Minimum Tax Templates

Looking for information on minimum tax? Look no further. Our comprehensive collection of documents related to minimum tax will provide you with everything you need to know about this important aspect of taxation.

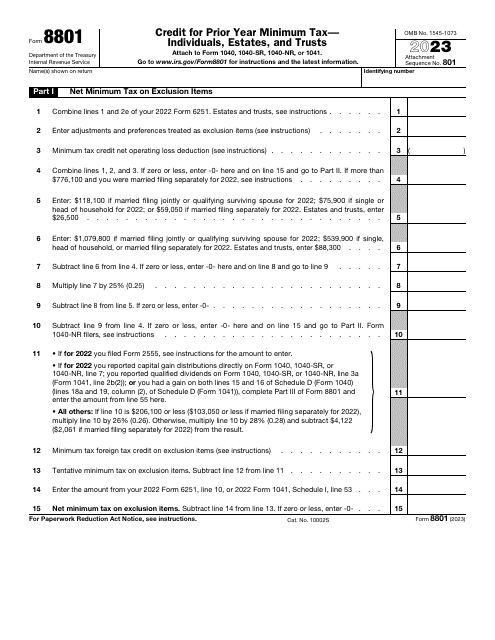

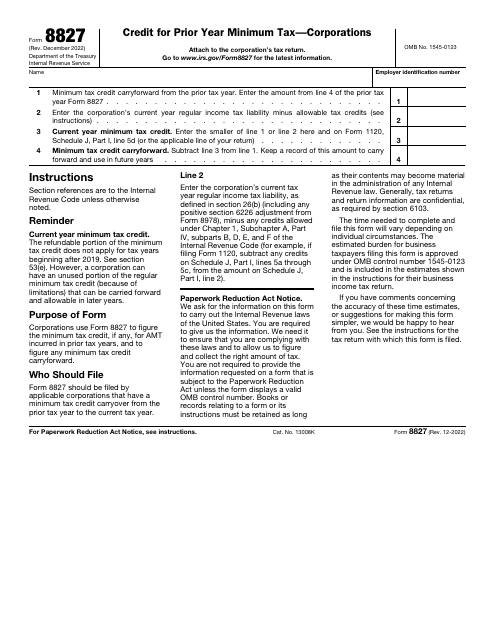

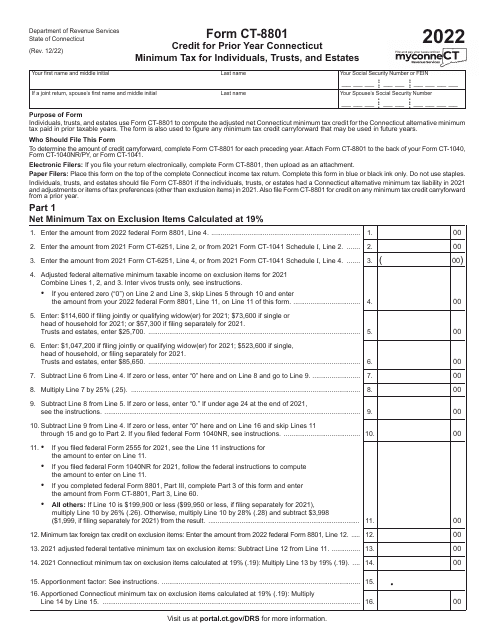

Whether you're an individual, estate, trust, or corporation, our collection includes forms and instructions specifically designed for your needs. From IRS Form 8801 Credit for Prior Year Minimum Tax - Individuals, Estates, and Trusts to IRS Form 8827 Credit for Prior Year Minimum Tax - Corporations, we have you covered.

