Homeowner Exemption Templates

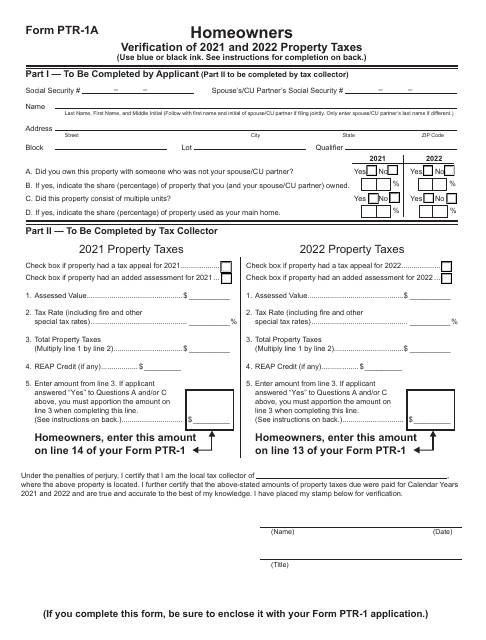

Are you a homeowner looking for ways to lower your property taxes? You may be eligible for a valuable benefit known as the homeowner exemption. This exemption, also called the homeowners exemption, provides qualifying homeowners with a reduction in their property tax liability, saving them potentially hundreds or even thousands of dollars each year.

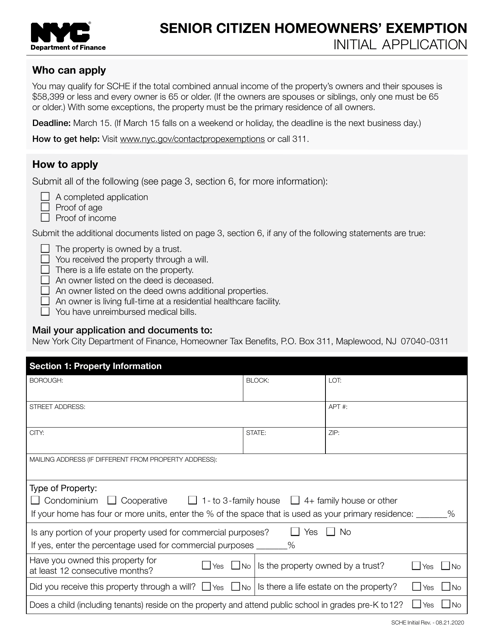

The homeowner exemption is available in various forms across different states and cities. For instance, in New York City, eligible senior citizens can apply for the Senior Citizen Homeowners' Exemption. This application, available in different languages such as Chinese Simplified and Korean, allows seniors to enjoy additional propertytax savings.

