Contingent Beneficiary Templates

A contingent beneficiary is an individual or entity who receives a designated asset or benefit only if certain conditions are met. This legal arrangement is often used in estate planning to ensure that assets are distributed according to the wishes of the deceased individual.

When creating a will or trust, it is crucial to specify not only primary beneficiaries but also contingent beneficiaries. By naming contingent beneficiaries, you can provide for alternative recipients in case the primary beneficiaries are unable to inherit the assets. This can be due to various reasons such as their death, incapacity, or any other circumstance that renders them ineligible to receive the assets.

Designating contingent beneficiaries helps to ensure that your assets will be distributed accurately and efficiently, avoiding any potential disputes or complications in the future. Without clear instructions regarding contingent beneficiaries, the distribution of your assets may be determined by state laws, which may not align with your intentions.

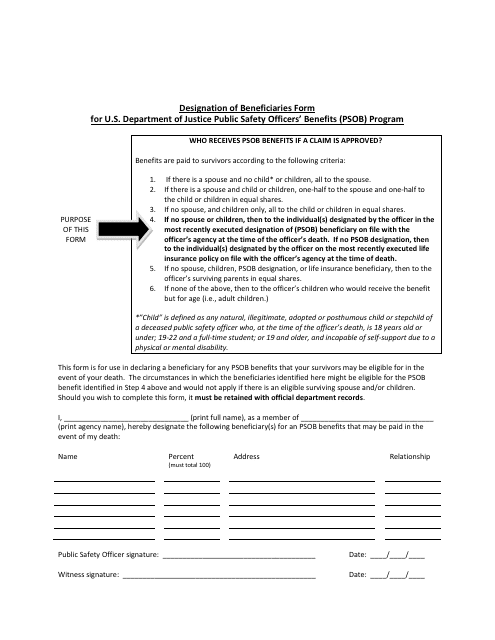

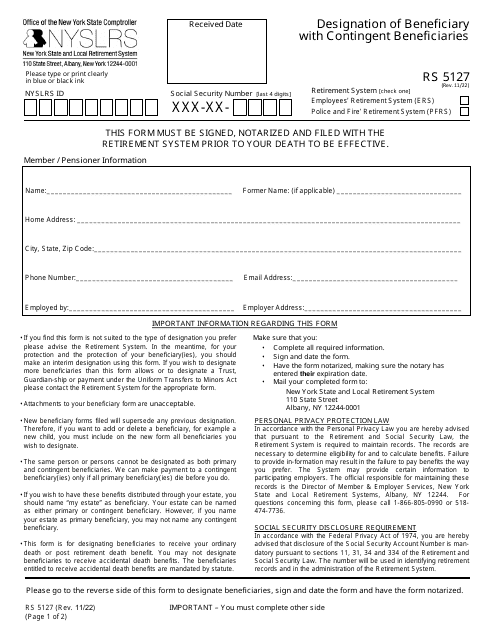

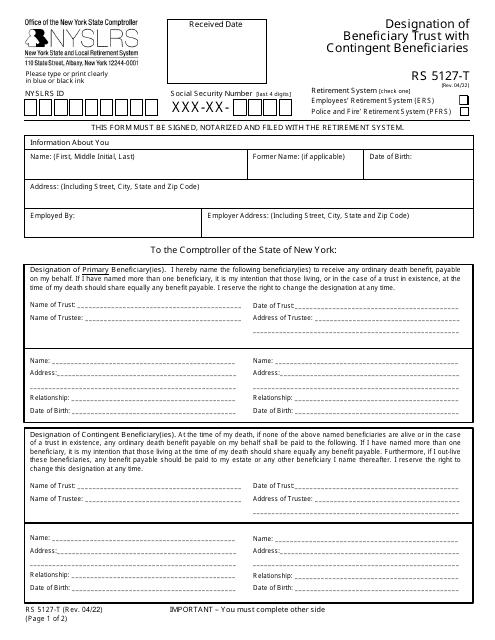

To establish contingent beneficiaries, you will need to complete the necessary legal documents, such as a designation of beneficiary form. This document allows you to name primary beneficiaries as well as one or more contingent beneficiaries. It is essential to keep these forms up to date and review them periodically to reflect any changes in circumstances or relationships.

In some cases, a trust may be used to designate contingent beneficiaries. This provides additional control and flexibility in the distribution of assets. By creating a trust with contingent beneficiaries, you can specify detailed instructions regarding when and how the assets should be distributed.

Considering the importance of contingent beneficiaries in your estate planning, it is advisable to seek the guidance of a qualified legal professional. They can help you navigate the complexities of estate planning and ensure that your wishes are accurately reflected in the legal documents.

So, whether you refer to them as contingent beneficiaries, contingent beneficiaries forms, or contingent beneficiaries designation, it is essential to include these individuals or entities in your estate planning to safeguard the distribution of your assets according to your intentions.

Documents:

7

This form is used for designating beneficiaries for a retirement plan, life insurance policy, or other types of financial accounts.