Paycheck Protection Program Templates

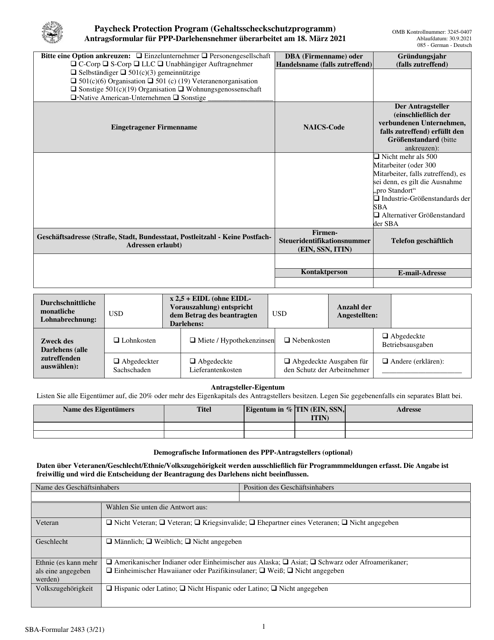

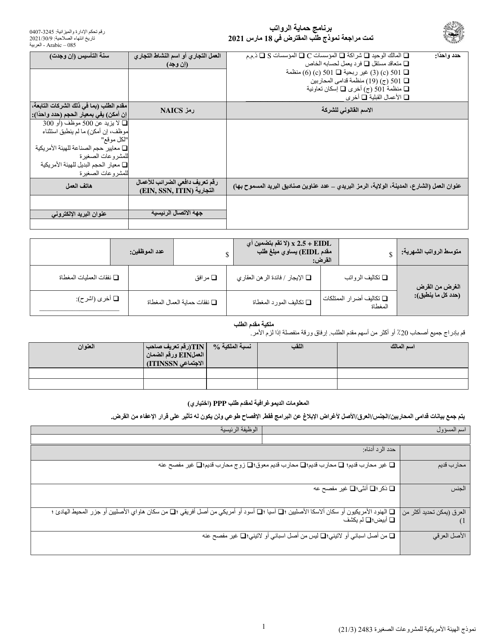

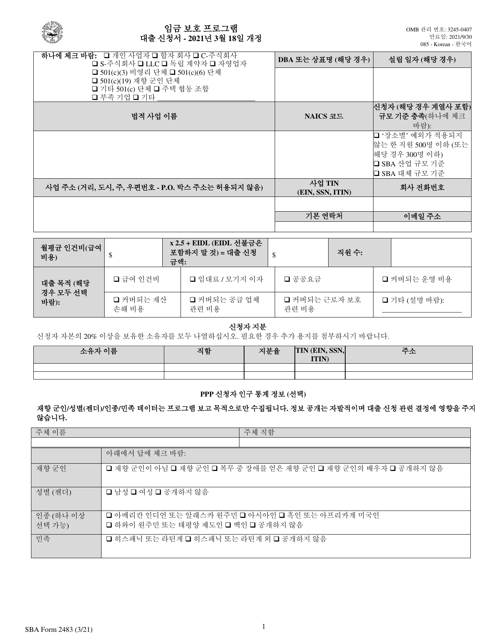

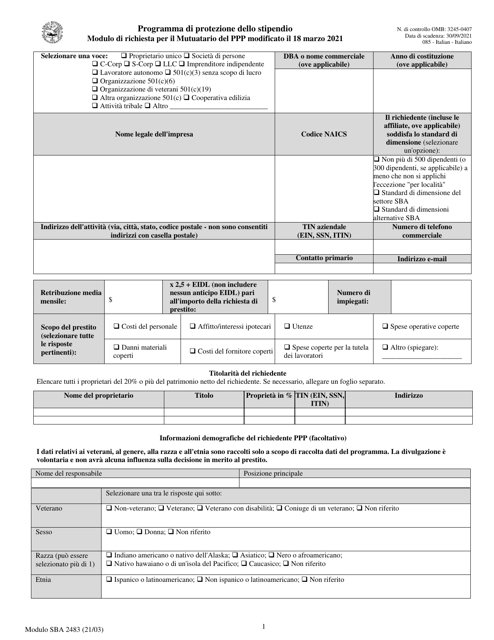

The Paycheck Protection Program, also known as PPP or the Paycheck Protection Program Form, is a government initiative designed to provide financial assistance to small businesses affected by the COVID-19 pandemic. This program offers forgivable loans to eligible businesses to help cover payroll and other essential expenses.