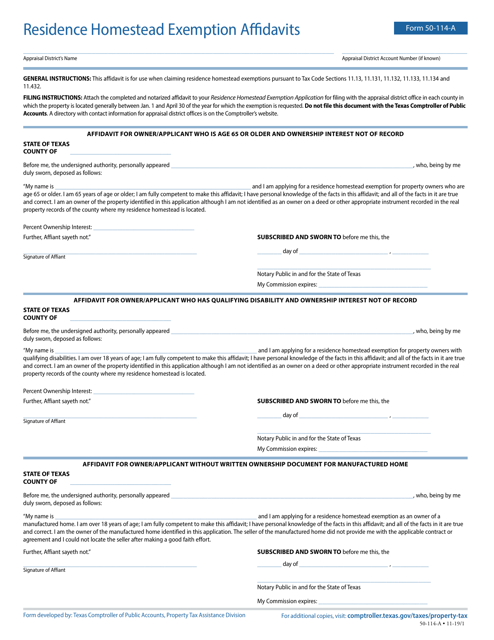

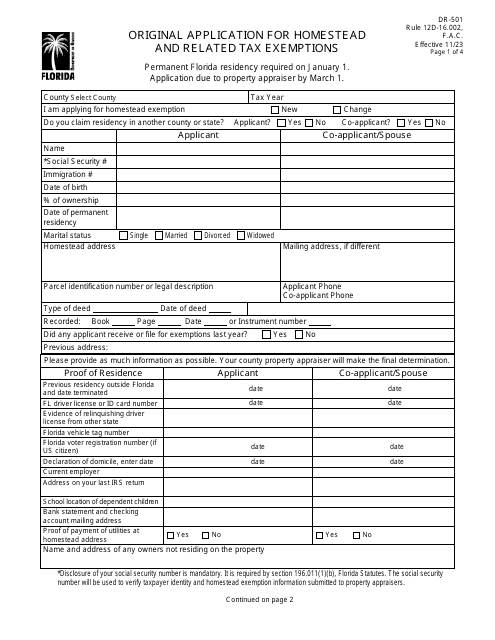

In Florida, the Form DR-501 Original Application for Homestead and Related Tax Exemptions is used to apply for various homeowner exemptions. This application allows homeowners to apply for different types of exemptions, including the homeowner exemption, providing them with significant tax savings.

