Paid Preparer Templates

Are you looking for assistance with paid preparer documents? We can help you navigate through the complex world of tax preparation and ensure that you comply with all the necessary guidelines. Our team of experts understands the importance of accurate tax preparation and can guide you through the process step by step.

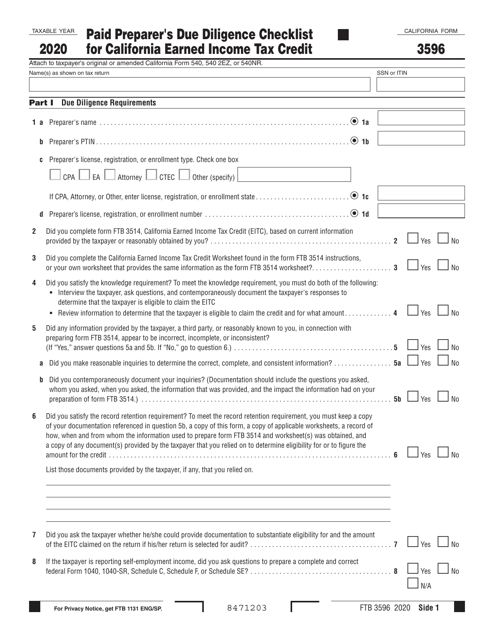

Our paid preparer services include a comprehensive checklist to ensure that you meet all the requirements for claiming tax credits. This checklist is specifically designed for California residents who are eligible for the Earned Income Tax Credit. By following the guidelines outlined in our checklist, you can maximize your tax benefits and avoid potential penalties.

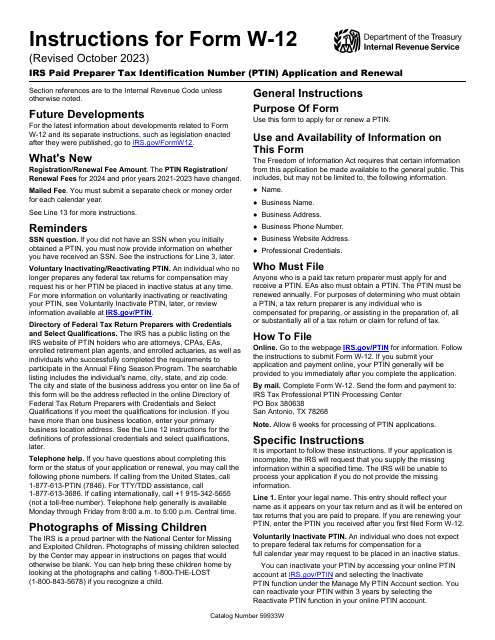

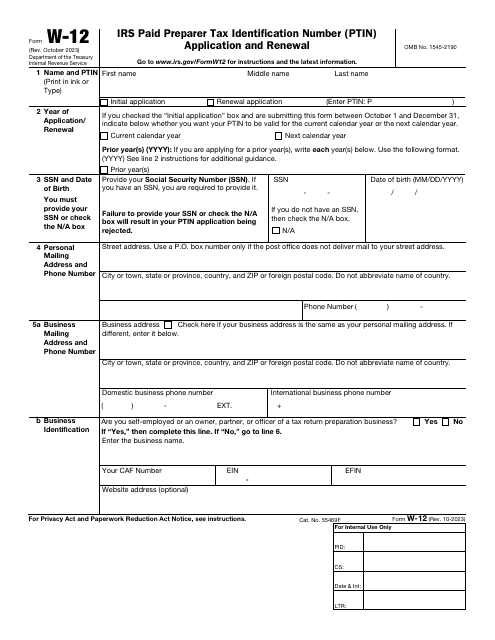

In addition to our checklist, we also provide guidance on obtaining a Paid Preparer Tax Identification Number (PTIN) from the IRS. This number is required for professional tax preparers and ensures that they adhere to the highest standards of ethics and professionalism.

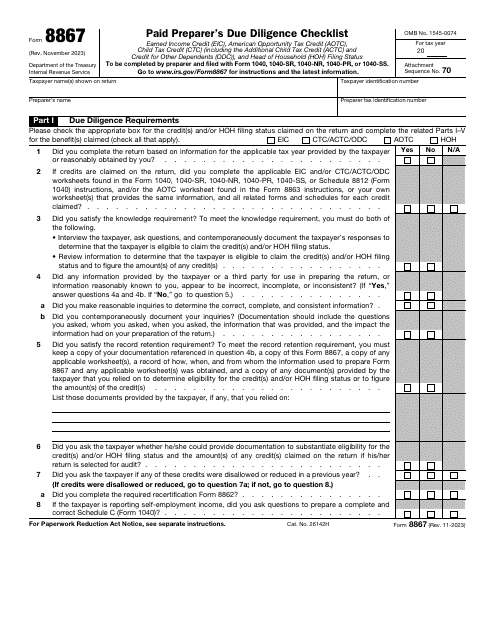

Our services extend beyond California, as we also offer assistance with the IRS Form 8867. This form is a due diligence checklist for paid preparers that is applicable nationwide. By completing this form accurately and thoroughly, you can demonstrate your commitment to providing quality tax preparation services.

Trust our experienced team to provide you with the resources and knowledge you need to excel as a paid preparer. Contact us today to learn more about our paid preparer documents and how they can benefit your tax preparation business.

Documents:

9