Under the Paycheck Protection Program, businesses can apply for loans through designated lenders and use the funds to retain employees, cover rent or mortgage payments, and pay for utilities. The loans are intended to provide a lifeline for small businesses during this challenging time, ensuring they can continue to operate and retain their workforce.

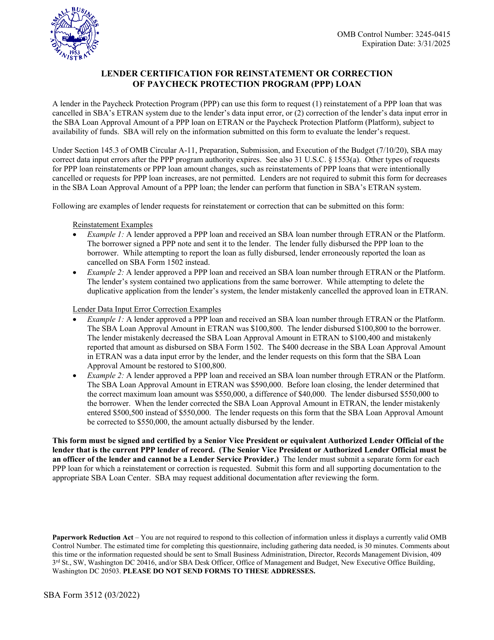

To apply for the Paycheck Protection Program, businesses will need to submit the necessary documents, which can vary based on the lender and the specific circumstances of the business. Some of the forms and questionnaires include:

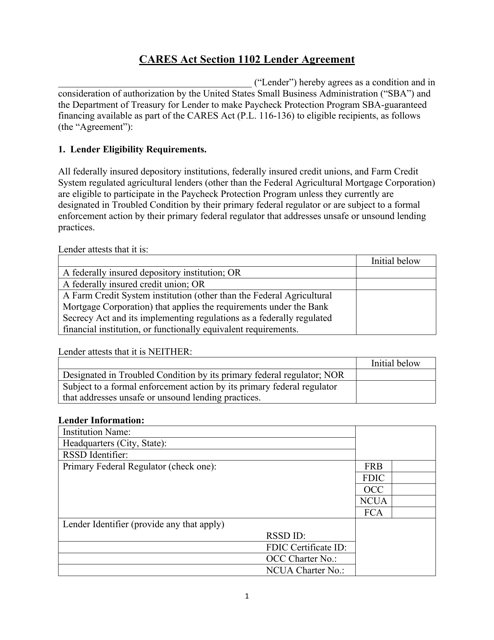

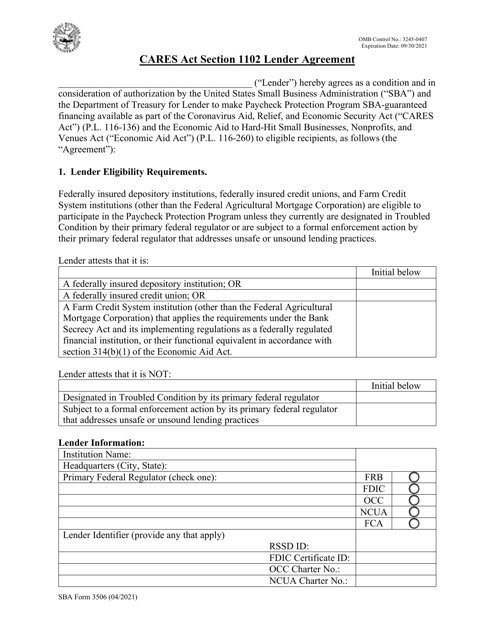

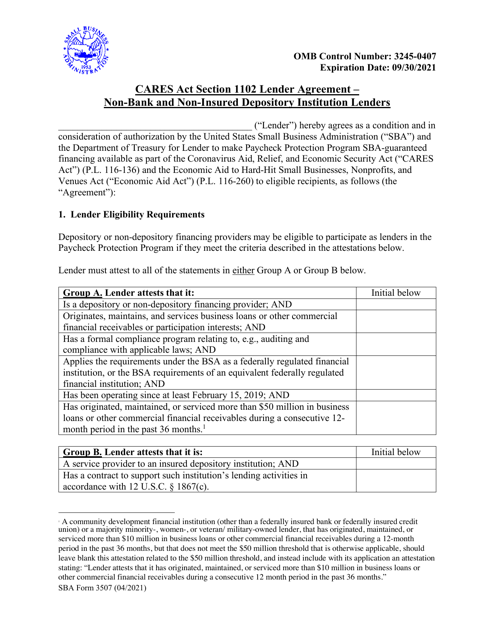

- SBA Form 3506 CARES Act Section 1102 Lender Agreement

- SBA Form 3510 Paycheck Protection Program Loan Necessity Questionnaire (Non-profit Borrowers) (Italian)

