Charitable Organizations Templates

Documents:

228

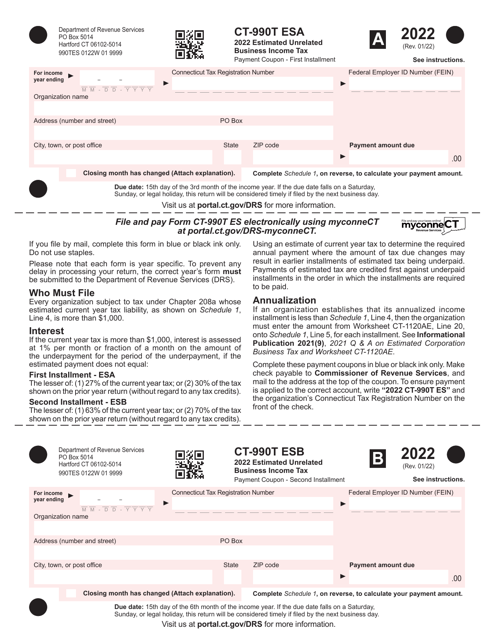

This form is used for estimating the unrelated business income tax for entities operating in Connecticut.

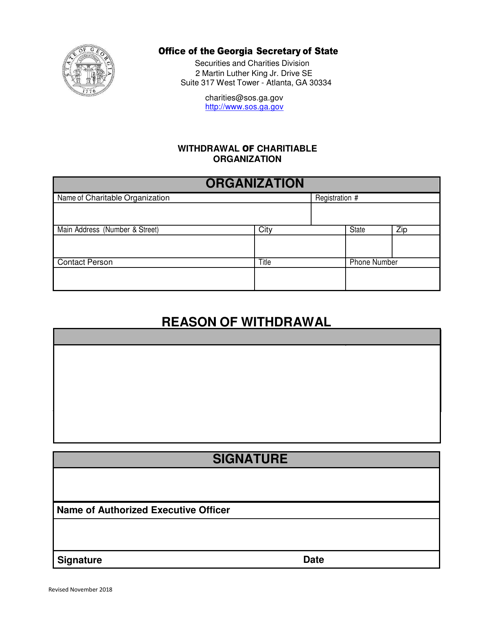

This Form is used for the withdrawal of a charitable organization in the state of Georgia, United States.

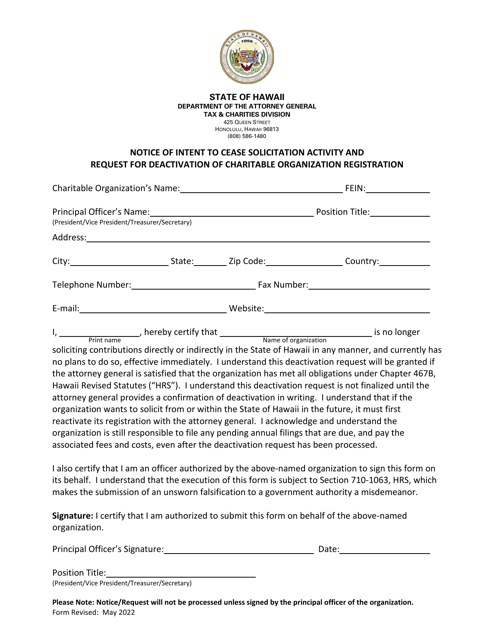

This document is used to inform the authorities in Hawaii of a charitable organization's intent to stop soliciting donations. The organization also requests to deactivate its registration as a charitable organization in Hawaii.

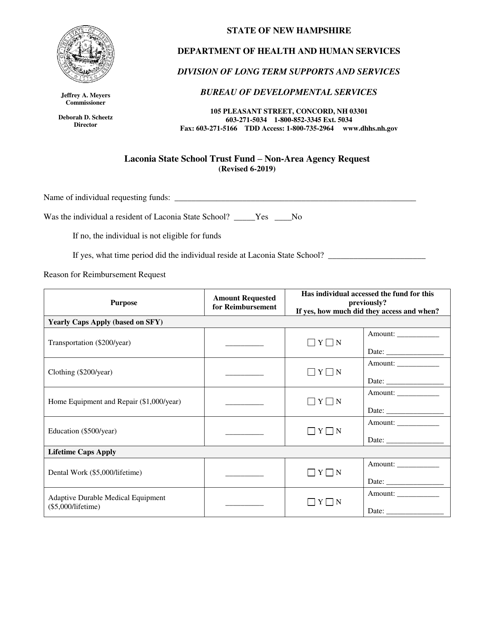

This form is used for requesting funds from the Laconia State School Trust Fund in New Hampshire.

