Consumer Rights Templates

Documents:

161

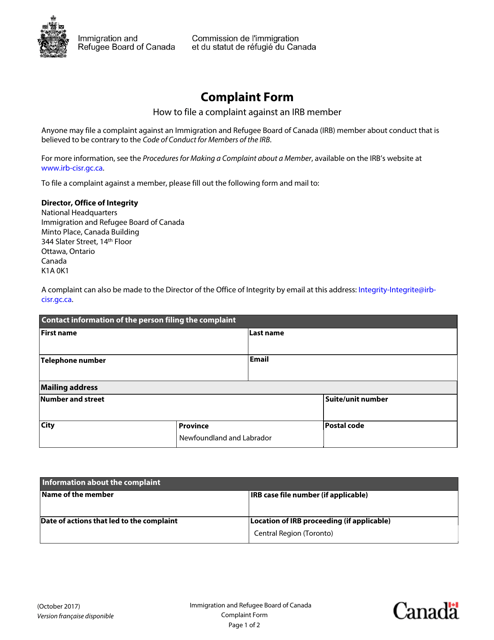

This form is used for filing a complaint in Canada. It allows individuals to formally express their dissatisfaction or grievance regarding a specific situation or issue.

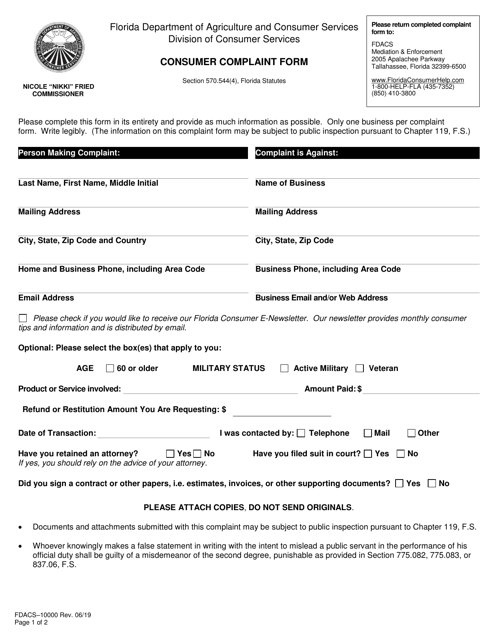

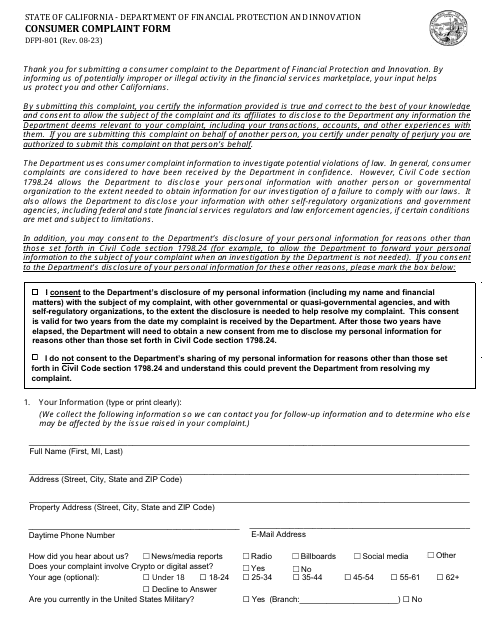

This form is used for filing consumer complaints in Florida.

This Form is used for filing a complaint against a collection agency in Idaho.

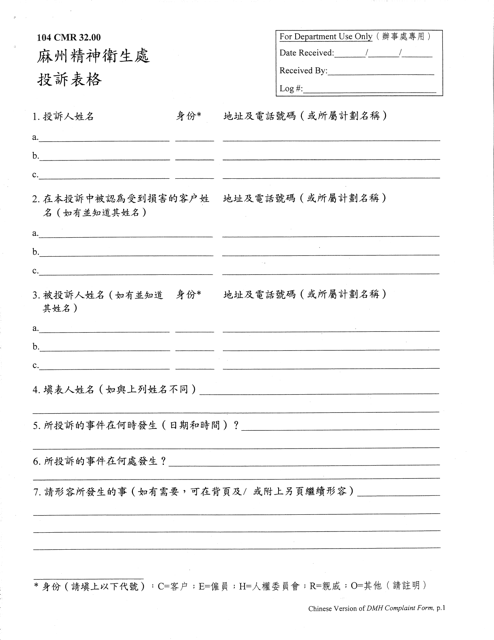

This document is a complaint form that is used in Massachusetts. It is available in Chinese language to cater to Chinese-speaking residents.

