Fraud Prevention Templates

Fraud Prevention: Safeguarding your Business Against Illicit Activities

Protecting your organization from fraudulent activities is paramount in today's complex business landscape. The Fraud Prevention program ensures that you stay one step ahead of potential threats, safeguarding your company's reputation and financial stability.

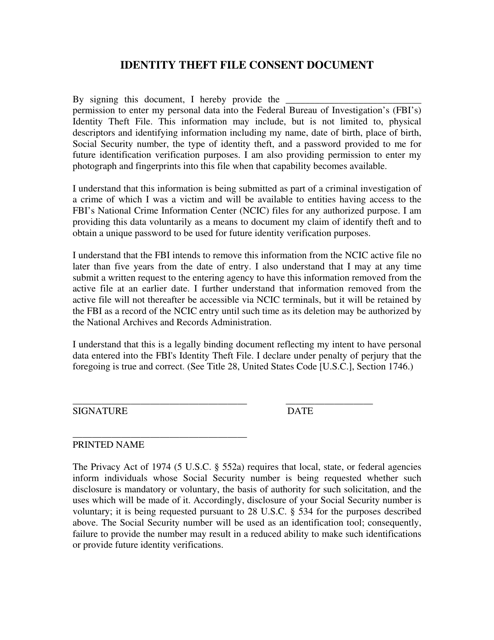

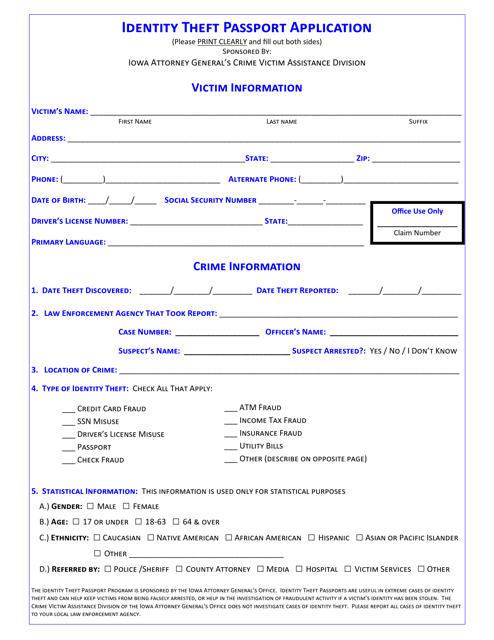

Our comprehensive suite of documents and resources equips businesses across industries with the necessary tools to prevent and detect fraudulent activities. These resources, including the Project Proposal Template from the institute for Fraud Prevention, the Retailer Suspicious Transaction Report Form from Kansas, and the Identity Theft Consent Form from Arkansas, among others, will assist you in implementing robust fraud prevention measures tailored to your specific needs.

