Free Tax Help Templates

Are you looking for free tax help? Our website offers a wide range of resources to assist you with your tax forms and filing. Whether you need assistance with IRS Form 1040 Schedule A Itemized Deductions, Form FTB1564 Financially Disabled - Suspension of the Statute of Limitations - California, or Instructions for Form NJ-1040X New Jersey Amended Resident Income Tax Return - New Jersey, we've got you covered.

We understand that tax forms can be confusing and overwhelming, but our free tax help section aims to simplify the process for you. Our team of experts has curated a collection of informative articles and guides that provide step-by-step instructions on how tofill out various tax forms.

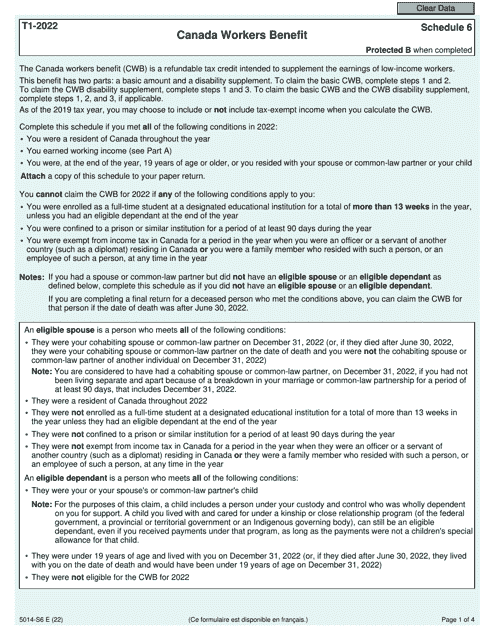

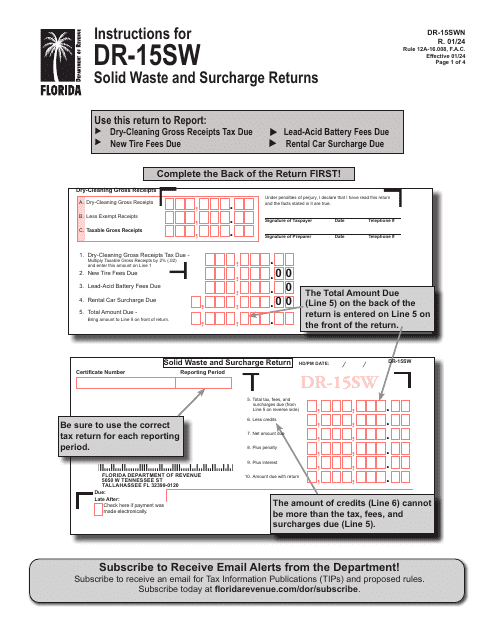

Don't let the complexities of tax forms discourage you from filing your taxes accurately. Our tax help resources cover a wide range of topics, including deductions, credits, and tax implications for different states. We provide assistance for both residents and non-residents, catering to the specific needs of each individual.

Don't waste your time scouring the internet for reliable tax help. Visit our website today and take advantage of our comprehensive free tax help section. We are committed to empowering you with the knowledge and assistance you need to navigate the often confusing world of tax forms.

Whether you refer to it as tax help, tax form help, or even tax help form, our website is here to guide you through the process. Trust us to provide you with accurate and up-to-date information, so you can file your taxes confidently and hassle-free.

Documents:

