Nyc Tax Templates

Are you looking for information about taxes in New York City? Our website provides a comprehensive collection of tax documents related to NYC tax. Whether you are an individual or a business entity, our database includes all the necessary forms and documents you may need to fulfill your tax obligations in NYC.

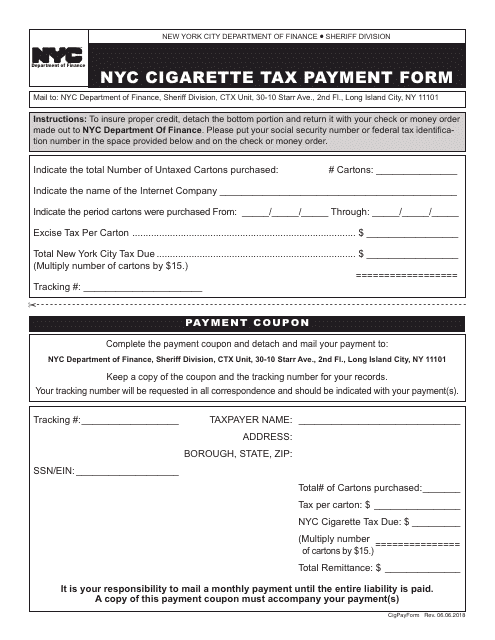

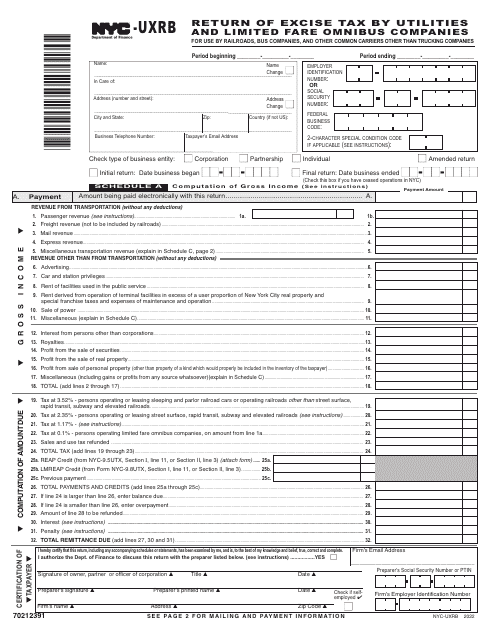

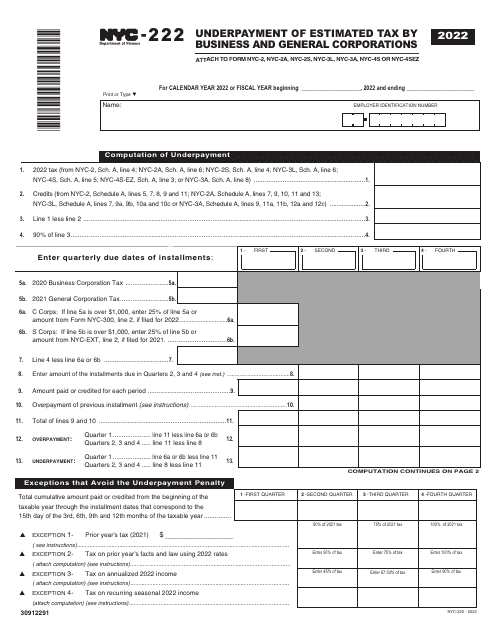

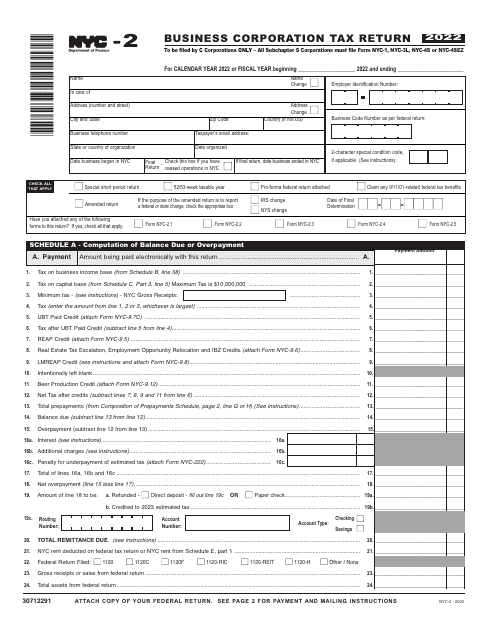

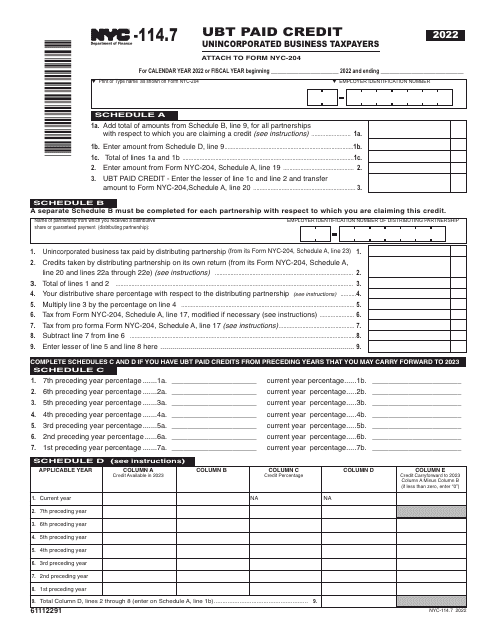

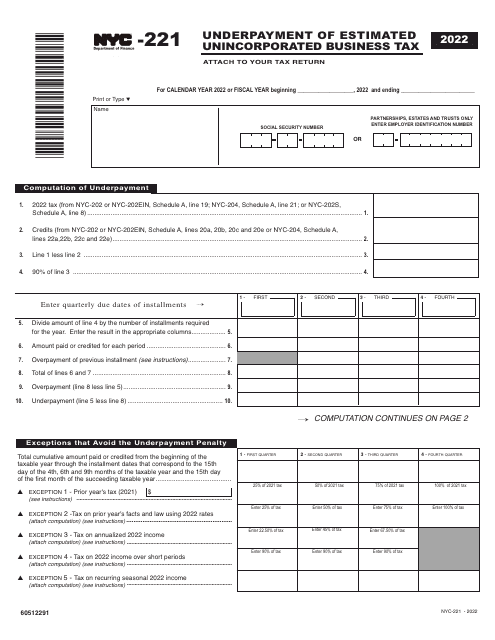