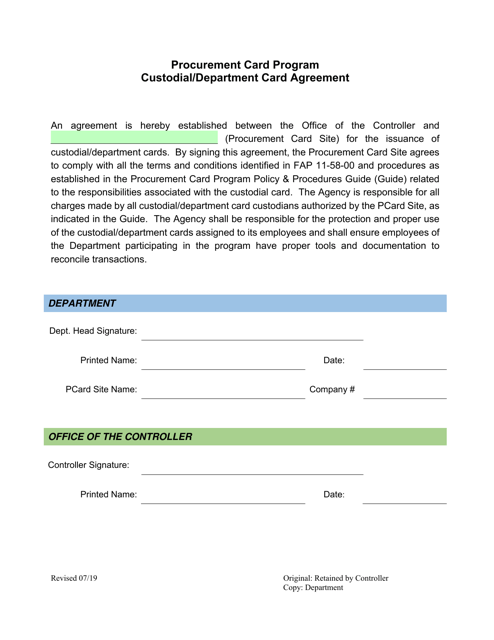

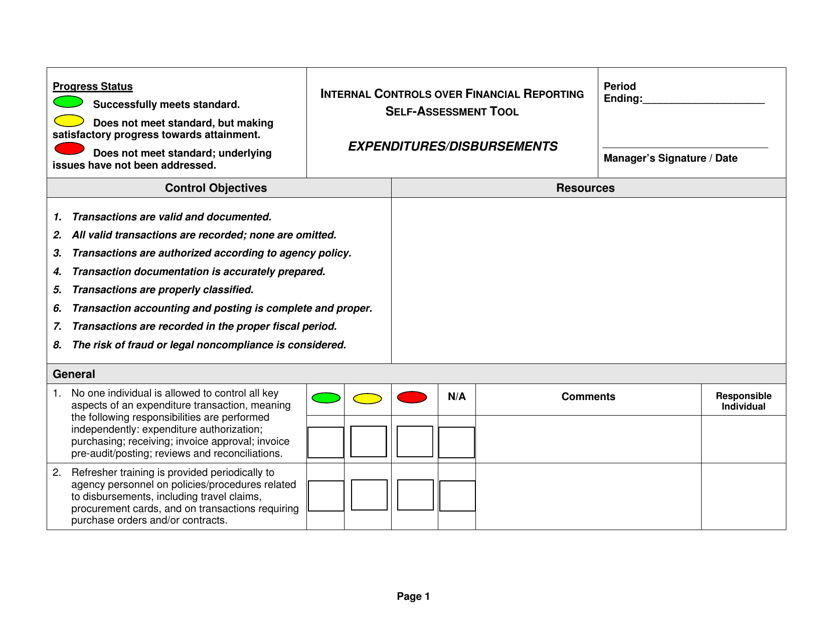

With the Procurement Card Program Custodial/Department Card Agreement from Kentucky, you can establish clear guidelines and accountability for the use of procurement cards, minimizing the risk of fraud and unauthorized spending. Additionally, the Internal Controls Over Financial Reporting Self-assessment Tool for Expenditures/Disbursements, available in Nebraska, enables you to evaluate and improve your organization's internal controls, reducing the vulnerability to fraudulent activities.

Staying vigilant and proactive is essential for your business's long-term success. Our Fraud Prevention program, also known as the Fraud Prevention Collection, offers a comprehensive array of resources to enhance your fraud detection and prevention capabilities. Invest in the security of your business and protect your assets with our trusted resources. Start fortifying your defenses against fraud today.

Documents:

22

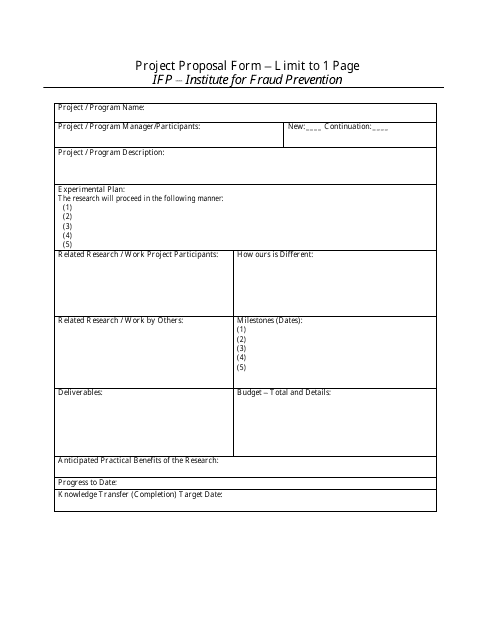

This one-page project proposal form was released by the Institute for Fraud Prevention (IFP) at West Virginia University.

This document provides guidelines and instructions for the Procurement Card Department in Colorado. The manual covers the processes and procedures of using procurement cards for purchasing and payment purposes.

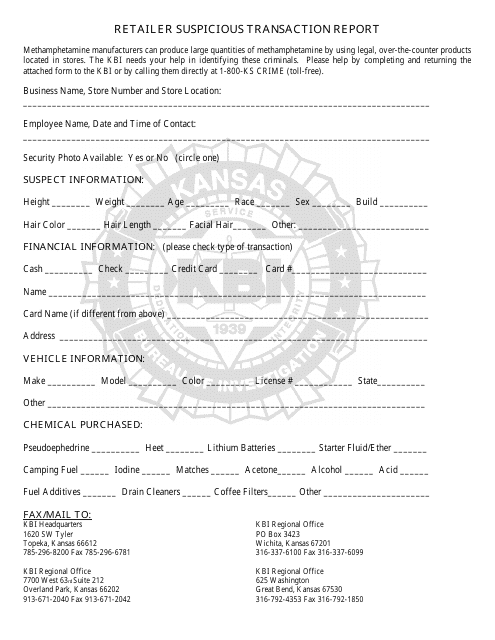

This form is used for reporting suspicious transactions by retailers in the state of Kansas. It helps to identify and prevent potential criminal activity in the retail industry.

This form is used for acknowledging the Fraud, Waste, and Abuse Policy in Mississippi.