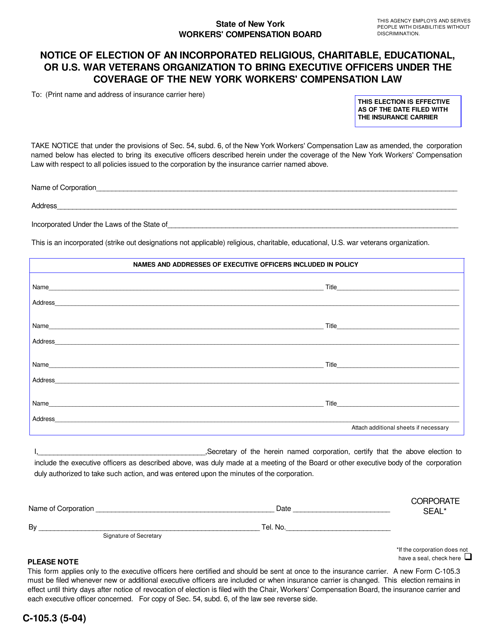

This form is used for notifying an incorporated religious, charitable, educational, or U.S. war veterans organization in New York about their election to bring executive officers under the coverage of the New York Workers' Compensation Law.

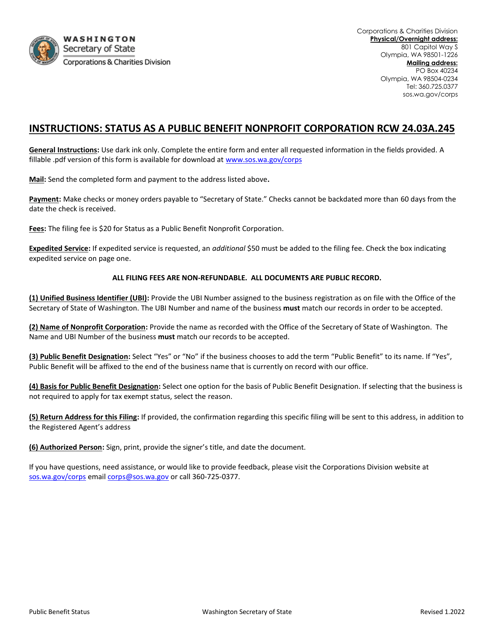

This document is used for applying for status as a public benefit nonprofit corporation in the state of Washington. It is necessary for organizations seeking to operate as a nonprofit and provide public benefits.

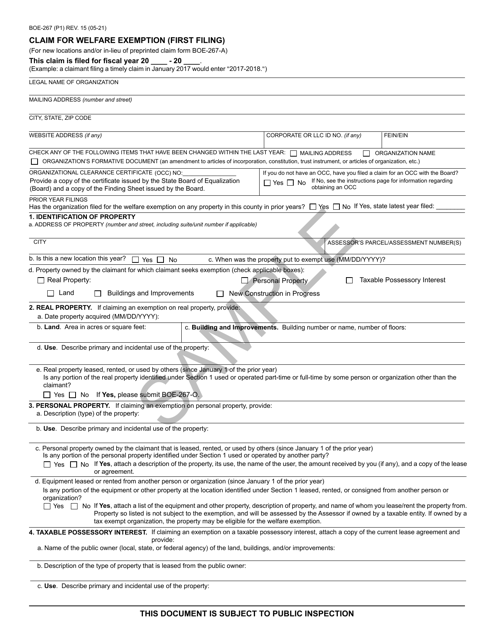

This form is used for claiming a welfare exemption for the first time in California. It is a sample form for reference purposes.