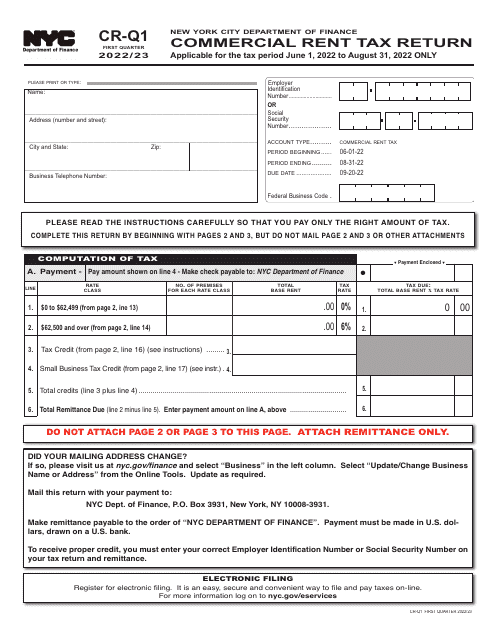

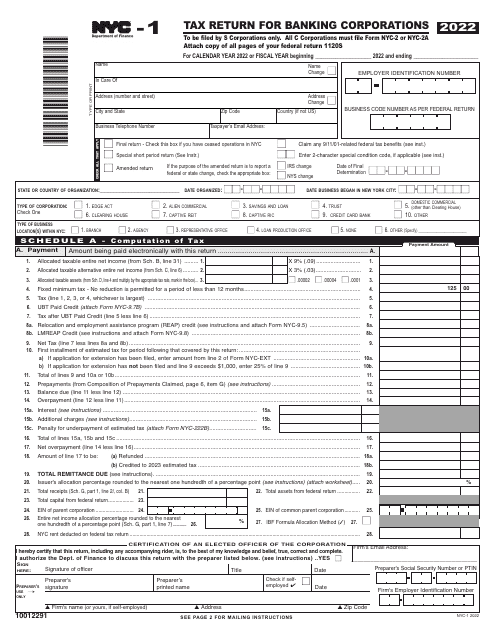

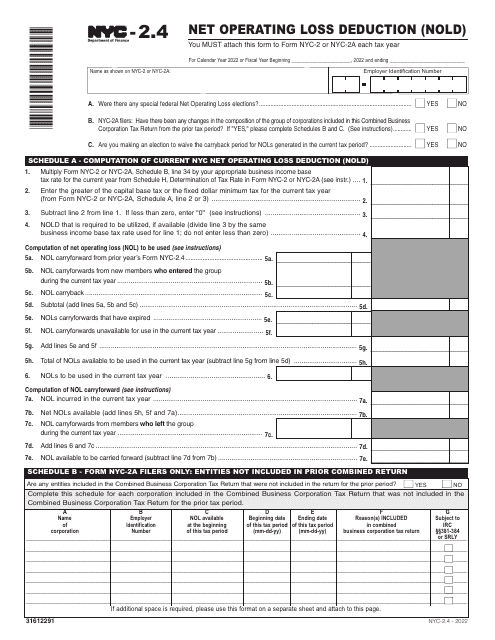

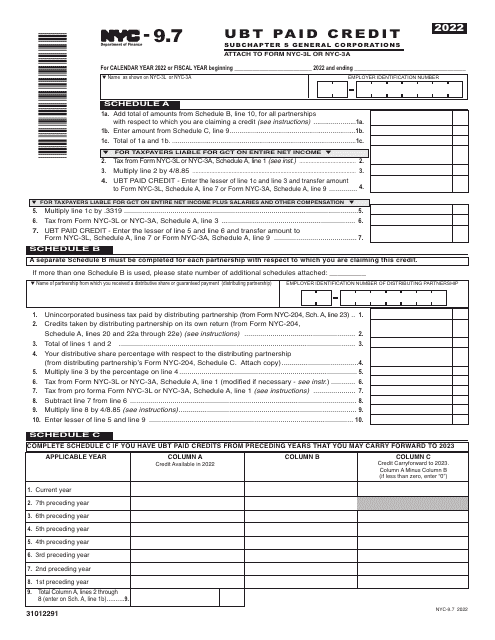

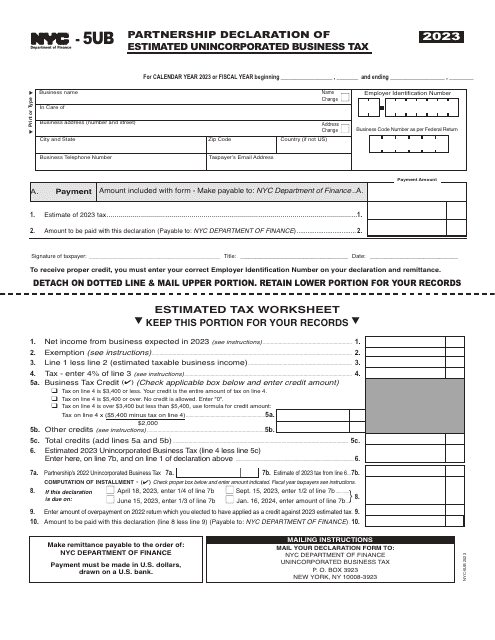

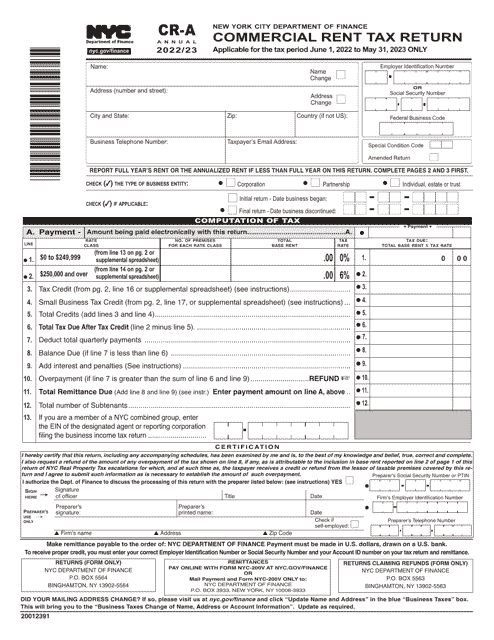

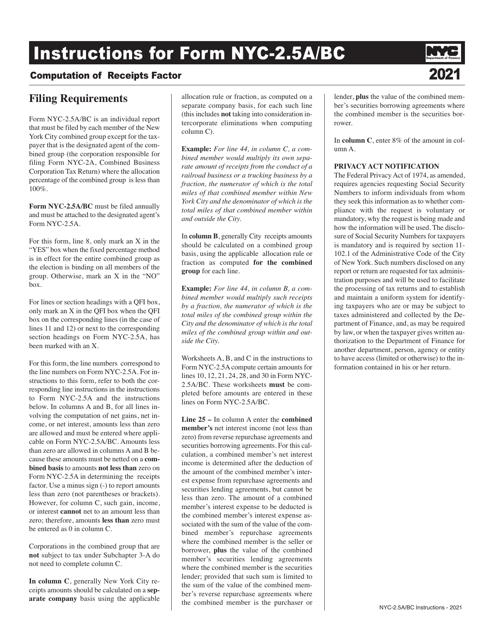