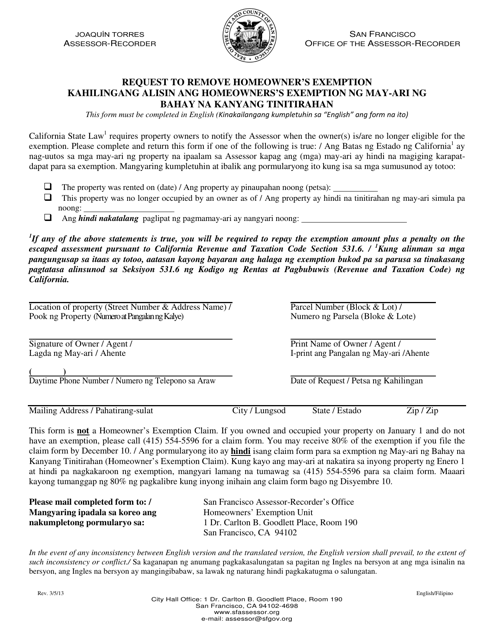

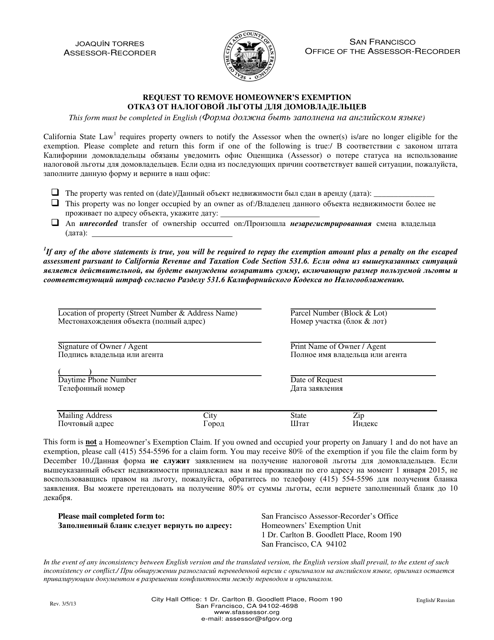

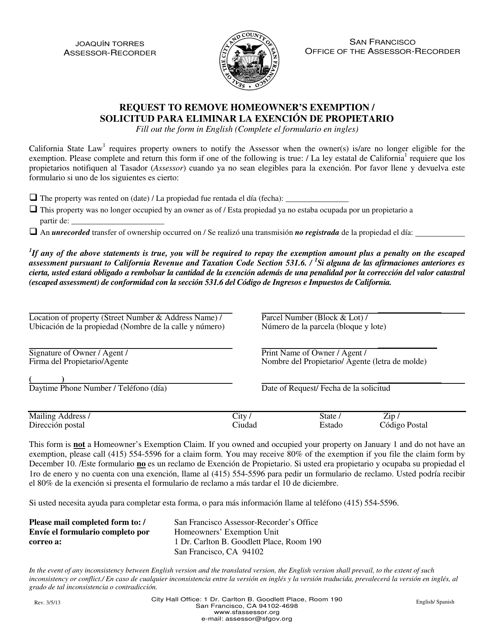

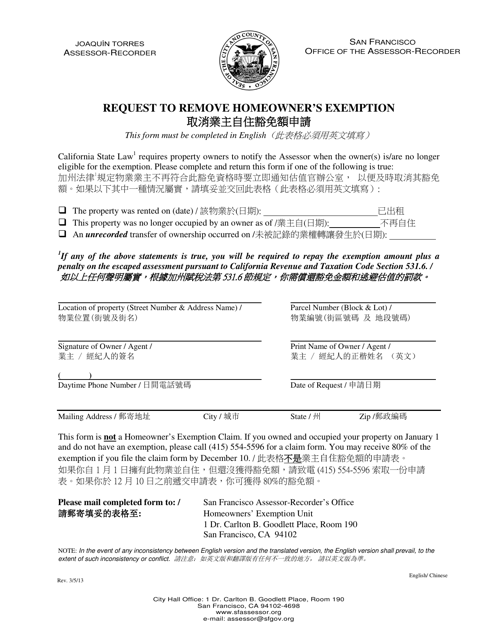

In some cases, homeowners may need to make changes to their homeowner exemption status. If you reside in the City and County of San Francisco, California, and wish to remove your homeowner's exemption, you can use the Request to Remove Homeowner's Exemption form, available in English and Chinese.

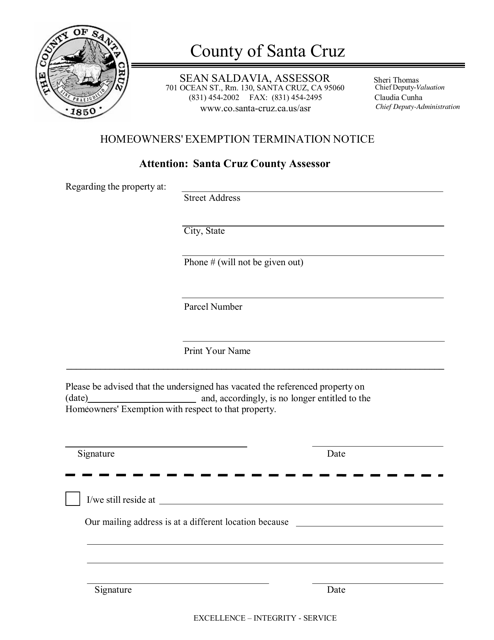

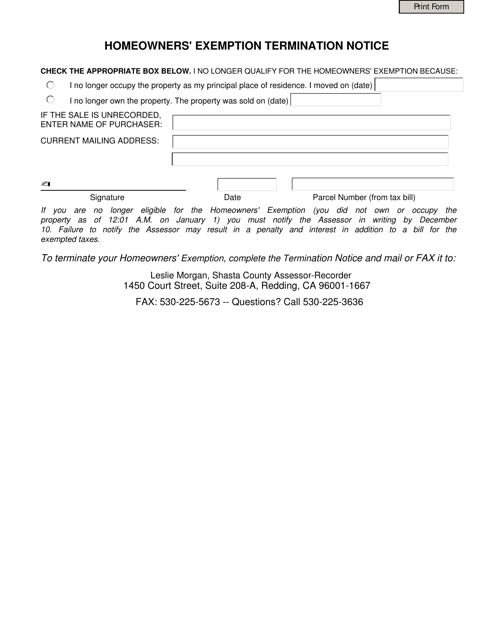

It's also important to stay informed about any changes or terminations relating to your homeowner exemption. In Shasta County, California, homeowners receive a notification called the Homeowners' Exemption Termination Notice if their exemption is no longer valid.

