Indian Tax Forms and Templates

Indian Tax Forms are used for various purposes related to taxation in India. These forms are used by individuals and businesses to fulfill their tax obligations, such as filing income tax returns, claiming tax credits, applying for registration under tax laws, and requesting adjustments or amendments to their tax-related information. These forms provide a structured format for taxpayers to report their financial information and comply with tax regulations imposed by the Indian government.

Documents:

8

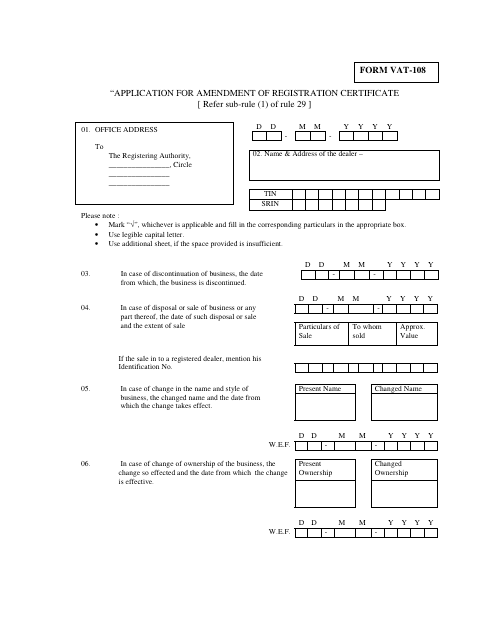

This form is used for applying to amend a registration certificate for Value Added Tax (VAT) in India. It is necessary to update or correct information on the registration certificate.

This form is used for individuals in India to declare their eligibility for a tax exemption on interest income or income from units without deduction of tax.

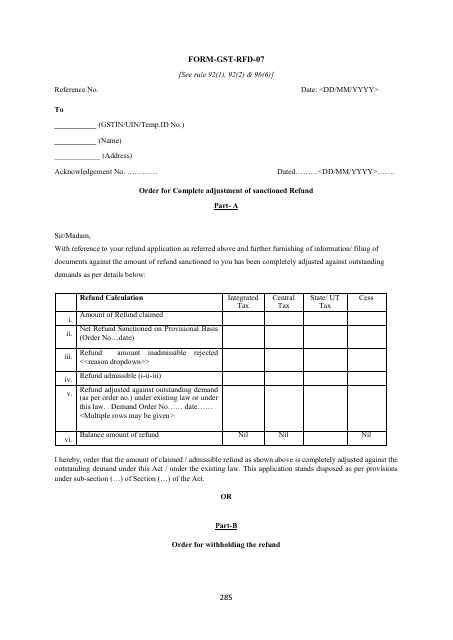

This form is used for placing an order to completely adjust a sanctioned refund in the state of Karnataka, India.

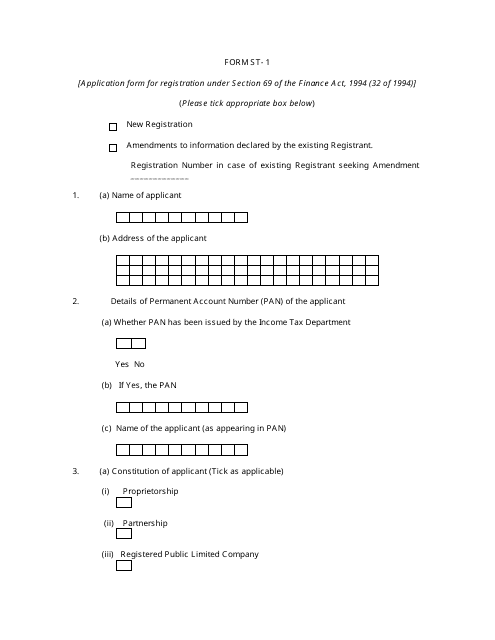

This form is used for applying for registration under Section 69 of the Finance Act, 1994 in India.

