Dividend Income Templates

Are you looking for information on how to report dividend income on your taxes? Or do you need assistance with the various forms and schedules related to dividend income? Our webpage provides comprehensive and easy-to-understand information about dividend income, including the forms and instructions you may need to accurately report your earnings.

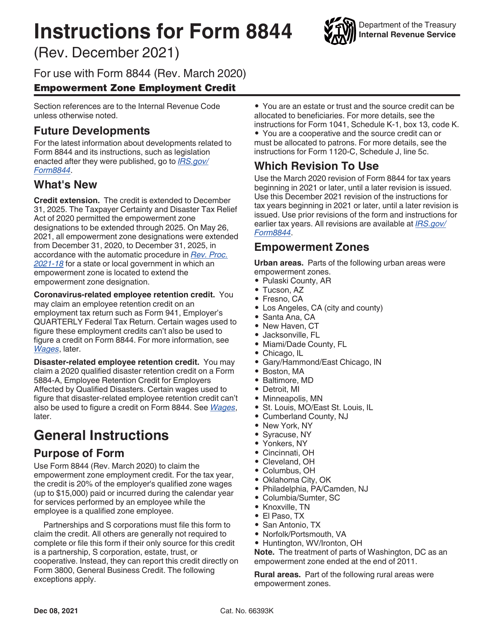

Dividend income, also known as investment income, is a common source of additional earnings for individuals, estates, and trusts. It includes the money you receive from stocks, mutual funds, and other investments you may have. Reporting dividend income correctly on your tax return is essential to ensure compliance with tax laws and maximize your deductions.