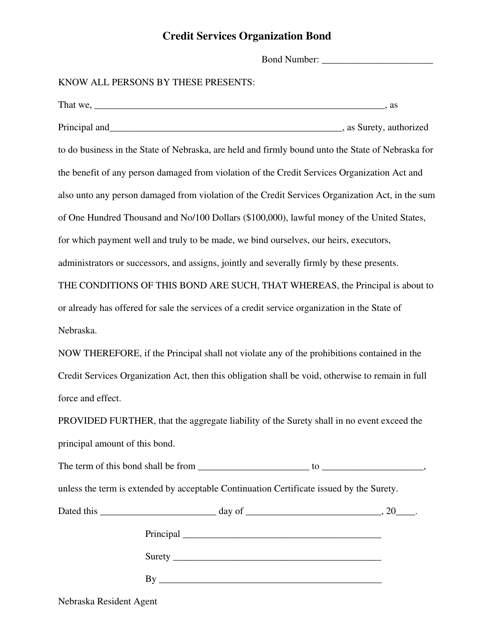

This document is a bond required for Credit Services Organizations operating in Nebraska.

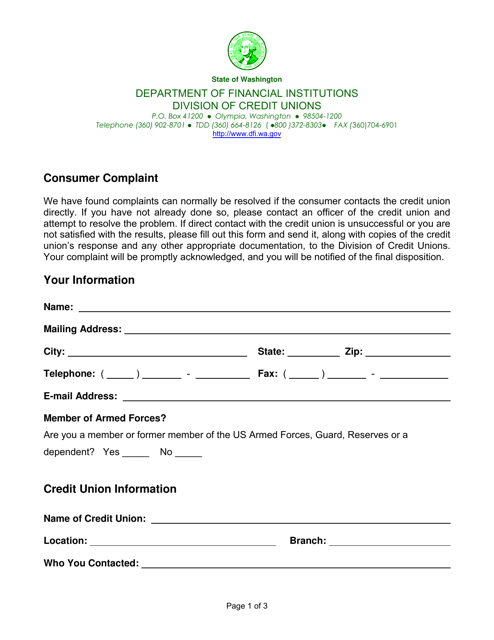

This document is for filing consumer complaints against a credit union in Washington state.

This document is a survey designed to measure the financial literacy of consumers. It aims to gather information about people's knowledge and understanding of personal finance topics, such as budgeting, saving, and investing. The survey results can help researchers and policymakers assess the effectiveness of financial education programs and identify areas where consumers may need additional support or resources.