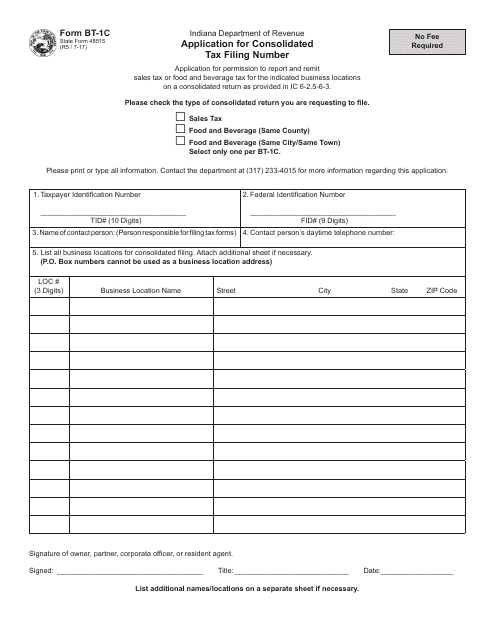

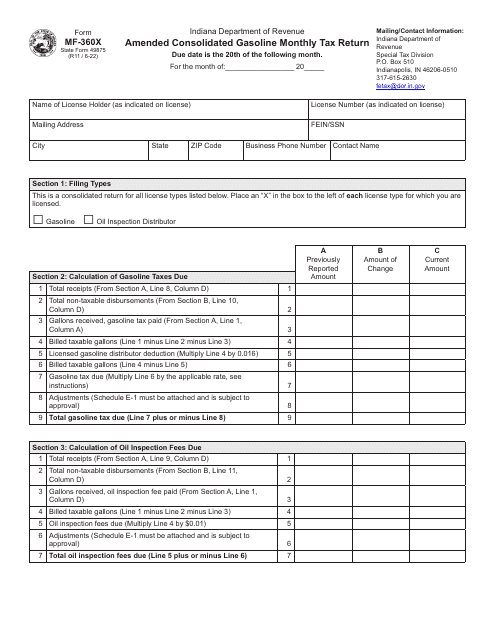

This form is used for applying for a consolidated tax filing number in the state of Indiana.

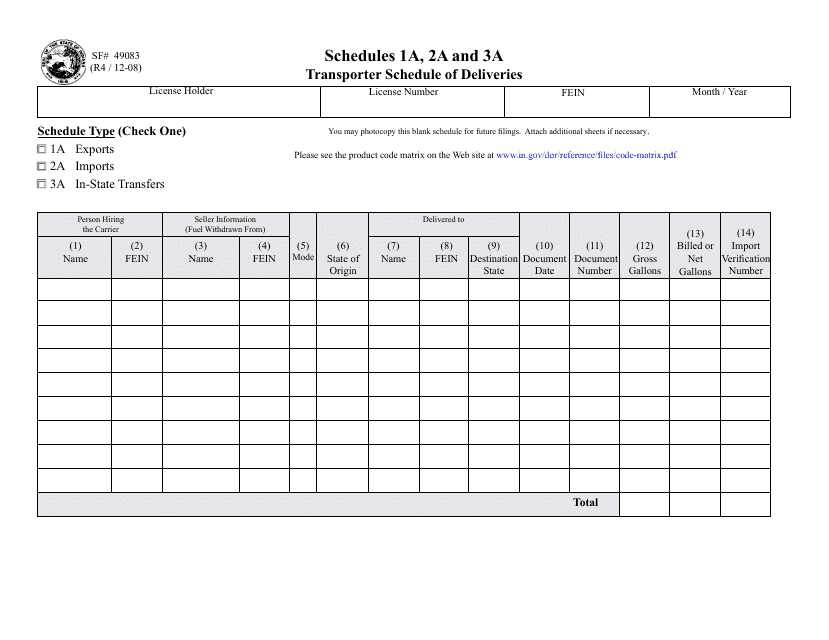

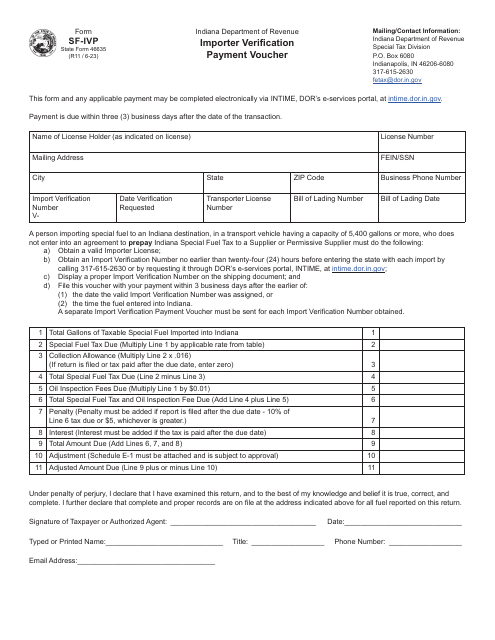

This form is used for reporting the schedule of deliveries for transporters in the state of Indiana.

![Form 15H Declaration Under Section 197a (1a) of the Income Tax Act, 1961 to Be Made by a Persons [not Being a Company or a Firm] Claiming Receipt of Interest Other Than "interest on Securities" or Income in Respect of Units Without Deduction of Tax - India](https://data.templateroller.com/pdf_docs_html/32/322/32275/form-15h-declaration-under-section-197a-1a-the-income-tax-act-1961-to-be-made-by-a-persons-not-being-a-company-or-a-firm-claiming-receipt-interest-other-than-interest-on-securities-or-income-in-respect-units-without-deduction-tax-india_big.png)