Whether you're a senior citizen, a first-time homeowner, or seeking additional property tax relief, taking advantage of the homeowner exemption can have a significant impact on your annual property tax bill. These exemptions, available in different forms and applications, help homeowners save money and retain more of their hard-earned dollars.

(Note: The provided text is a sample SEO text and may not accurately represent the exact details or specifications of the homeowner exemption in any specific location.)

Documents:

27

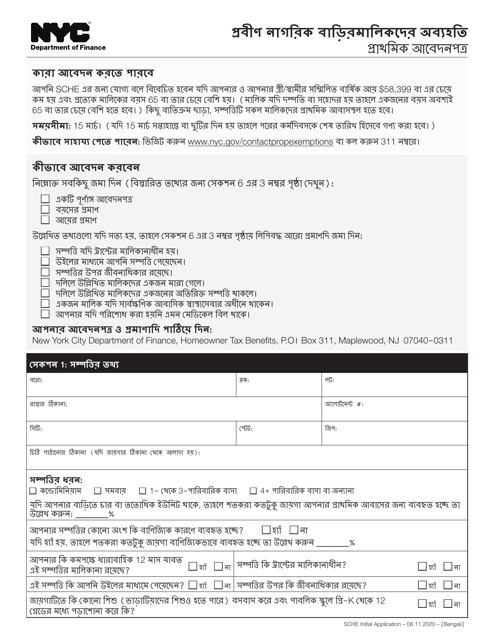

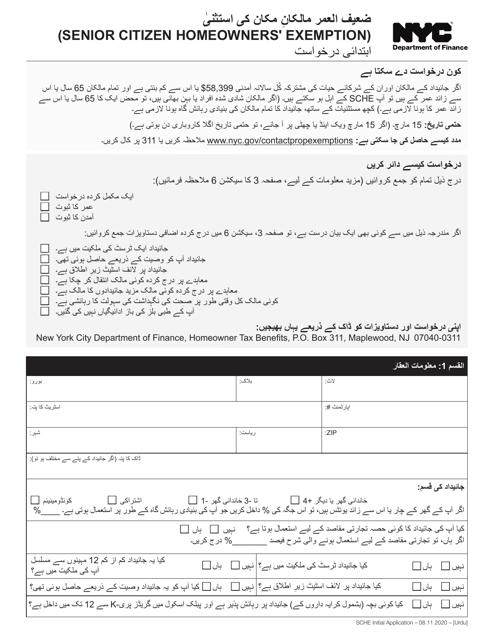

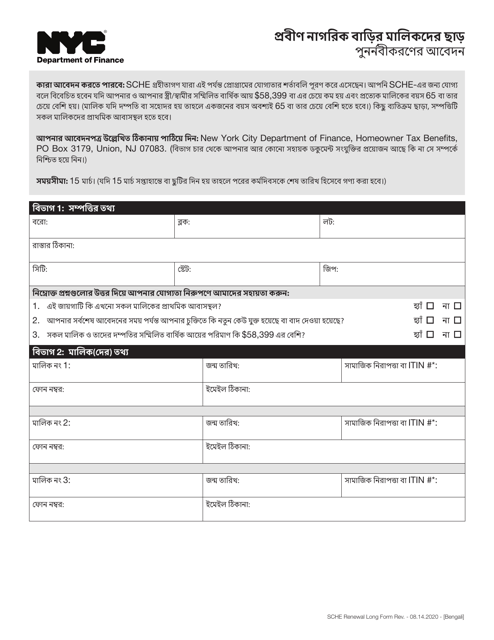

This document is for senior citizens in New York City who want to apply for a property tax exemption. It is available in the Bengali language.