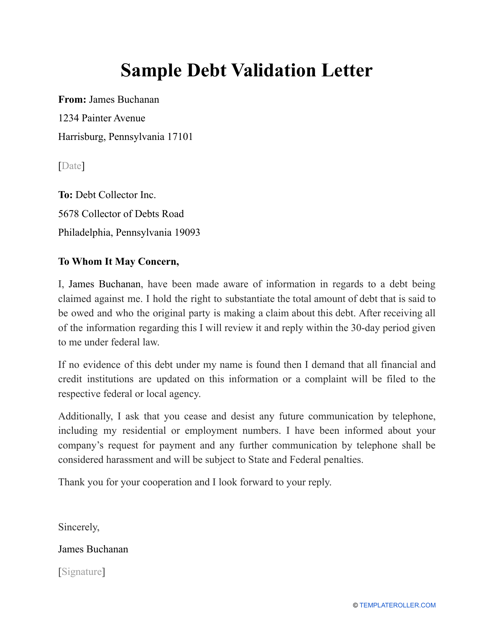

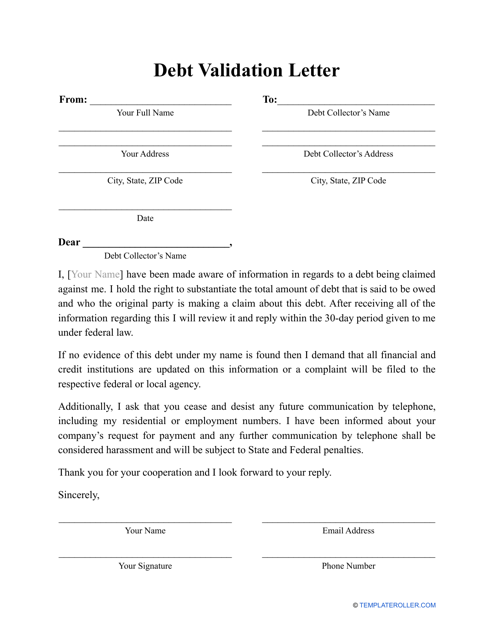

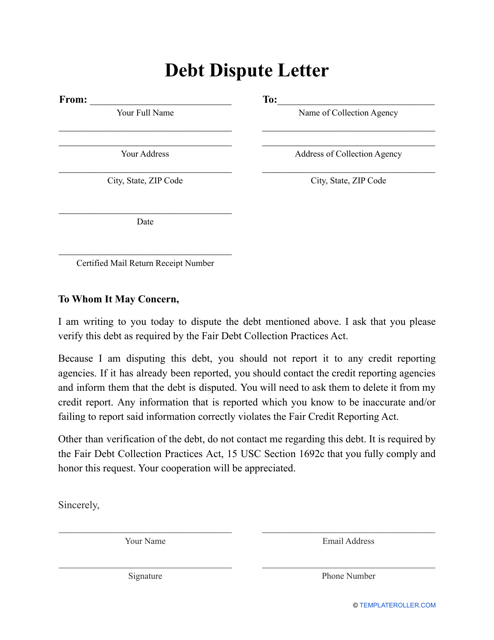

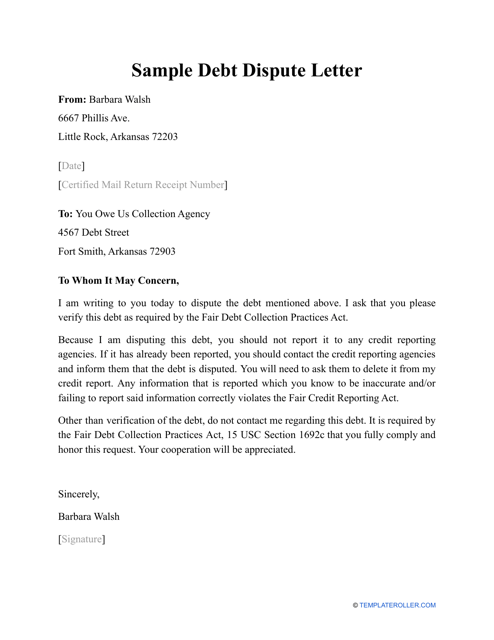

An individual or entity may prepare this type of letter and send it to a financial institution that has notified them about a debt to find out whether this debt is legitimate.

Use this letter to request information about your credit history and any particular debts you may have.

This letter serves as a refusal to accept debt and is written in response to a collector's notice.

This is a written or typed letter that any individual can prepare when they have received a letter from a creditor or debt collector if they do not believe they owe any money or the amount of the debt indicated in the notice is not accurate.

