Tax Petition Templates

Are you looking for a way to dispute or challenge your taxes? Our tax petition service can help you navigate through the process and ensure your voice is heard. Whether you are a business owner or an individual taxpayer, our team is here to assist you in filing and presenting your tax petition.

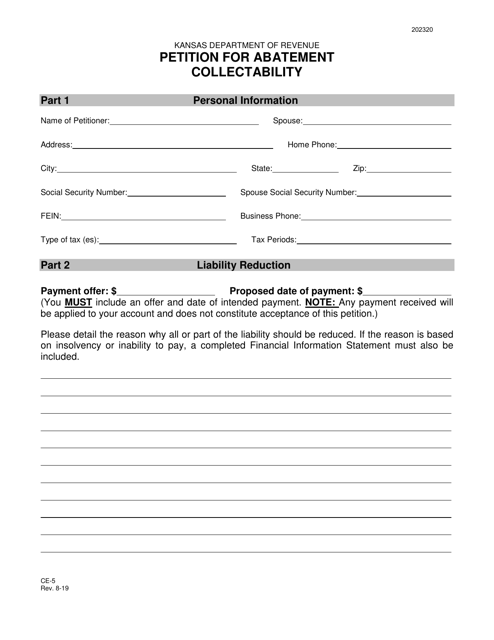

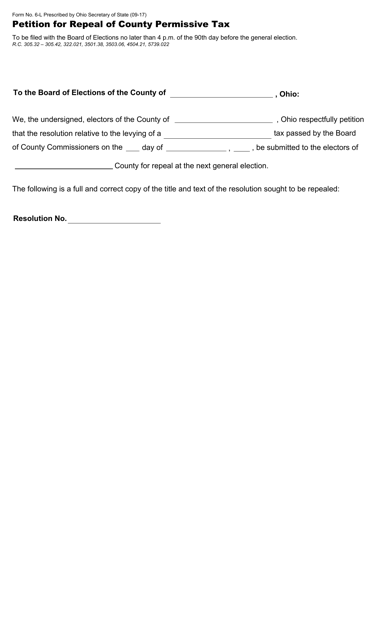

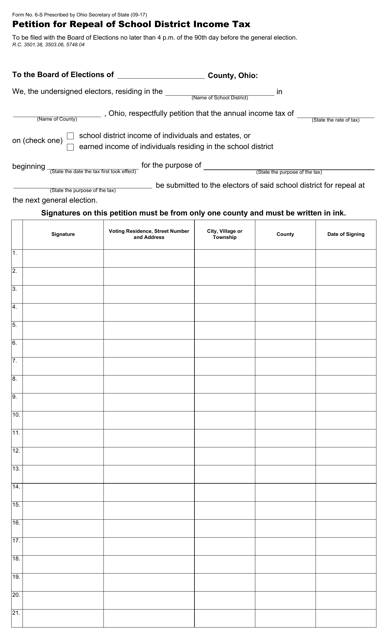

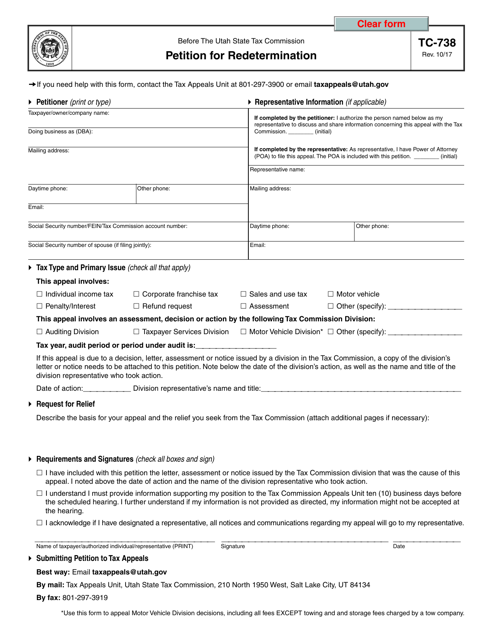

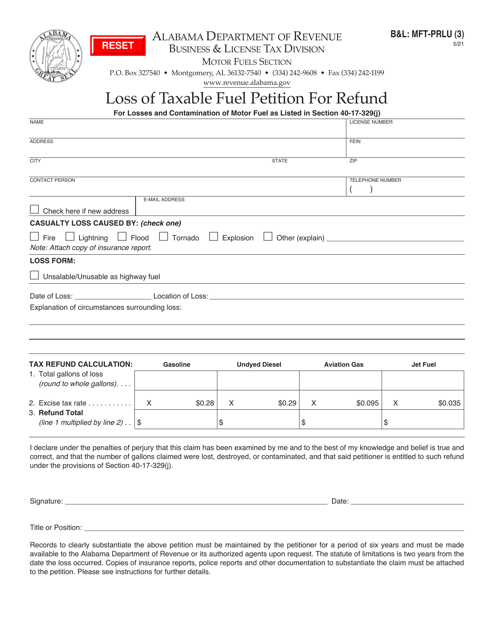

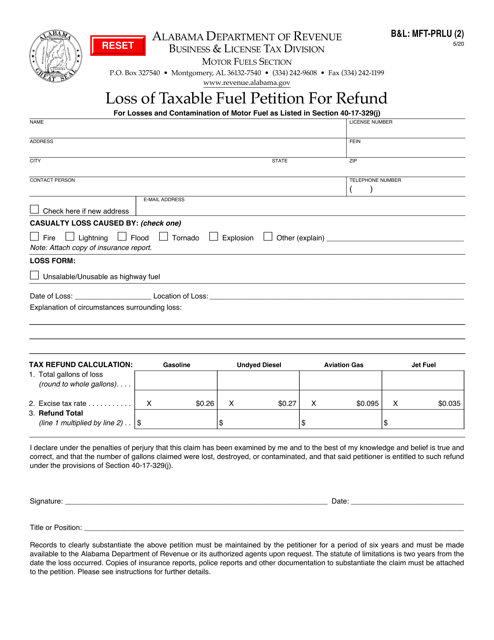

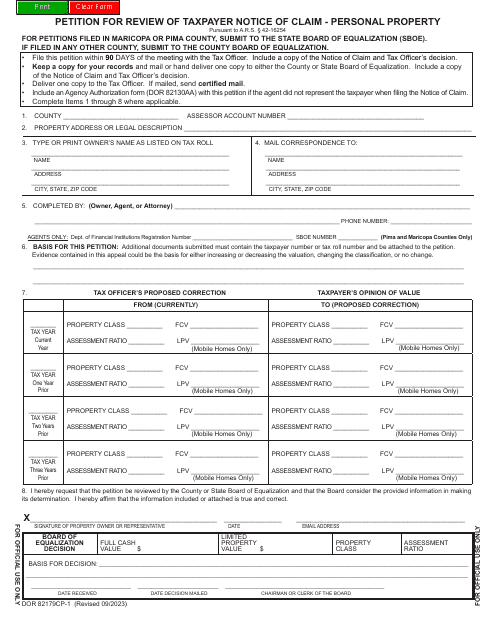

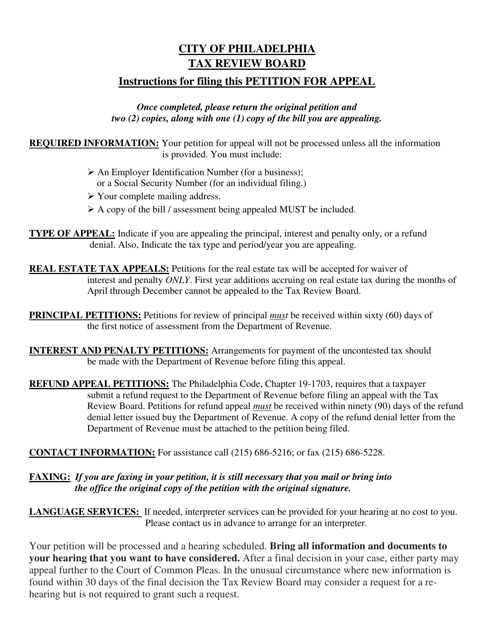

Also known as a tax appeal or tax protest, a tax petition is a formal request to review and potentially revise an imposed tax assessment. Our comprehensive collection of tax petition forms includes Form CE-5 Petition for Abatement Collectability in Kansas, Form 6-S Petition for Repeal of School District Income Tax in Ohio, Form B&L: MFT-PRLU Loss of Taxable Fuel Petition for Refund in Alabama, Form DOR82179CP-1 Petition for Review of Taxpayer Notice of Claim - Personal Property in Arizona, and Instructions for Tax Review Board Petition for Appeal in the City of Philadelphia, Pennsylvania.

Our tax petition service is designed to provide you with the necessary resources and guidance to present a strong case against your tax assessment. We understand that dealing with taxes can be complex and time-consuming, which is why we are here to simplify the process for you.

With our expertise in tax laws and regulations, we will work closely with you to gather all the required documentation, complete the necessary forms, and compile a persuasive argument to support your tax petition. Our dedicated team of professionals is committed to helping you achieve a positive outcome and potentially secure a reduction or elimination of your tax liability.

Don't let an unfair tax assessment burden you any longer. Take advantage of our tax petition service and let us advocate for your rights as a taxpayer. Contact us today to get started on your tax petition and regain control over your financial situation.

Documents:

14

This Form is used for residents of Ohio to petition for the repeal of a county permissive tax. It allows residents to express their opposition to the tax and request for it to be repealed.

This Form is used for petitioning the repeal of a school district income tax in Ohio.