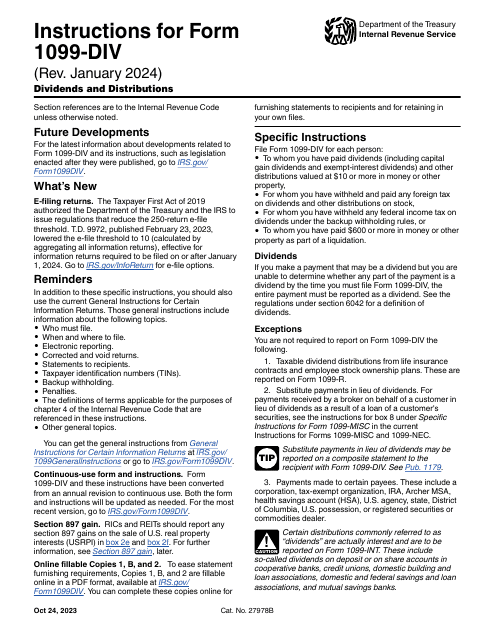

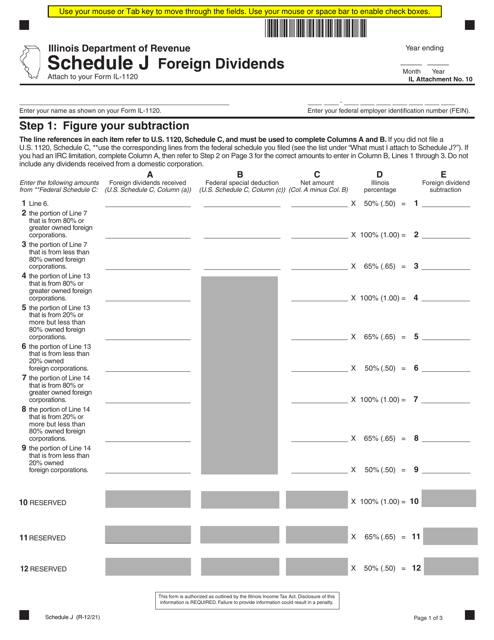

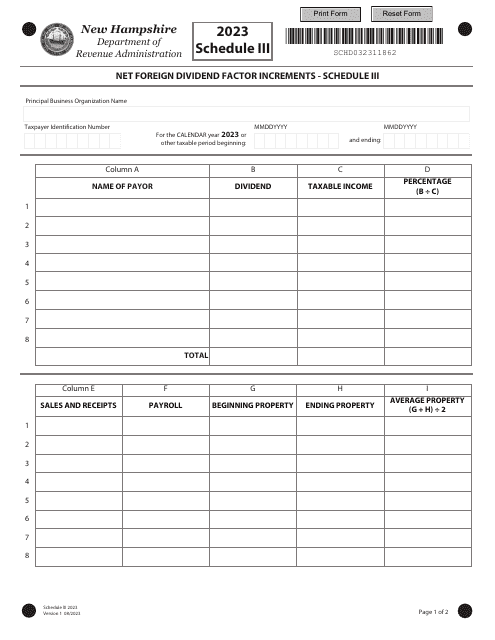

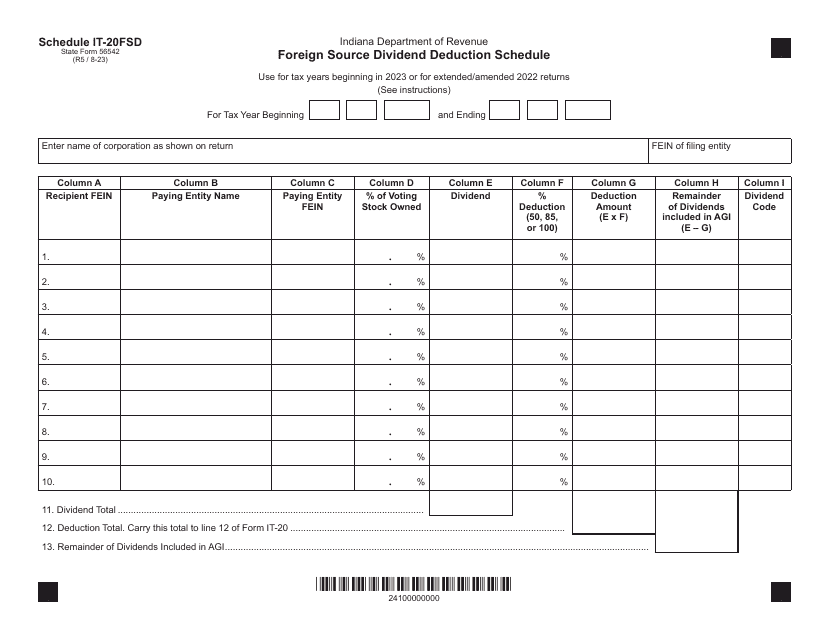

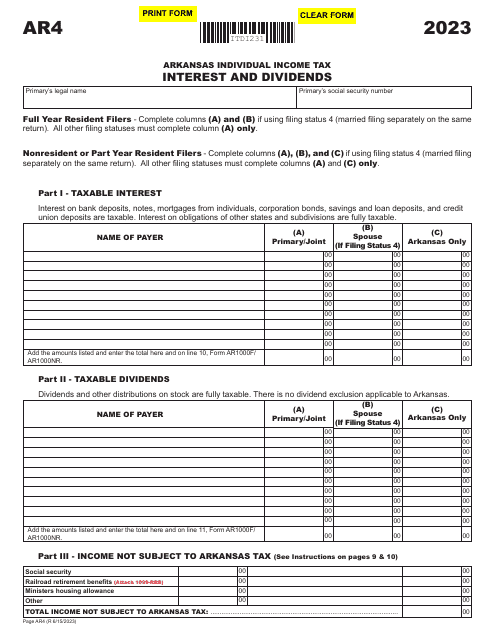

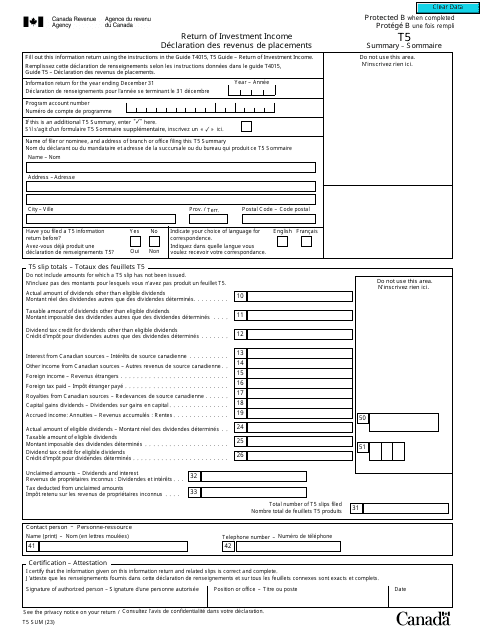

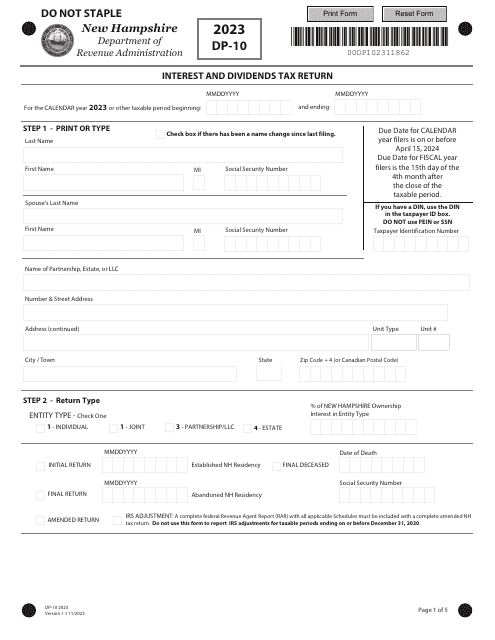

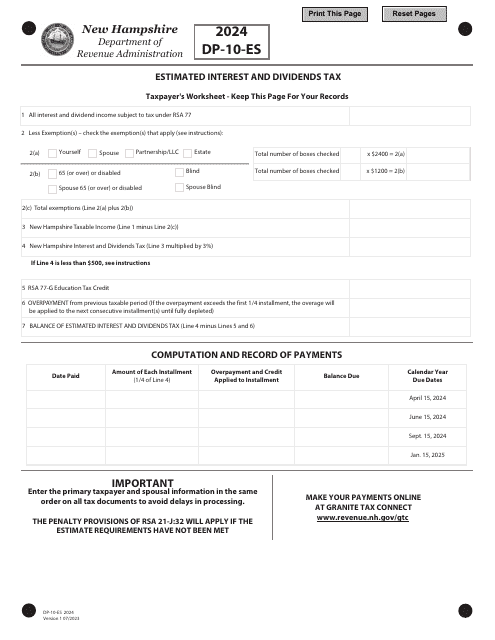

Our webpage offers detailed instructions for the IRS Form 1040 Schedule B, which is used to report interest and ordinary dividends. We also provide information on Schedule III Net Foreign Dividend Factor Increments for residents of New Hampshire and the Form T5SUM Return of Investment Income for Canadian taxpayers.

