College Savings Account Templates

A college savings account, also known as a college savings plan or a 529 account, is a specialized financial tool designed to help families save for the cost of higher education. These accounts offer tax advantages and flexibility, making it easier for parents and guardians to save for their children's future education expenses.

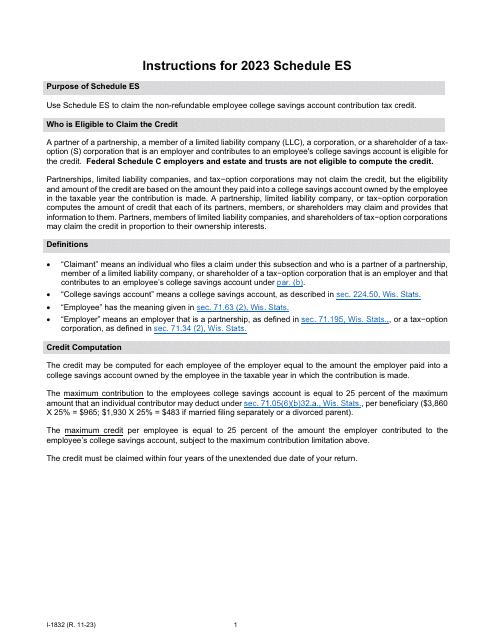

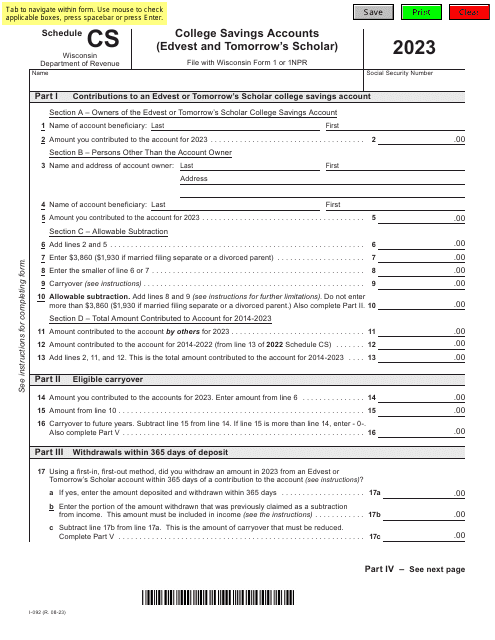

With a college savings account, you can contribute money on a regular basis, allowing it to grow over time. This growth is usually tax-deferred, meaning you won't have to pay taxes on the earnings until you withdraw the funds for qualified educational expenses. Additionally, some states offer tax incentives for contributing to a college savings account, such as an employee college savings account contribution credit or a deduction on your state income taxes.

The funds in a college savings account can be used to pay for a variety of education-related expenses, including tuition, fees, books, supplies, and even room and board. Plus, the account is not limited to traditional four-year colleges and universities - it can also be used for vocational schools, community colleges, and graduate programs.

By establishing a college savings account, you are taking a proactive step towards securing your child's future education. You can choose from a range of investment options that suit your risk tolerance and financial goals. Plus, you have the flexibility to change the beneficiary of the account if your child decides not to pursue higher education or receives a scholarship.

Start saving for your child's education today with a college savings account. Benefit from the tax advantages, flexibility, and peace of mind that comes with knowing you are actively preparing for the cost of higher education. Plan for their future and give them the opportunities they deserve. Set up a college savings account now and make their dreams a reality.