Disabled Homeowners Templates

Are you a disabled homeowner looking for assistance in managing your property taxes? Look no further. Our organization is dedicated to providing support and resources to disabled homeowners like yourself. Whether you're facing financial challenges or need help navigating the complex tax system, we're here to guide you every step of the way.

Our program offers a range of services tailored specifically to disabled homeowners. From exemption applications to tax deferral affidavits, we understand the unique needs and challenges you may encounter. Our team of experts is well-versed in the regulations and requirements of various jurisdictions, including New York City and Harris County, Texas.

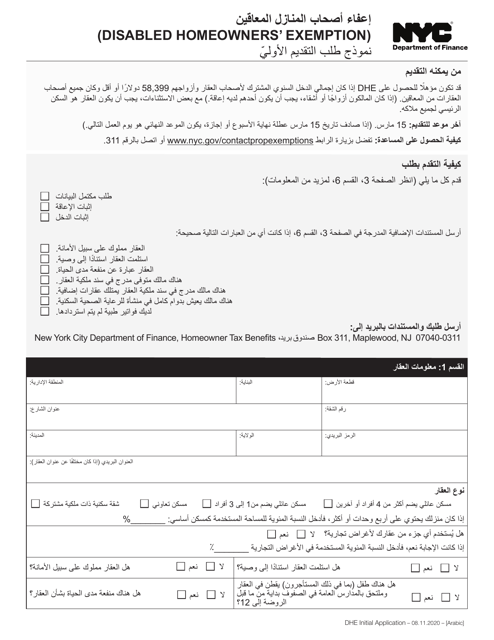

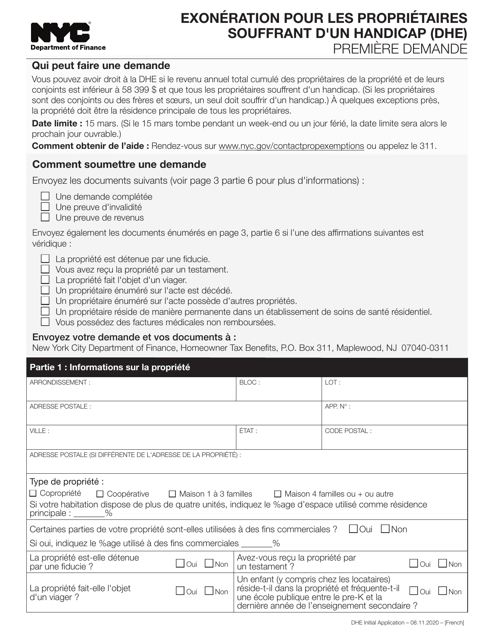

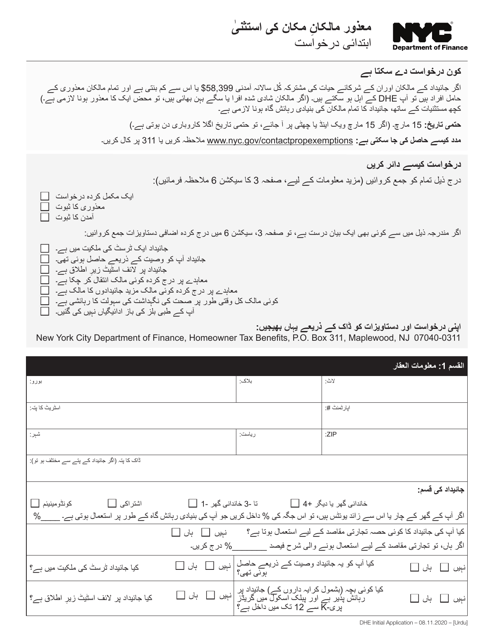

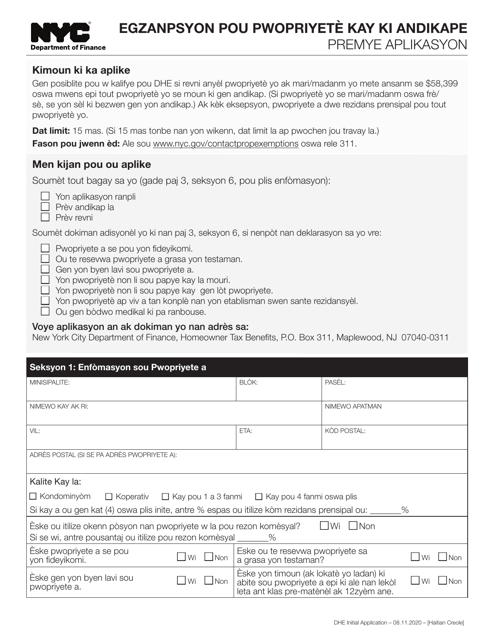

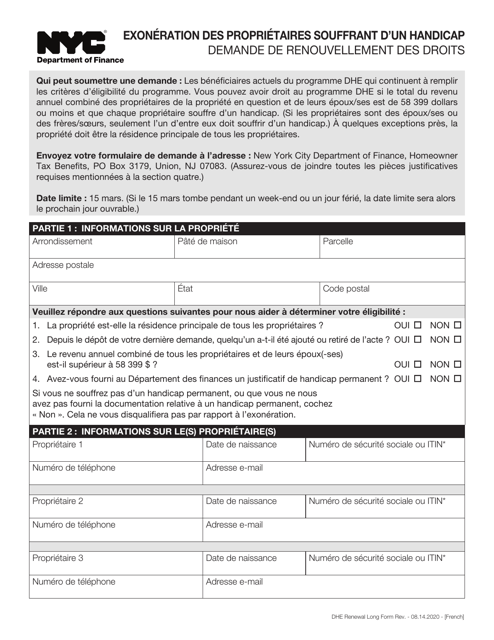

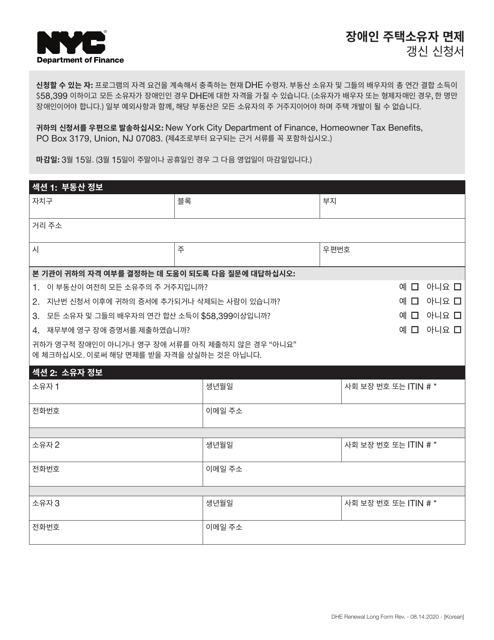