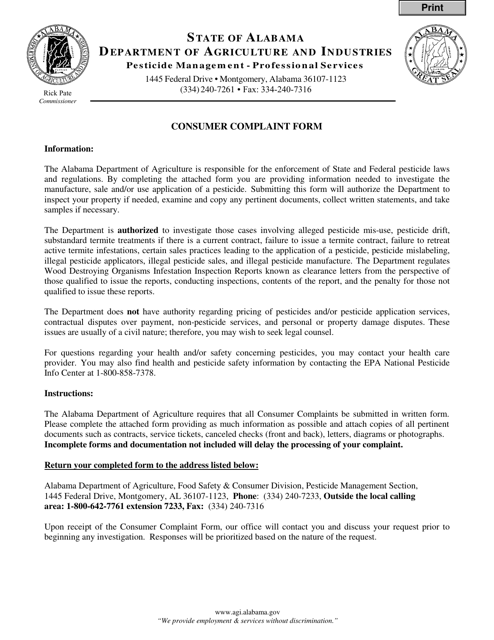

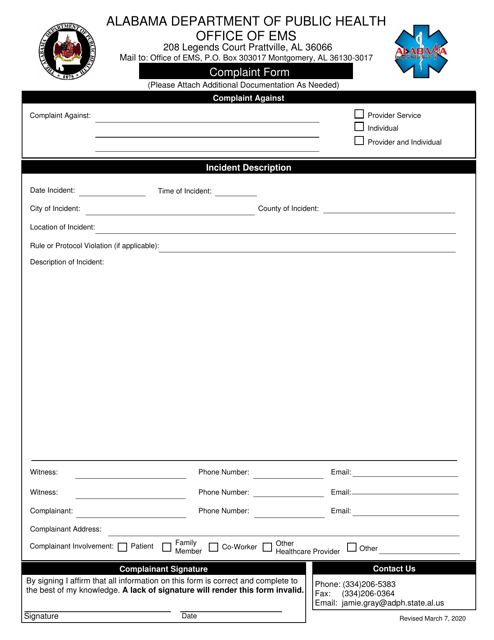

This form is used for submitting consumer complaints in the state of Alabama.

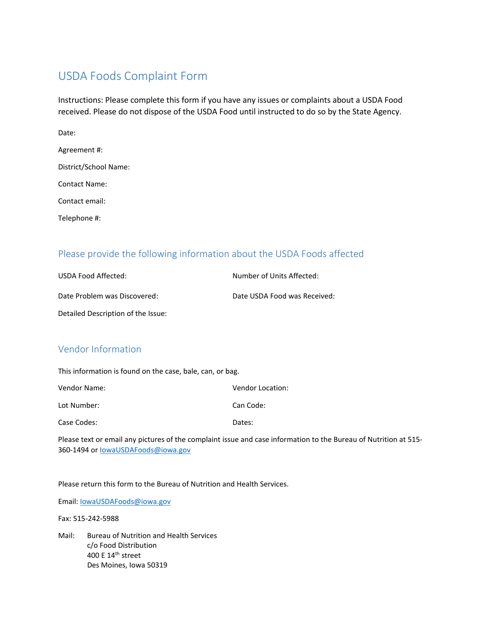

This form is used for filing a complaint about USDA foods in Iowa.

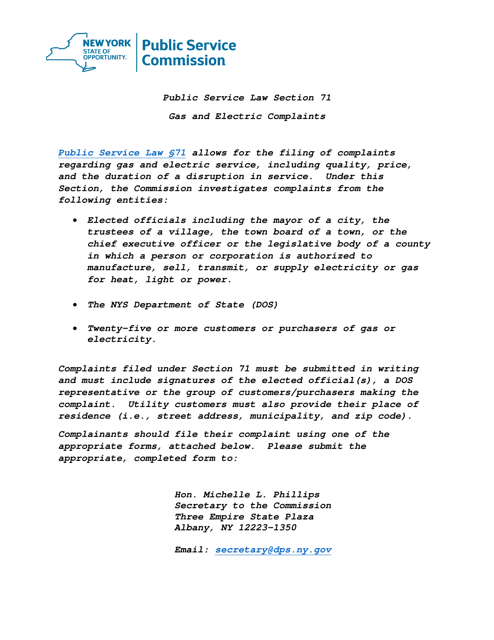

This Form is used for filing complaints related to gas and electric services in New York under Public Service Law Section 71.