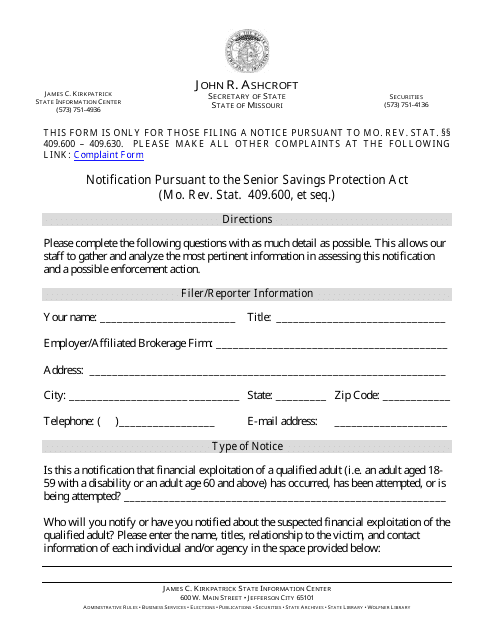

This document notifies individuals in Missouri about the Senior Savings Protection Act, which aims to protect senior citizens from financial exploitation.

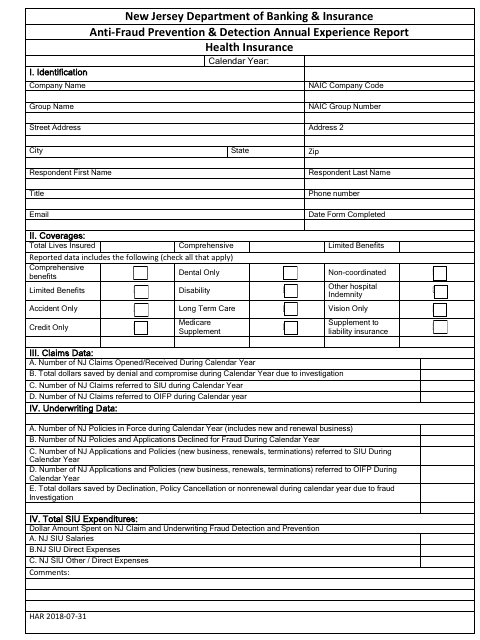

This annual report provides an overview of the anti-fraud prevention and detection efforts in New Jersey. It highlights the measures taken to safeguard against fraud and outlines the experiences of the past year.

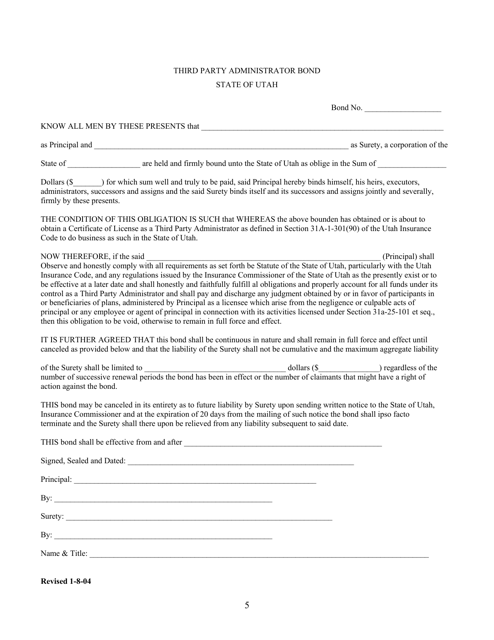

This is a type of bond required in Utah for third party administrators. It provides a financial guarantee to protect clients from financial loss resulting from the actions of the administrator.