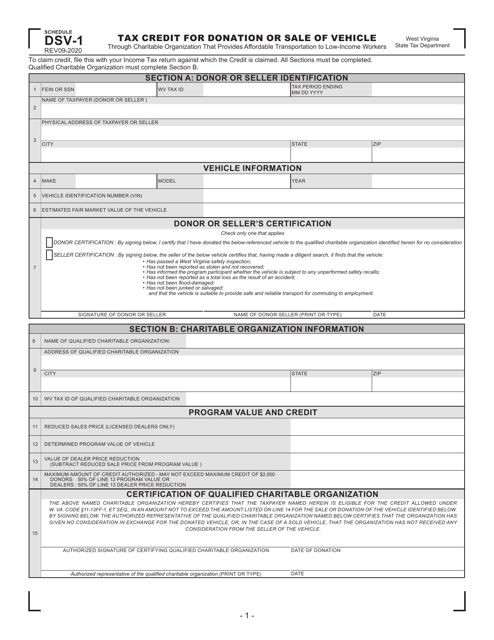

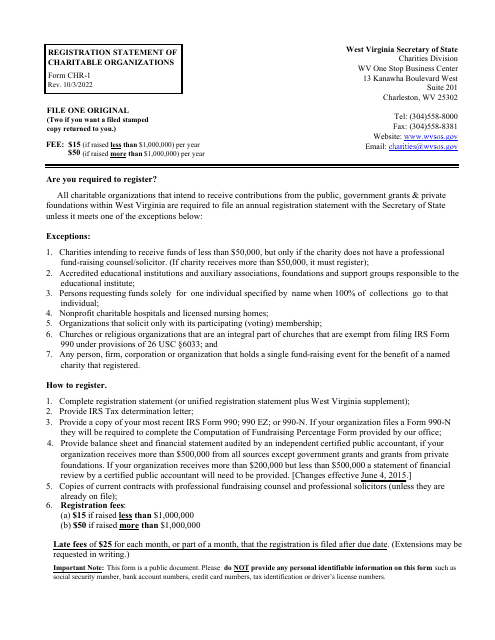

This type of document is used for claiming a tax credit in West Virginia for donating or selling a vehicle to a charitable organization that provides affordable transportation to low-income workers.

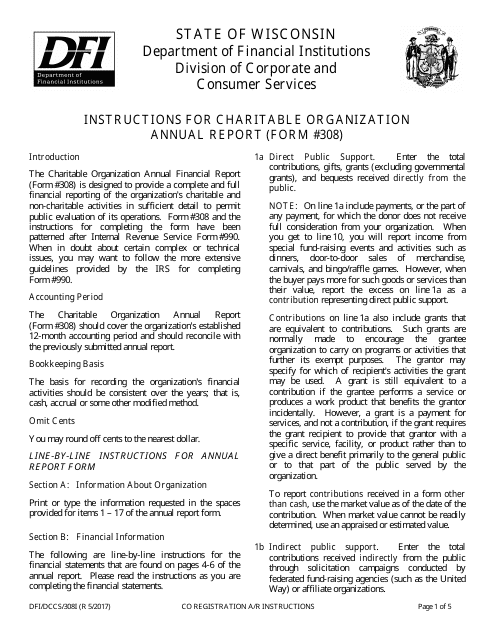

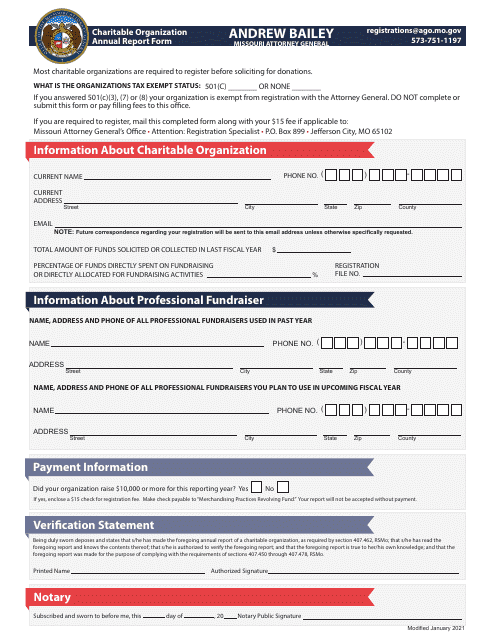

This Form is used for filing the Charitable Organization Annual Report in the state of Wisconsin. It provides instructions on how to fill out the form and what information is required for reporting purposes.