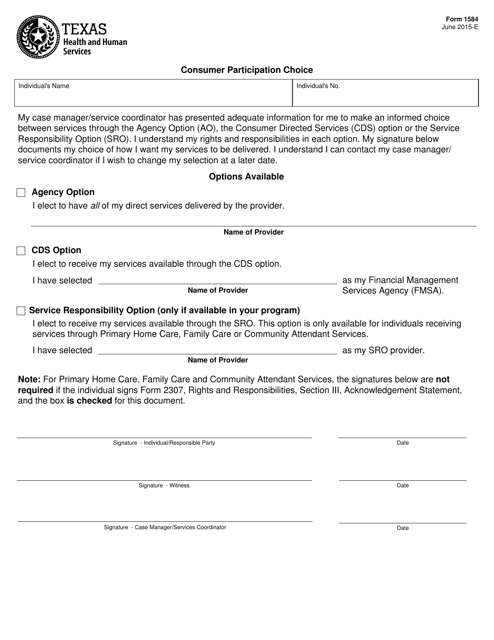

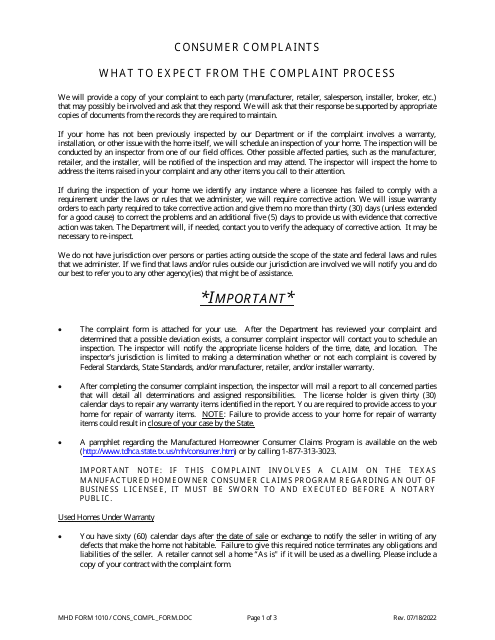

This form is used for consumer participation choice in Texas. It allows consumers to indicate their preference for participating in certain programs or services.

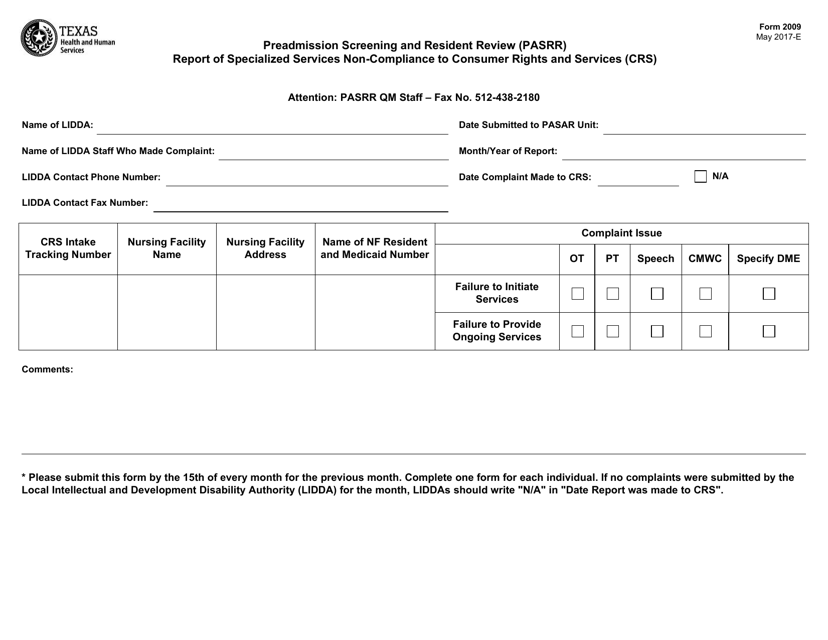

This document is used for reporting instances of non-compliance with consumer rights and services for specialized services in Texas.

