Mixed Beverages Templates

Are you looking for information about mixed beverages? Look no further! Our website is your one-stop resource for all things related to mixed beverages, also known as mixed beverage or cocktails. Whether you're a seasoned bartender or just a casual drinker, we have everything you need to know about the world of mixed beverages.

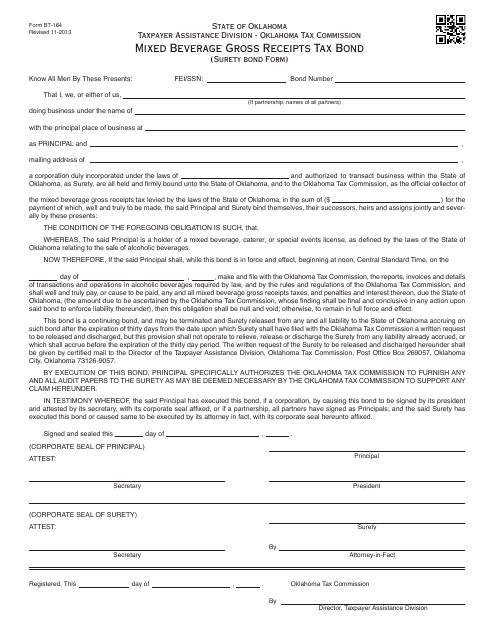

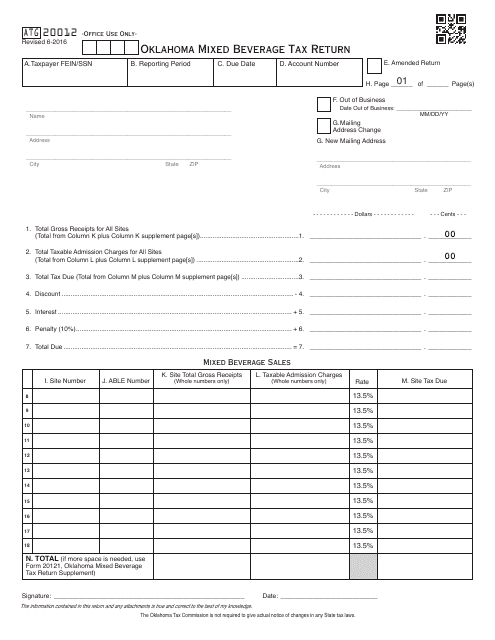

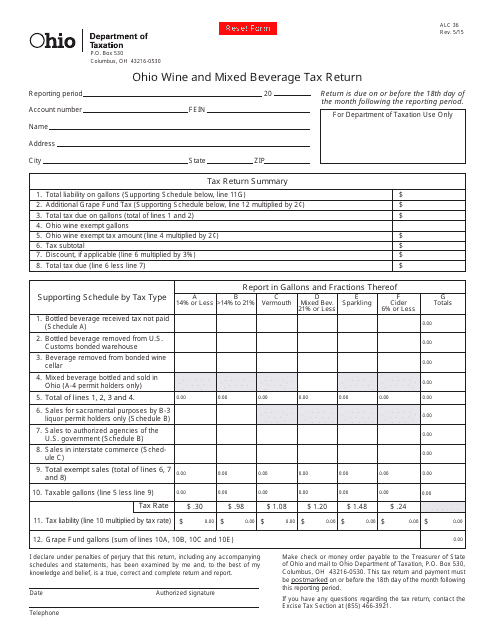

Discover the wide range of mixed beverage tax forms and applications that may be applicable to your business. From the OTC Form BT-164 Mixed Beverage Gross Receipts Tax Bond (Surety Bond Form) in Oklahoma, to the Form ALC36 Ohio Wine and Mixed Beverage Tax Return in Ohio, we have all the necessary forms to help you stay compliant with local regulations.