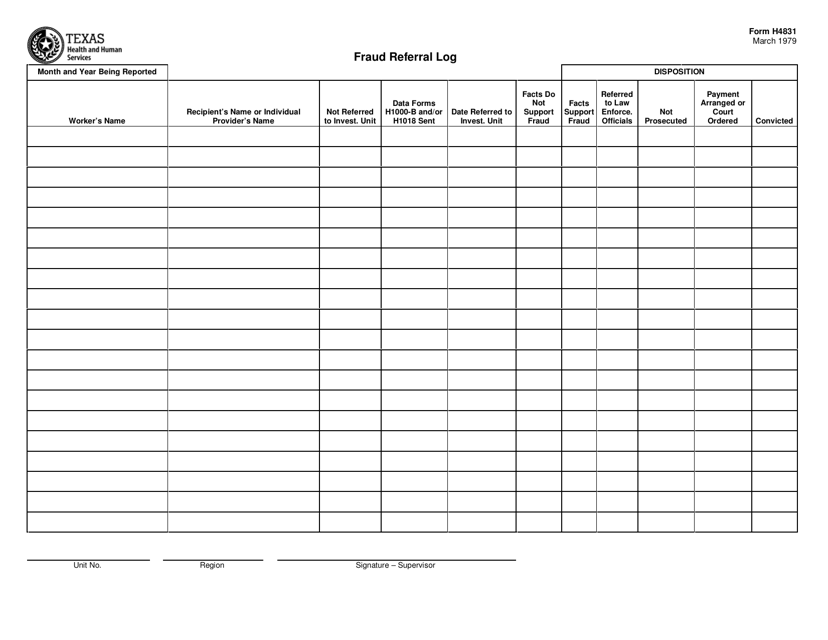

This form is used for logging and reporting cases of fraud in the state of Texas.

This form is used for giving consent to investigate cases of identity theft in the state of Arkansas.

This form is used for applying for an Identity Theft Passport in the state of Iowa. It is a document that helps victims of identity theft protect their identity and prevent further fraud.

This document is for the custodial/department card agreement for the procurement card program in Kentucky. It outlines the terms and conditions for the use of these cards.

This document is a self-assessment tool specific to Nebraska for evaluating internal controls over financial reporting related to expenditures and disbursements. It helps organizations ensure that proper financial controls are in place to prevent fraud and errors in spending.

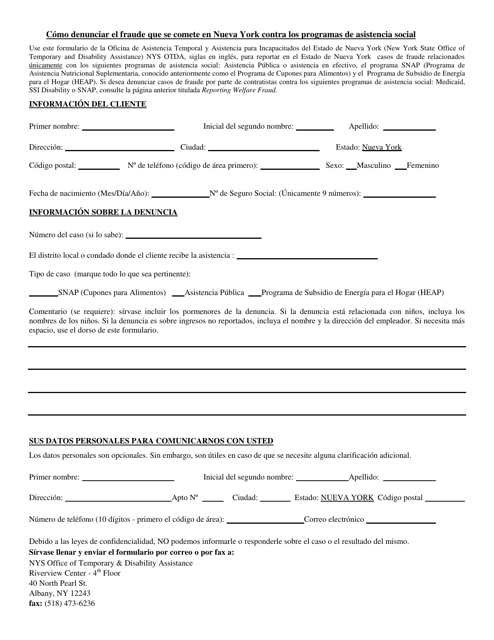

This form is used for reporting welfare fraud in New York. It is available in Spanish.

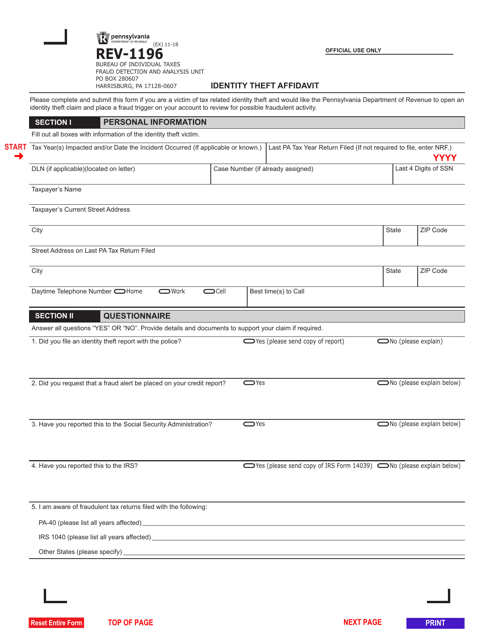

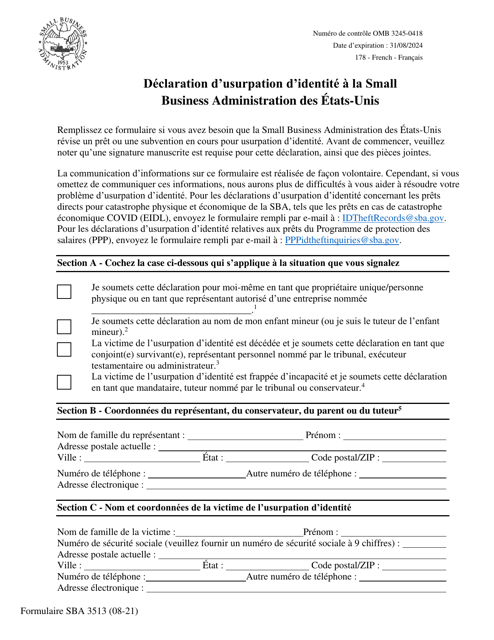

This form is used for declaring identity theft in French.