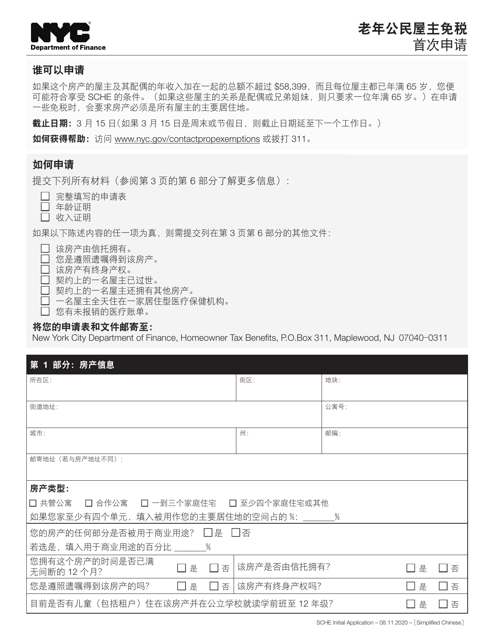

This document is for senior citizens in New York City who want to apply for a tax exemption on their residential property. It is available in Chinese Simplified language.

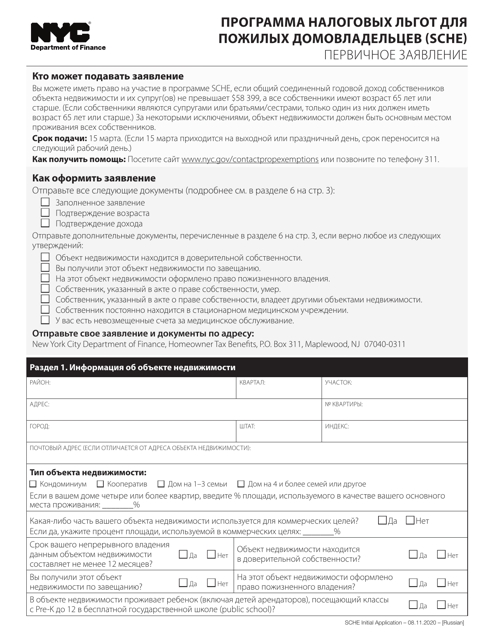

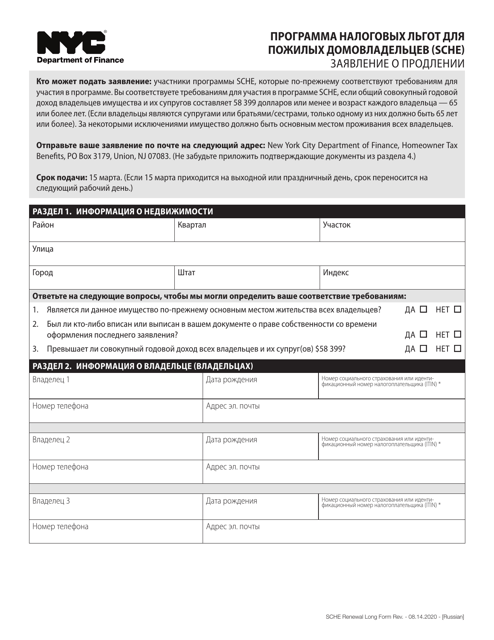

This form is used for applying for the Senior Citizen Homeowners' Exemption in New York City for Russian-speaking residents.

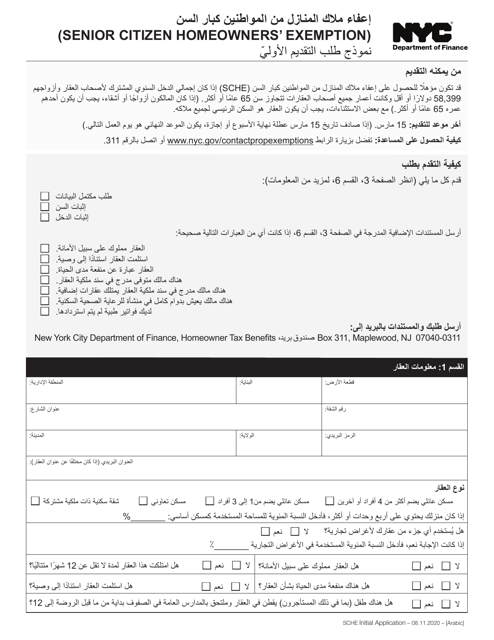

This type of document is an initial application form for the Senior Citizen Homeowners' Exemption program in New York City. It is specifically for Arabic-speaking individuals.

