Charity Gaming Templates

Are you a charity organization looking to host gaming events for fundraising? Look no further than our comprehensive collection of charity gaming documents. Also known as charity gaming, these documents provide a guide to the legal requirements and regulations surrounding charitable gaming activities.

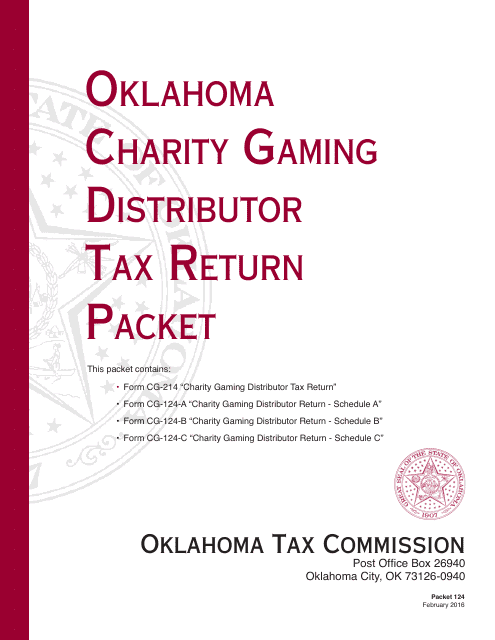

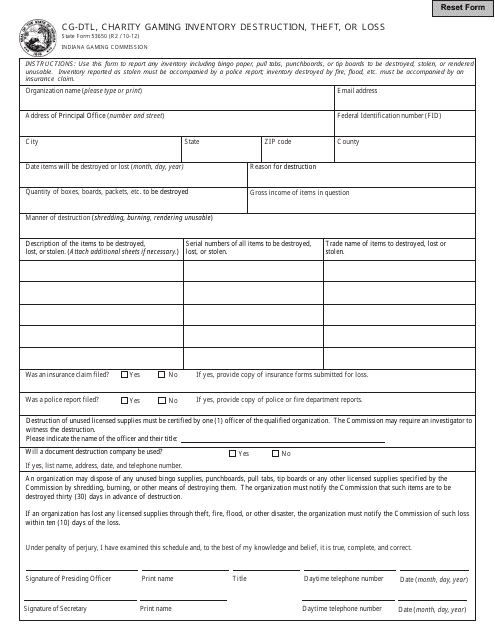

In our collection, you will find a variety of resources to help you navigate the world of charity gaming. Whether you are planning a Texas Hold'em tournament, bingo night, or a raffle, these documents will assist you in understanding the necessary permits, licenses, and tax forms you need to comply with. From OTC Form 124 Oklahoma Charity Gaming Distributor Tax Return Packet to State Form 53650 Cg-Dtl, our collection covers various states and jurisdictions.

Our alternate names for this documents group include charity gaming. These documents are an invaluable resource for charitable organizations looking to raise funds through gaming activities. By taking the time to familiarize yourself with these documents, you can ensure that your charity gaming events are not only fun but also compliant with the law.

So, whether you are a small community organization or a larger nonprofit, our collection of charity gaming documents will provide you with the guidance you need. Start exploring our comprehensive collection today to ensure that your charity gaming events are a success!

(Note: This is a fictional example, and the text is for illustrative purposes only.)

Documents:

5

This form is used for filing taxes for charity gaming distributors in Oklahoma.

This form is used for reporting the destruction, theft, or loss of inventory related to charity gaming in Indiana.

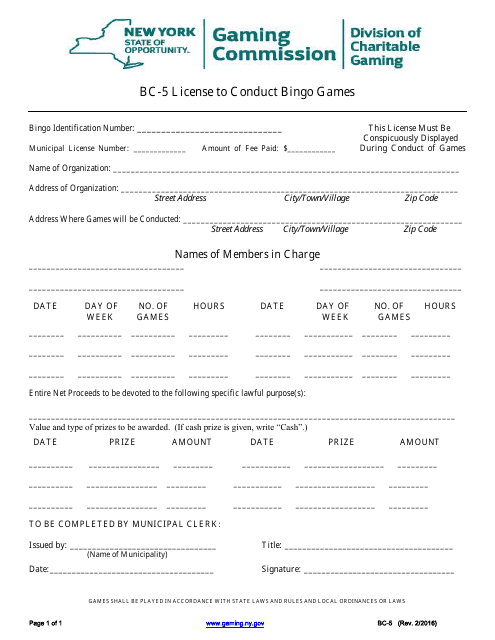

This Form is used for obtaining a license to conduct bingo games in New York.

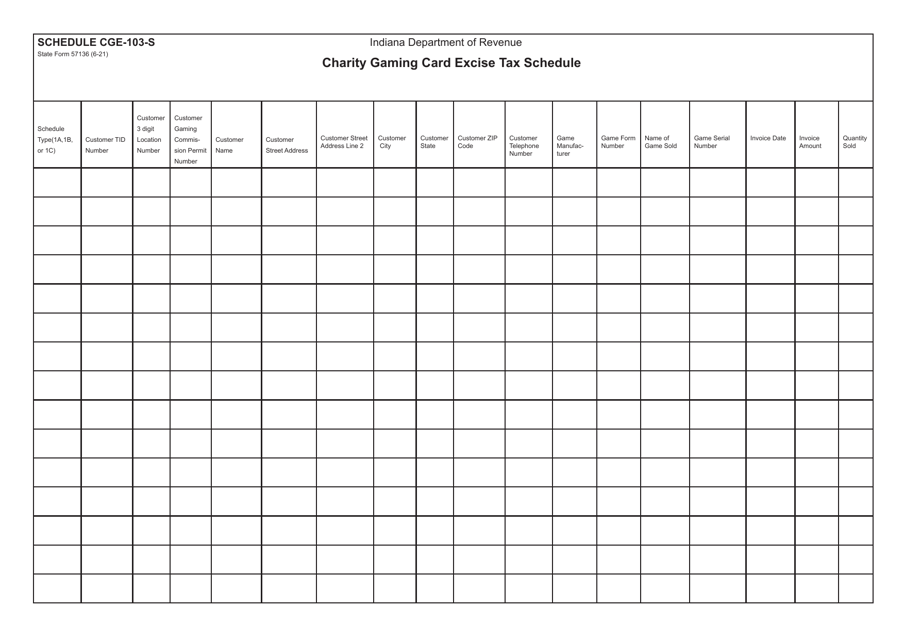

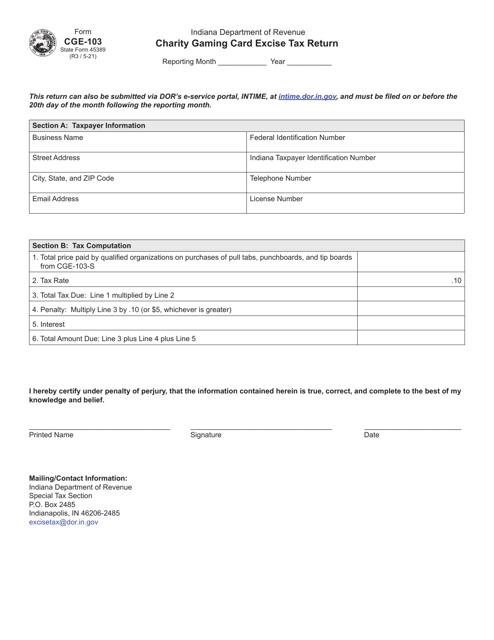

This Form is used for reporting and calculating the Charity Gaming Card Excise Tax in Indiana. It is required for organizations conducting charitable gaming activities.