This form is used to file a petition for redetermination in the state of Utah. It allows taxpayers to contest a decision made by the Utah State Tax Commission regarding taxes owed.

This form is used for filing a petition to request a refund of taxable fuel in the state of Alabama.

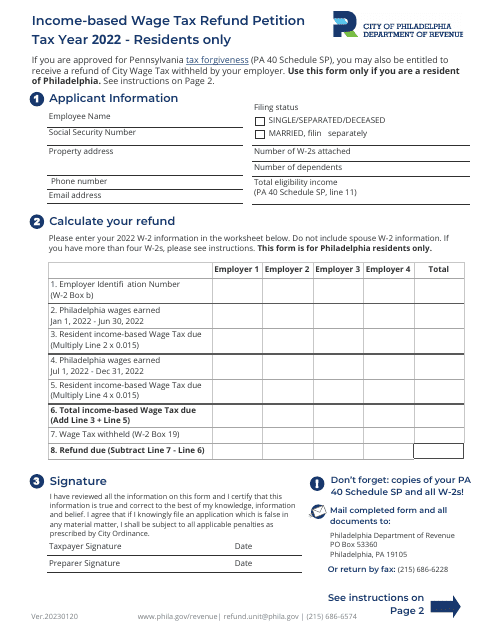

This document is for individuals in Philadelphia, Pennsylvania who wish to appeal a tax assessment made by the Tax Review Board. It provides instructions on how to complete a petition for appeal to challenge the assessment.

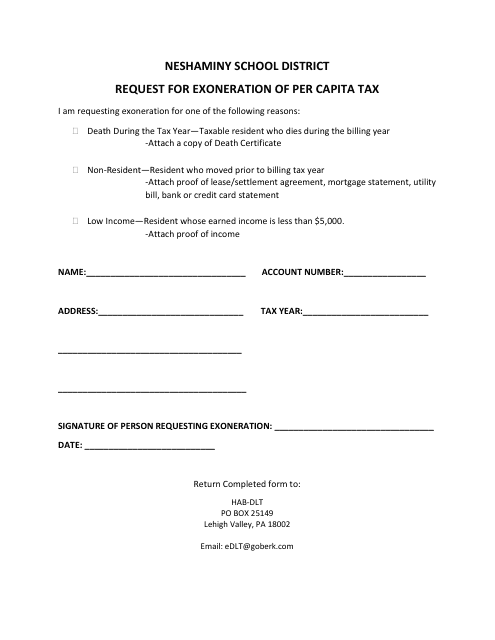

This document is a request to be exempted from paying the per capita tax in the Neshaminy School District in Pennsylvania.

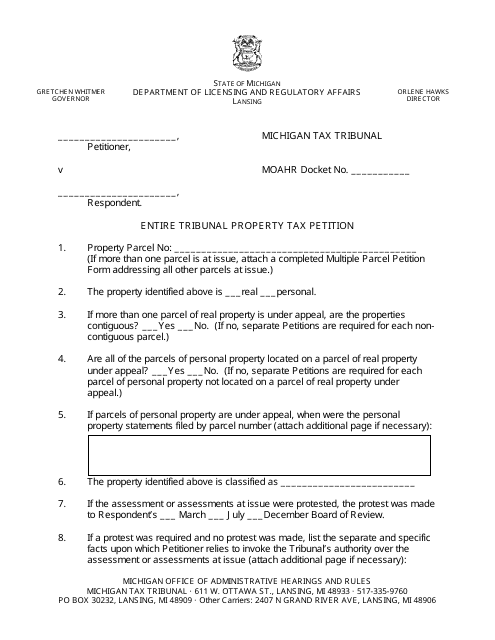

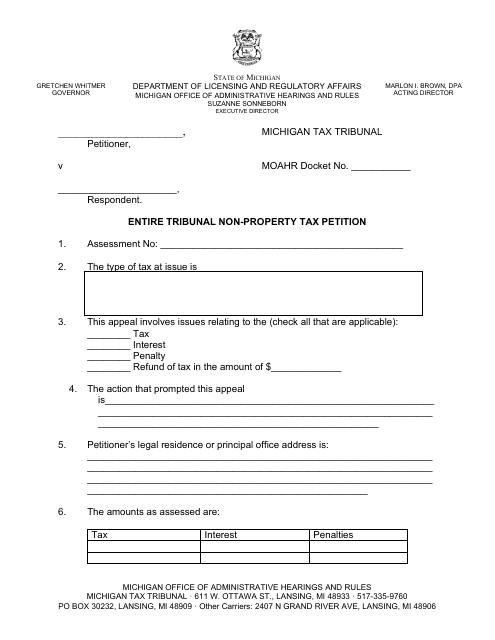

This document is used for filing a petition related to property tax assessment in Michigan. It allows taxpayers to contest their property tax assessment before the Tribunal.