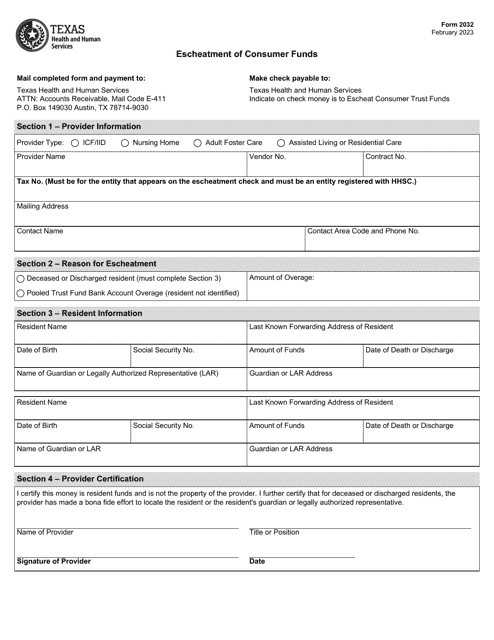

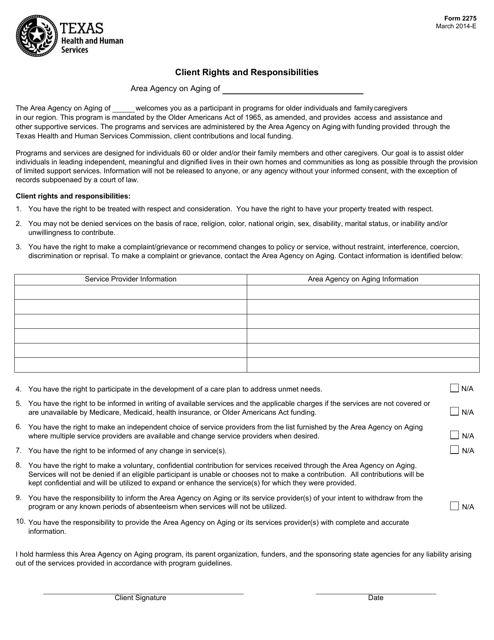

This form is used for outlining the rights and responsibilities of clients in the state of Texas.

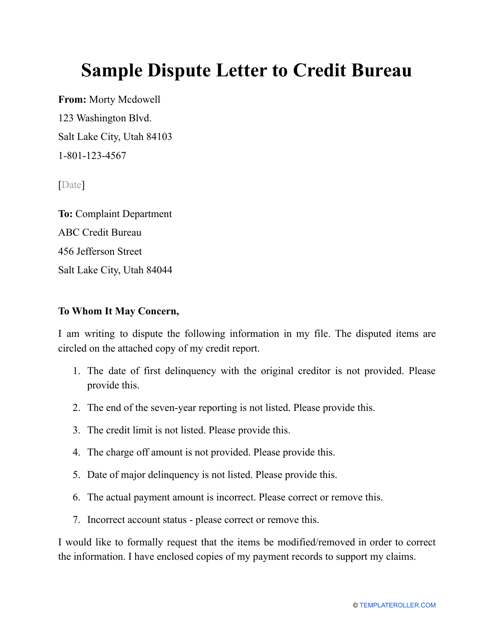

If an individual notices an error in their credit report they can use this letter to have it corrected by the agency reporting the information.

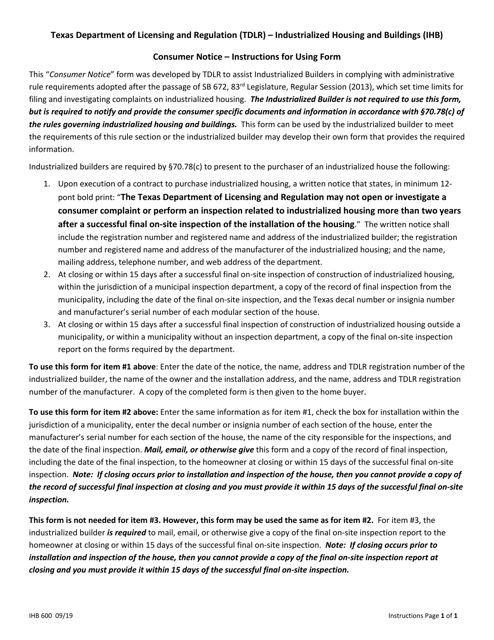

This form is used for providing consumer notice in the state of Texas. It provides important information to consumers regarding their rights and protections.

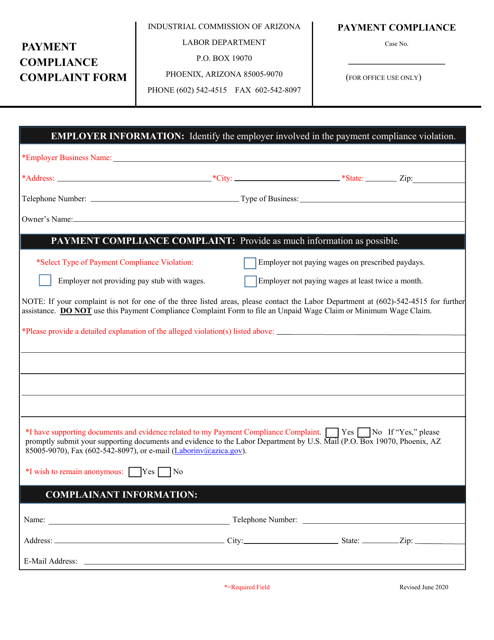

This Form is used for filing a payment compliance complaint in Arizona.