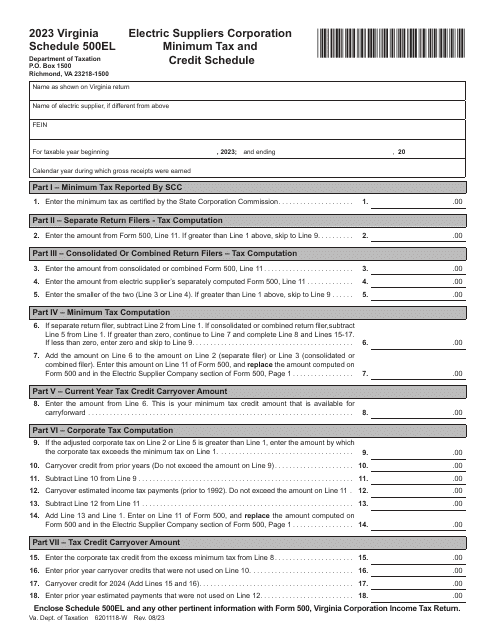

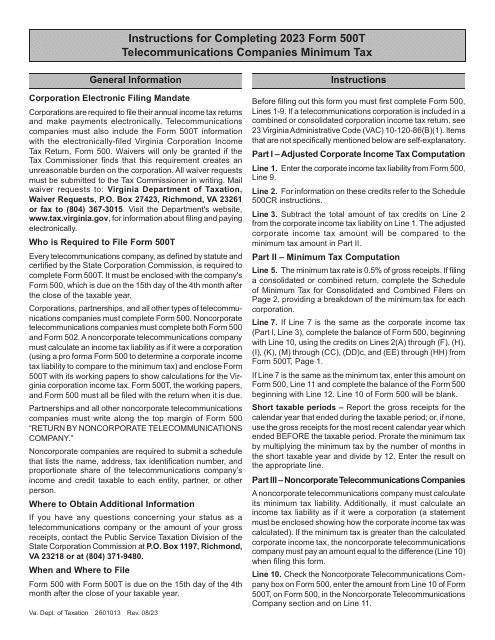

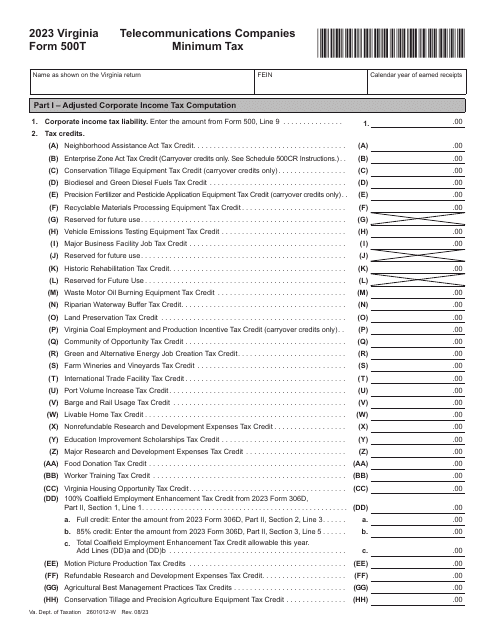

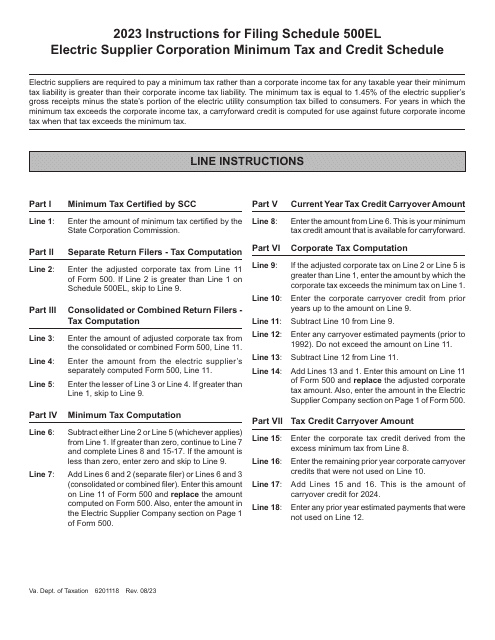

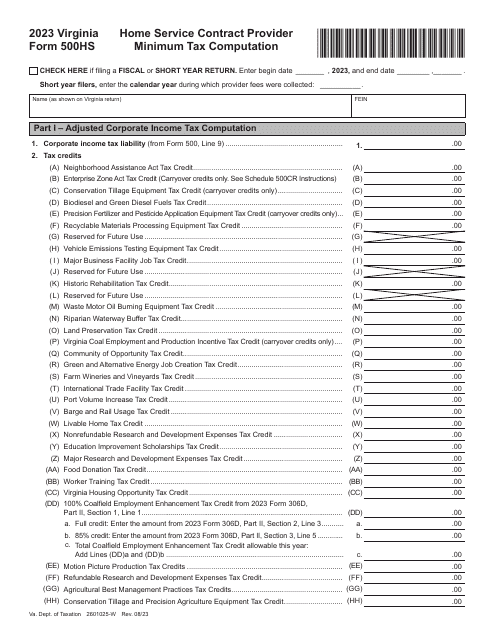

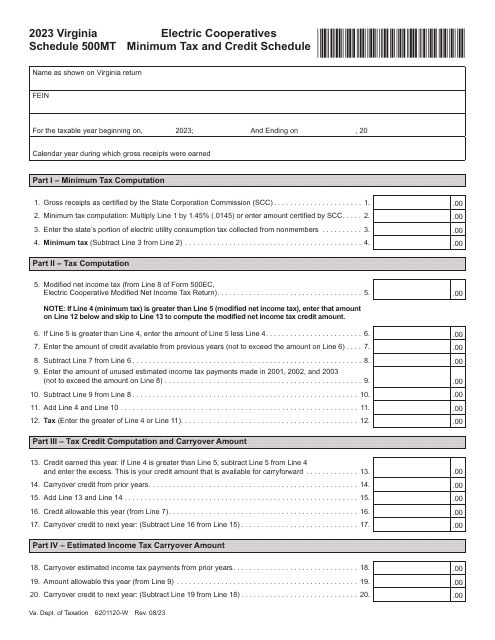

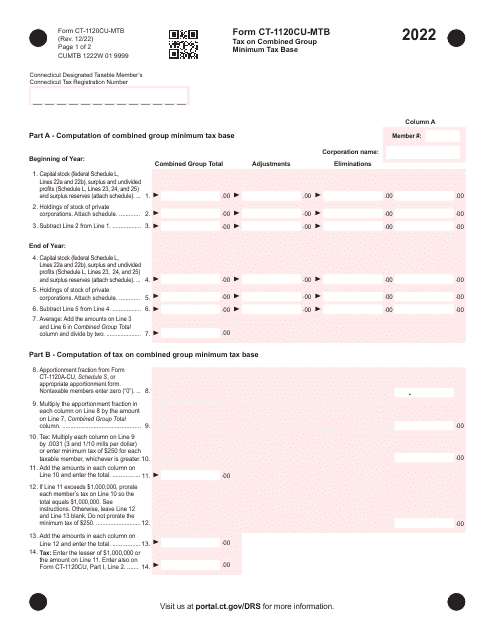

But it doesn't stop there. Our collection also includes state-specific documents, such as Form CT-1120CU-MTB Tax on Combined Group Minimum Tax Base - Connecticut and Schedule 500EL Electric SuppliersCorporation Minimum Tax and Credit Schedule - Virginia. Plus, you'll find Instructions for Form 500T Telecommunications Companies Minimum Tax - Virginia to help guide you through the process.

So whether you're trying to understand how minimum tax affects your personal finances or need to comply with state-specific requirements, our collection of minimum tax documents is here to assist you. Don't waste time searching through various sources - find everything you need in one convenient place.

Documents:

