Deferred Compensation Program Templates

A deferred compensation program, also known as a deferred compensation plan or deferred compensation arrangement, is a type of employee benefit that allows individuals to set aside a portion of their income to be paid out at a later date, typically after retirement. This program provides employees with the opportunity to defer taxes on their earnings and potentially accumulate additional wealth for the future.

In a deferred compensation program, employees contribute a portion of their salary or bonus into a dedicated account, which is then invested according to their preferences. The funds in the account grow tax-deferred until a pre-determined distribution event, such as retirement or separation from service, occurs. At that point, the employee can receive periodic payments or a lump sum payout from the accumulated funds.

One of the key advantages of a deferred compensation program is the ability to lower taxable income during the contribution phase, as contributions are typically made on a pre-tax basis. This can help individuals reduce their current tax liability and potentially enter a lower tax bracket. Additionally, since the funds grow tax-deferred, any investment earnings within the account are not subject to annual taxes, allowing for greater potential growth over time.

Another benefit of a deferred compensation program is the flexibility it offers in terms of distribution options. Employees can choose when and how they receive the funds, whether it be in equal installments over a specific period of time or as a lump sum payout. This allows individuals to align their income needs with their personal financial goals and circumstances.

It's important to note that a deferred compensation program is typically offered by employers to their employees and can be subject to specific rules and regulations set forth by the governing authorities. Each program may have its own set of eligibility criteria, contribution limits, investment options, and distribution terms. Therefore, it's essential to review the specific plan documents and consult with a financial advisor to fully understand the details and implications of participating in a deferred compensation program.

In summary, a deferred compensation program provides individuals with a valuable opportunity to save for the future and potentially enjoy additional income during retirement. By deferring taxes on contributions and investment earnings, participants can maximize their long-term financial well-being. Whether it's called a deferred compensation plan, deferred compensation arrangement, or any other alternate name, this program offers individuals a path towards a secure and prosperous future.

Documents:

9

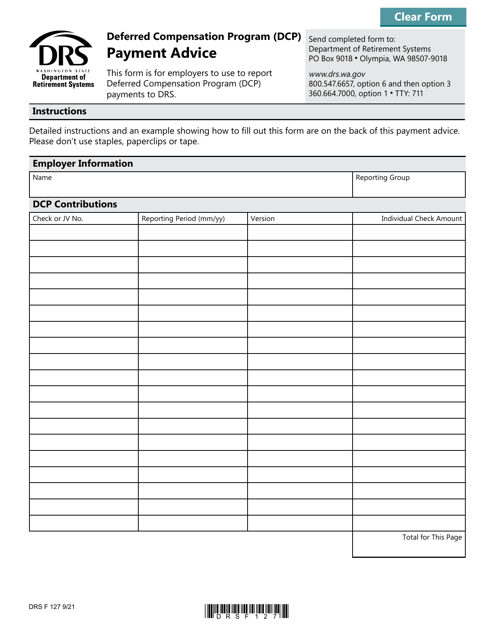

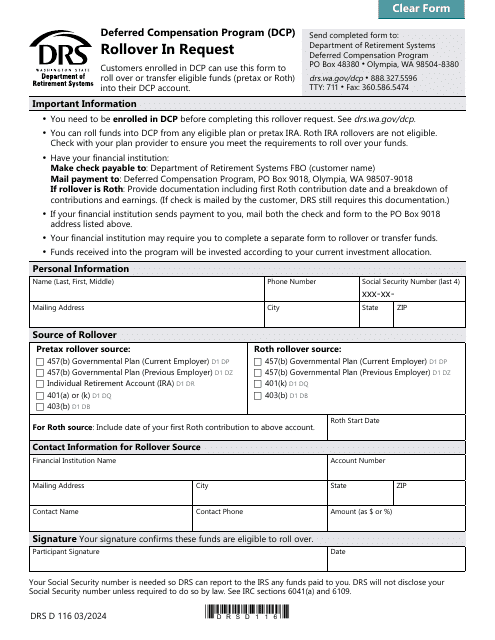

This form is used for providing payment advice for the Deferred Compensation Program (DCP) in Washington.