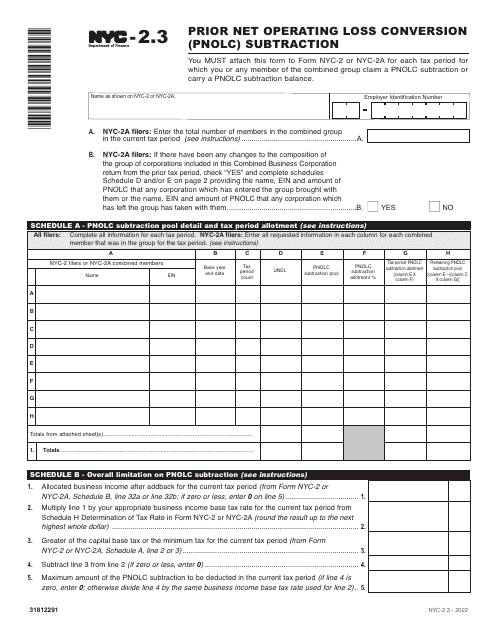

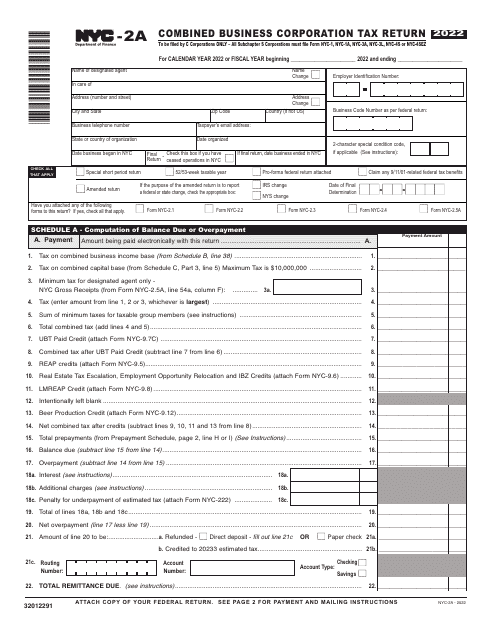

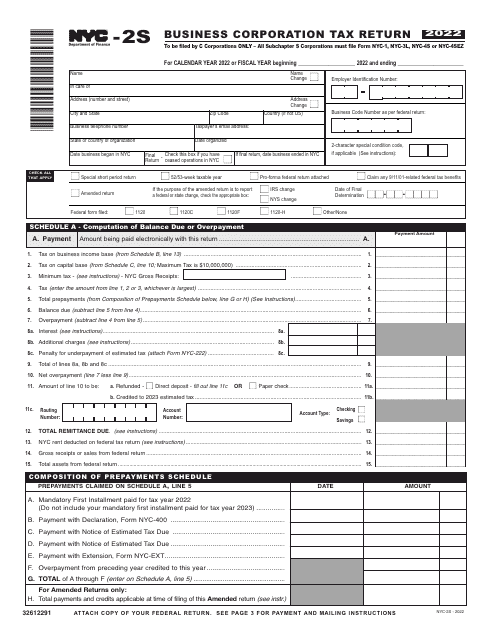

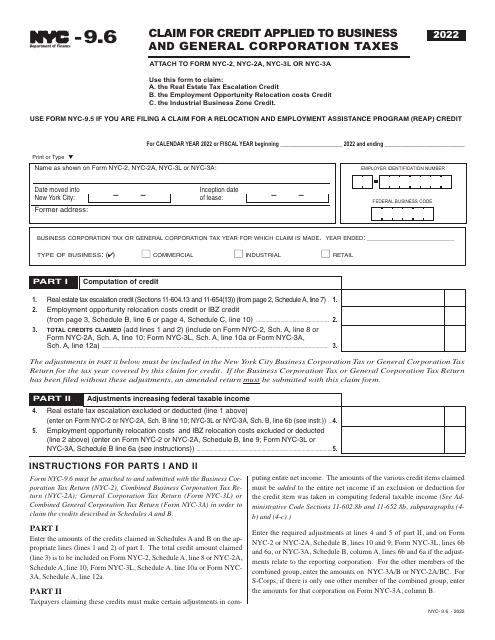

Our NYC tax collection, sometimes referred to as NYC taxes or NYC tax forms, consists of a wide range of documents designed to address various tax scenarios. From the Nyc Cigarette Tax Payment Form to Form NYC-222 Underpayment of Estimated Tax by Business and General Corporations, we have you covered. Additionally, we offer resources like Form NYC-1 Tax Return for Banking Corporations and Form NYC-2A Combined Business Corporation Tax Return.

