Structured Settlement Templates

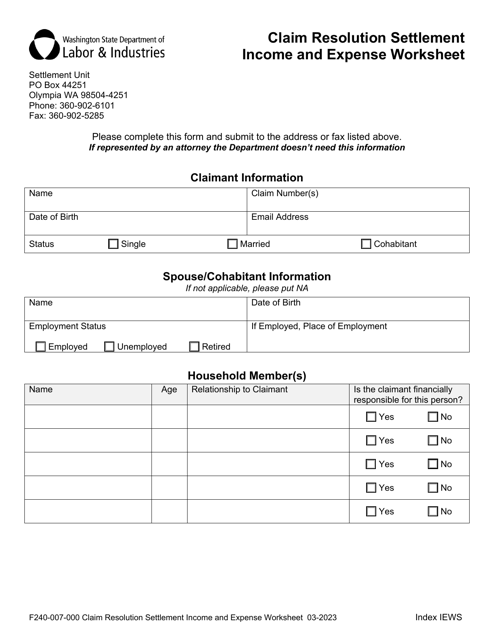

A structured settlement, also known as structured settlements, is a legal arrangement that provides individuals with a series of regular payments over a specified period of time. It is often used as a form of financial compensation in cases of personal injury, medical malpractice, or wrongful death.

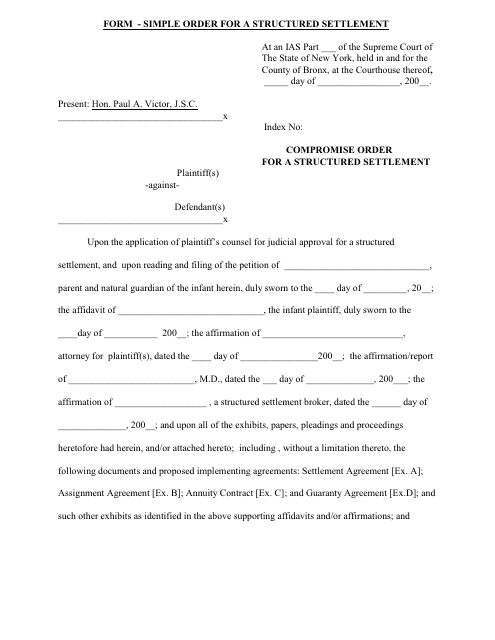

Structured settlements provide a secure and predictable source of income for those who receive them. They are designed to ensure long-term financial stability and can be customized to meet the unique needs and circumstances of the individual. These settlements are often established through a compromise order or agreement between the parties involved in the legal case.

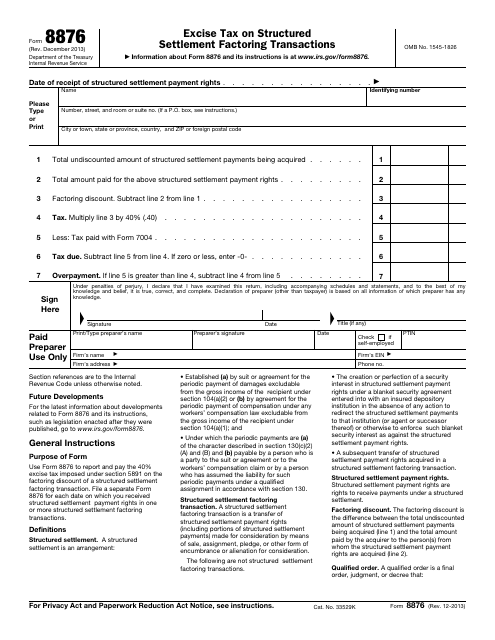

The IRS Form 8876 Excise Tax on Structured Settlement Factoring Transactions is an important document related to structured settlements. It helps ensure compliance with tax regulations when transferring or selling structured settlement payments. Similarly, the Compromise Order for a Structured Settlement provides a detailed outline of the terms and conditions of the settlement, protecting the rights of both the receiving and paying parties.