We understand that language can be a barrier, which is why we provide application forms in multiple languages, such as Urdu, Korean, and Haitian Creole. Our goal is to make the process as accessible as possible, ensuring that all disabled homeowners can take advantage of the benefits available to them.

We recognize that being a disabled homeowner may come with its own set of financial burdens. That's why we offer assistance and guidance on property tax exemptions, helping you save money and alleviate some of the stress associated with homeownership. Our resources and expertise in this area are invaluable when it comes to finding financial relief.

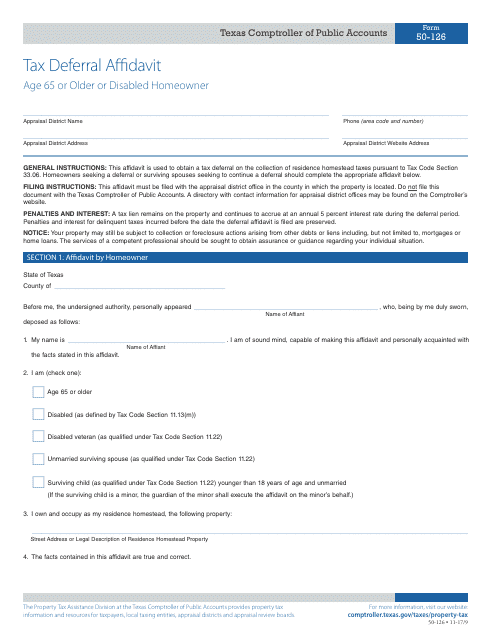

As a disabled homeowner, you may also qualify for tax deferral programs. These programs allow you to temporarily postpone your property tax payments, providing you with much-needed breathing room. Our organization is well-equipped to assist you in navigating these programs and ensuring you take full advantage of the benefits they offer.

