Tax Status Templates

Tax Status: Ensuring Compliance and Peace of Mind

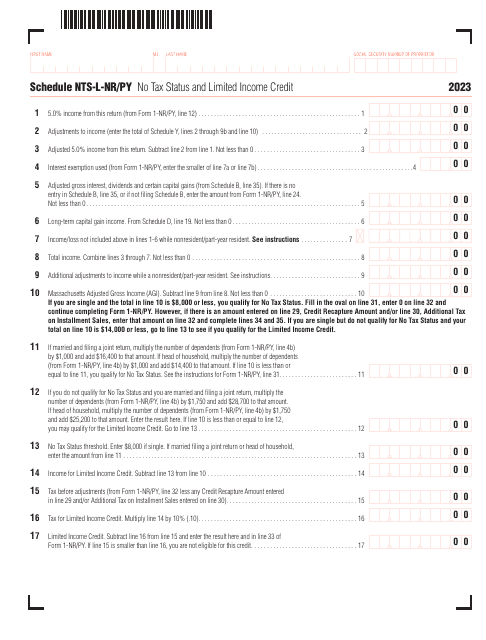

Maintaining the correct tax status is crucial for individuals and businesses alike. Whether you're a resident of Alaska, Montana, New York City, Utah, or Washington, understanding and fulfilling your tax obligations is essential. At our Tax Status hub, we provide a comprehensive range of resources to help you navigate the intricate world of tax compliance.

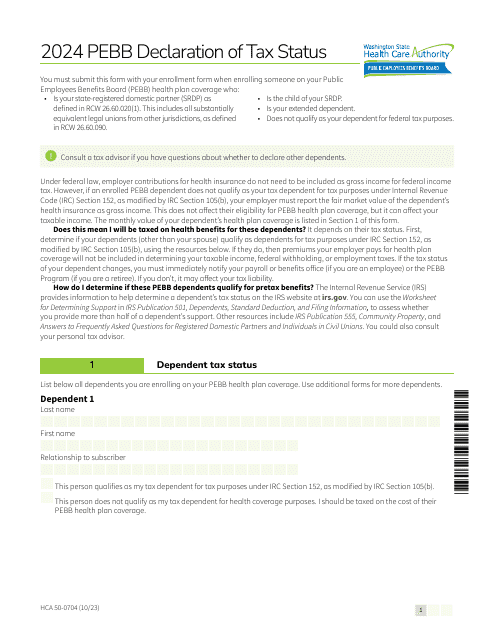

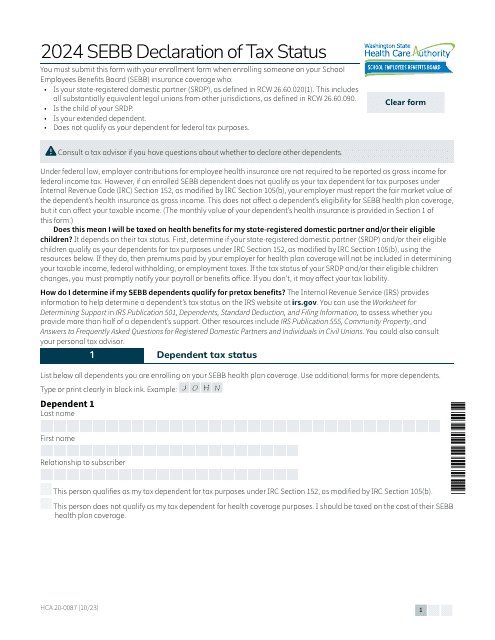

Explore our collection of forms, including the widely utilized Form BEN069 Declaration of Tax Status for Alaska Care, and the Form MT21 Declaration of Tax Status of Same-Sex Domestic Partner as a Dependent for residents of Montana. These documents offer individuals the means to accurately declare their tax status and ensure that they receive the benefits they're entitled to.

