Subordination Agreement Templates

A Subordination Agreement, also known as a subordination agreement form, is a legally binding document that establishes the priority of lenders' claims on a property. This agreement is commonly used in real estate transactions to determine the order in which lenders are paid if the property goes into foreclosure or is sold.

In the world of finance and mortgage lending, a subordination agreement plays a crucial role in defining the rights and obligations of various parties involved. It ensures that one lender's interest takes precedence over another in the event of default or liquidation.

A Subordination Agreement may be required by various organizations and jurisdictions, such as state governments, banks, financial institutions, and the Department of Housing and Urban Development (HUD). It is essential for borrowers and lenders alike to understand the terms and conditions outlined in the agreement to protect their interests.

Whether you are a homeowner, real estate investor, or financial institution, having a well-drafted subordination agreement is vital to safeguard your financial position. It provides clarity and security by establishing the priority of liens and ensuring that debts are repaid in the correct order.

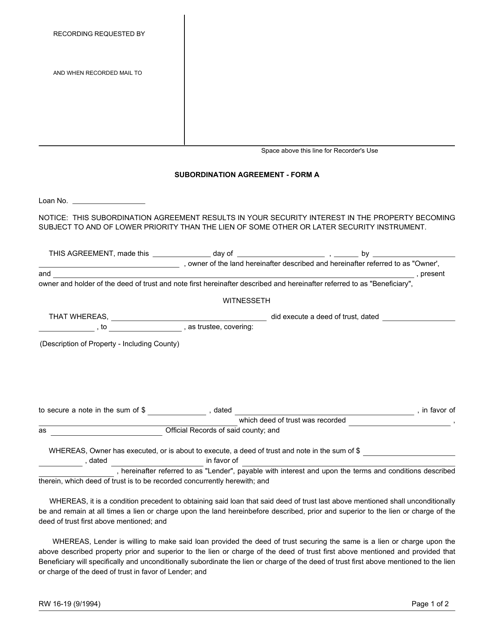

If you are in need of a subordination agreement in California, you may come across forms such as Form A (RW16-19) Subordination Agreement and Form RW16-19 (A) Subordination Agreement. Conversely, in Nebraska, a Corporation Subordination Resolution may serve a similar purpose.

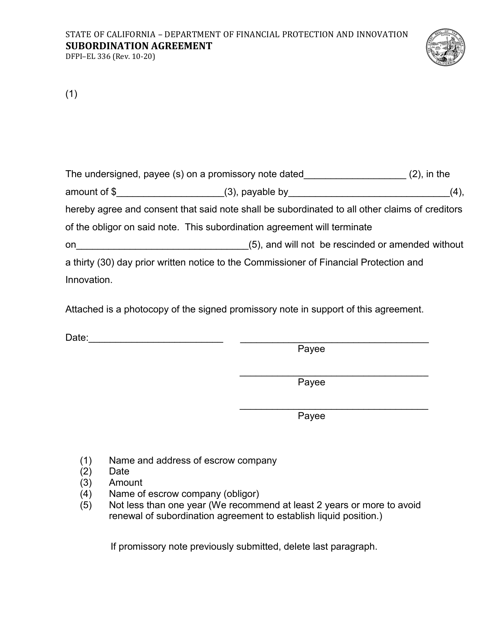

At USA, Canada and other countries document knowledge system, we understand the significance of having comprehensive and legally sound subordination agreements. Our curated collection of subordination agreement forms, including Form DFPI-EL336 Subordination Agreement and Form HUD-92420M Subordination Agreement - Public, is designed to meet the unique needs and requirements of various jurisdictions.

Don't let the complexities of subordination agreements overwhelm you. Let our document knowledge system guide you through the process, ensuring that you have the necessary tools to protect your interests and navigate the world of real estate and finance with confidence.

Note: The provided example documents and alternate names are fictional and are intended solely for the purpose of creating a coherent and informative text.

Documents:

12

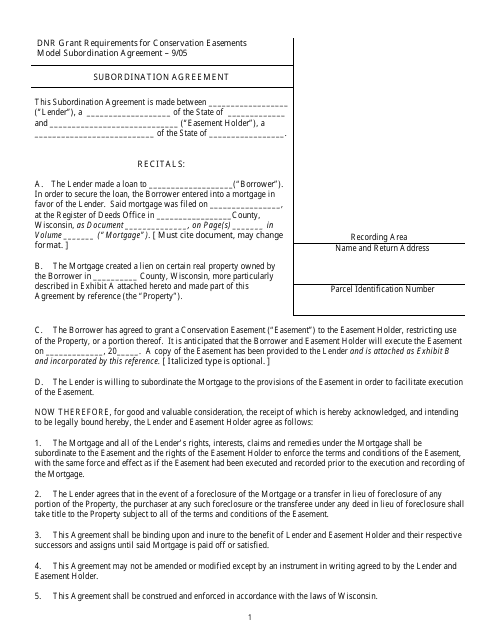

This document is used for formalizing the subordination agreement between parties in the state of Wisconsin.

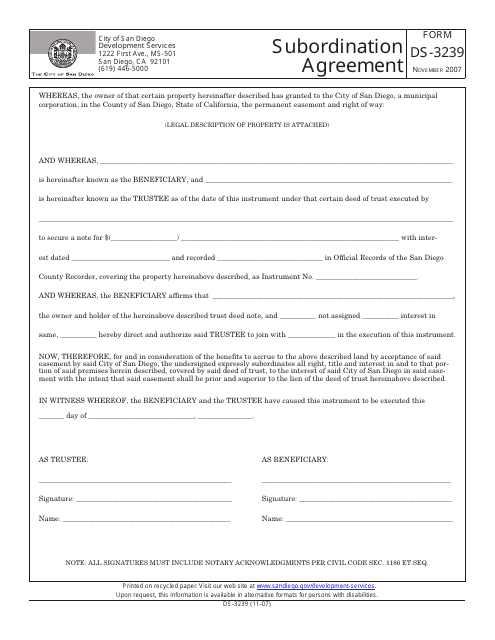

This form is used for filing a subordination agreement with the City of San Diego, California.