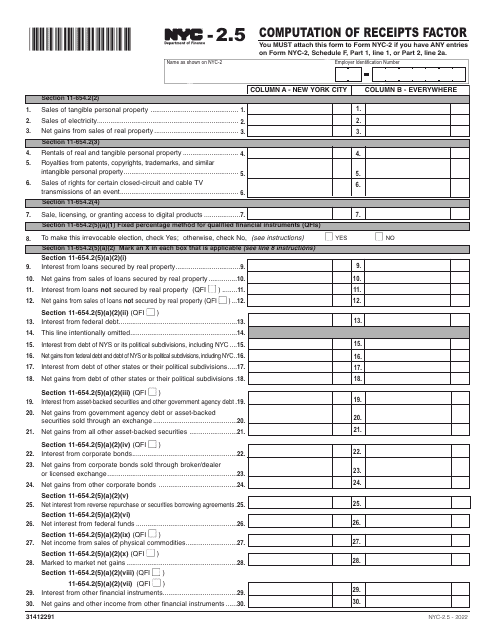

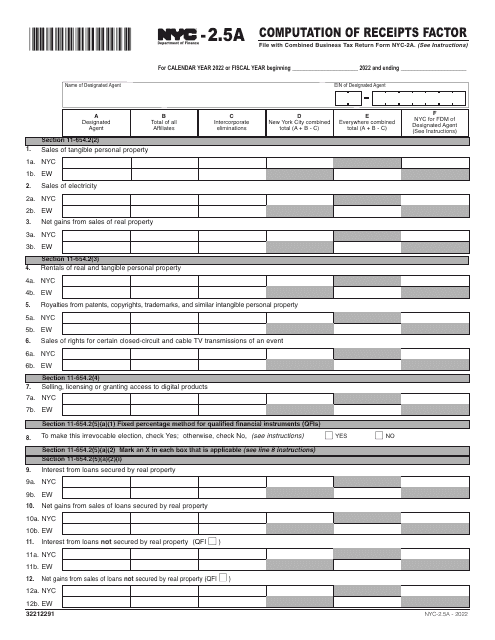

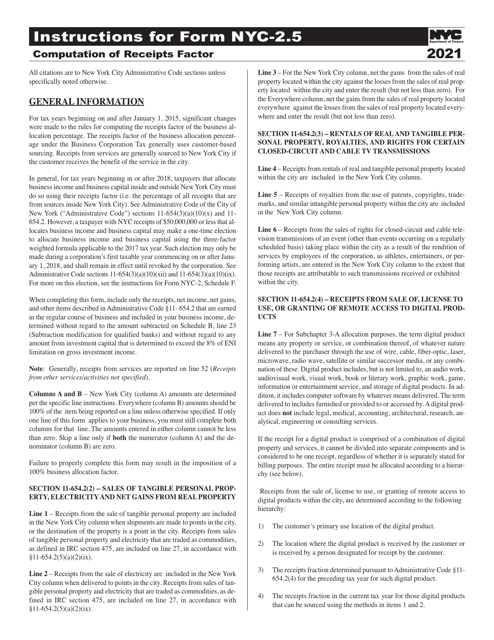

Furthermore, if you are specifically interested in calculating your receipts factor, we also provide Form NYC-2.5 Computation of Receipts Factor. Our goal is to simplify the tax-filing process and provide a convenient platform for accessing all the necessary tax documents.

By utilizing our NYC tax document collection, you can ensure compliance with the tax regulations in New York City. Our user-friendly website allows you to easily navigate through the various forms and download them for your use. Stay organized and up-to-date with your tax responsibilities using our comprehensive NYC tax document collection.

So, whether you are a business owner or an individual taxpayer, our website serves as a valuable resource for all your NYC tax needs. Explore our extensive collection of tax documents today and make sure you have the proper forms to fulfill your tax obligations.

Documents:

47

This form is used for making cigarette tax payments in New York City.

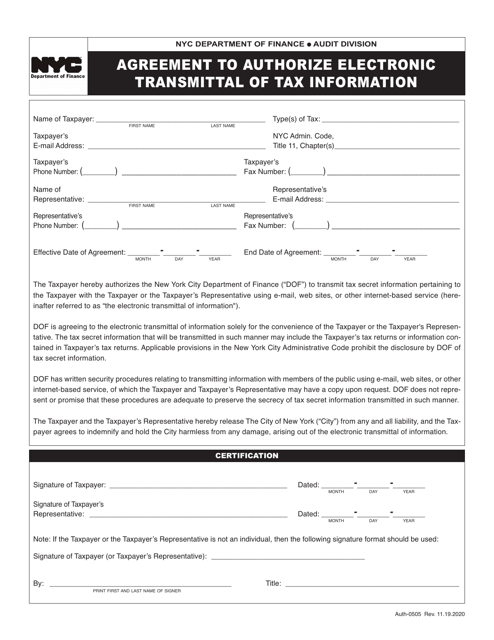

This form is used for authorizing the electronic transmittal of tax information in New York City.

