aspect to consider when engaging in a real estate transaction. Whether you are a buyer or a seller, understanding the real estate transfer tax can help you navigate the process smoothly.

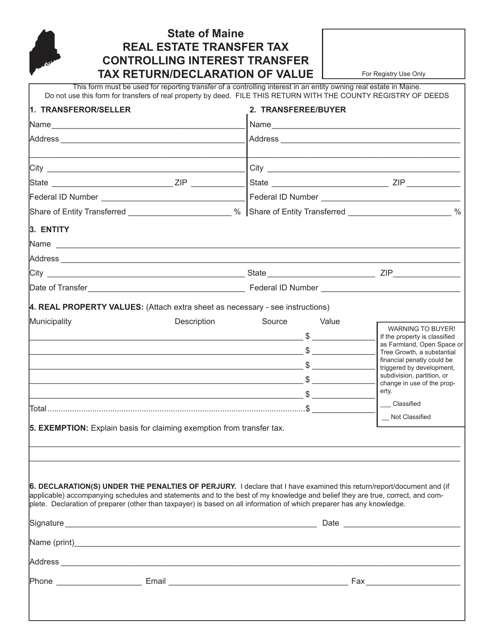

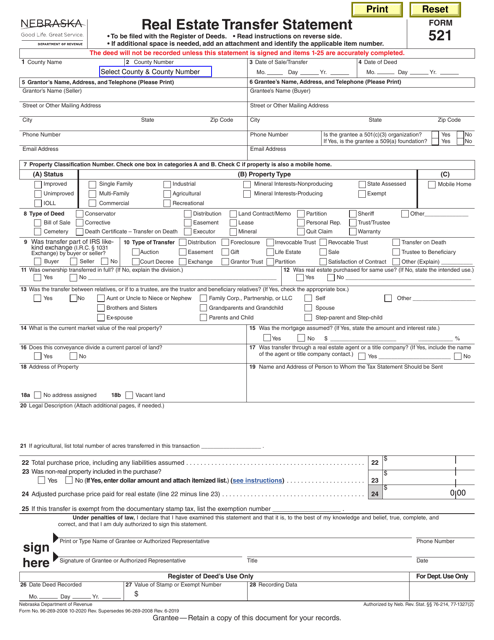

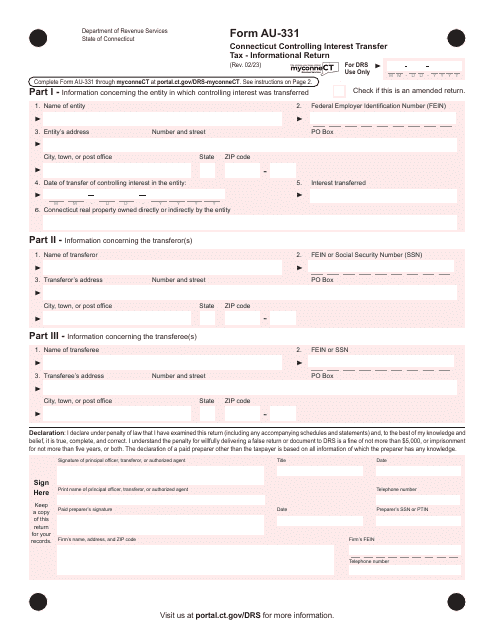

The real estate transfer tax refers to the tax imposed on the transfer of property ownership from one party to another. This tax is typically calculated based on the value of the property being transferred. It is important to note that the rates and regulations surrounding the real estate transfer tax may vary from state to state.