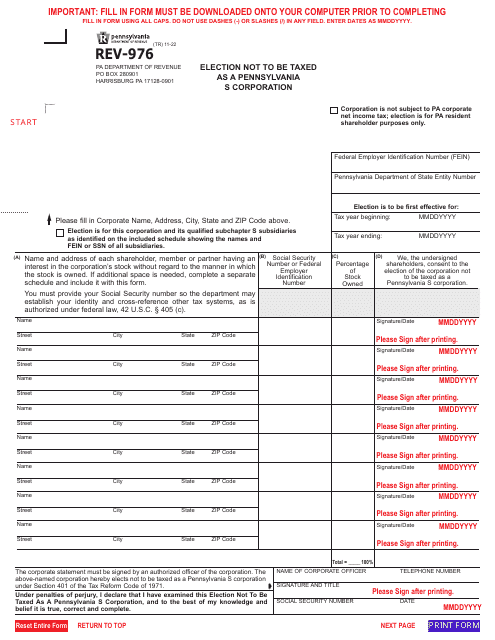

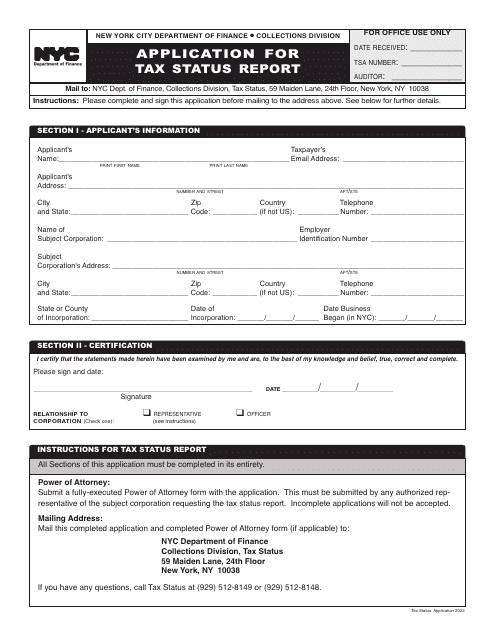

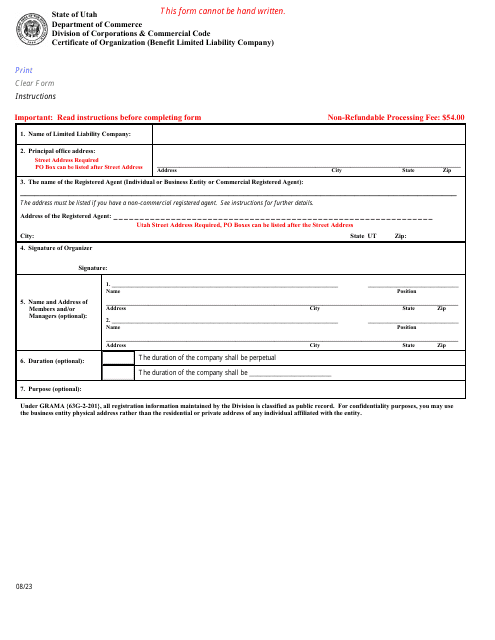

For businesses, we offer resources such as the Certificate of Organization (Benefit Limited Liability Company) specific to Utah, which establishes your tax status as a Benefit Limited Liability Company. No matter where you're located, our Application for Tax Status Report, available to New York City residents, will provide you with the necessary information to assess your tax standing.

Stay informed and compliant with our comprehensive tax status resources, conveniently available in one place. Whether you're an individual or a business, our goal is to simplify the tax process and provide you with the peace of mind that comes from knowing you're fulfilling your tax obligations accurately and efficiently.

Discover the many benefits of maintaining the correct tax status and access the forms and information you need to stay compliant. Trust our Tax Status hub to guide you through the intricate world of taxation, ensuring that you're maximizing your financial opportunities and minimizing potential risks.

Documents:

16

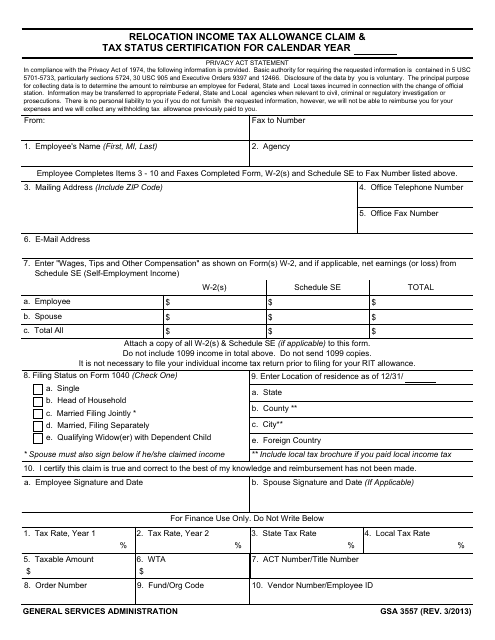

This Form is used for claiming relocation income tax allowance and certifying tax status during a relocation. It helps individuals calculate and claim tax deductions related to their relocation expenses.