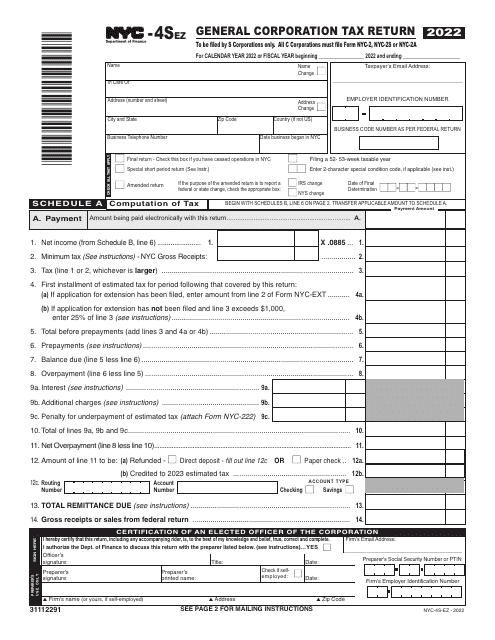

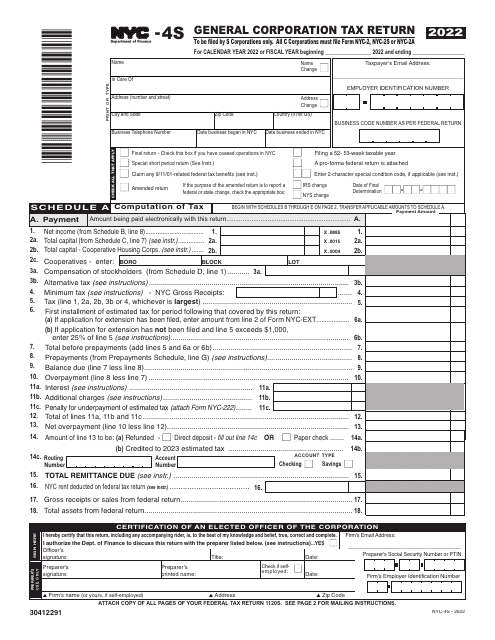

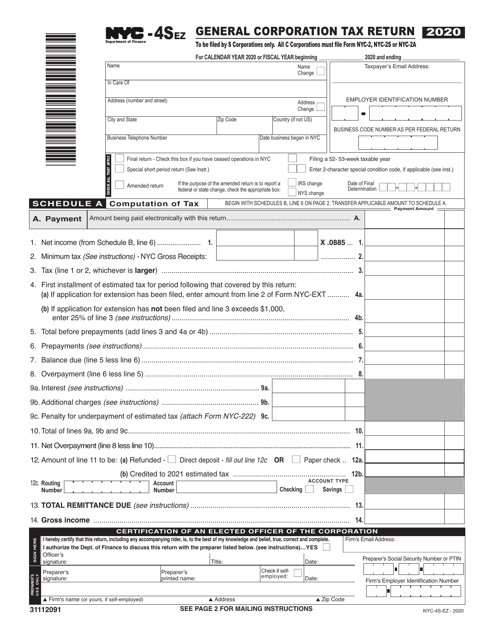

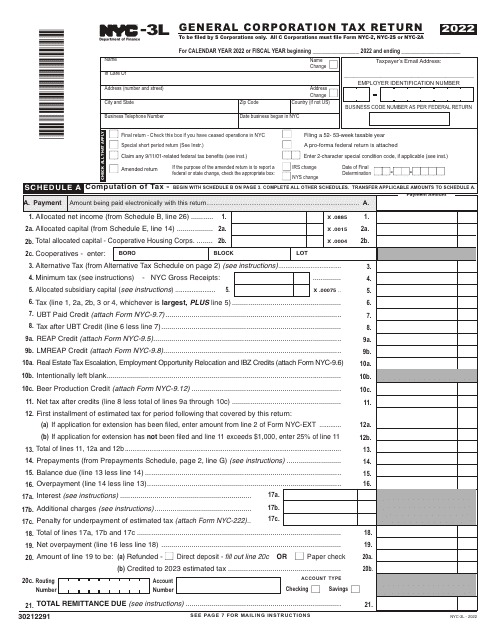

This form is used for filing the General Corporation Tax Return for businesses located in New York City.