Whether you're a disabled homeowner, disabled homeowner, or a disabled homeowner- we're here for you. Our aim is to empower and support individuals like yourself, helping you overcome the challenges and obstacles that may arise. When it comes to managing your property taxes, you don't have to do it alone. Reach out to our organization today and let us assist you in securing the financial relief you deserve.

Documents:

14

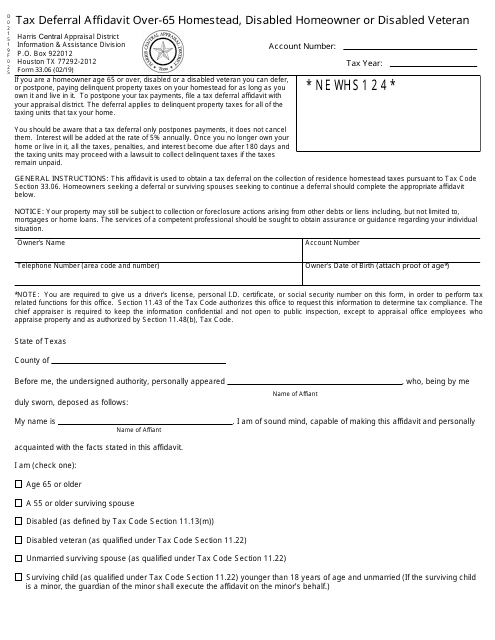

This form is used for requesting a tax deferral for homeowners in Texas who are 65 years or older or who have a disability.

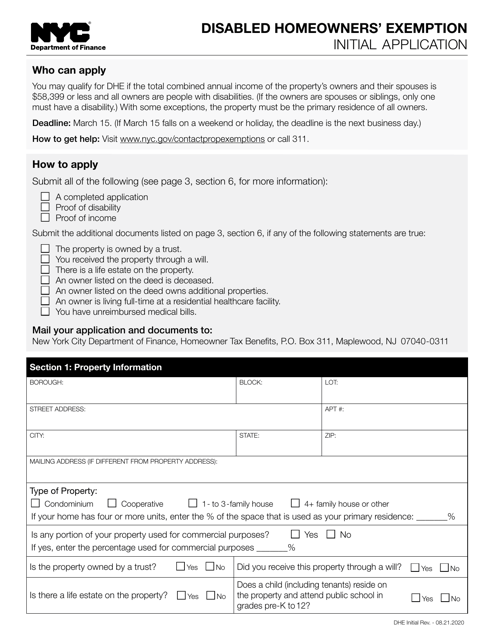

This document is for disabled homeowners in New York City who want to apply for the initial exemption on their property taxes.

This document for applying for the Disabled Homeowners' Exemption in New York City. It is available in French.

This form is used for disabled homeowners in New York City to apply for an initial exemption on their property taxes. (Note: The form is available in Urdu language)

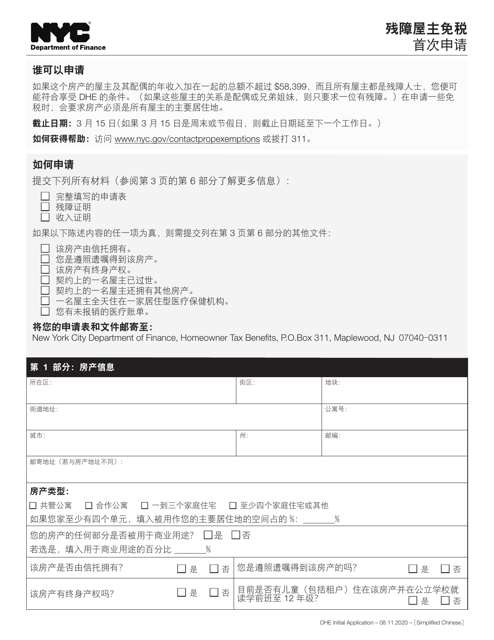

This document is for disabled homeowners in New York City who want to apply for the initial exemption. The application is available in Chinese Simplified language.