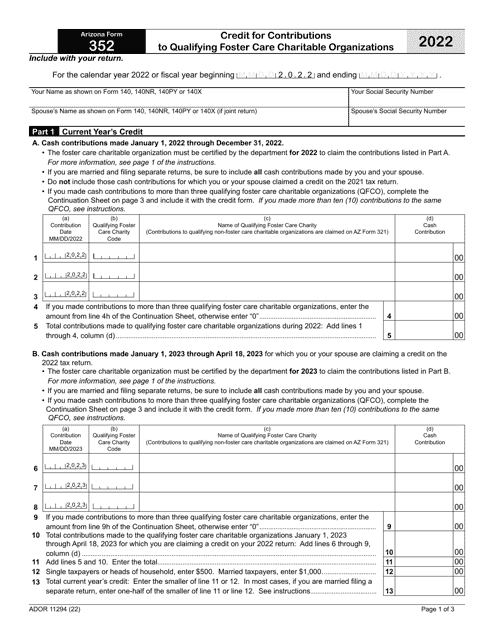

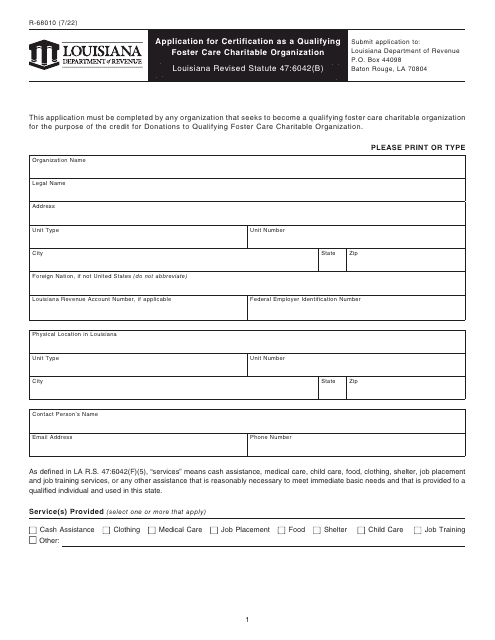

This form is used for applying to become a qualifying foster care charitable organization in Louisiana. It is necessary to fill out this form in order to seek certification.

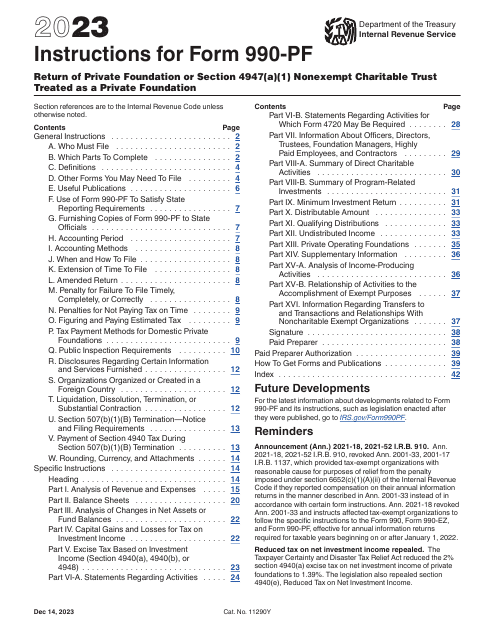

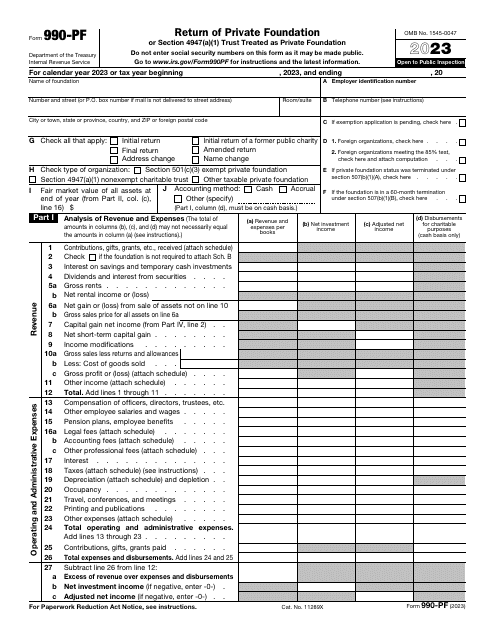

This form, also known as the private foundation tax return, can also substitute Form 1041, if a trust has no taxable income. Use this form to calculate the tax on the income from an investment and to report charitable activities and distributions.