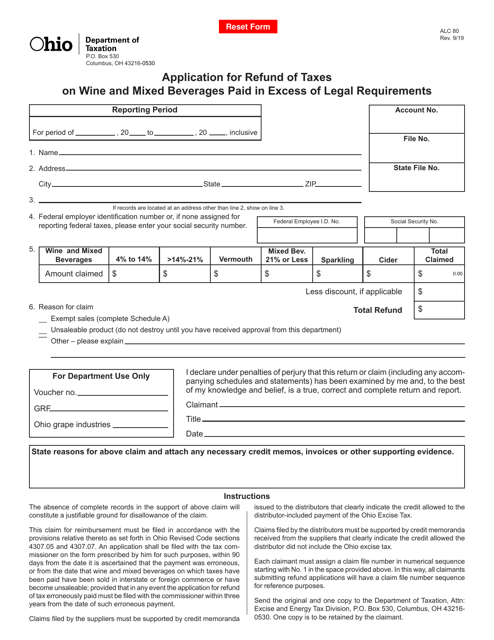

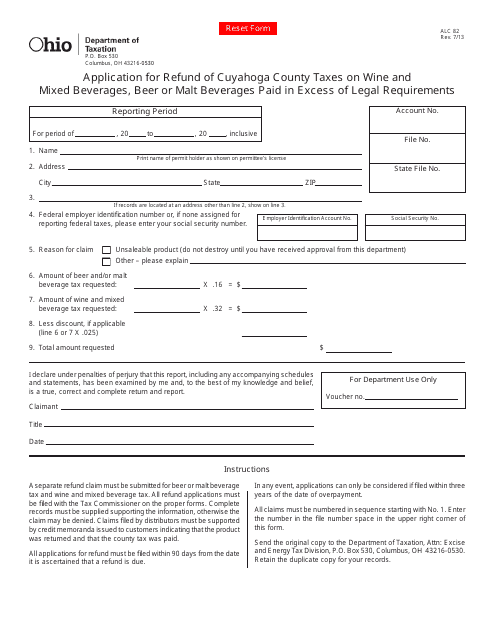

If you've overpaid your taxes on wine and mixed beverages, don't worry! Our website also provides you with the necessary forms, such as the Form ALC80 Application for Refund of Taxes on Wine and Mixed Beverages Paid in Excess of Legal Requirements in Ohio, to help you get a refund.

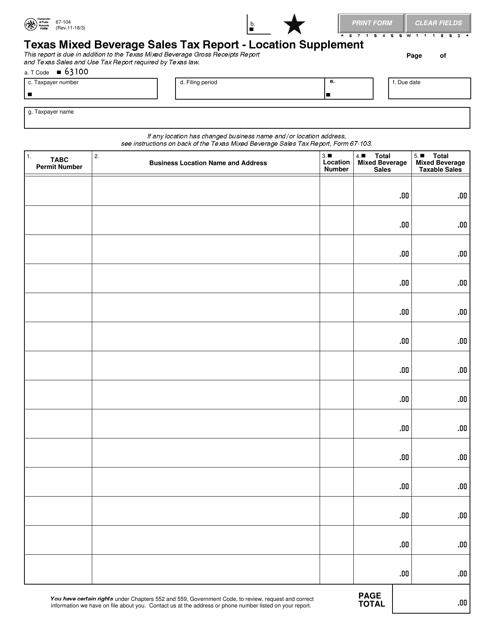

Additionally, if you're a business owner in Texas, you'll find the Form 67-104 Texas Mixed Beverage Sales Tax Report - Location Supplement particularly useful. It will assist you in reporting your mixed beverage sales tax accurately.

So whether you're a business owner searching for tax forms or an individual interested in learning more about mixed beverages, our website has the information you're looking for. Explore our comprehensive collection of mixed beverage documents and resources to satisfy your thirst for knowledge.

Documents:

12

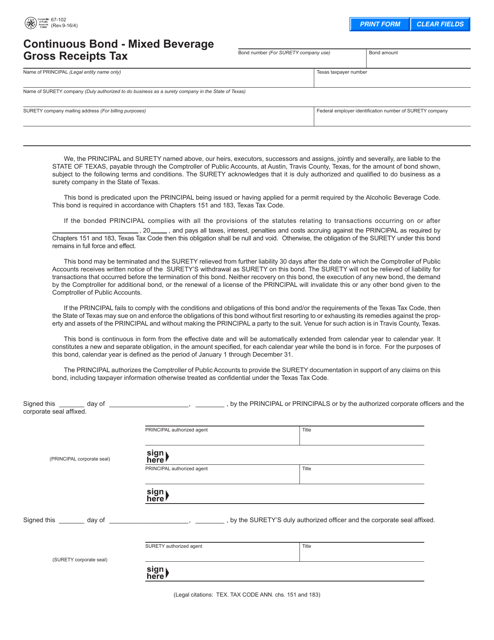

This document is used for obtaining a surety bond for the Mixed Beverage Gross Receipts Tax in Oklahoma. It is known as Form BT-164 and is used for compliance with tax regulations.

This form is used for filing Mixed Beverage Tax Return in Oklahoma.