This form is used for filing the General Corporation Tax Return for businesses in New York City. It provides instructions on how to complete the form and pay the appropriate taxes.

This Form is used for providing instructions on how to fill out forms NYC-3A, NYC-3A/B, and NYC-3A/ATT for New York City residents. It provides guidance on completing these tax forms correctly.

This Form is used for filing the General Corporation Tax Return for businesses in New York City. It provides instructions on how to complete the form and file taxes properly.

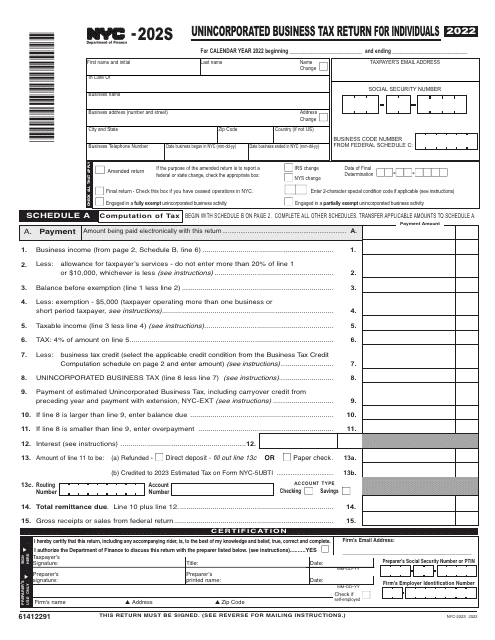

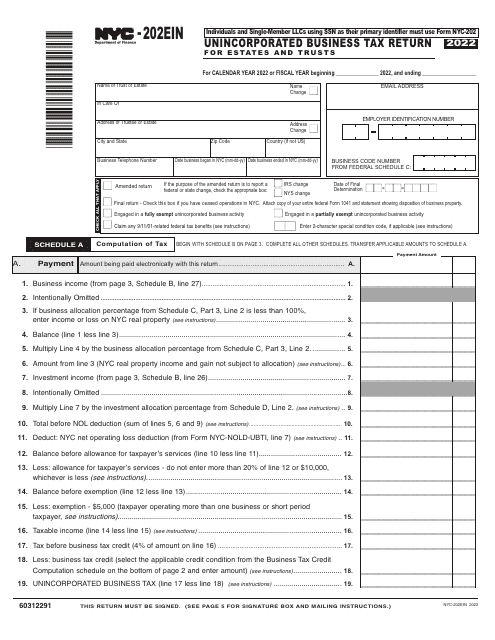

This Form is used for filing the Unincorporated Business Tax Return for individuals and single-member LLCs in New York City. It provides instructions on how to report and calculate taxes on business income.

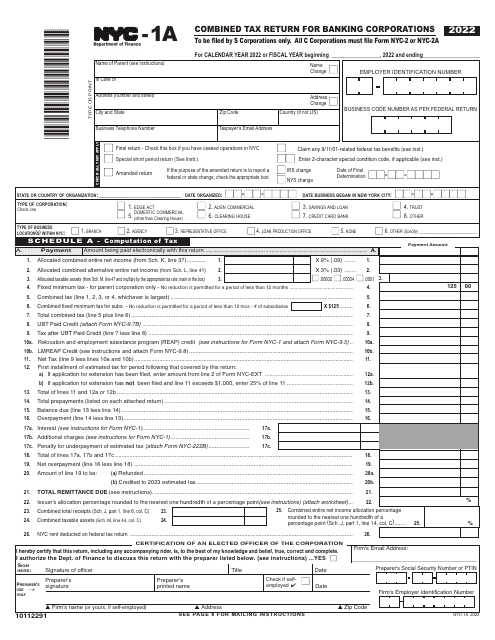

This Form is used for filing the combined tax return for banking corporations in New York City.