Apportionable Income Templates

Apportionable income refers to the portion of income that is allocated and apportioned among different jurisdictions based on specific rules and formulas. This process is essential for businesses operating in multiple states or countries, as it determines how much income should be attributed to each jurisdiction for tax purposes.

Managing apportionable income involves complex calculations and requires the accurate reporting of various factors, such as sales, payroll, and property. By properly apportioning income, businesses can ensure compliance with tax laws and avoid double taxation.

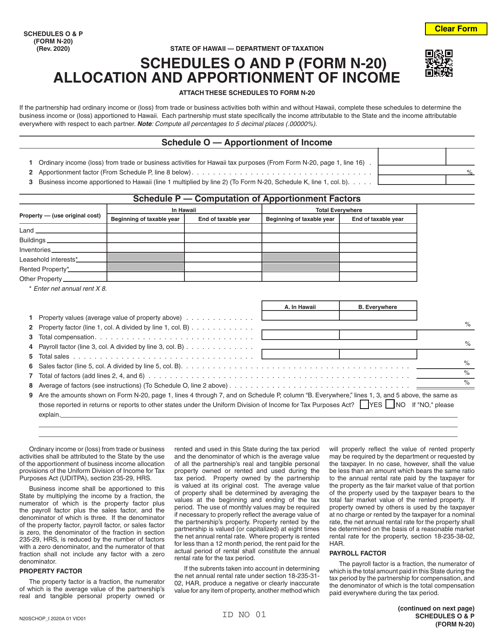

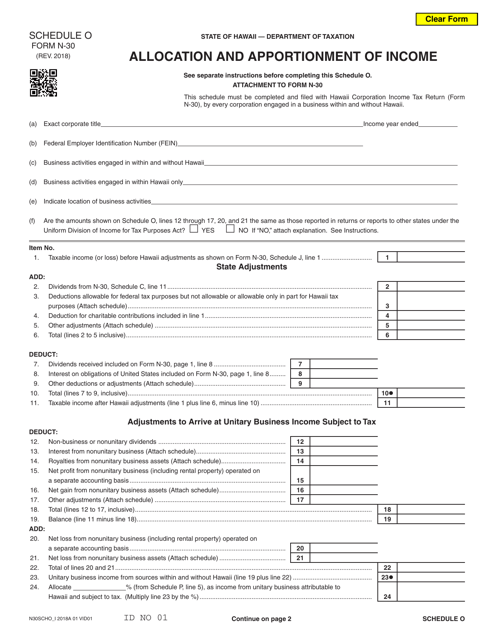

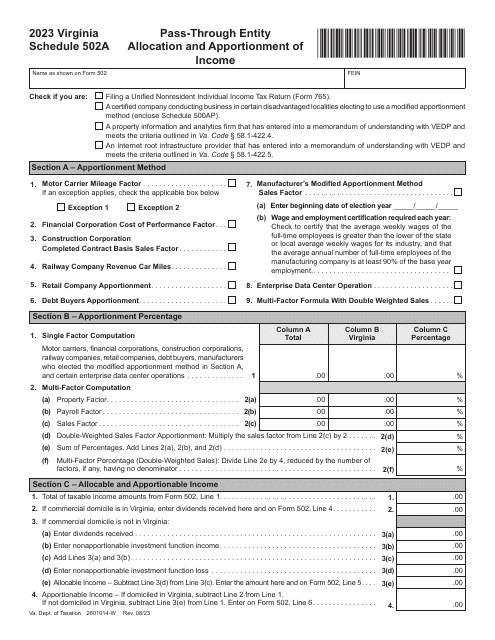

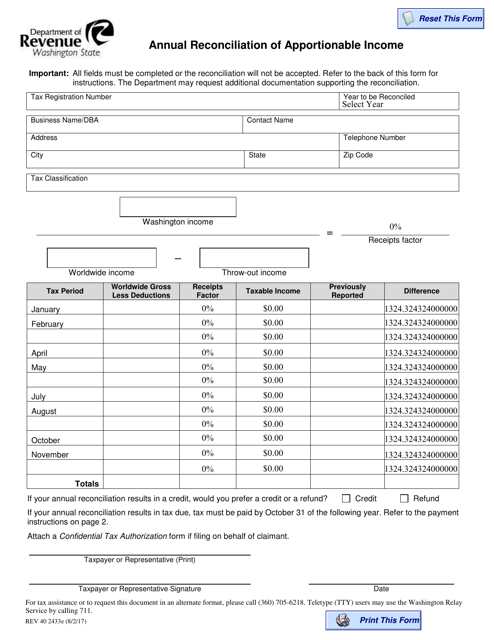

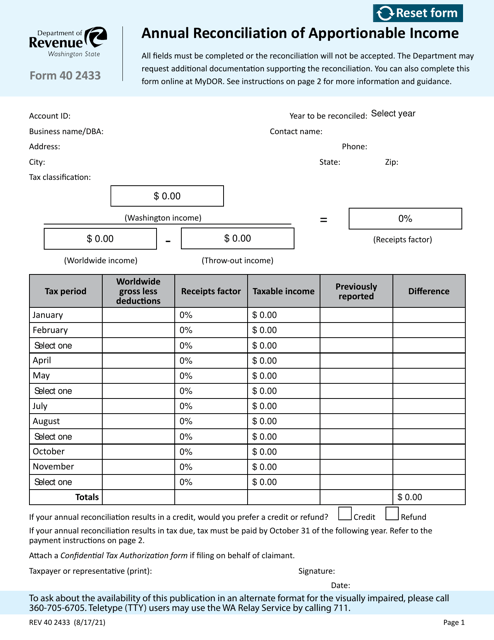

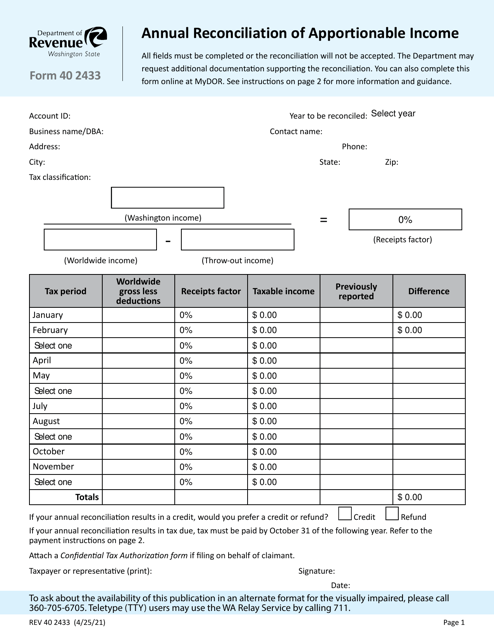

Form N-20 Schedule O, P Allocation and Apportionment of Income - Hawaii; Form N-30 Schedule O Allocation and Apportionment of Income - Hawaii; Form 40 2433 Annual Reconciliation of Apportionable Income - Washington; and Form REV40 2433 Annual Reconciliation of Apportionable Income - Washington are just a few examples of the documents used to report and reconcile apportionable income.

Whether it's called apportionable income, income apportionment, or any other alternate name, understanding and correctly handling this type of income is crucial for businesses operating across different jurisdictions. By staying informed on the latest regulations and using the appropriate documentation, businesses can effectively manage their apportionable income and ensure compliance with tax laws.

Documents:

11

This form is used for the annual reconciliation of apportionable income in the state of Washington. It is used to determine the amount of income that is subject to taxation in the state.