Veterans Exemption Templates

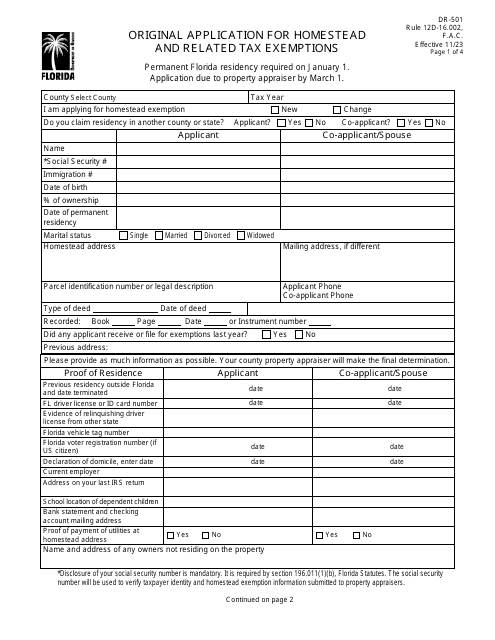

Are you a veteran looking for information on how to receive exemptions on your property taxes? Look no further! Our website provides a comprehensive guide on veterans exemptions, also known as veterans tax relief or veterans property tax exemptions.

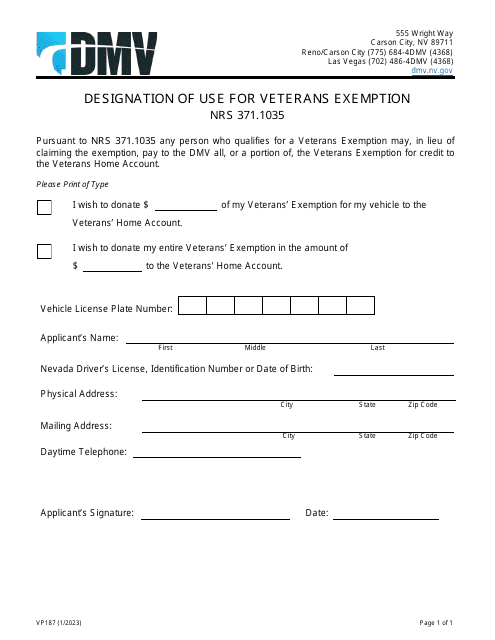

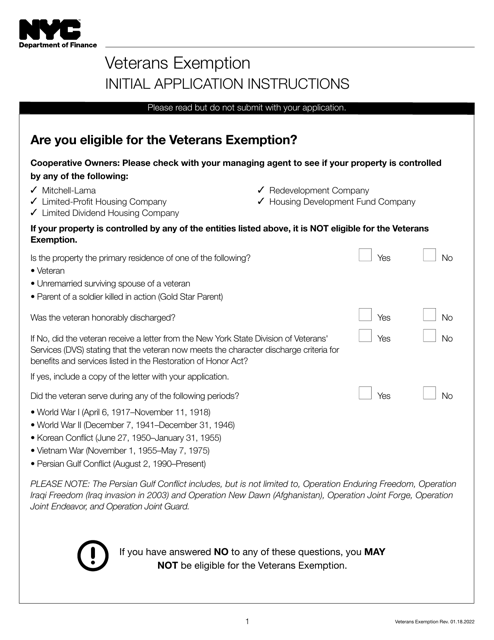

We understand that navigating the complex world of tax laws and exemptions can be overwhelming. That's why we have gathered all the necessary information and forms to help you easily apply for veterans exemptions in various states across the USA, including New York and Oklahoma.