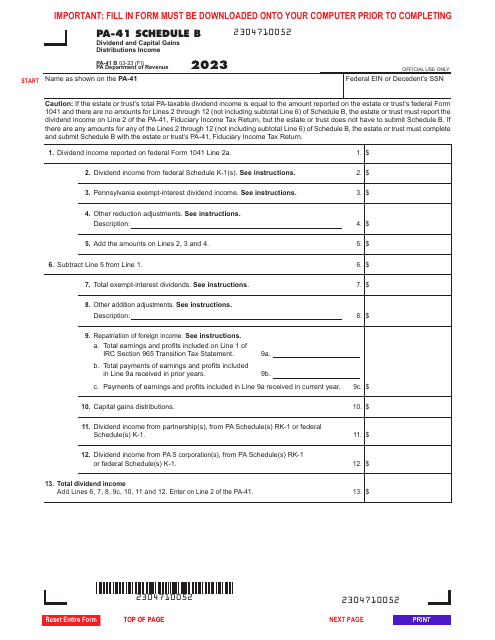

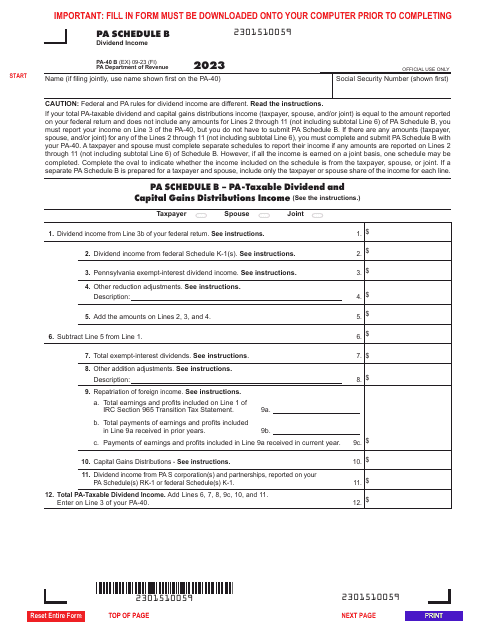

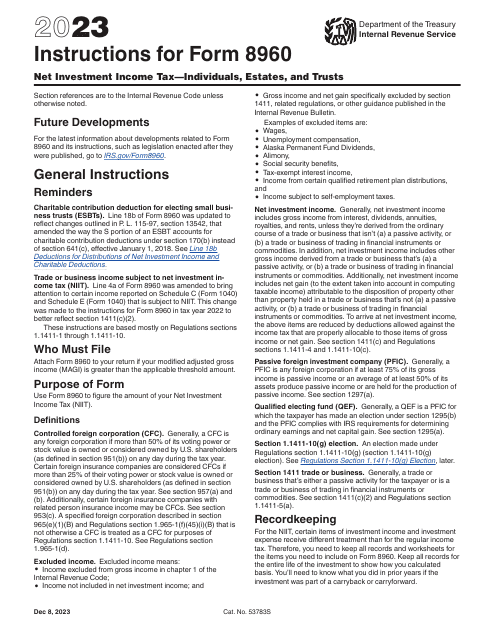

If you're looking for guidance on calculating the Net Investment Income Tax or reporting dividend income on state-specific forms, we have you covered as well. Our webpage includes instructions for the IRS Form 8960 Net Investment Income Tax and the Form PA-40 Schedule B Dividend Income for residents of Pennsylvania.

No matter where you are located or the complexity of your dividend income situation, our webpage will help you navigate the process with ease. We provide clear explanations, step-by-step instructions, and helpful tips to ensure you accurately report your dividend income and avoid any penalties.

Don't let the stress of reporting dividend income on your taxes overwhelm you. Visit our webpage today to access the information and resources you need to successfully manage your dividend income reporting.

Documents:

27

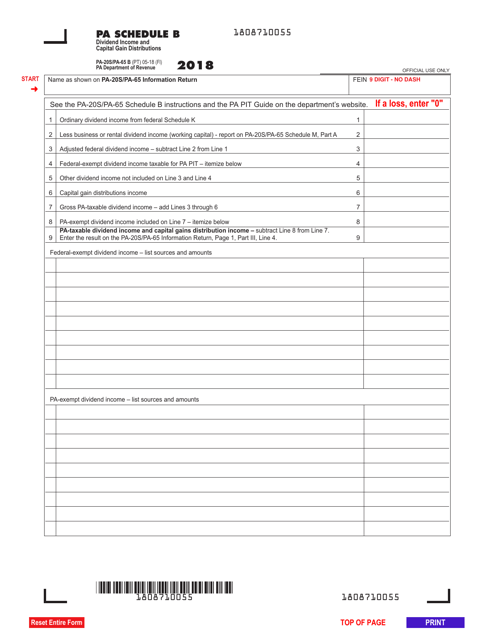

Form PA-20S (PA-65 B) Schedule B Dividend Income and Capital Gain Distributions - Pennsylvania, 2018

This Form is used for reporting dividend income and capital gain distributions in Pennsylvania.

This is a fiscal document completed by financial entities to specify the amount of supplementary income investors have generated during the year.

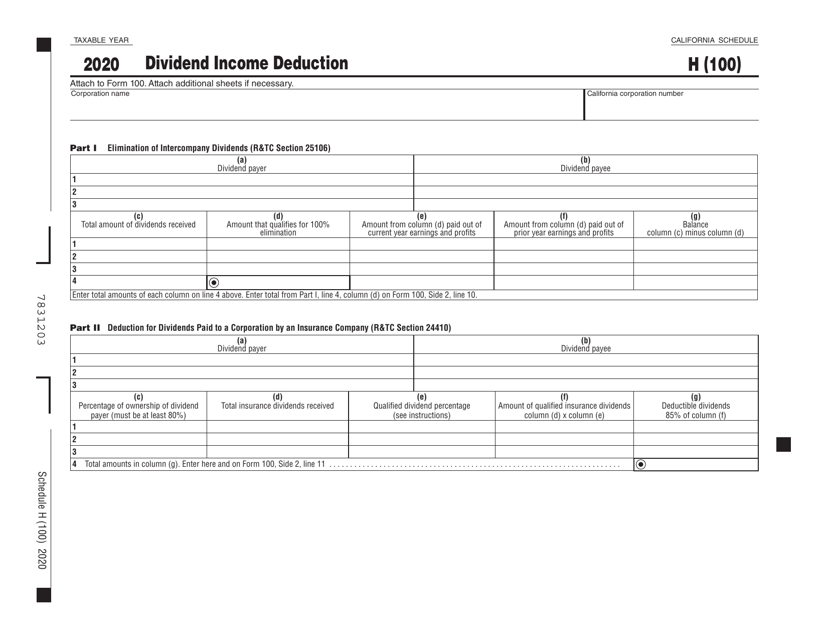

This form is used for claiming a deduction on dividend income in the state of California.