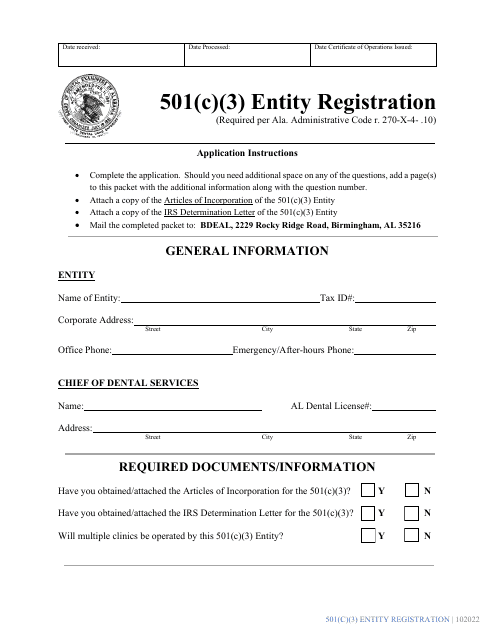

This document is used for the registration of a 501(c)(3) entity in the state of Alabama.

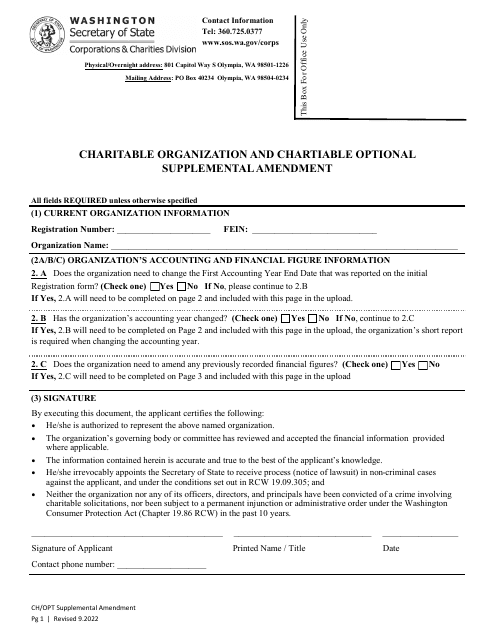

This document is used for making changes or amendments to the articles of incorporation of a charitable organization registered in Washington state. It allows the organization to update or modify certain provisions in their original filing.

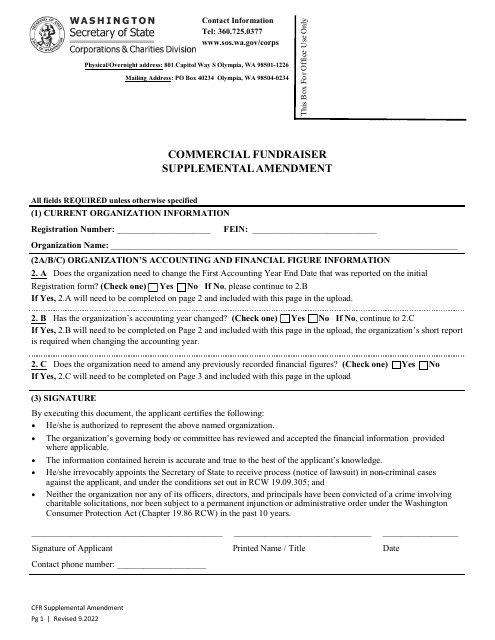

This form is used for submitting additional information to amend a commercial fundraiser registration in Washington state.