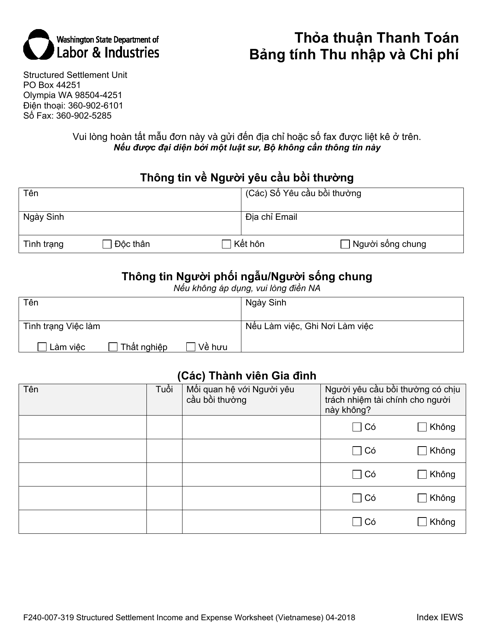

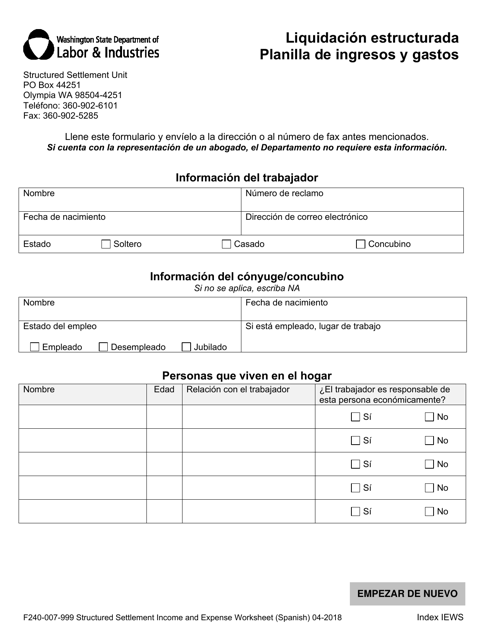

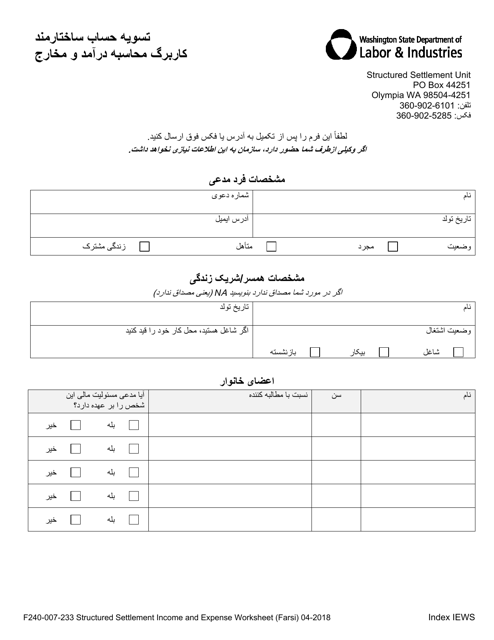

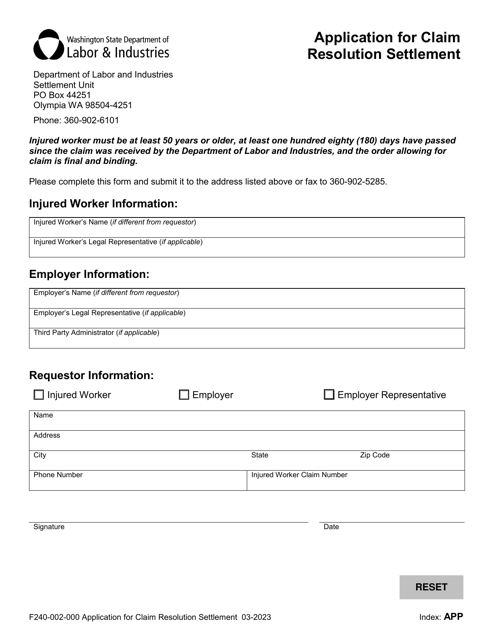

In some instances, structured settlements may be subject to state or regional-specific requirements. For example, the Formulario F240-007-999 Liquidacion Estructurada Planilla De Ingresos Y Gastos is a Spanish-language form used in Washington to report income and expenses related to structured settlements. Similarly, the Form F240-007-233 Structured Settlement Income and Expense Worksheet is available in Farsi for individuals in Washington.

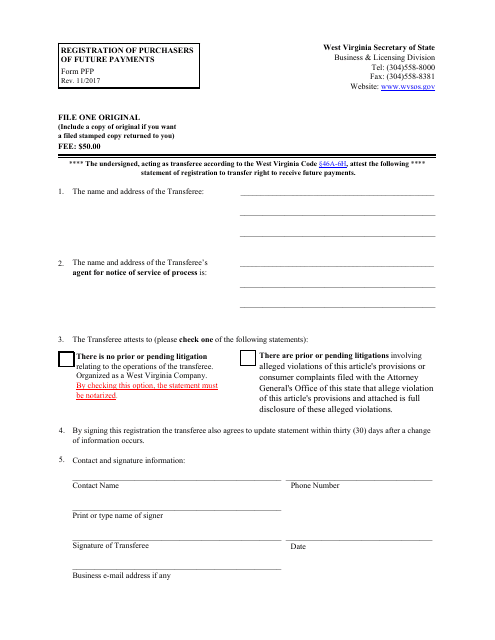

To ensure transparency and accountability within the structured settlement industry, some states, like West Virginia, require purchasers of future payments to register using Form PFP Registration of Purchasers of Future Payments. This form helps protect individuals from unscrupulous buyers and ensures fair transactions.