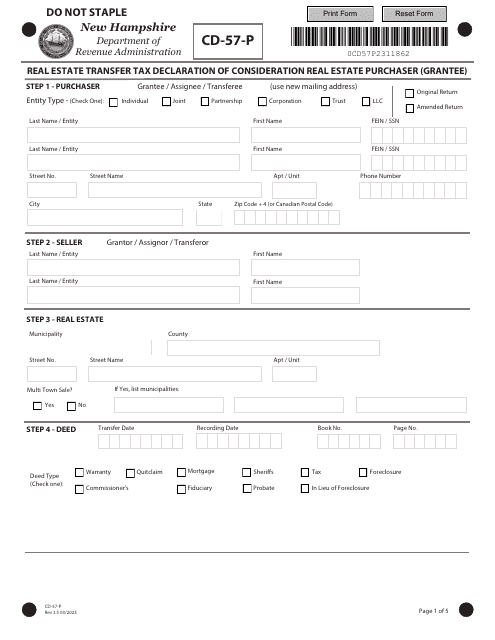

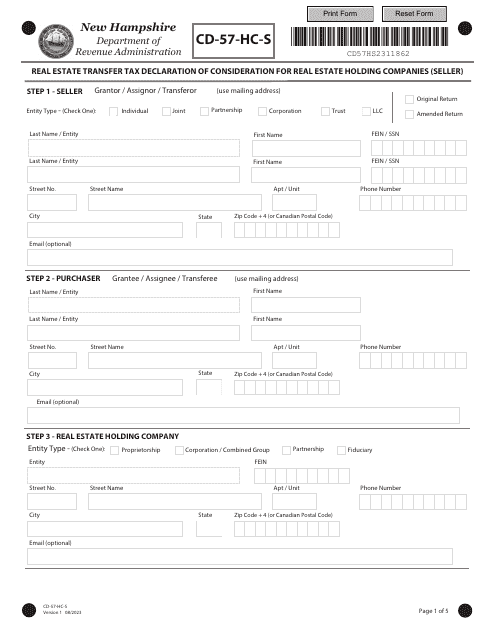

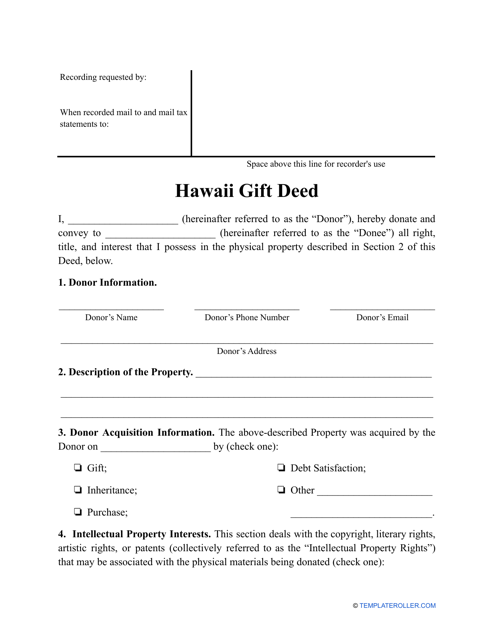

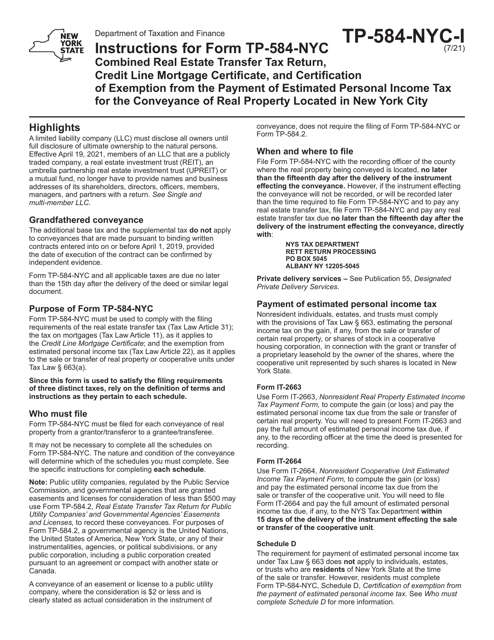

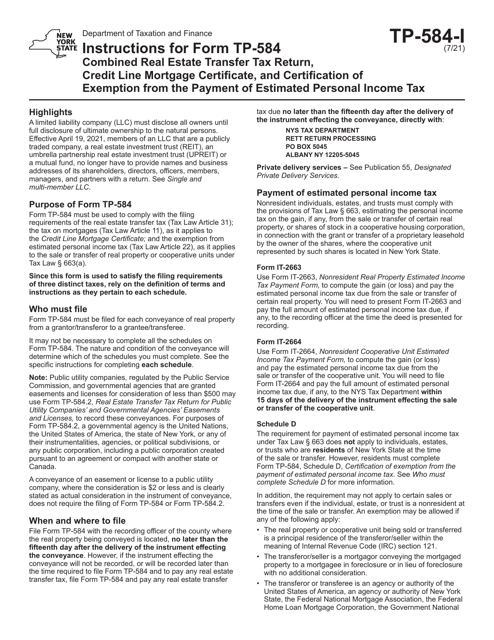

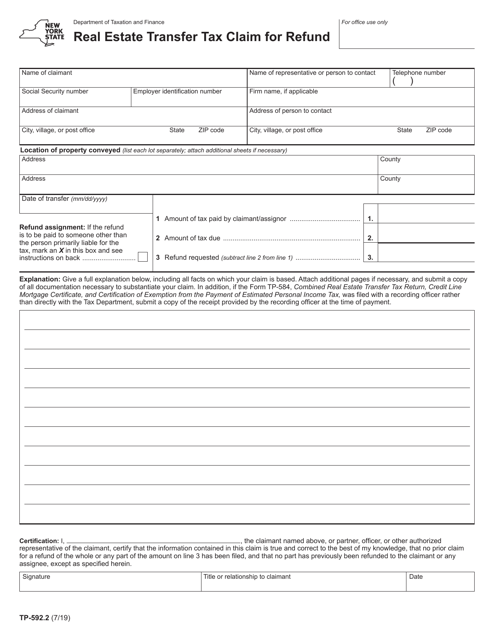

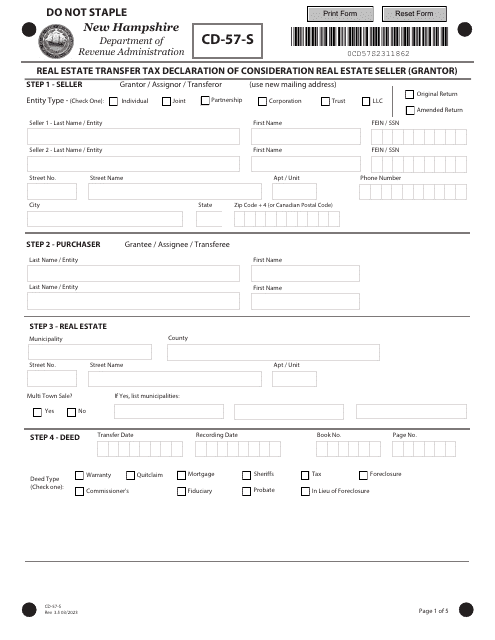

At our website, we provide a comprehensive collection of resources related to the real estate transfer tax. Our database includes a wide range of documents that can be helpful throughout the real estate transfer process. These documents include the Form CD-57-HC-S Real Estate Transfer Tax Declaration of Consideration for Holding Companies (Seller) in New Hampshire, the Gift Deed Form in Hawaii, the Form TP-584 Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, and Certification of Exemption From the Payment of Estimated Personal Income Tax in New York, the Form TP-592.2 Real Estate Transfer Tax Claim for Refund in New York, and the Form CD-57-P Real Estate Transfer Tax Declaration of Consideration Real Estate Purchaser (Grantee) in New Hampshire.

Whether you are a buyer, seller, or a professional in the real estate industry, our website is a valuable resource to learn more about the real estate transfer tax. Our collection of documents and alternate names for the real estate transfer tax document group will equip you with the knowledge and tools necessary to navigate the complexities of the real estate transfer process.

Visit our website now to access our vast library of resources on the real estate transfer tax. You can search for specific documents or browse through the different categories to find the information you need. Gain a better understanding of the real estate transfer tax and ensure a smooth and successful property transfer process.