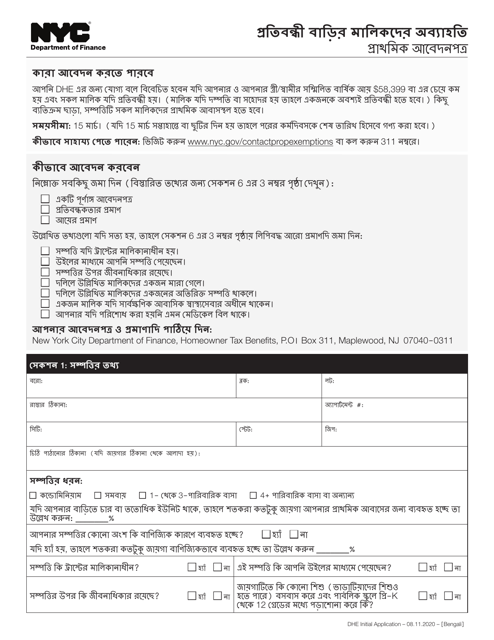

This document is for disabled homeowners in New York City who want to apply for an initial exemption. It is available in Bengali.

This document is for disabled homeowners in New York City who want to apply for initial exemption.

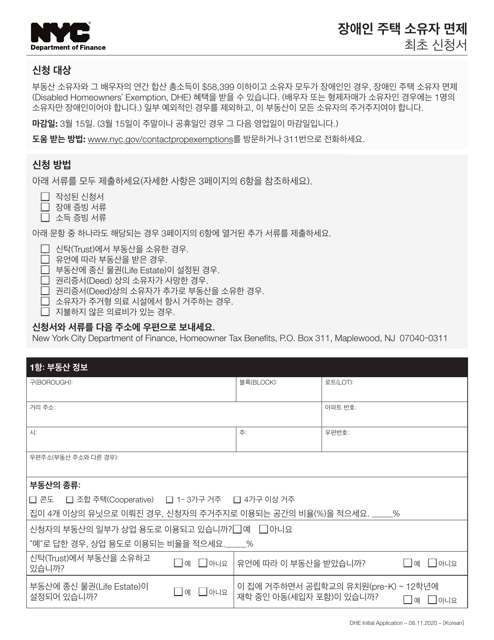

This document is for disabled homeowners in New York City who are applying for the initial exemption.

This type of document is used for disabled homeowners in New York City who are applying for the initial exemption. It is available in Haitian Creole language.

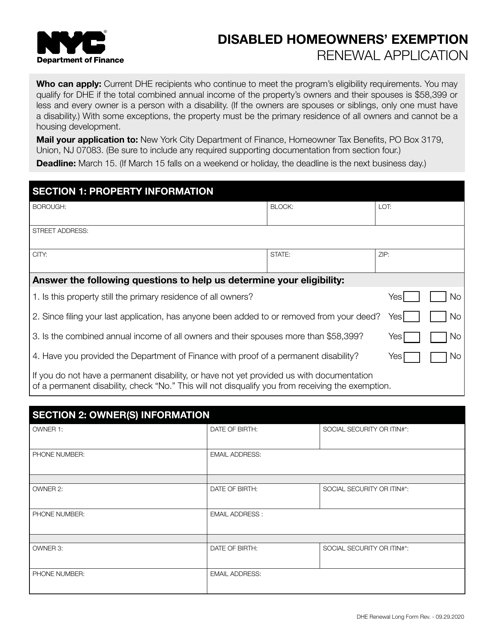

This Form is used for renewing the Disabled Homeowners' Exemption in New York City.

This Form is used for renewing the Disabled Homeowners' Exemption in New York City.

This document is for disabled homeowners in New York City who need to renew their exemption application. It is available in Korean.

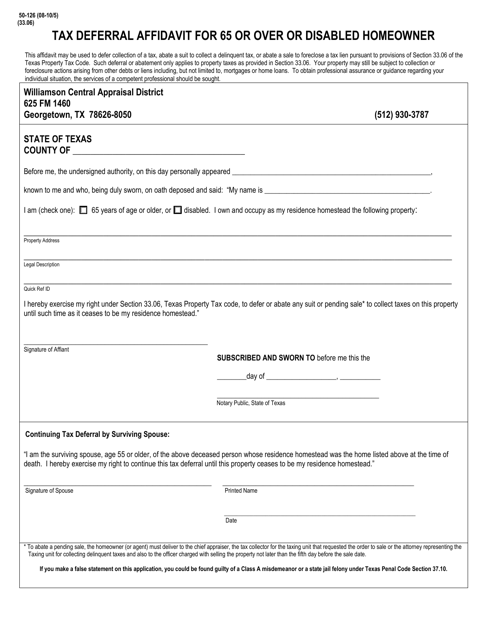

This form is used for homeowners in Williamson County, Texas who are 65 years or older or disabled and want to defer their property taxes.