- SBA Form 3510 Paycheck Protection Program Loan Necessity Questionnaire (Non-profit Borrowers) (Arabic)

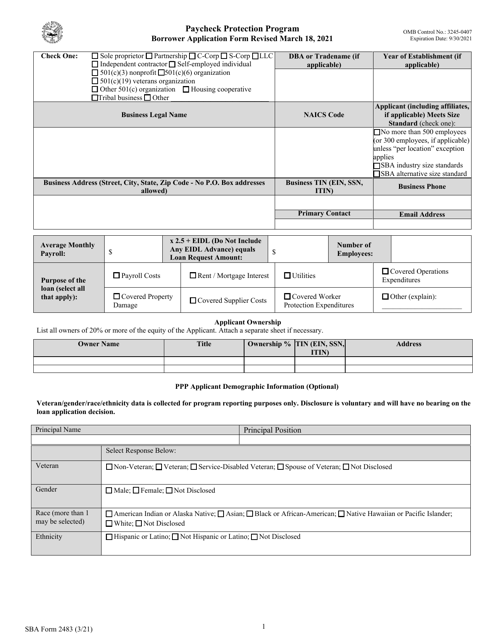

- SBA Form 2483 PPP First Draw Borrower Application Form (Arabic)

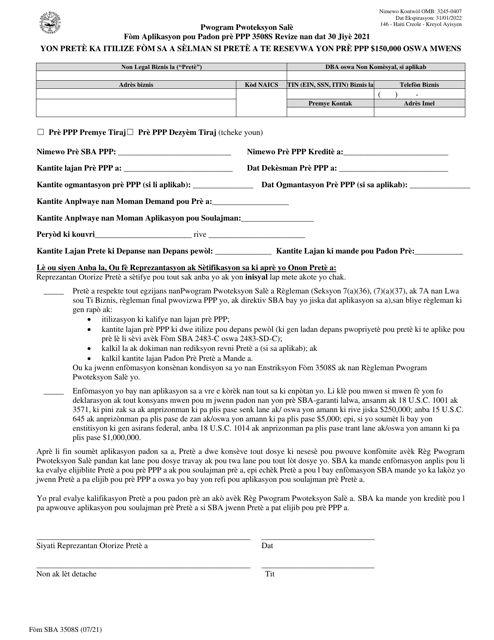

- SBA Form 3508S PPP Loan Forgiveness Application Form (Haitian Creole)

These forms and questionnaires are essential for businesses seeking financial assistance through the Paycheck Protection Program. They provide lenders with the necessary information to evaluate the eligibility and necessity of the loan.

If you're a small business impacted by the pandemic, the Paycheck Protection Program can be a valuable resource to help you overcome the financial challenges you may be facing. By taking advantage of this program, you can secure the funding needed to retain your employees and ensure the continuity of your operations.

Note: The content provided is for informational purposes only and does not constitute legal or financial advice. It is always recommended to consult with a professional advisor or the Small Business Administration (SBA) for specific guidance on the Paycheck Protection Program.

Documents:

35

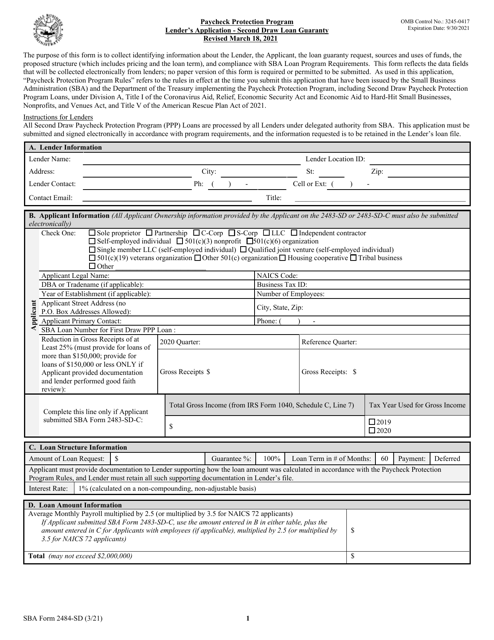

This document is a Lender Agreement under Section 1102 of the CARES Act. It outlines the terms and conditions that lenders must agree to in order to participate in the Paycheck Protection Program.