Whether you are involved in a legal case or seeking financial stability, understanding structured settlements and the associated documentation is crucial. It is important to consult with legal and financial professionals to navigate the complexities of structured settlements and ensure your rights and interests are protected.

Documents:

17

This document is used for arranging a compromise order related to a structured settlement in Bronx County, New York.

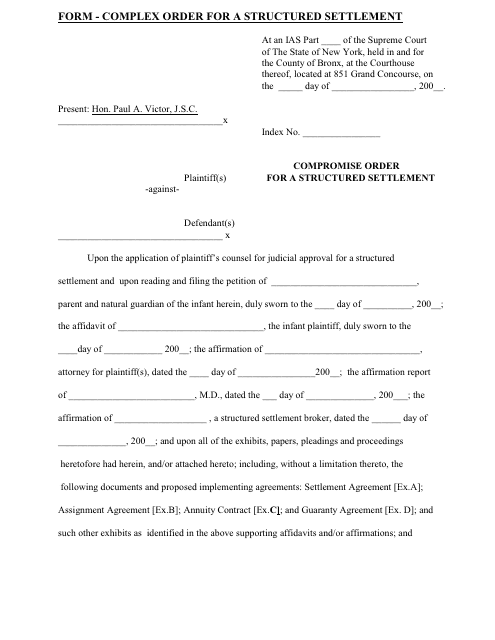

This document is used for making a complex order for a structured settlement in New York. It outlines the specific terms and conditions of the settlement, including how the payments will be structured and distributed.

This form is used for reporting income and expenses related to structured settlements in Washington. It is available in Vietnamese.

This type of document is used for reporting income and expenses related to a structured settlement in the state of Washington. It is available in Farsi language.