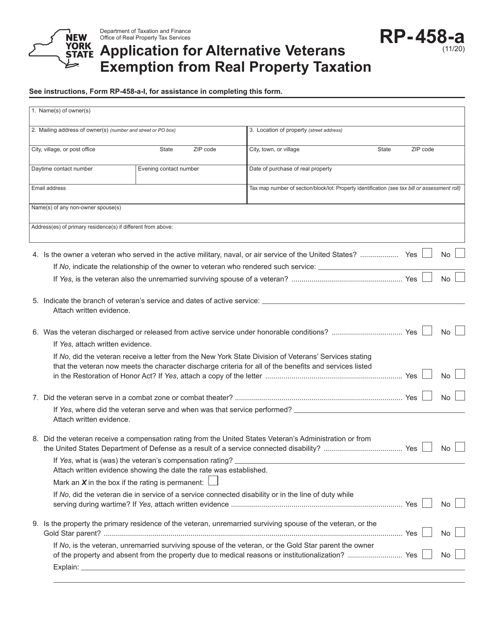

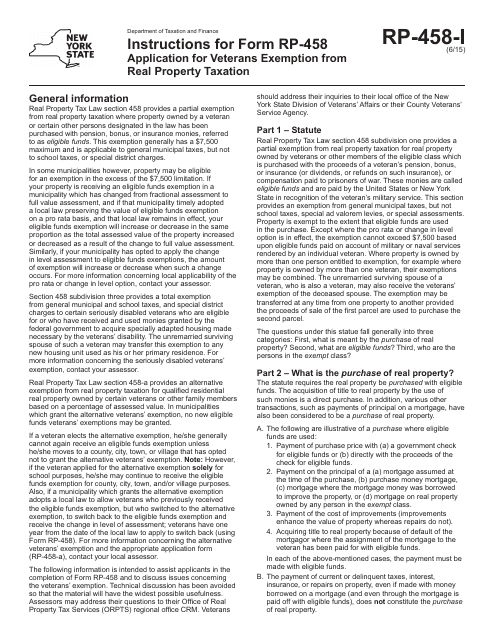

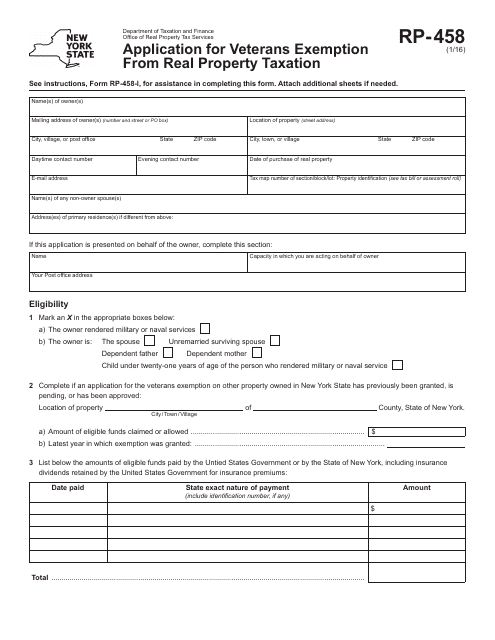

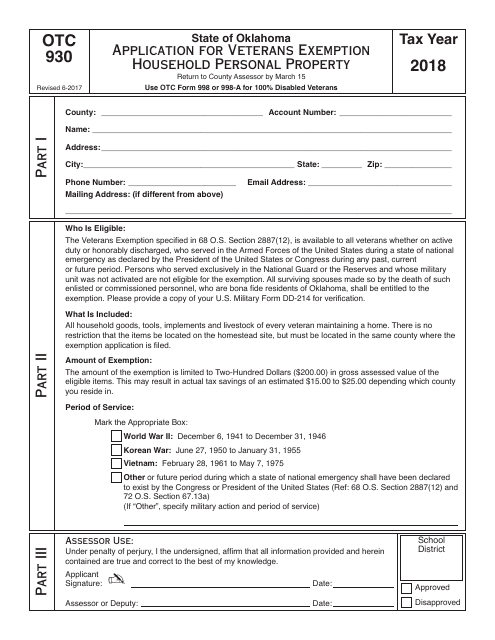

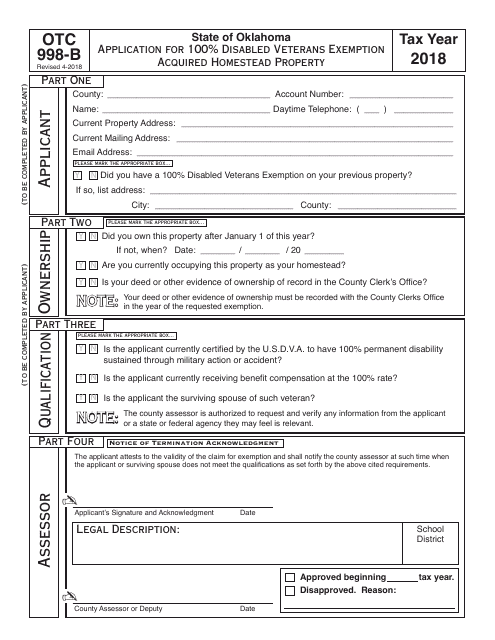

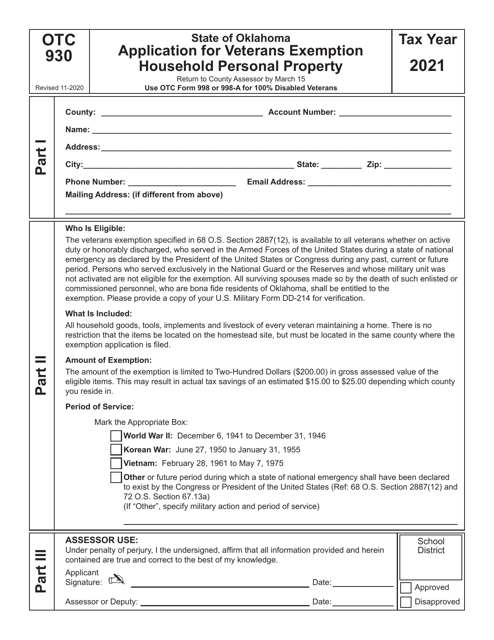

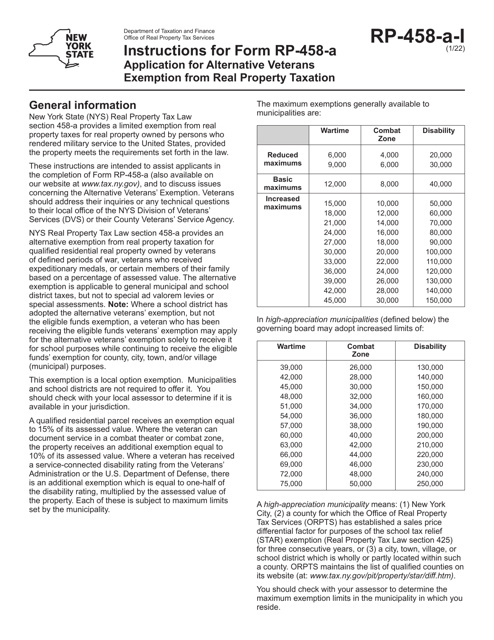

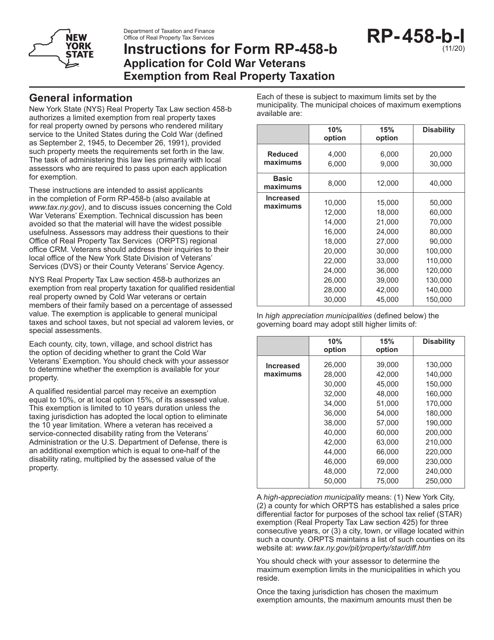

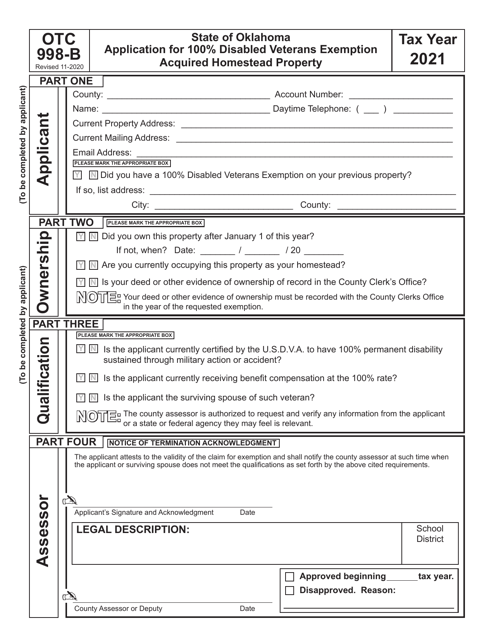

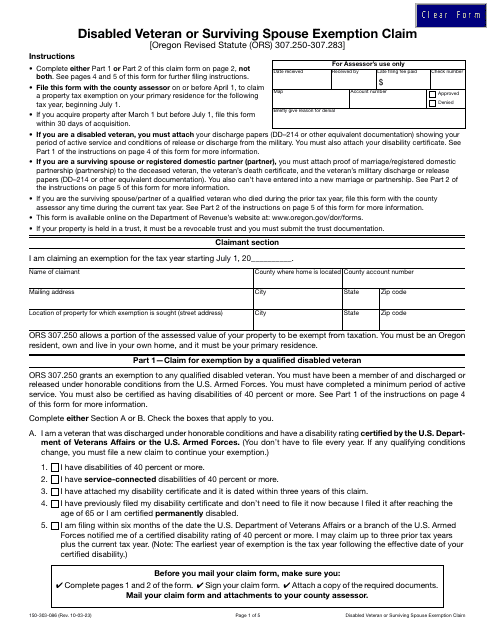

Whether you are a disabled veteran seeking a 100% exemption on your acquired homestead property or a veteran looking to exempt your household personal property, our website has the instructions and application forms you need. We have compiled all the necessary documents, including the "Instructions for Form RP-458 Application for Veterans Exemption From Real Property Taxation" in New York and the "OTC Form OTC998-B Application for 100% Disabled Veterans Exemption Acquired Homestead Property" in Oklahoma.