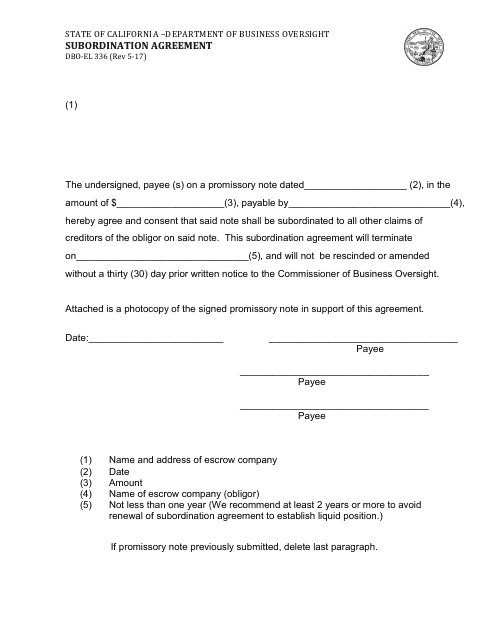

This document is used for a Subordination Agreement in the state of California. It is a legal form that allows one party to agree that their claim on a property or asset will be subordinate to another party's claim.

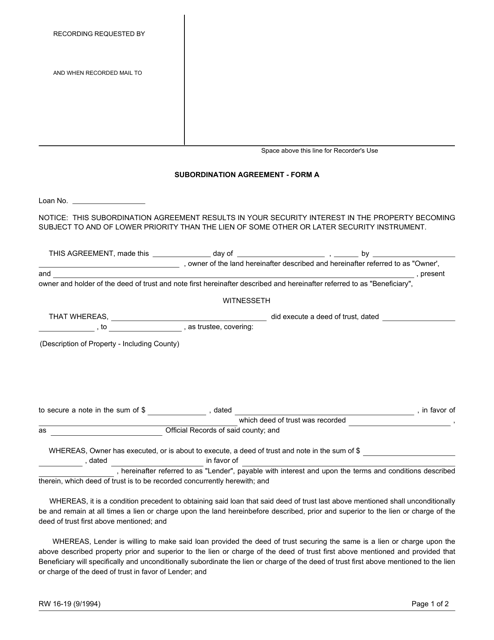

This form is used for a subordination agreement in California.

This form is used for a subordination agreement in California. It allows one party to waive their claims to a property in favor of another party.

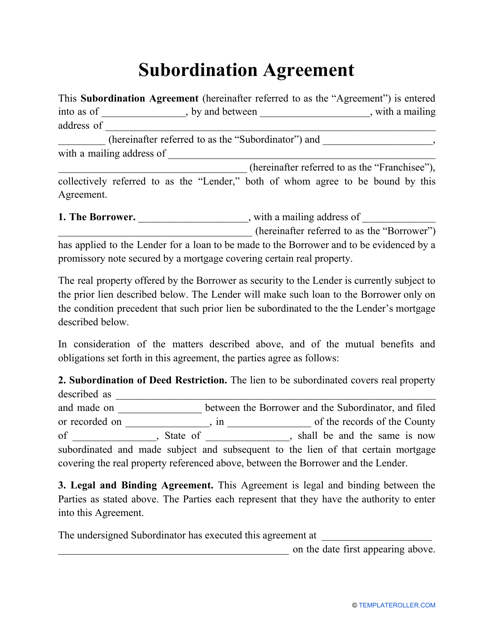

This is a formal document signed by a lender and a debtor by means of which the parties confirm the existing debt owed by the borrower has a preference before other debts of the borrower.

This form is used for creating a subordination agreement in the state of California. It allows for the prioritization of certain debts or liens over others.

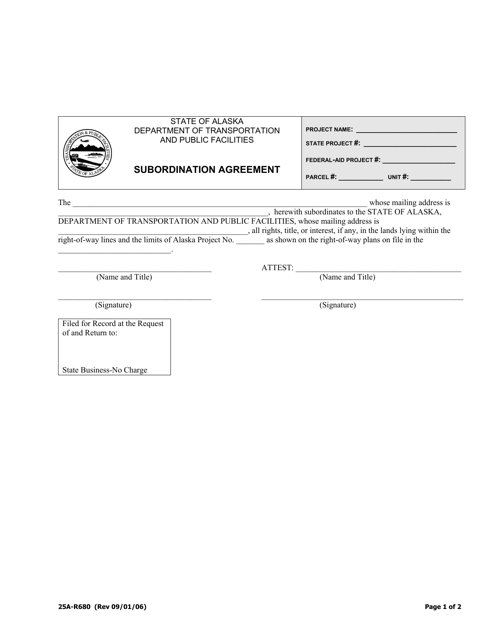

This form is used for a Subordination Agreement in Alaska.

This form is used for a Utility Subordination Agreement in Illinois.

This document is used for resolving the subordination of a corporation in the state of Nebraska. It outlines the terms and conditions under which the corporation will be subordinated to another entity.

This form is used for subordination agreements in the public sector. It outlines the terms and conditions for the subordination of a mortgage or other lien to a new loan or lien.