69

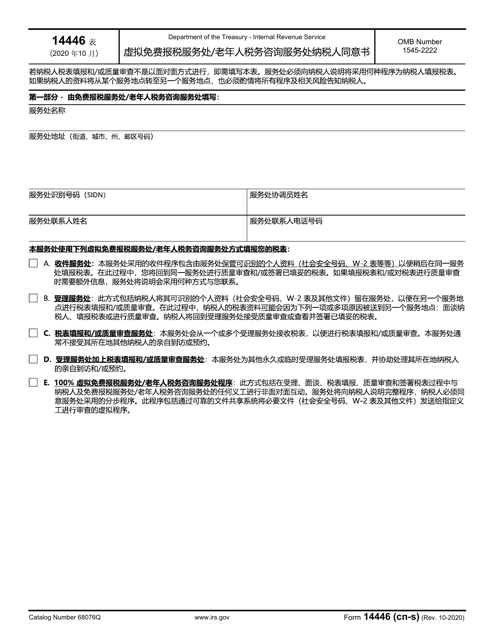

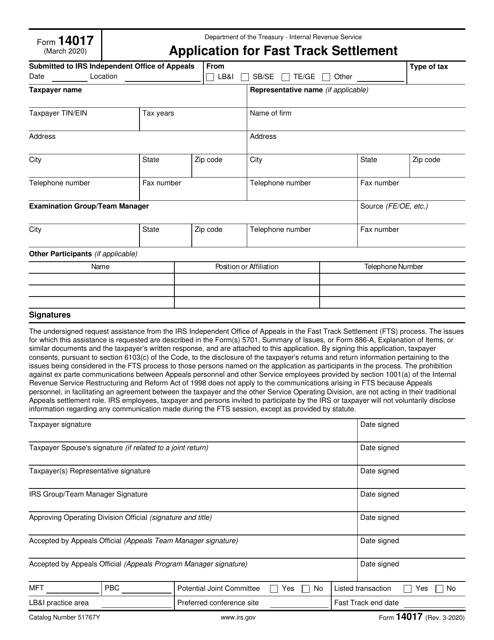

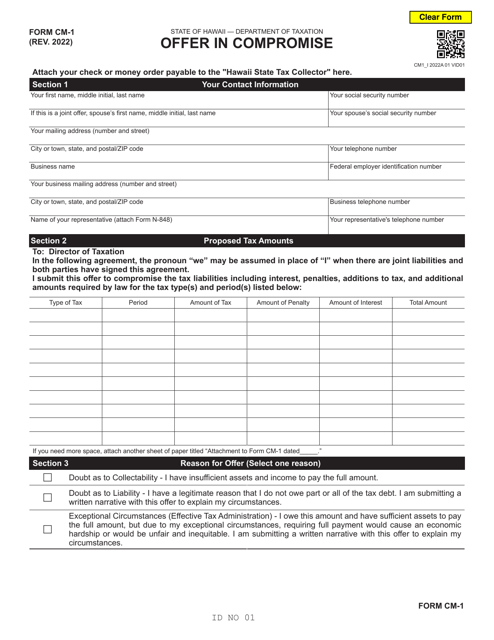

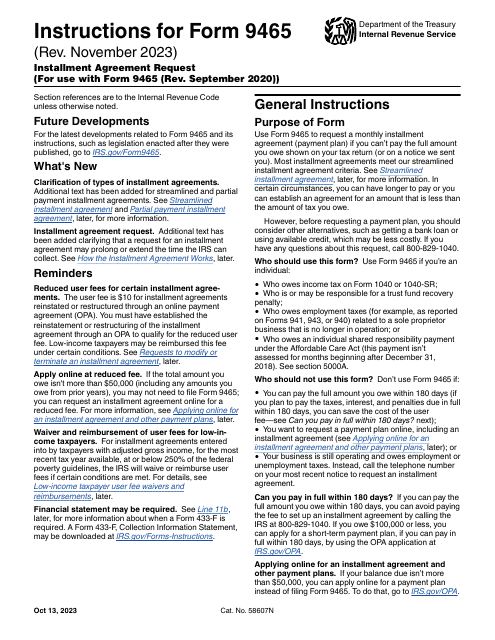

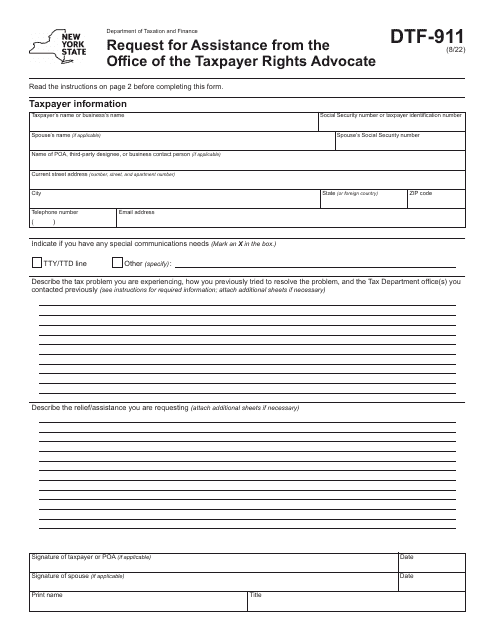

This is a fiscal form used by taxpayers that have already exhausted all other options when dealing with a tax issue.