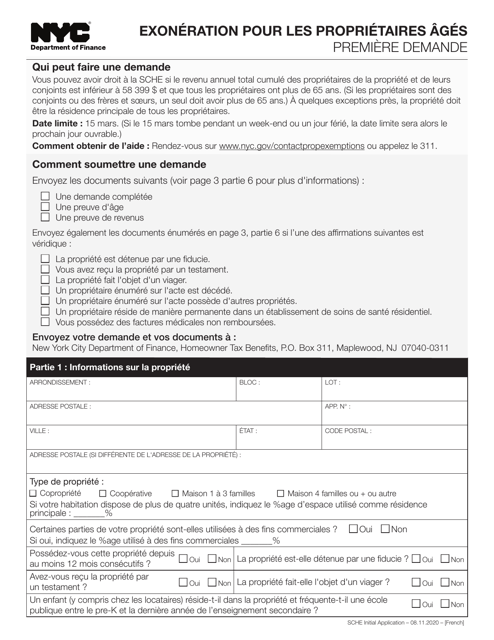

This document is used for applying for the Senior Citizen Homeowners' Exemption in New York City. It is available in French.

This document is for senior citizens in New York City who own a home and want to apply for a tax exemption. It is the initial application for the Senior Citizen Homeowners' Exemption.

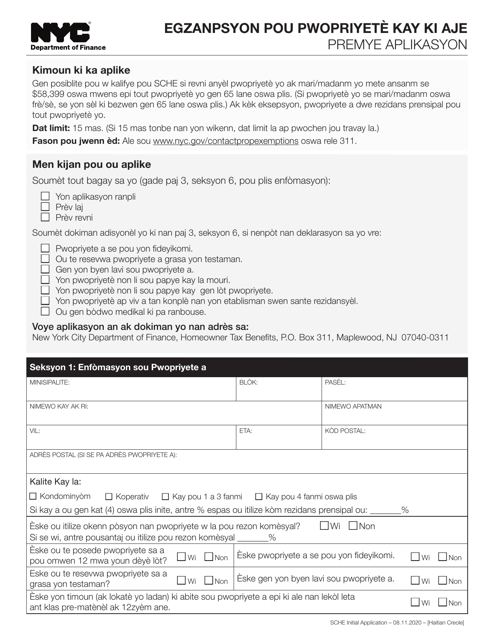

This Form is used for applying for the Senior Citizen Homeowners' Exemption in New York City, and is available in Haitian Creole.

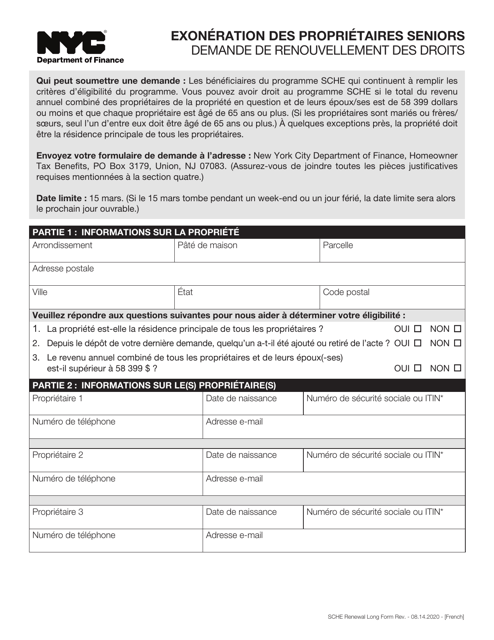

This document is for renewing the Senior Citizen Homeowners' Exemption in New York City. It is available in French.

