Oil Tax Templates

Are you interested in learning more about oil taxes and how they impact various jurisdictions? Look no further! Our comprehensive collection of documents, also referred to as oil tax forms, will provide you with the information you need.

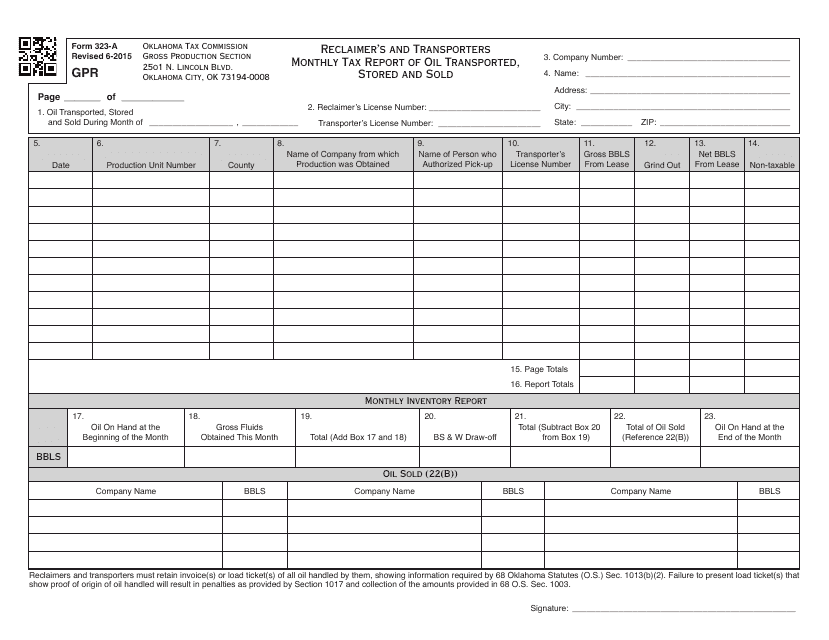

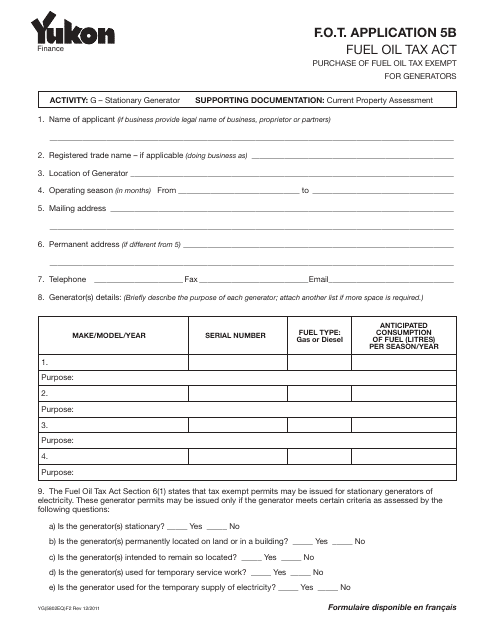

Whether you're a business involved in the transport or storage of oil or an individual looking to understand your tax obligations related to oil, our extensive database has just what you need. From Form 323-A Reclaimer's and Transporters Monthly Tax Report of Oil Transported, Stored and Sold in Oklahoma to Form YG5802 Fuel Oil Tax - Application 5b in Yukon, Canada, we have a wide range of documents that cover various jurisdictions and requirements.