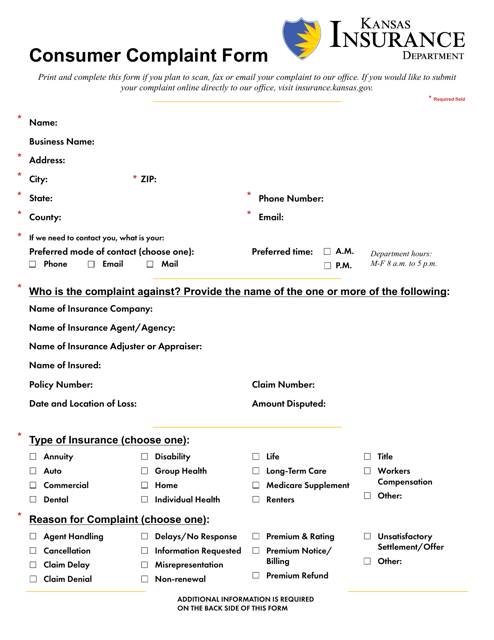

This Form is used for consumers in Kansas to file a complaint against a business regarding a product or service.

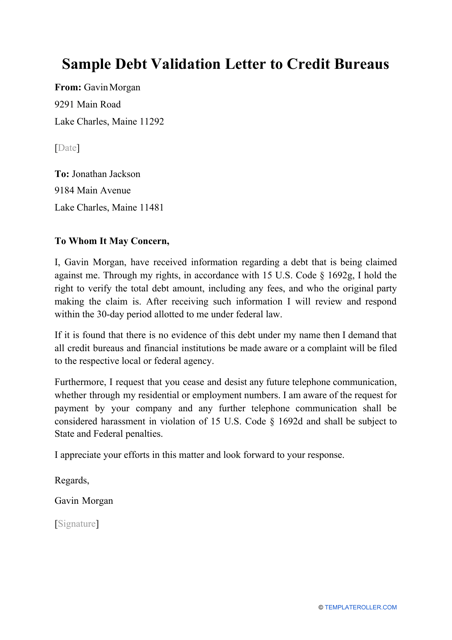

A debtor or their representative may prepare this letter with the intention of finding out whether their debt is real, to request information about an existing debt, and to warn the credit bureau that handles the debt to cease their harassing behavior if necessary.

This guide provides information on repossession practices in California, helping consumers understand their rights and the procedures that lenders must follow.

This form is used for filing a consumer complaint in Montana.

This document provides consumer information and tips to help you make informed decisions while shopping and making purchases. It covers a variety of topics related to consumer rights, safety, and making smart choices.

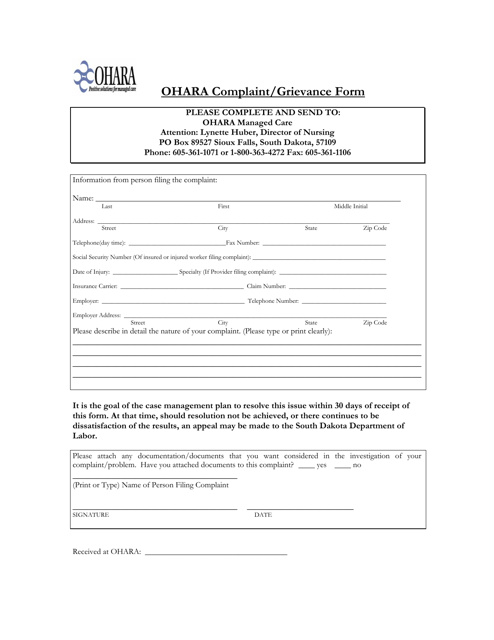

This document is used for filing complaints or grievances in South Dakota.