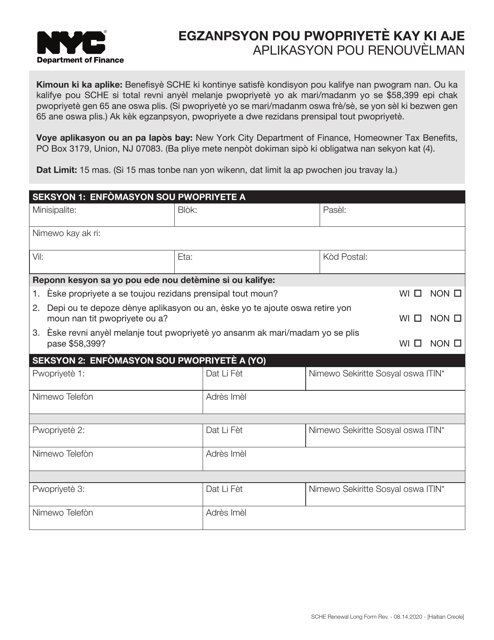

This Form is used for renewing the Senior Citizen Homeowners' Exemption in New York City. It is available in Haitian Creole language.

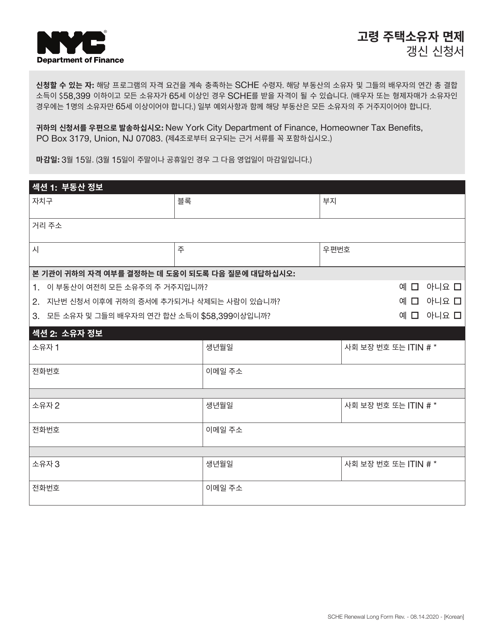

This document is for renewing the Senior Citizen Homeowners' Exemption in New York City for Korean-speaking residents.

This document is for renewing the Senior Citizen Homeowners' Exemption in New York City. It is available in Russian.

This document is for renewing the Senior Citizen Homeowners' Exemption in New York City.

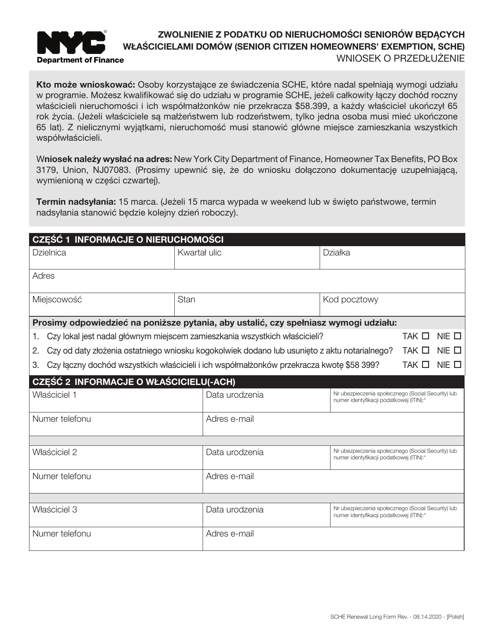

This form is used for senior citizens in New York City who own homes and need to renew their exemption for property taxes. The form is available in Polish.