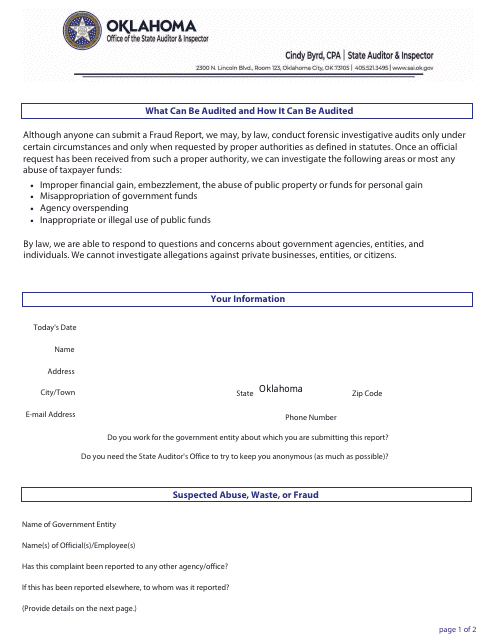

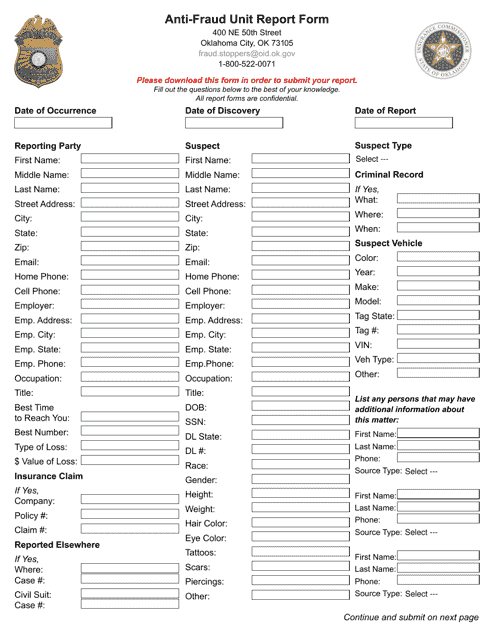

This document is used for reporting fraud incidents to the Anti-fraud Unit in Oklahoma.

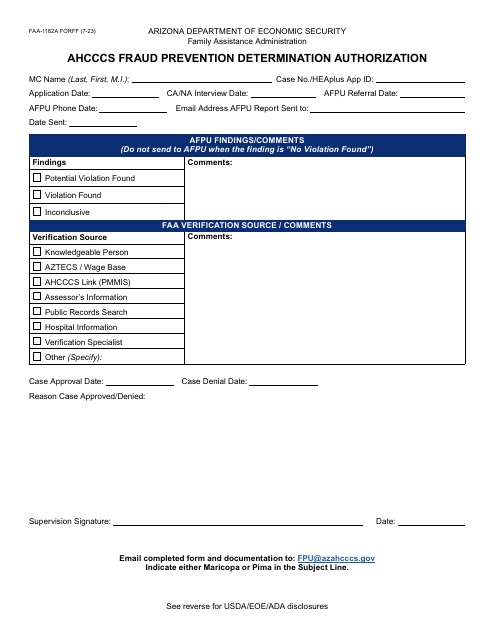

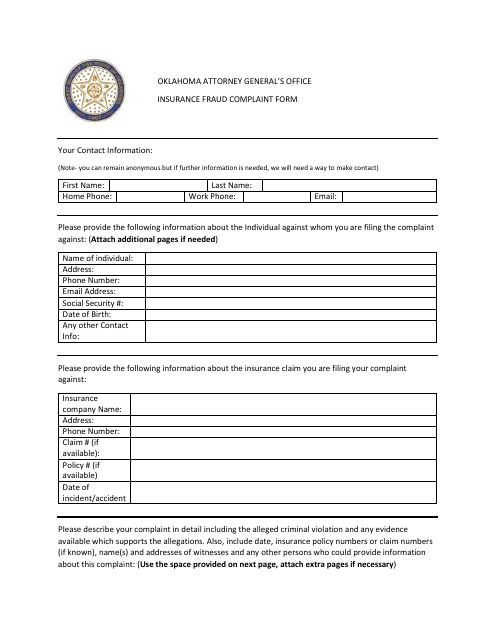

This type of document is used for filing a complaint about insurance fraud in the state of Oklahoma.