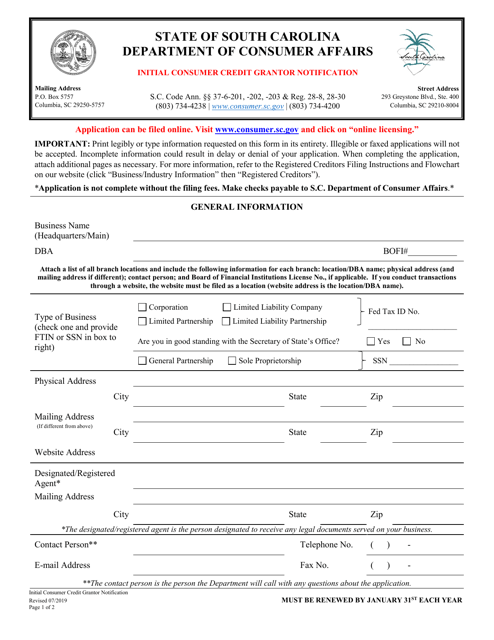

This document is a notification form used in South Carolina to inform a consumer credit grantor about their initial credit decision.

This form is used for consumer credit counseling proctors to register in South Carolina.

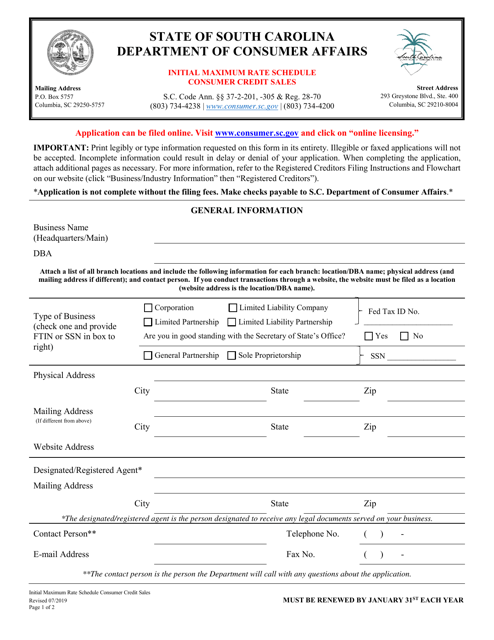

This document provides the maximum interest rates for consumer credit sales in South Carolina.

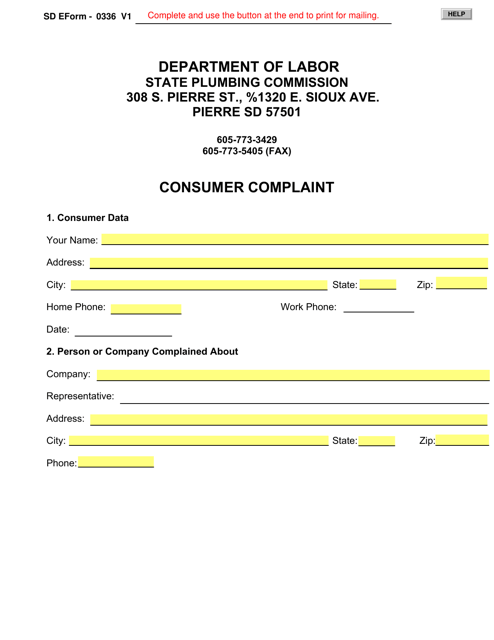

This form is used for submitting a consumer complaint in South Dakota.

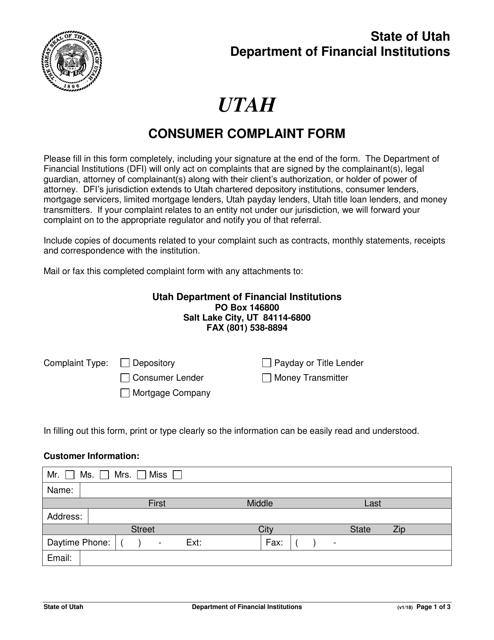

This form is used for filing a consumer complaint in the state of Utah.