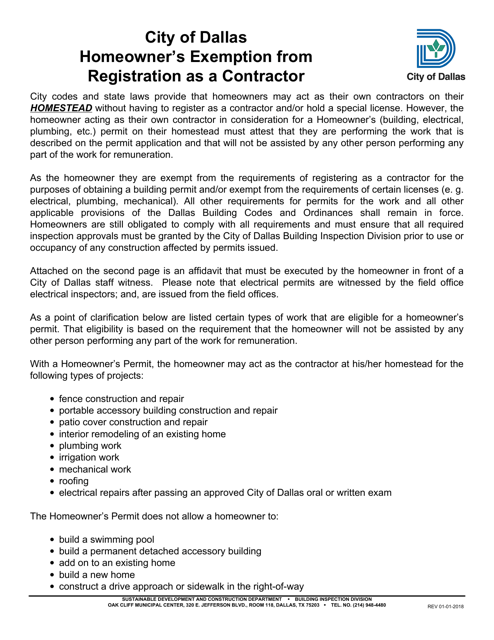

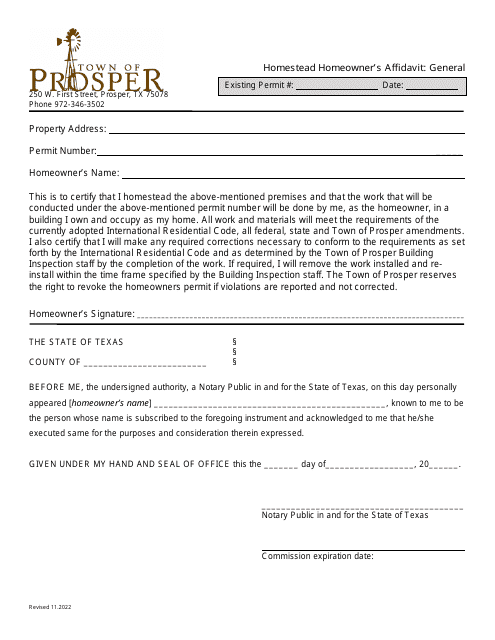

This document allows homeowners in Dallas, Texas, to be exempt from registering as a contractor when working on their own property.

This form is used for requesting the removal of the homeowner's exemption in the City and County of San Francisco, California. It is available in both English and Tagalog languages.

This document is a request form used in the City and County of San Francisco, California to remove the homeowner's exemption. The form is available in both English and Russian languages. It can be used by homeowners who no longer qualify for the exemption and need to have it removed from their property tax assessment.

This document is a request to remove the homeowner's exemption in the City and County of San Francisco, California. It can be used by homeowners who no longer qualify for the exemption or wish to opt out of it. The form is available in both English and Spanish.

This form is used for requesting the removal of the homeowner's exemption in San Francisco, California. It is available in both English and Chinese.

This document is a notice that informs homeowners in Santa Cruz County, California about the termination of their homeowners' exemption.

This Form is used for terminating the homeowners' exemption in Shasta County, California.

This document is used by homeowners in the town of Prosper, Texas to declare that their property is their primary residence.

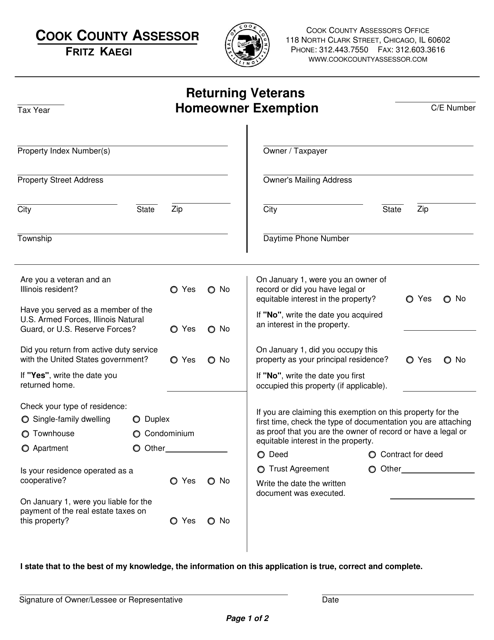

This document is used for claiming a tax exemption for returning veterans who own a home in Cook County, Illinois.