Marijuana Tax Templates

Are you looking for information on marijuana taxes? Look no further! Our webpage provides comprehensive details on the various tax regulations surrounding marijuana across the USA, Canada, and other countries. We understand that navigating the complex world of marijuana taxation can be daunting, which is why we have compiled a collection of valuable resources to assist you.

Discover everything you need to know about marijuana tax laws, requirements, and forms. Whether you are a business owner in Oregon, Nevada, Missouri or any other location where marijuana is legalized, our webpage offers a wide range of documents to guide you through the tax process.

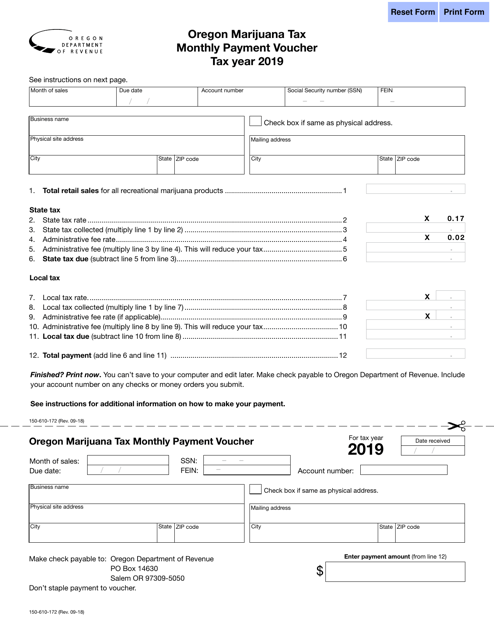

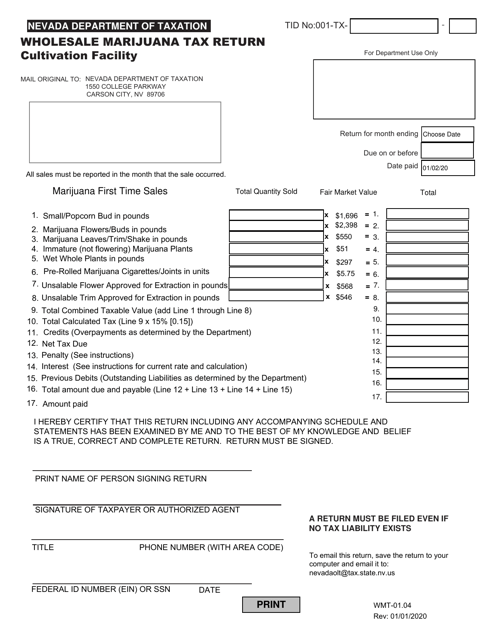

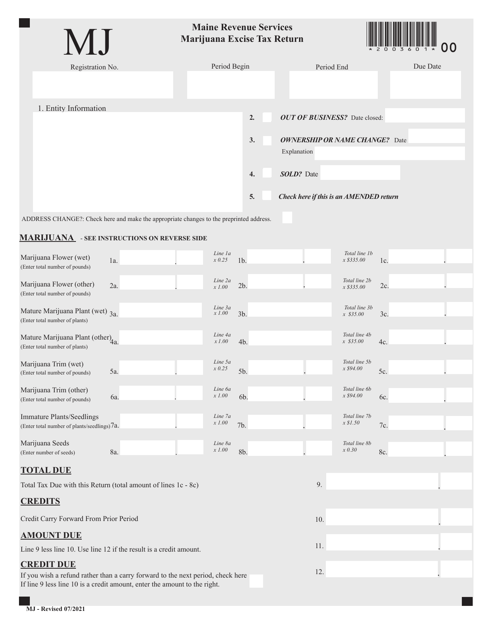

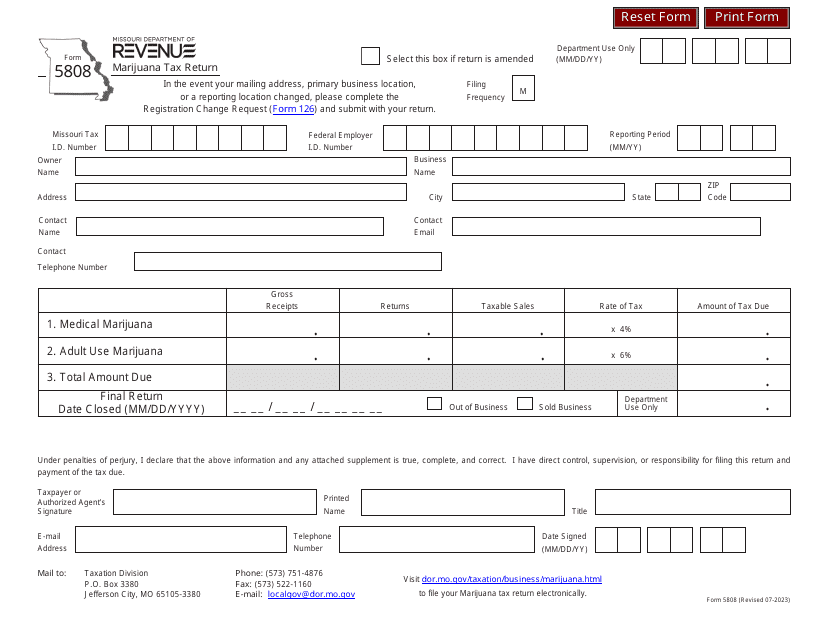

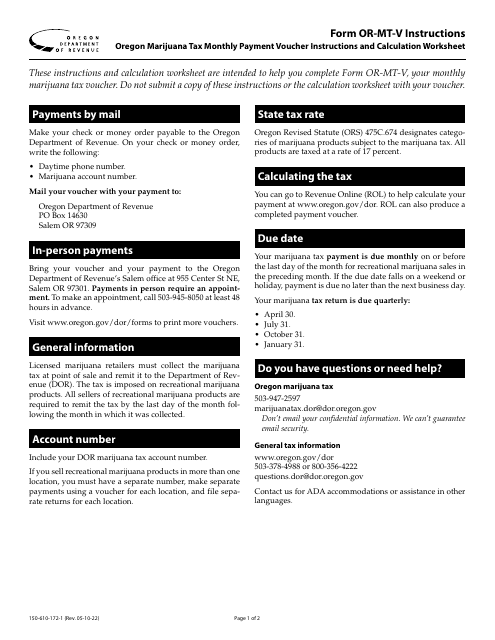

From Oregon Marijuana Tax Monthly Payment Vouchers to Wholesale Marijuana Tax Returns in Nevada, our document collection covers it all. You can also find instructions for completing forms such as the Oregon Marijuana Tax Registration or the Medical Marijuana 4% Tax Return in Missouri.