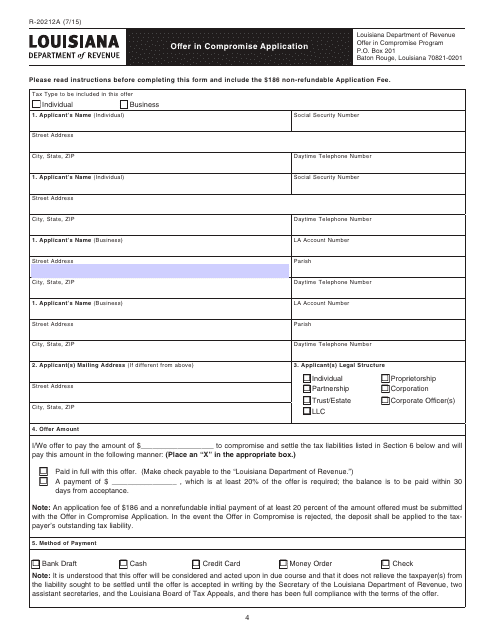

This Form is used for filing an Offer in Compromise Application in the state of Louisiana.

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

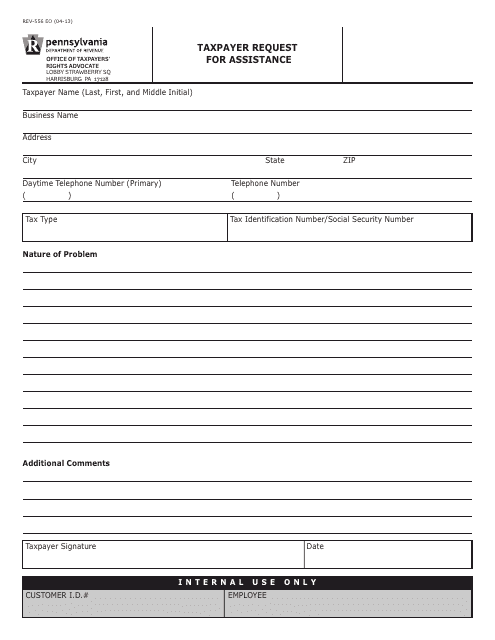

This form is used for Pennsylvania taxpayers to request assistance from the state tax authority.

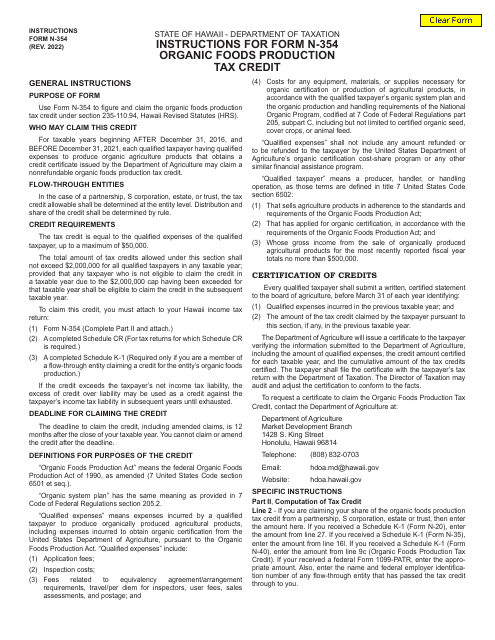

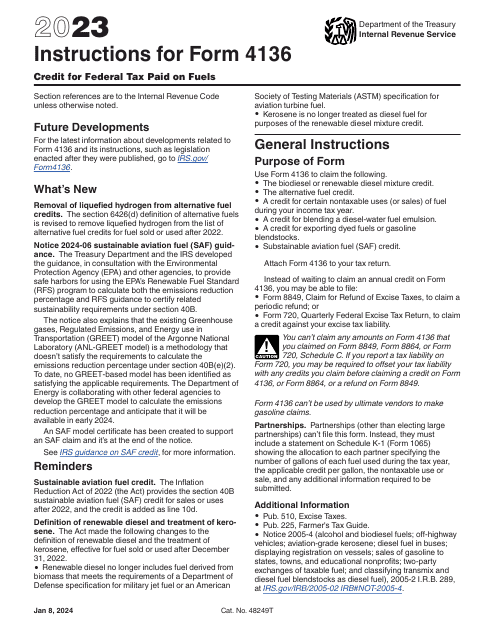

This is a document you may use to figure out how to properly complete IRS Form 6765

This form is used for requesting a suspension of the statute of limitations in California due to being financially disabled. It helps individuals who are unable to pay their taxes to temporarily stop collections activities.