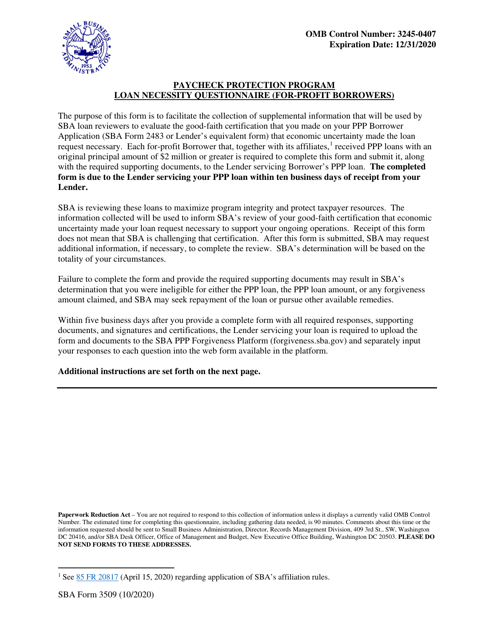

This form is used for for-profit borrowers applying for the Paycheck Protection Program loan to answer a questionnaire about the necessity of the loan.

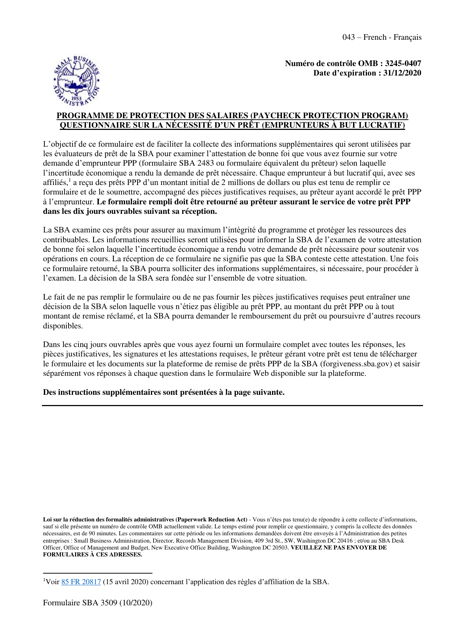

This Form is used for Italian For-Profit Borrowers to complete the Paycheck Protection Program Loan Necessity Questionnaire.

This Form is used for nonprofit borrowers to complete the Paycheck Protection Program Loan Necessity Questionnaire. It helps assess the necessity of the loan for nonprofit organizations applying for the Paycheck Protection Program.

This document is used for non-profit borrowers who have received a Paycheck Protection Program loan and need to fill out a questionnaire regarding the necessity of the loan.

This Form is used for non-profit borrowers to answer questions about the necessity of their Paycheck Protection Program loan.

This document is for non-profit borrowers participating in the Paycheck Protection Program. It is the SBA Form 3510, which is a questionnaire regarding the necessity of the loan. It is specifically for Italian borrowers.

This form is used for non-profit organizations applying for the Paycheck Protection Program loan. It includes a questionnaire to assess the necessity of the loan.