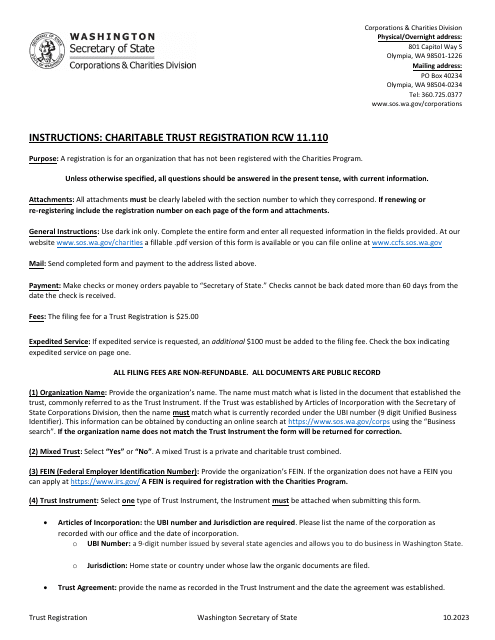

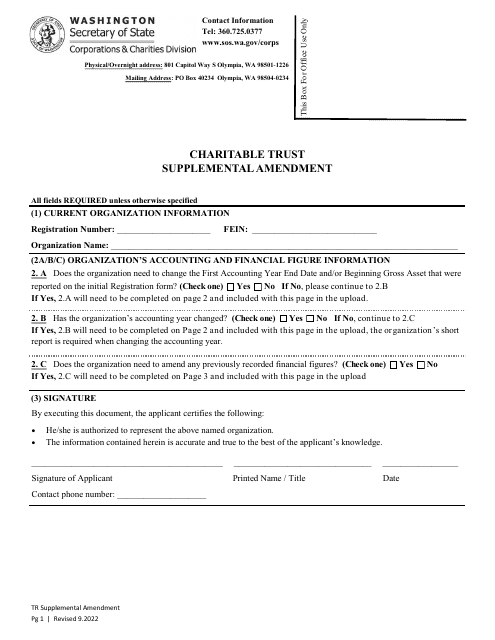

This document is used to make additional changes to a charitable trust in the state of Washington. It allows for modifications or updates to the trust's provisions or terms.