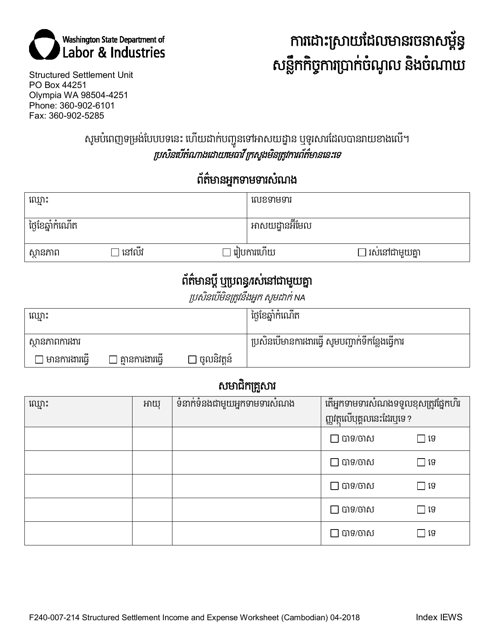

This form is used for calculating and reporting the income and expenses associated with a structured settlement in the state of Washington. It is available in Cambodian language.

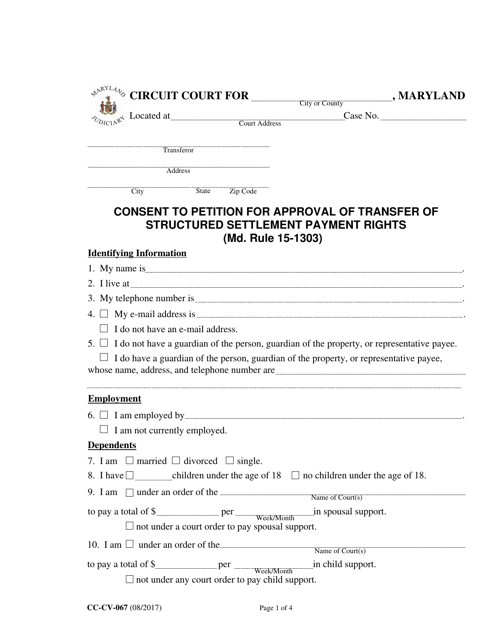

This form is used for consenting to petition for approval of transfer of structured settlement payment rights in the state of Maryland, in accordance with Maryland Rule 15-1303.

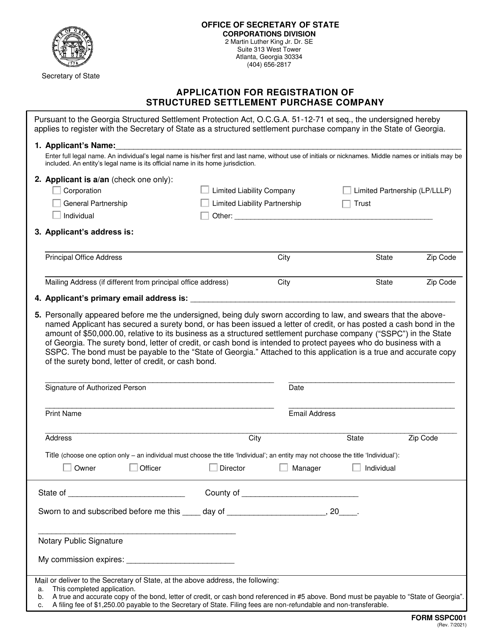

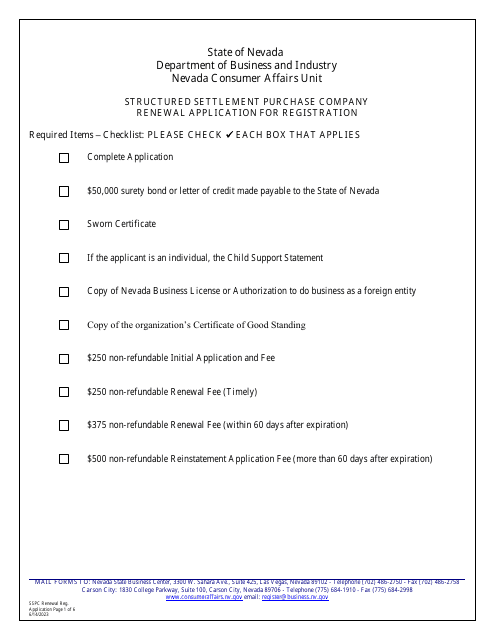

This form is used for applying to register a structured settlement purchase company in Georgia, United States.