46

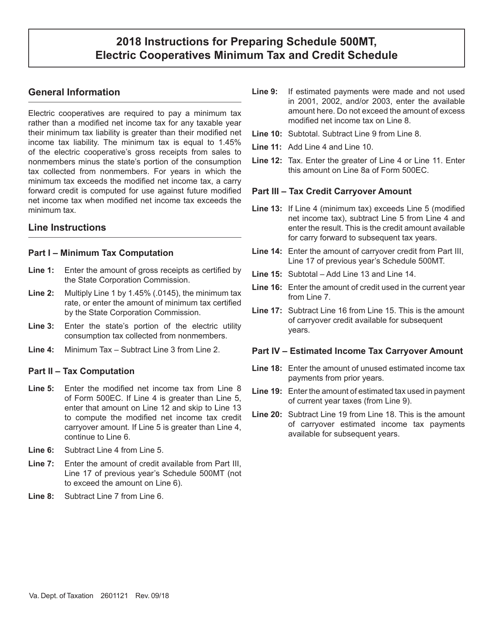

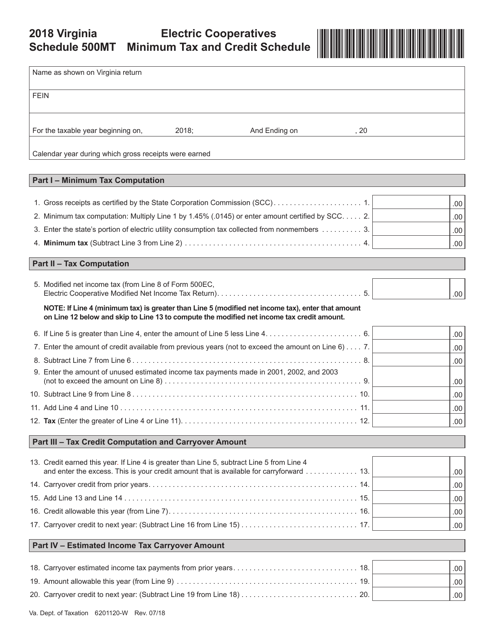

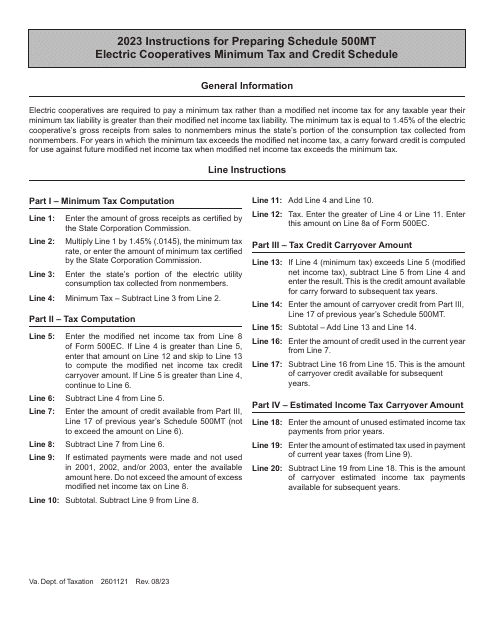

This Form is used for reporting the Minimum Tax Credit Schedule for Electric Cooperatives in Virginia.

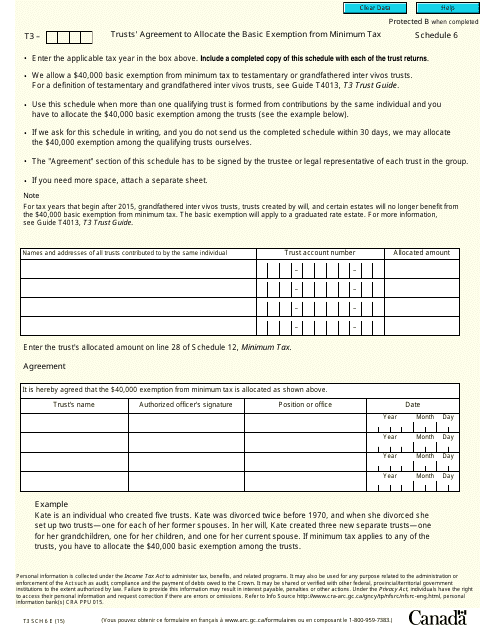

This Form is used for trusts in Canada to allocate the basic exemption from minimum tax.

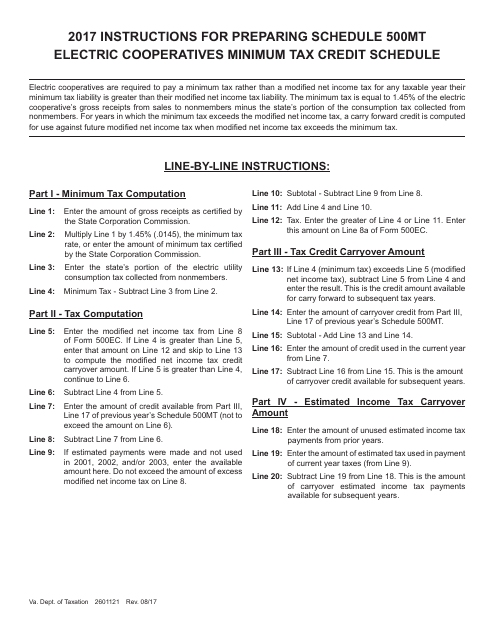

Form 6201120-W Schedule 500MT Electric Cooperatives Minimum Tax and Credit Schedule - Virginia, 2018