Payroll Services Templates

Payroll Services

Looking for reliable and efficient payroll services to streamline your business operations? Look no further! Our comprehensive payroll services are designed to simplify the process of paying your employees, handling deductions, and ensuring compliance with tax regulations. With our expertise in payroll management, you can focus on your core business activities and leave the intricacies of payroll administration to us.

Our payroll services encompass a wide range of tasks and responsibilities, including processing payroll deductions, managing employee withholdings, and ensuring timely and accurate payroll tax filings. We understand that each business has unique payroll requirements, which is why we offer customizable payroll solutions to meet your specific needs.

Whether you're a small business owner or a large corporate enterprise, our payroll services can save you time, effort, and resources. By outsourcing your payroll administration to us, you can minimize the risk of errors, penalties, and compliance issues. Our team of payroll experts stays up-to-date with the ever-changing payroll regulations in various jurisdictions, ensuring that your payroll processes are in compliance with the law.

In addition to payroll processing, we also provide a wide range of related services, such as payroll tax calculation and filing, employee record management, and payroll reporting. Our user-friendly payroll software enables you to access relevant payroll data anytime, anywhere, providing you with complete transparency and control over your payroll operations.

Don't let payroll administrative tasks consume your valuable time. Let us handle your payroll services, allowing you to focus on what matters most – growing your business. Contact us today to learn more about our comprehensive payroll solutions tailored to suit your business needs.

Other names:

- Payroll Service

- Payroll Management Services

- Outsourced Payroll Services

- Payroll Processing Services

Documents:

8

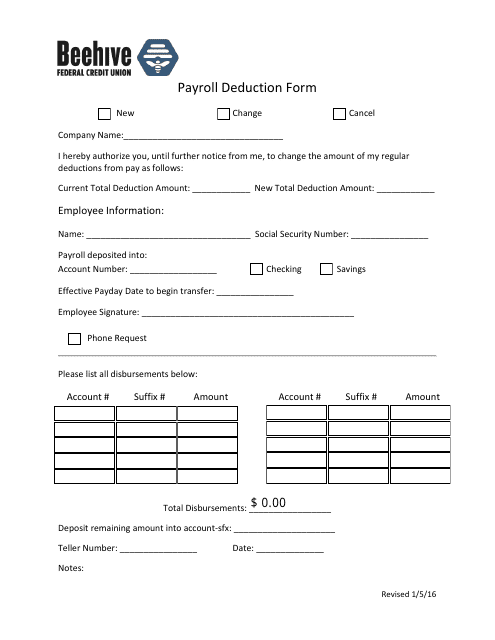

This form is used for authorizing payroll deductions for Beehive Federal Credit Union.

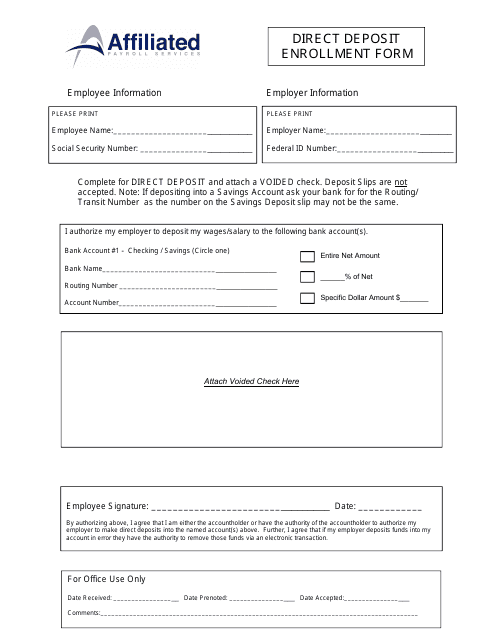

This Form is used for enrolling in direct deposit with Affiliated Payroll Services to receive payment electronically.