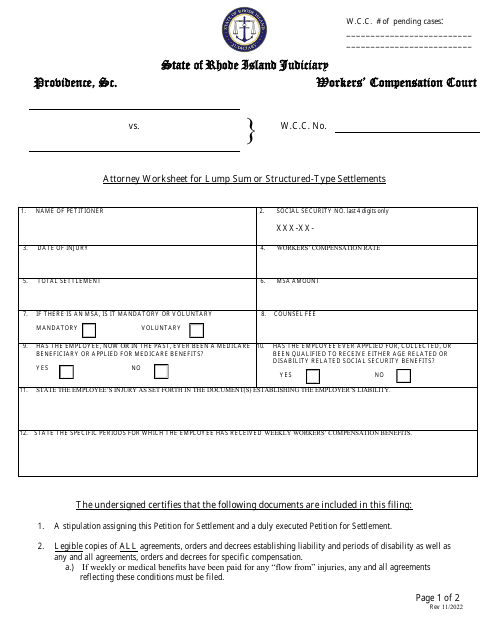

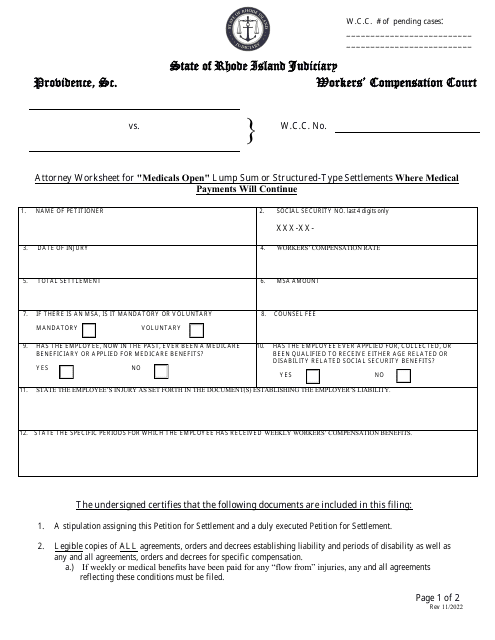

This document is an Attorney Worksheet for "medicals Open" Lump Sum or Structured-type Settlement Where Medical Payments Will Continue in Rhode Island. This type of document helps attorneys organize the details of a settlement where ongoing medical payments are required.

This form is used for registering purchasers of future payments in the state of West Virginia. It is required for individuals or companies who buy structured settlement or annuity payments from others.

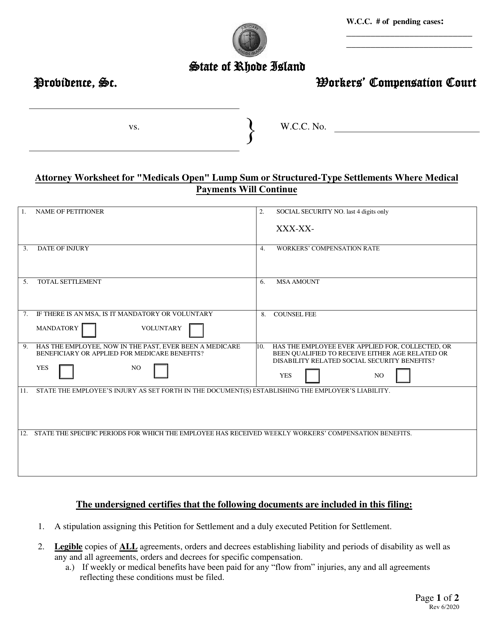

This type of document is an attorney worksheet used for "medicals open" lump sum or structured-type settlements in Rhode Island where medical payments will continue. It helps attorneys calculate the financial aspects of such settlements.