Acquired Property Templates

Are you looking to learn more about acquired property, also known as acquiring property or property acquired? Look no further! Our comprehensive collection of documents related to acquired property is here to provide you with all the information you need.

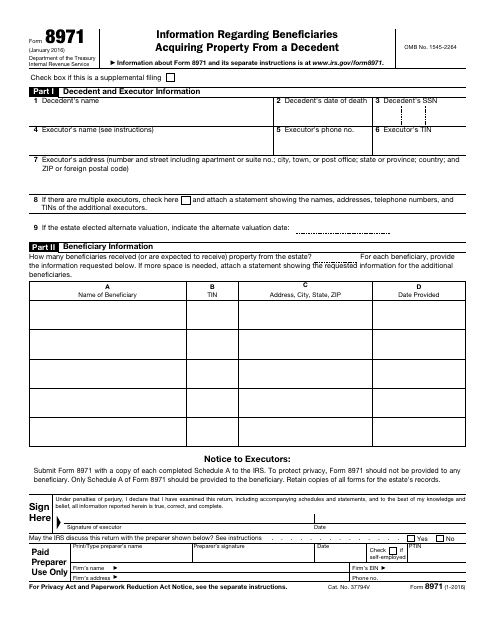

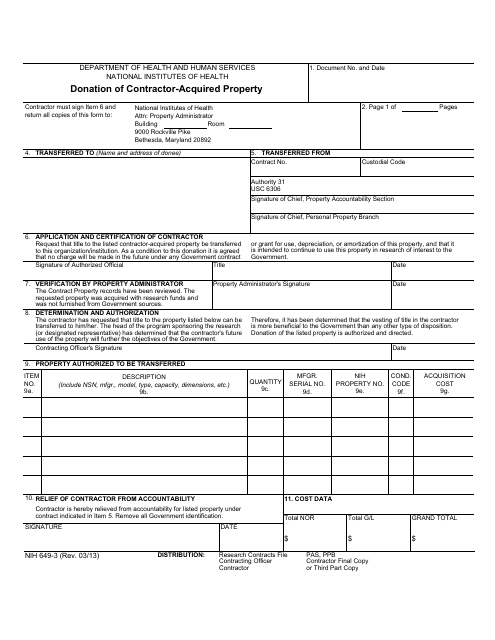

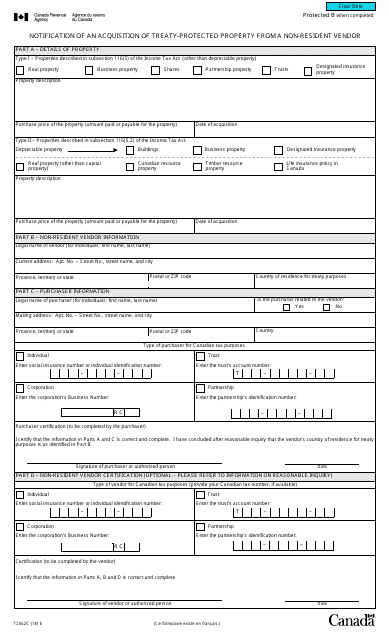

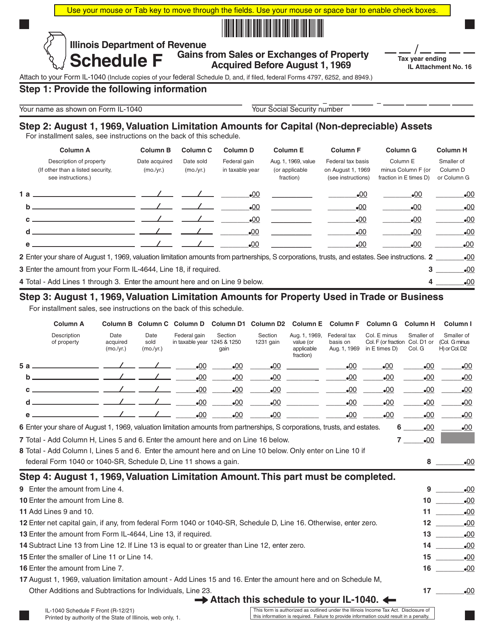

Whether you are a beneficiary who has acquired property from a decedent or a contractor involved in the donation of contractor-acquired property, our documents cover all aspects of the process. We also have resources for individuals or businesses who are involved in the acquisition of treaty-protected property from non-resident vendors in Canada or those who need to report gains from sales or exchanges of property acquired before August 1, 1969 in Illinois.

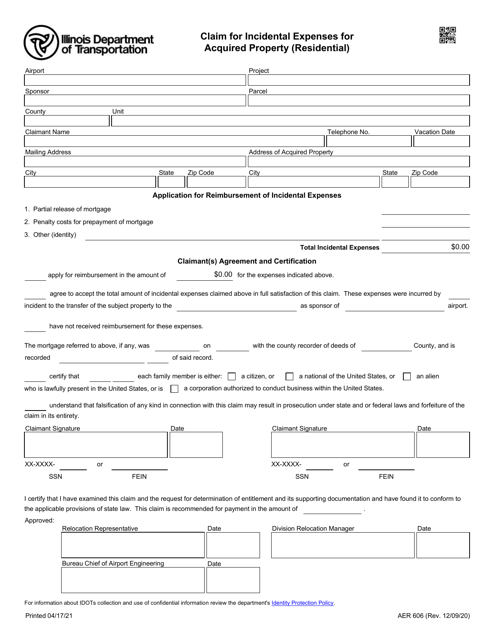

Navigating the world of acquired property can be complex, but our documents make it easy to understand and comply with the necessary regulations. From IRS Form 8971 to Form T2062C, Form IL-1040 Schedule F, and Form AER606, we have a wide range of forms and schedules that cater to different requirements and jurisdictions.

Whether you are a professional in the field or an individual looking to understand the process of acquiring property, our comprehensive collection of acquired property documents is a valuable resource. Explore our collection today to find the information you need to navigate the world of acquired property seamlessly.

Documents:

5

This form is used for providing information about beneficiaries who acquire property from a deceased person.

This document is used for the donation of property acquired by a contractor to the National Institutes of Health (NIH).

This form is used for notifying the Canadian government about the acquisition of treaty-protected property from a non-resident vendor.

This form is used for claiming incidental expenses for acquired residential property in Illinois.