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

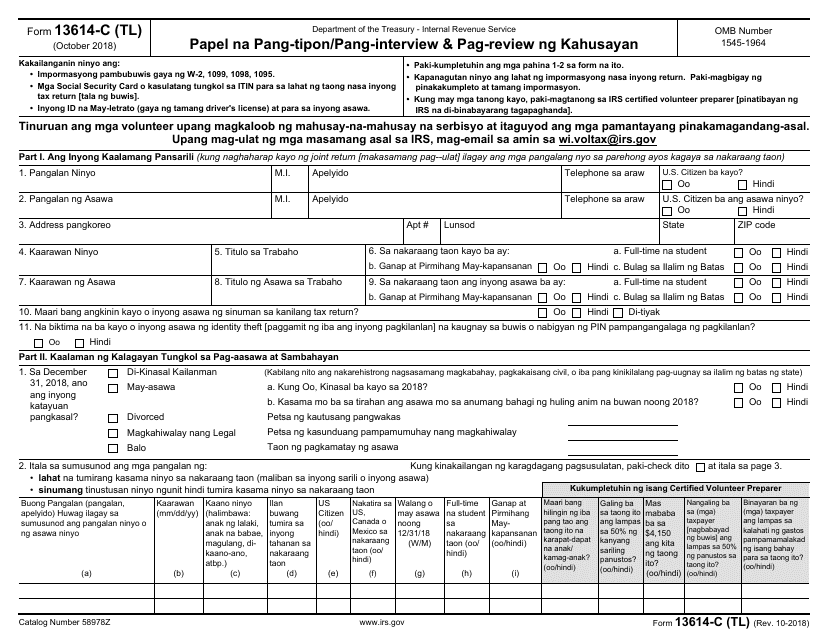

This document is for individuals who speak Tagalog and need assistance with their tax intake process. It is used to gather information about the taxpayer's financial situation for the IRS.

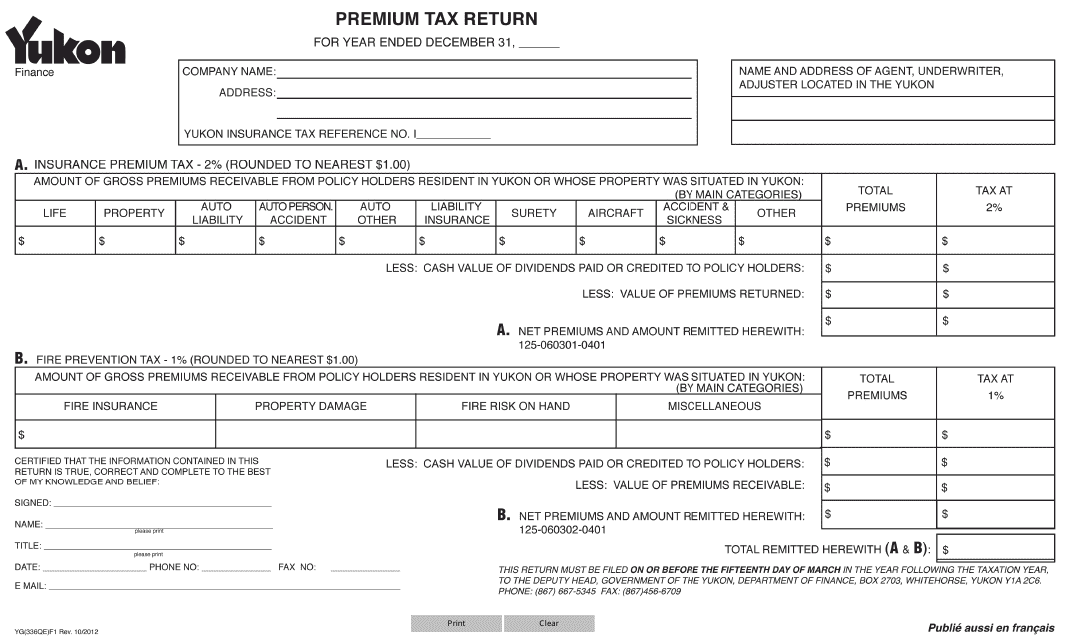

This form is used for filing premium tax returns in Yukon, Canada.

