Tax Revenue Templates

Tax revenue, also known as revenue tax documents or forms, is a collection of essential paperwork that governments use to track and manage the income generated from taxes. These forms are meticulously designed to ensure accuracy and transparency in the collection and allocation of funds. From certificates of estimated property tax revenue to detailed schedules for specific taxable items, tax revenue documents play a crucial role in maintaining financial stability and sustaining the various public services provided by the government.

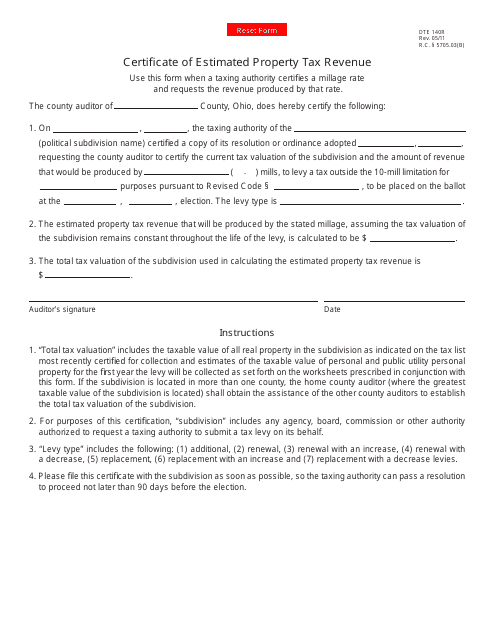

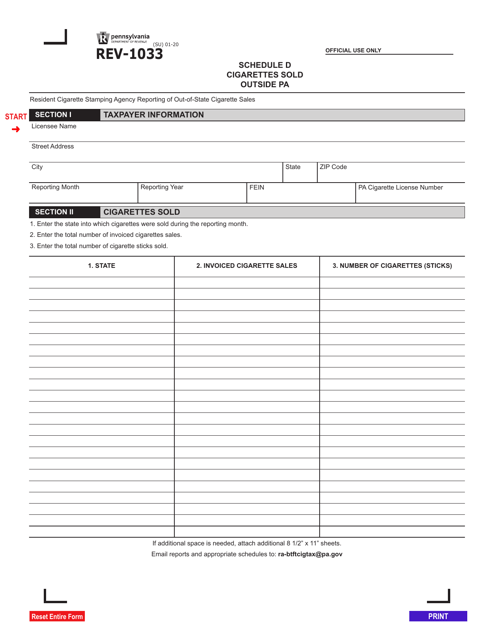

Individual states have their own unique tax revenue documents, such as the Form DTE140R Certificate of Estimated Property Tax Revenue in Ohio or the Form REV-1033 Schedule D Cigarettes Sold Outside Pa in Pennsylvania. These documents provide a comprehensive overview of the tax revenue collected from specific sources and help in determining the distribution of funds for vital programs and initiatives.

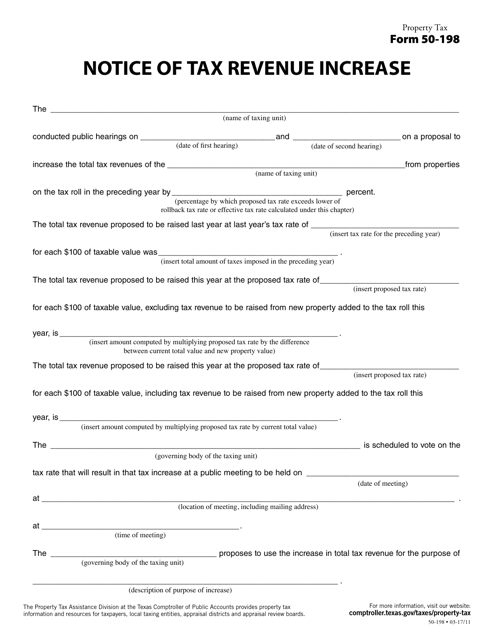

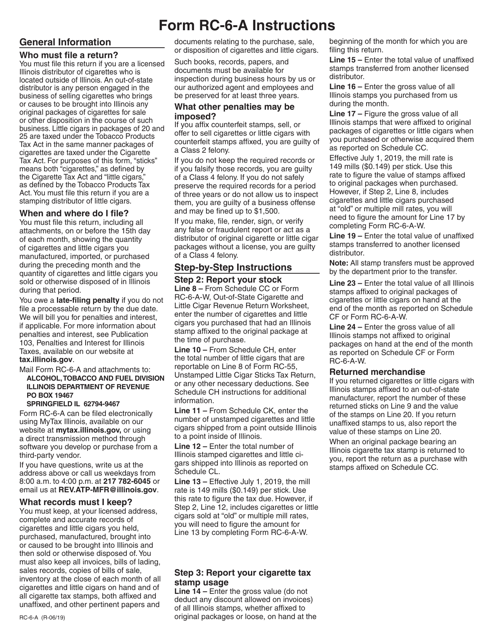

In addition to state-specific forms, there are also broader documents that impact tax revenue on a national level. For instance, the Form 50-198 Notice of Tax Revenue Increase in Texas highlights any significant changes in the collection of tax revenue, while the Instructions for Form RC-6-A, 433 Out-of-State Cigarette and Little Cigar Revenue Return in Illinois offer comprehensive guidelines for reporting revenue from specific products.

Considering the importance of tax revenue for the overall functioning of governments, staying up to date with these documents is crucial for individuals, businesses, and policymakers. By understanding the latest tax revenue forms, taxpayers can ensure compliance and contribute to the growth and development of their respective states.

At [Your Website], we provide a comprehensive range of resources and information related to tax revenue documents. Whether you are an individual looking to file your taxes accurately or a business owner seeking guidance on reporting revenue, our platform offers valuable insights and support. Stay informed about the latest tax revenue forms and take control of your financial obligations with our user-friendly tools and expert advice.

Documents:

5

This form is used for reporting and estimating property tax revenue in the state of Ohio. It is used by local governments and agencies to calculate and forecast the revenue that will be generated from property taxes.

This form is used for notifying Texas taxpayers about an increase in tax revenue.

This Form is used for reporting cigarette and little cigar revenue generated out-of-state. It is specific to the state of Illinois.

This document provides a summary of the President's proposed budget for the fiscal year 2022. It offers key information about how the government plans to spend and allocate funds for various programs and initiatives.