Payroll Tax Credit Templates

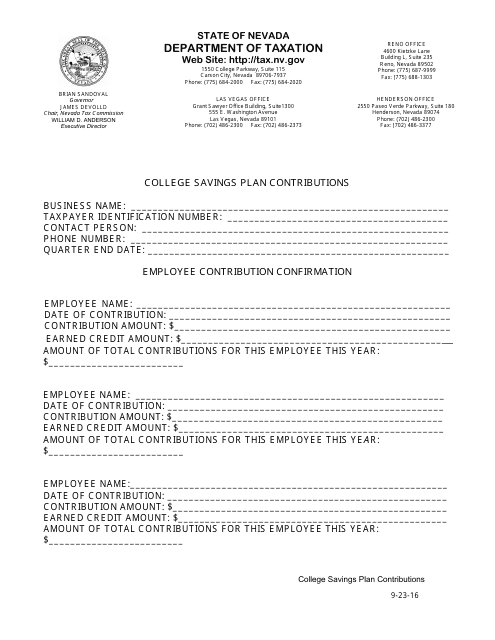

Looking to learn more about payroll tax credits? Our comprehensive collection of documents covers everything you need to know about this valuable tax incentive. Whether you're a qualified small business conducting research activities, an employer seeking advance payment credits due to COVID-19, or looking for credits relating to matching employee contributions to prepaid tuition contracts and college savingstrust accounts, we have the information you're looking for.

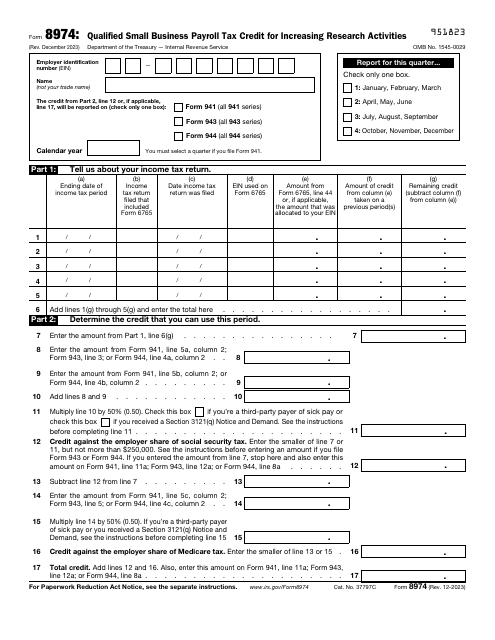

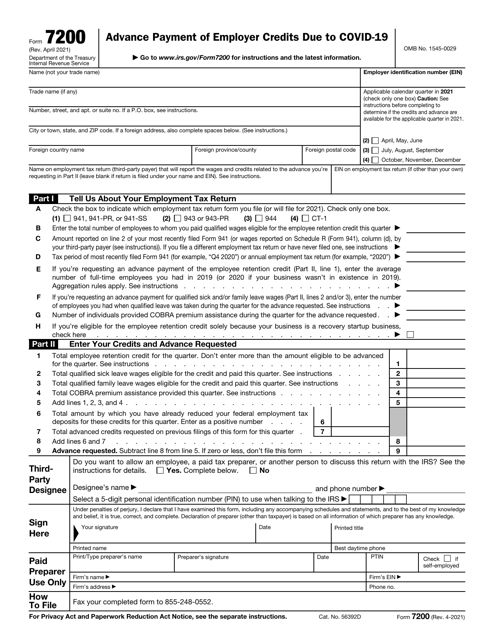

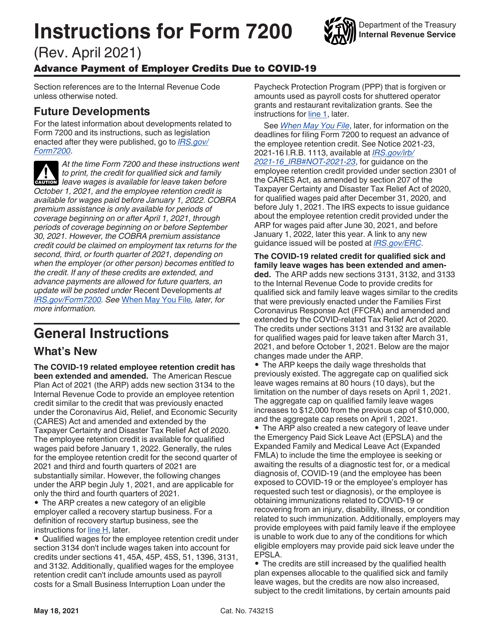

Our in-depth resources include IRS forms, such as Form 8974 for qualified small business payroll tax credits for increasing research activities and Form 7200 for advance payment of employer credits due to COVID-19. Additionally, we provide detailed instructions on how tofill out these forms accurately to ensure you maximize the benefits available to you.

Don't miss out on the opportunity to reduce your tax liability and take advantage of these payroll tax credits. Explore our collection of documents today to stay informed and make the most of your financial opportunities.

Documents:

6

This document is for payroll tax purposes in Nevada. It provides information about a credit for matching employee contributions to prepaid tuition contracts and college savings trust accounts.