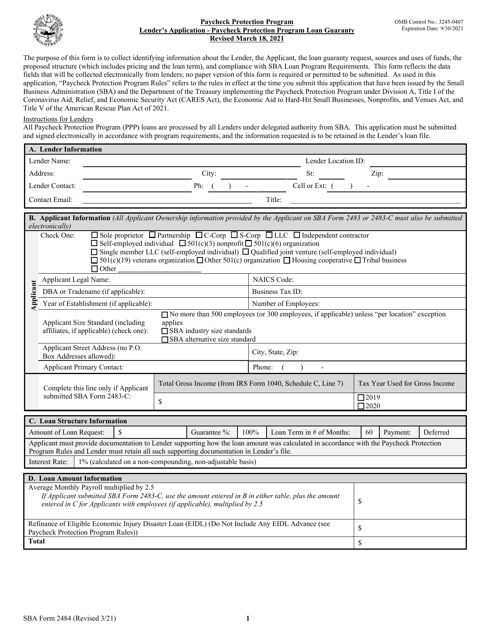

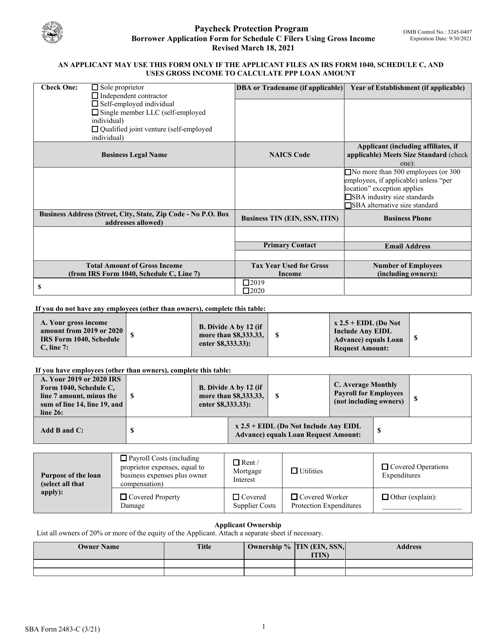

This Form is used for Schedule C filers who are applying for a loan with the Small Business Administration (SBA) and are using gross income as their method of calculation.

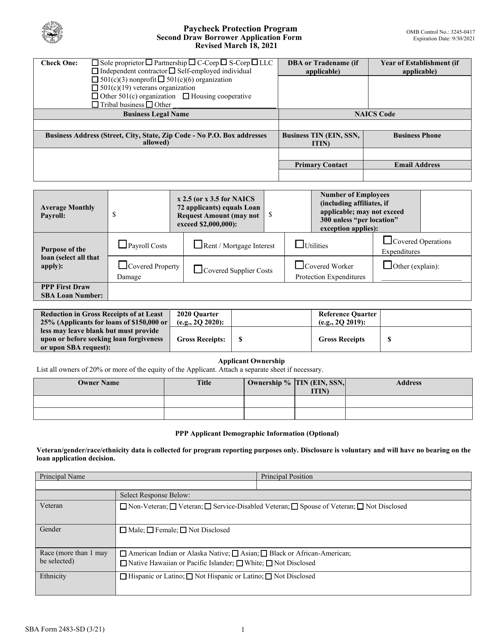

This Form is used for the Paycheck Protection Program Second Draw Loan Borrower Application.

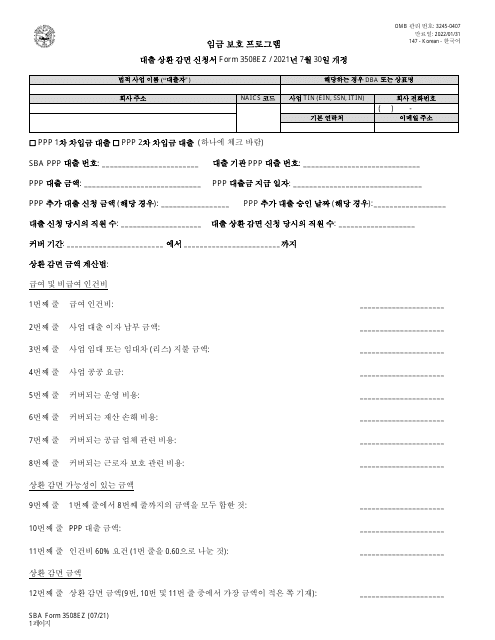

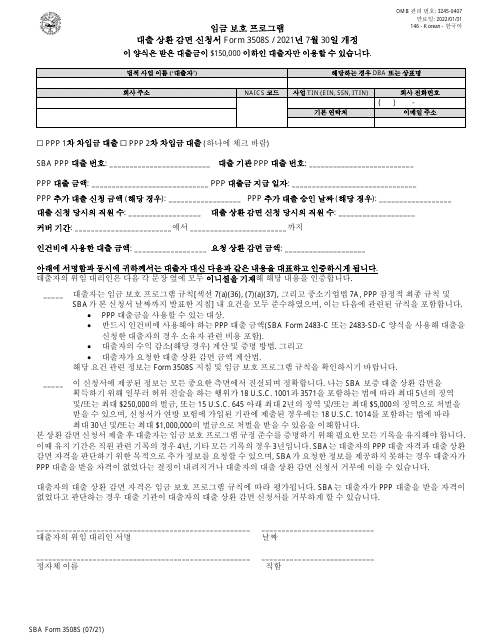

This document is the SBA Form 2483 PPP First Draw Borrower Application Form translated into Korean. It is used for Korean-speaking individuals or businesses applying for the Paycheck Protection Program (PPP) loan for the first time.