Documents:

20

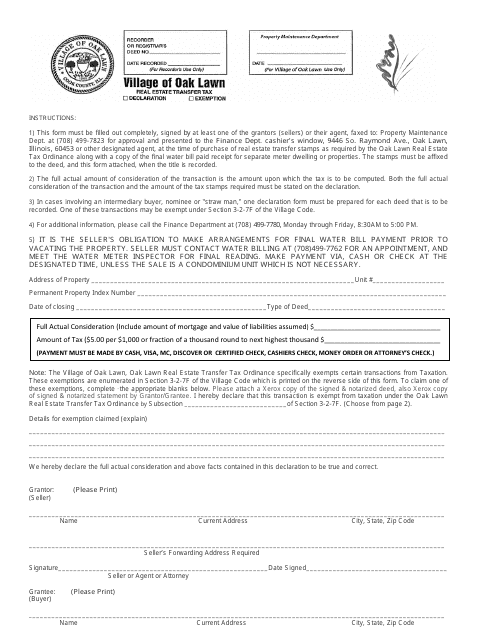

This form is used for reporting and paying the real estate transfer tax in Oak Lawn, Illinois. The tax is levied on the transfer of real property within the city limits.

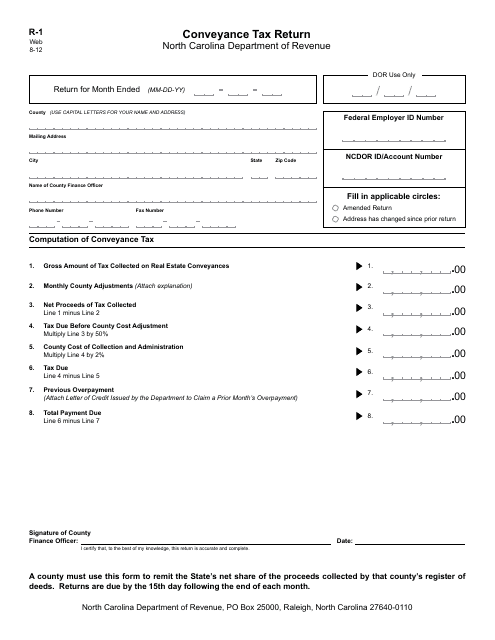

This Form is used for filing a Conveyance Tax Return in North Carolina.

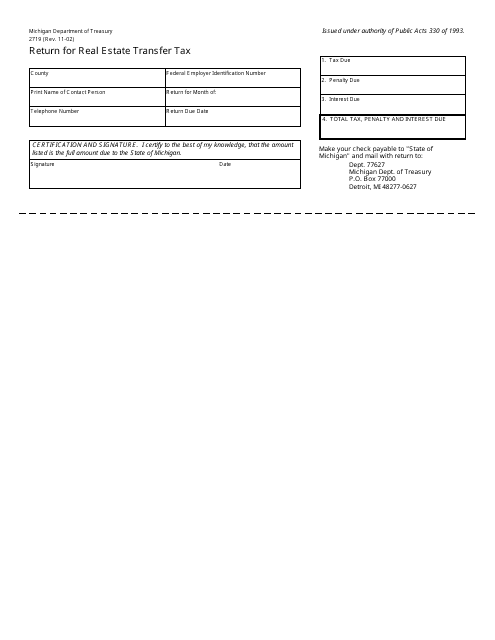

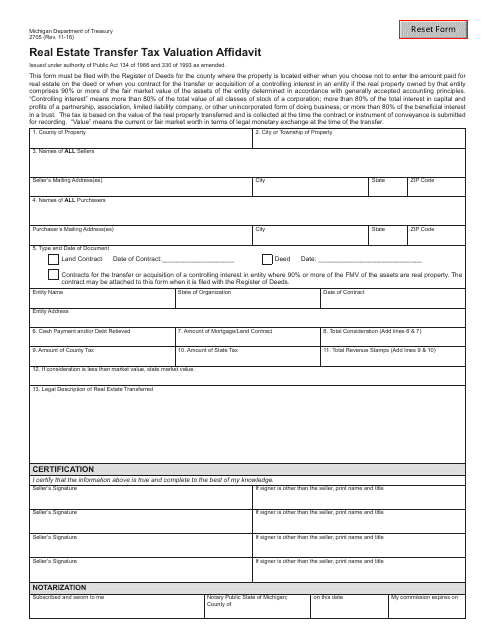

This form is used for reporting and paying the real estate transfer tax in the state of Michigan. It is required when a property is sold or transferred.