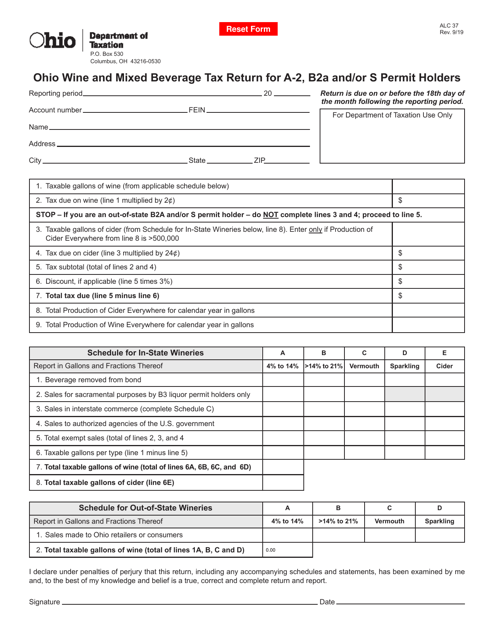

This form is used for reporting and paying taxes on wine and mixed beverage sales in the state of Ohio.

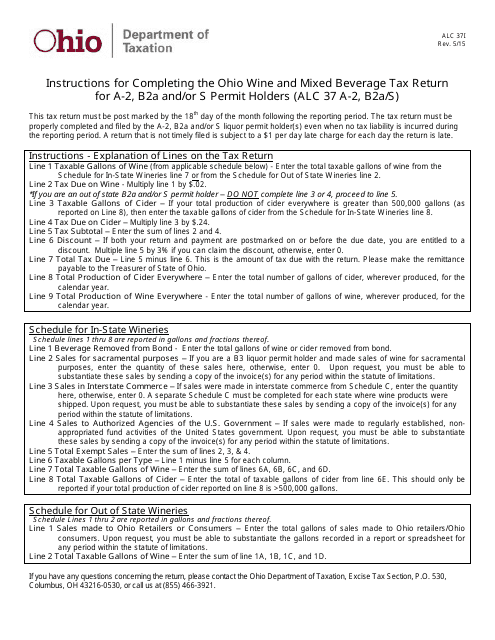

This Form is used for filing the Ohio Wine and Mixed Beverage Tax return for a-2, B2a and/or S permit holders in Ohio.

This form is used for applying for a refund of Cuyahoga County taxes on wine and mixed beverages, beer or malt beverages in Ohio.

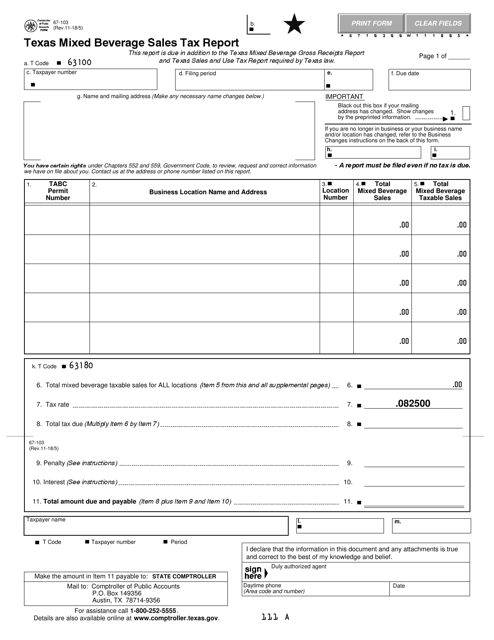

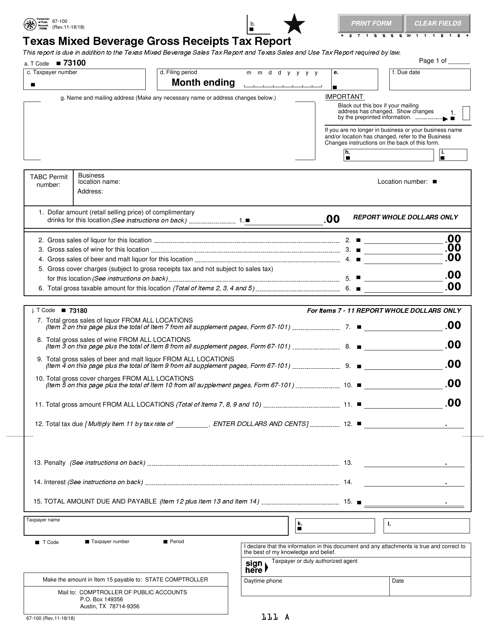

This Form is used for reporting and paying the mixed beverage gross receipts tax in the state of Texas.

This Form is used for reporting mixed beverage sales tax in Texas and includes supplemental information about the location.

This form is used for reporting sales tax on mixed beverages in Texas. It is required by the Texas Comptroller's Office for businesses that sell mixed alcoholic drinks.

This form is used for reporting the gross receipts tax on mixed beverages in the state of Texas. It is required for businesses that sell mixed drinks.