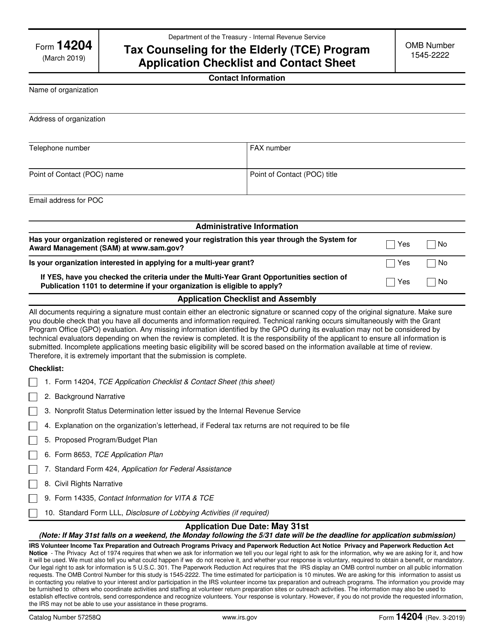

This document is a checklist for applying to the Tax Counseling for the Elderly (TCE) program. It includes a contact sheet for additional information.

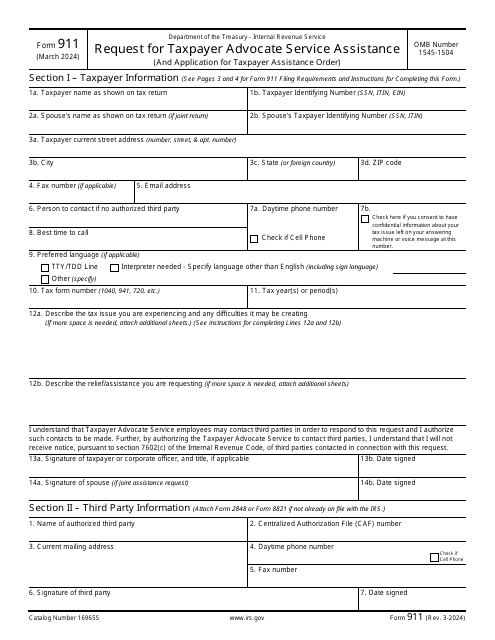

This document provides information about the Taxpayer Advocate Service, a resource available to help individuals with their tax-related issues.

This document provides information about the Taxpayer Advocate Service, a resource available to help taxpayers with their tax-related issues and concerns.

This document provides instructions for filling out IRS Form 1040 and 1040-SR. It guides you through the process of reporting your income, deductions, and credits to calculate your tax liability.

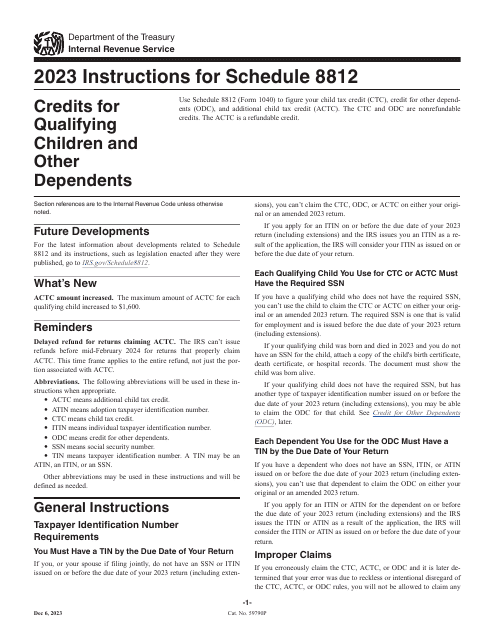

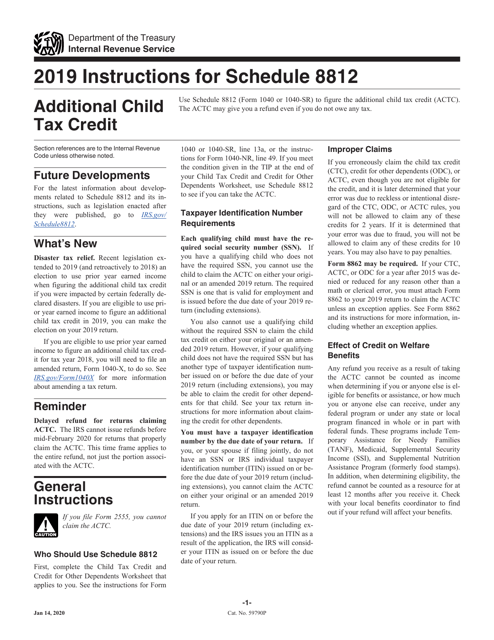

This form is used for claiming the Additional Child Tax Credit on your federal tax return. It provides instructions on how to fill out Form 1040 or Form 1040-SR if you qualify for this tax credit.