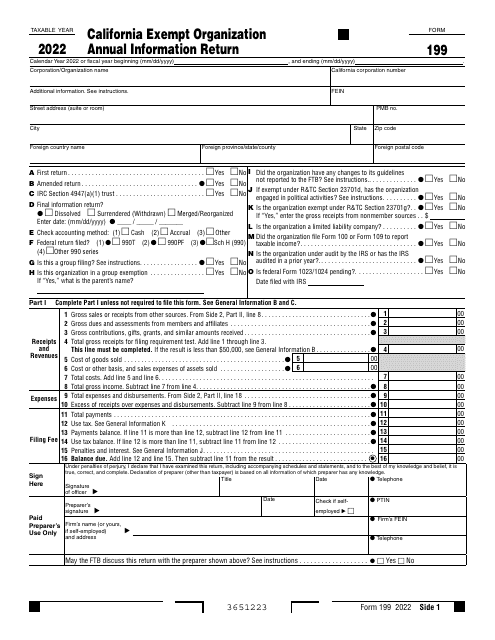

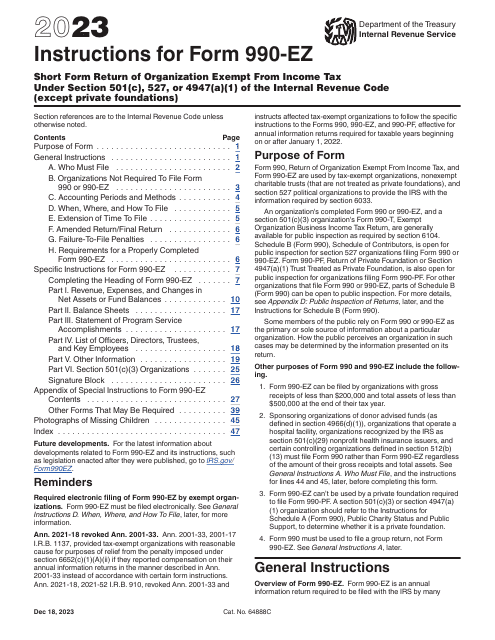

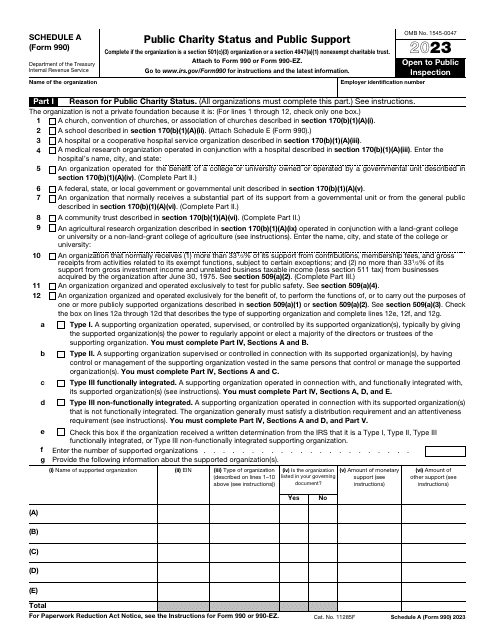

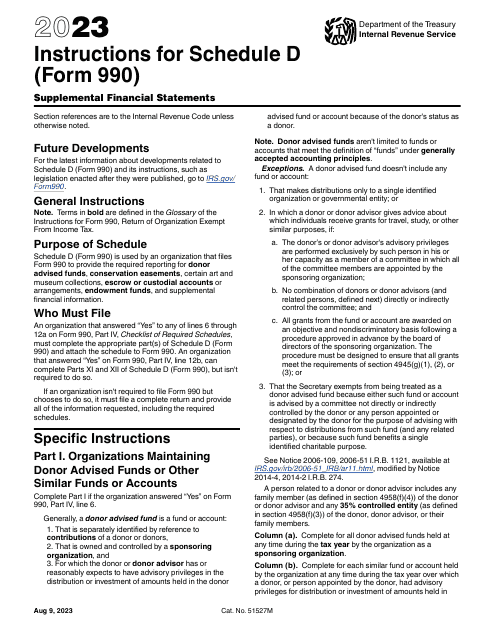

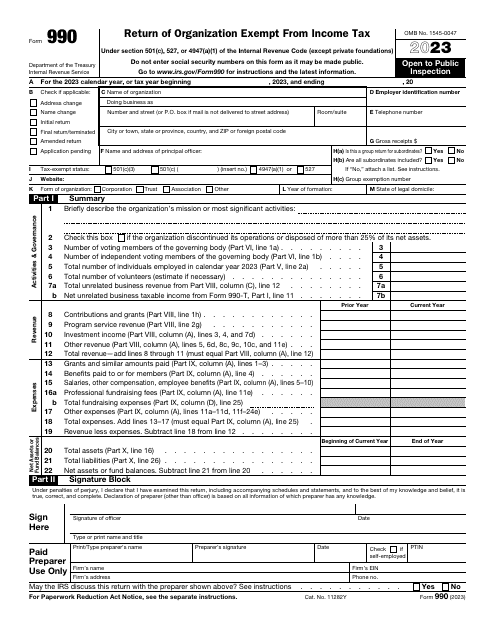

This form is used to supply the Internal Revenue Service (IRS) with information regarding receipts, gross income, disbursements, and other data used by tax-exempt organizations to summarize their work during the tax year.

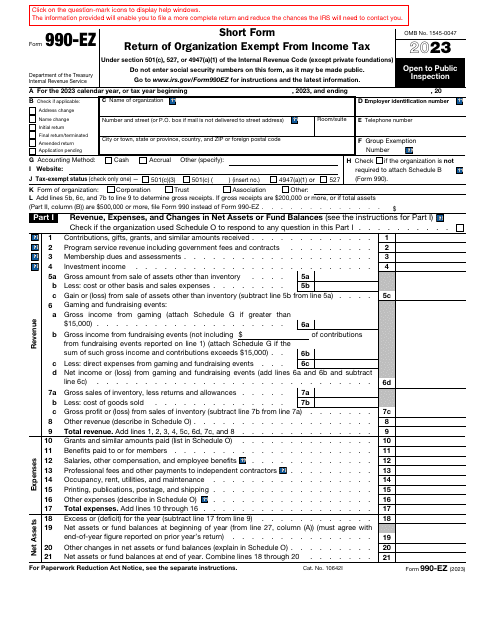

This is a fiscal form used by tax-exempt organizations required to inform tax organizations about their earnings, expenses, and achievements over the course of the year.

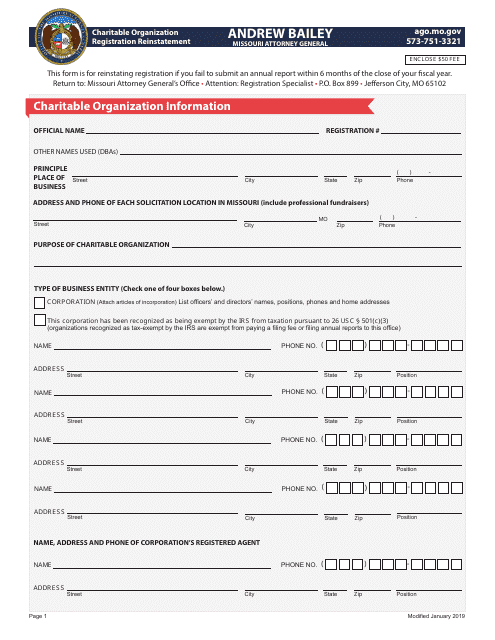

This document is for reinstating the registration of a charitable organization in the state of Missouri.