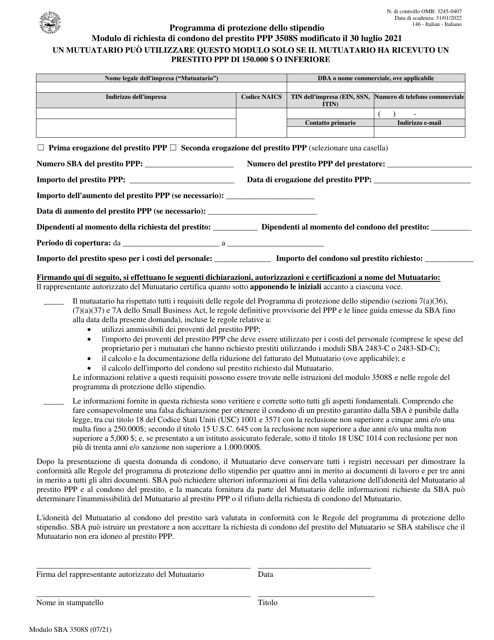

This document is for Italian applicants who want to apply for the First Draw PPP loan.

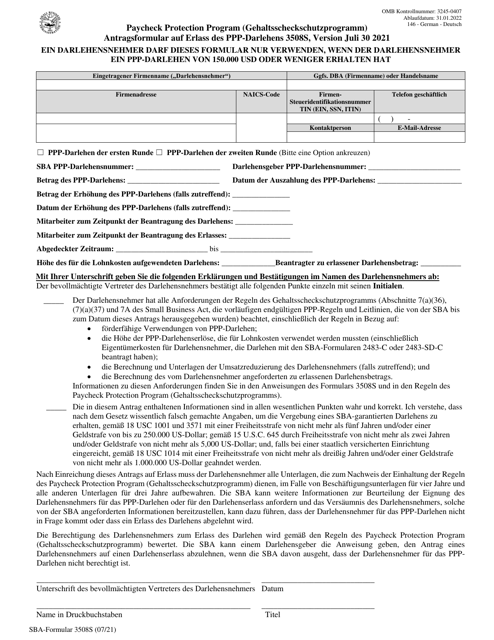

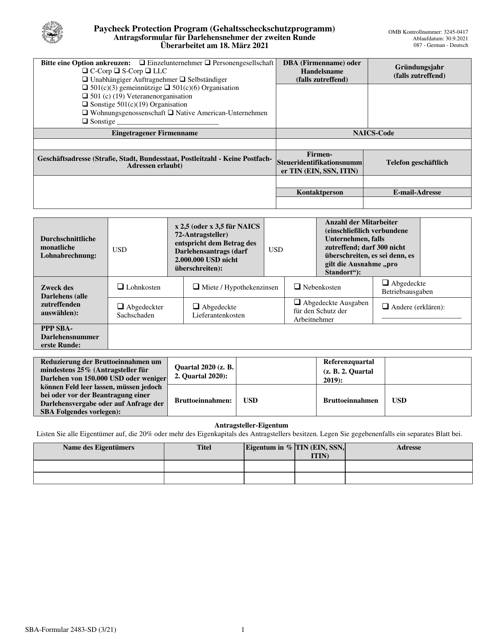

This document is the SBA Form 2483-SD PPP Second Draw Borrower Application Form, but it is in German.

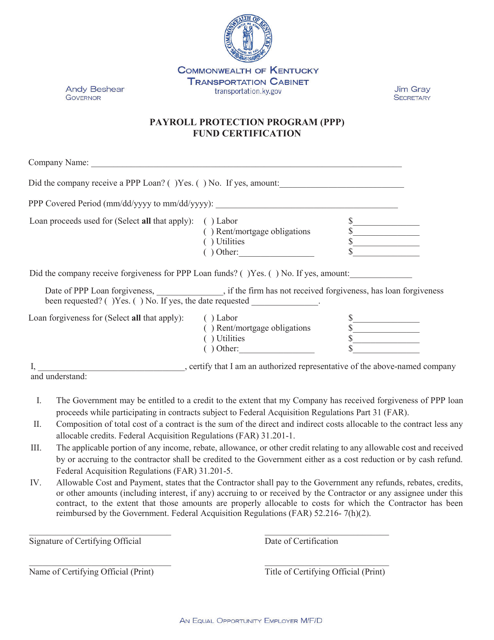

This document is the Payroll Protection Program (PPP) Fund Certification specifically for businesses located in Kentucky. It verifies that a business has received funds from the PPP program, which is designed to provide financial support to businesses during the COVID-19 pandemic.