At our webpage, we strive to make accessing marijuana tax information hassle-free and convenient. Our user-friendly interface allows you to easily navigate through the documents, ensuring that you have all the necessary resources to comply with marijuana tax regulations in your jurisdiction.

Stay up-to-date with the latest changes in marijuana tax laws and regulations by visiting our webpage regularly. Our comprehensive collection of documents and alternate names for marijuana tax will provide you with the knowledge you need to ensure compliance, while avoiding any potential penalties or issues.

Don't spend countless hours searching for information on marijuana taxes elsewhere. Visit our webpage today and gain the insights you need for successful tax compliance in the world of legalized marijuana.

Documents:

7

This form is used for filing wholesale marijuana tax returns in Nevada.

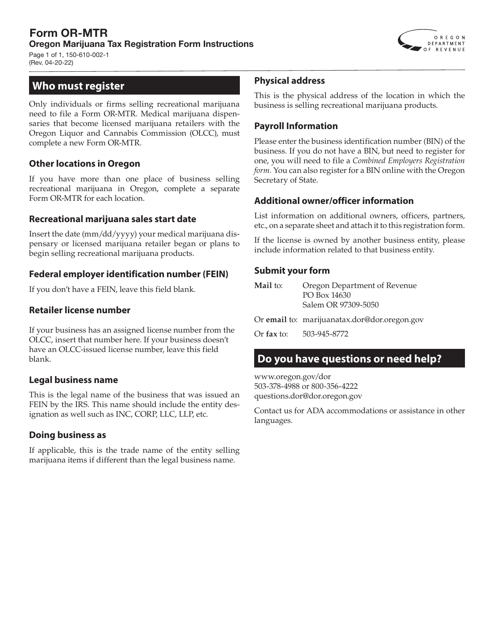

This Form is used for registering for the Oregon Marijuana Tax. It is required for individuals or businesses involved in the sale or production of marijuana in Oregon.