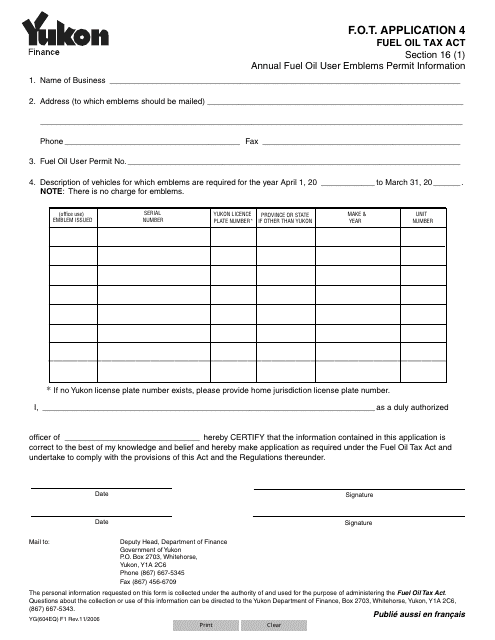

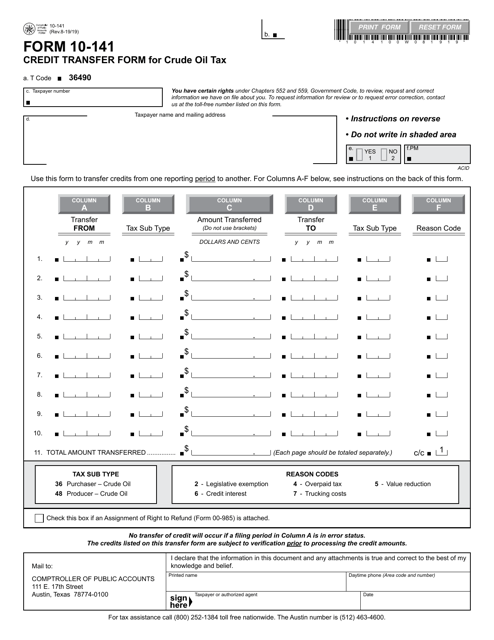

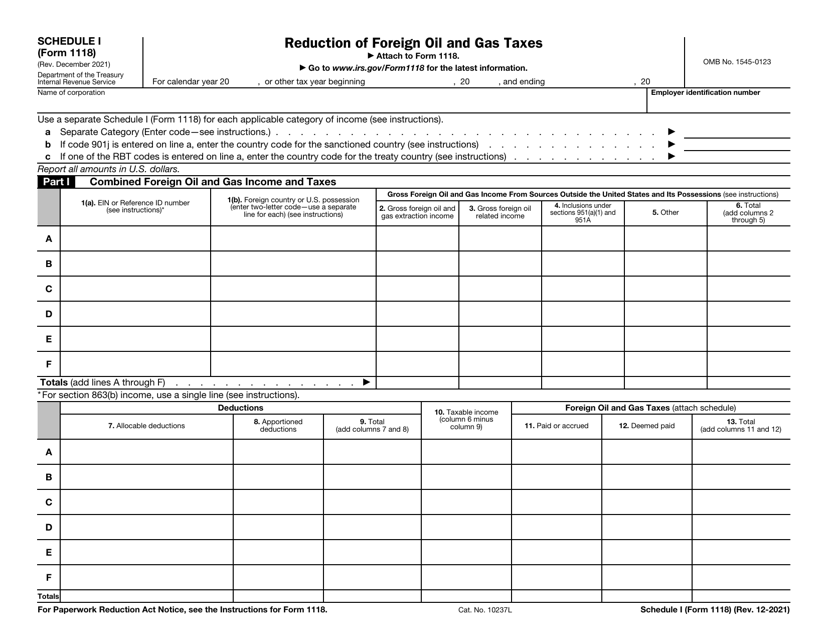

Our collection also includes forms like Form YG604 Fuel Oil Tax - Application 4 in Yukon, Canada and IRS Form 1118 Schedule I Reduction of Foreign Oil and Gas Taxes, which provide valuable insights for businesses dealing with international oil tax matters.

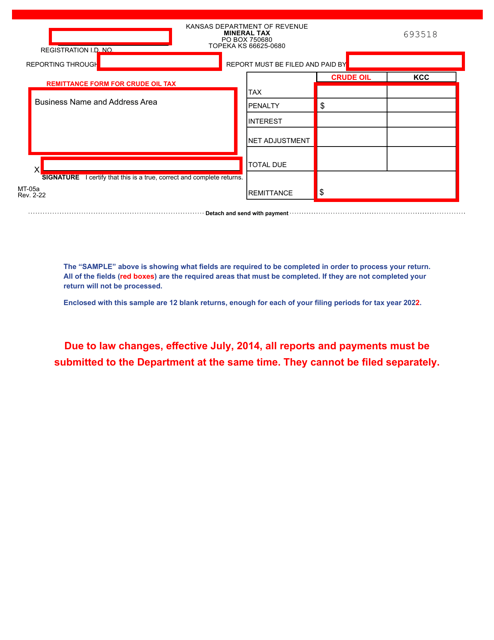

In addition to these specific forms, we offer resources such as the Form MT-05A Mineral Tax Return - Crude Oil in Kansas, ensuring that you have access to a comprehensive range of documents related to oil taxation.

By providing an extensive collection of oil tax forms from different jurisdictions, we aim to empower businesses and individuals to navigate the complexities of oil taxes with ease. Whether you're looking to accurately report your oil-related activities or understand the tax implications of your operations, our documents are your go-to resource.

Browse our collection of oil tax forms today and stay informed about your tax obligations in the world of oil. Start exploring now!

Note: The actual document titles from the given examples have not been used in the text.

Documents:

7

This form is used for reporting monthly taxes on oil transported, stored, and sold in Oklahoma by reclaimers and transporters.

This form is used for applying for a fuel oil tax in Yukon, Canada. It is specifically for Application 5b.

This Form is used for applying for fuel oil tax in the Yukon, Canada.

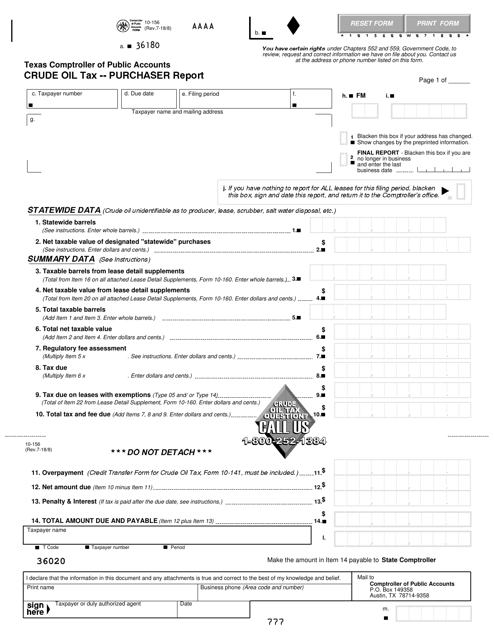

This form is used for reporting crude oil taxes in Texas for purchasers.

This form is used for transferring the credit for crude oil tax in Texas.