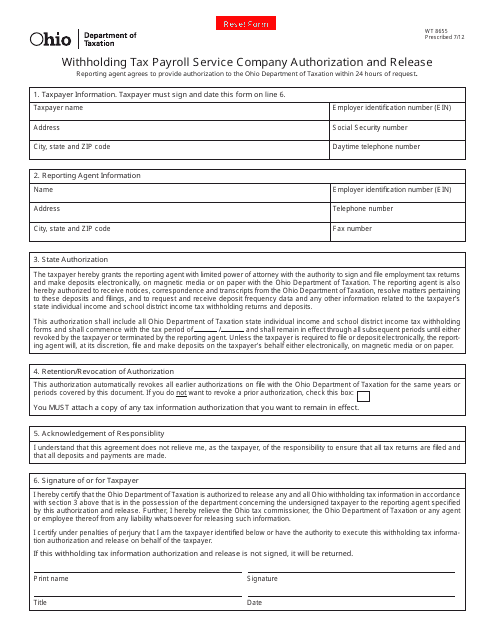

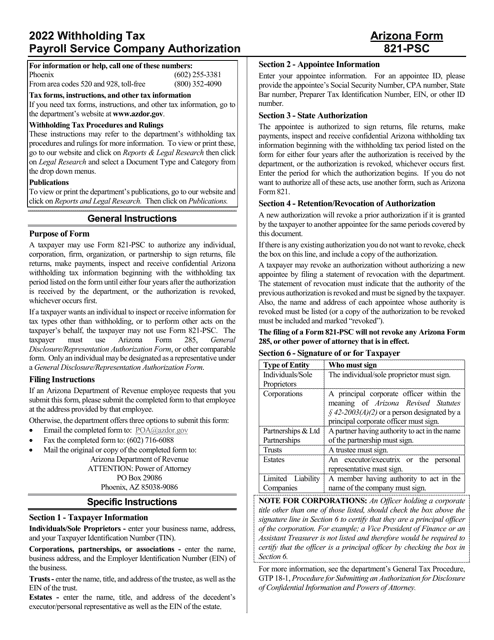

This form is used for authorizing a payroll service company to withhold tax payments on behalf of an employer in Ohio.

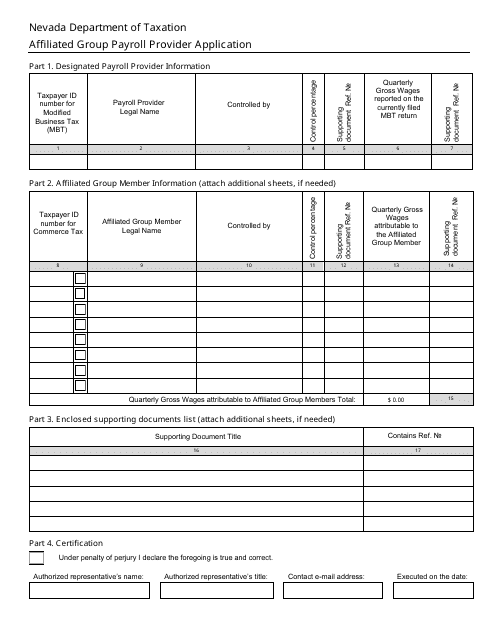

This document is an application form for a payroll provider that is seeking to become affiliated with a group in Nevada.

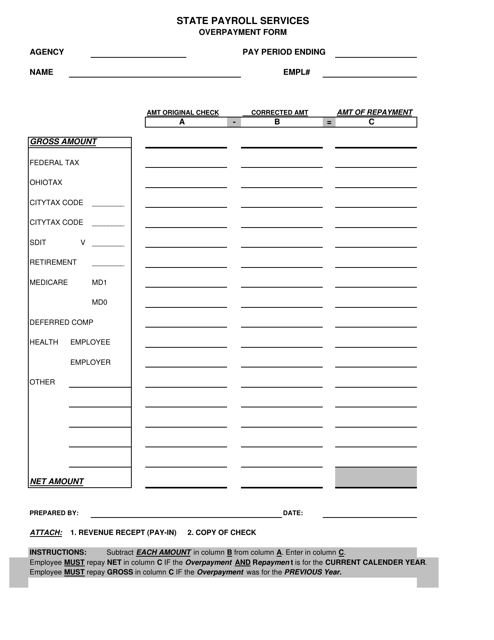

This Form is used for reporting and requesting a refund for overpayments made to employees by the State of Ohio.

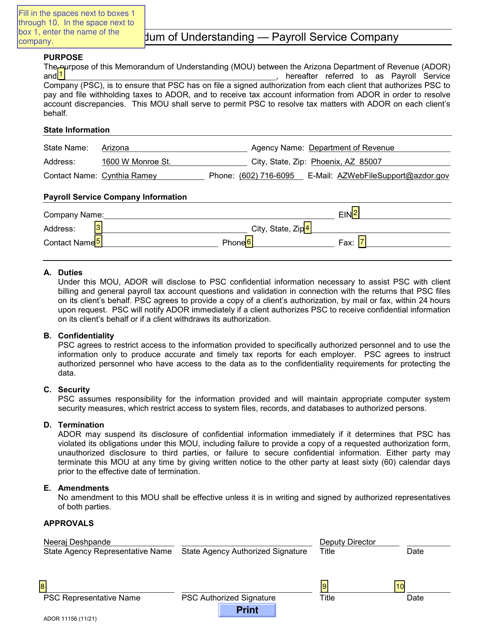

This form is used for creating a Memorandum of Understanding (MOU) between a company and a payroll service provider in the state of Arizona. The MOU outlines the agreement and responsibilities regarding payroll services.