This Form is used for reporting the value of real estate transfers in Michigan and calculating the applicable transfer tax.

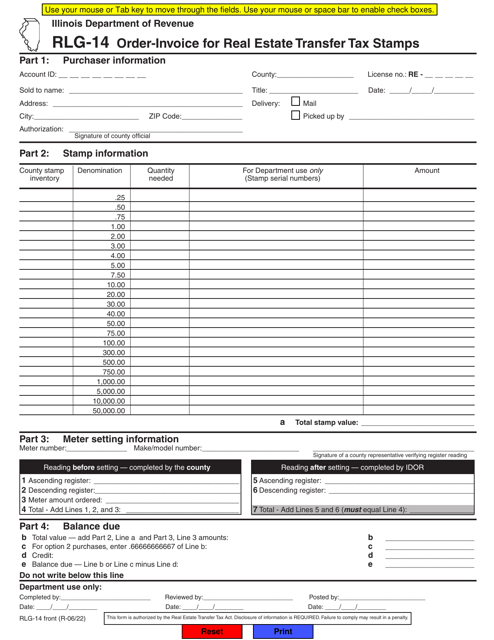

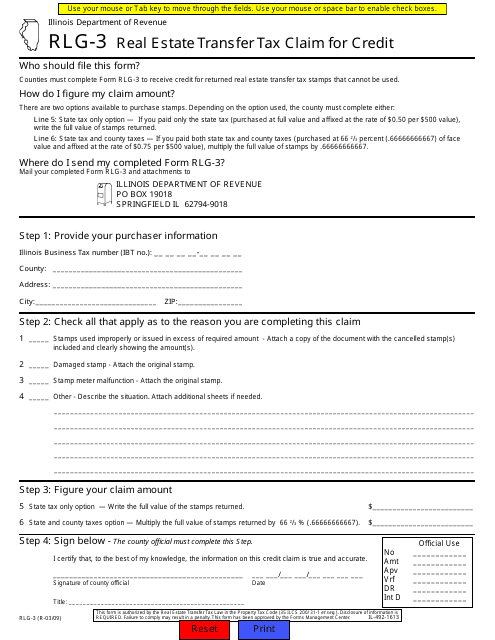

This form is used for claiming credit for real estate transfer tax in Illinois.

Use this printable template when making your own Gift Deed in the state of Hawaii.

This form is used for reporting real estate transfers, credit line mortgages, and claiming exemption from paying estimated personal income tax in New York.

This Form is used for filing real estate transfer tax return, mortgage certificate, and exemption certification for properties located in New York City. It provides instructions on how to complete the form and file it correctly.

This form is used in New York for reporting real estate transfers, providing credit line mortgage information, and certifying exemption from estimated personal income tax payments. It includes instructions on how to accurately complete the form.

This form is used for claiming a refund of real estate transfer tax in New York.

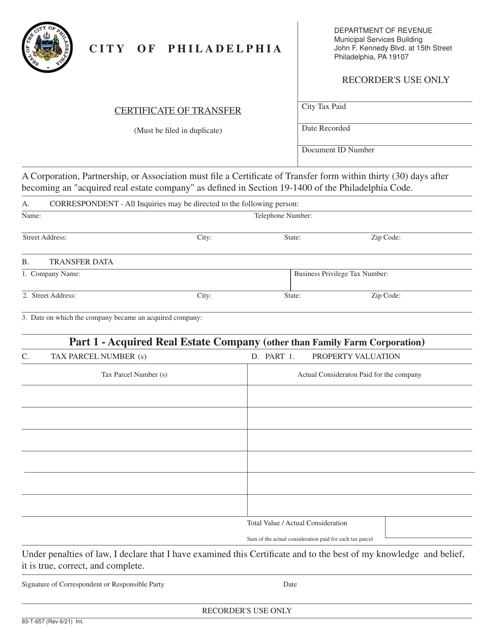

This form is used for reporting and paying real estate transfer taxes for entities in the City of Philadelphia, Pennsylvania.