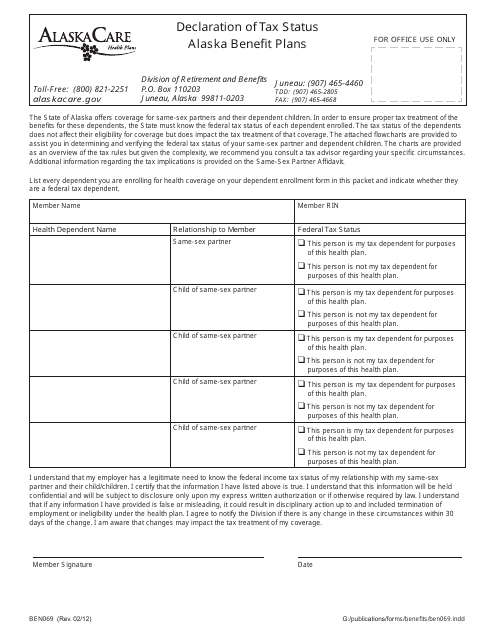

This Form is used for declaring your tax status for Alaska Care in Alaska.

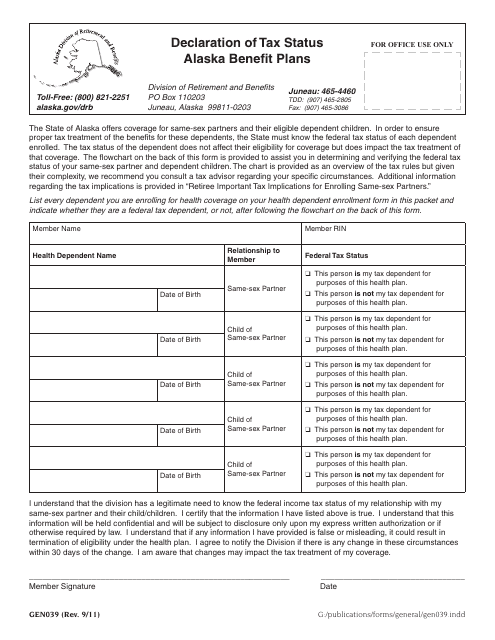

This form is used for declaring tax status for Alaska Retirement Benefits in Alaska.

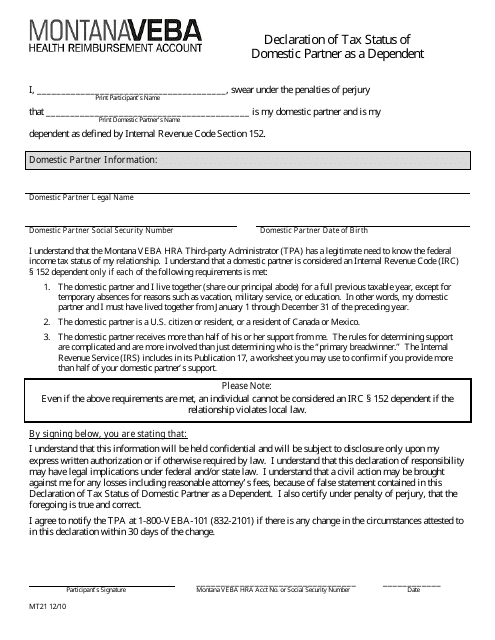

This document is used for declaring the tax status of a same-sex domestic partner as a dependent in the state of Montana.

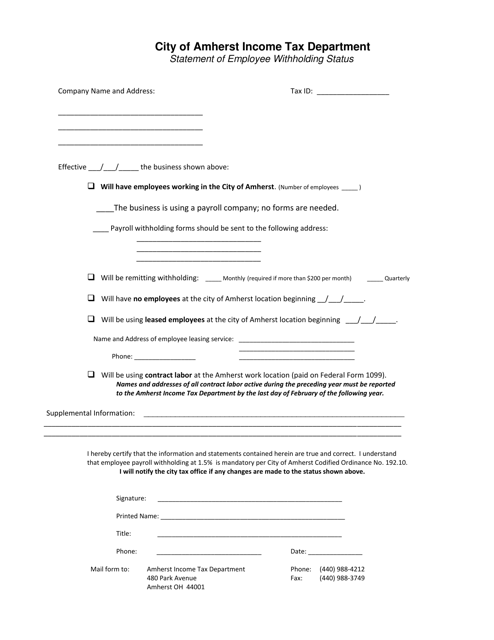

This document is for employees in the City of Amherst, Ohio to declare their withholding status for tax purposes.