We understand the importance of providing accurate and up-to-date information, which is why we regularly update our website to reflect any changes in legislation or application requirements. Our aim is to make the process as seamless as possible for veterans, ensuring that you receive the exemptions you deserve.

Don't miss out on the benefits you are entitled to as a veteran. Explore our website today and find all the resources you need to apply for veterans exemptions and ease the burden of property taxes. We are here to support you every step of the way.

Documents:

20

This Form is used for applying for the Veterans Exemption From Real Property Taxation in New York. It provides instructions on how to fill out and submit the application for this tax exemption.

This form is used for applying for the Veterans Exemption from real property taxation in New York. Eligible veterans can use this form to claim a tax exemption on their property.

This form is used for residents of Oklahoma to apply for a veterans exemption for household personal property.

This Form is used for applying for the 100% Disabled Veterans Exemption for acquired homestead property in Oklahoma.

This form is used for applying for a property tax exemption for 100% disabled veterans in Oklahoma who have acquired a homestead property.

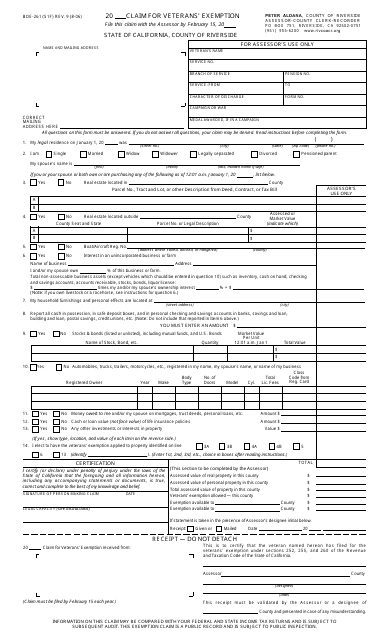

This form is used for claiming the Veterans' Exemption in Riverside County, California. It allows eligible veterans to apply for property tax exemption.

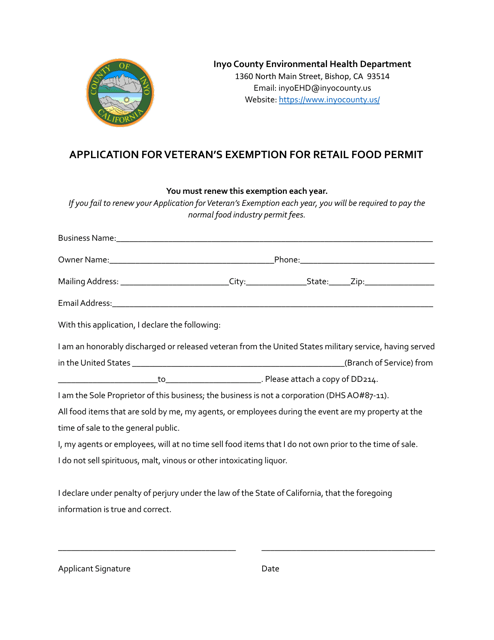

This document is used for applying for a veteran's exemption for a retail food permit in Inyo County, California. It provides a tax exemption for veterans who own a retail food business in the county.