Tax Objection Templates

Are you facing issues with your tax assessment and believe that it is incorrect or unfair? Our tax objection service can help you challenge the determination and seek a fair resolution. Whether you are an individual taxpayer or a business owner, we understand that dealing with tax matters can be complex and overwhelming.

Our tax objection service provides you with the necessary resources and guidance to file an objection and present your case effectively. We offer a comprehensive range of forms and notices of objection tailored to different tax jurisdictions, including Nebraska, Canada, and others.

Our experienced team is well-versed in tax laws and regulations, ensuring that your objection is prepared accurately and in compliance with the relevant requirements. We will assist you in gathering the necessary documentation, analyzing your tax assessment, and preparing a strong case to support your objection.

By utilizing our tax objection service, you can have peace of mind knowing that your interests are being protected. Our goal is to help you navigate the objection process efficiently and effectively, maximizing your chances of a successful outcome.

Don't let an inaccurate or unfair tax assessment burden you financially. Take action and file a tax objection to protect your rights. Contact us today to learn more about our tax objection service and how we can assist you in challenging your tax assessment.

Documents:

13

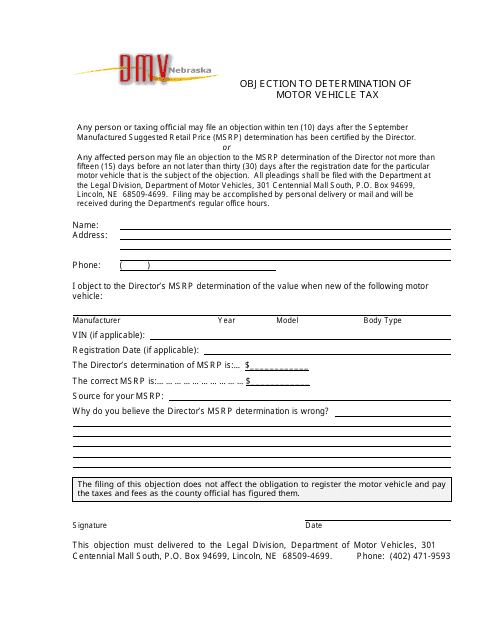

This document is used to object to the determination of motor vehicle tax in the state of Nebraska. It allows individuals to challenge the calculation or assessment of their tax liability for their motor vehicle.

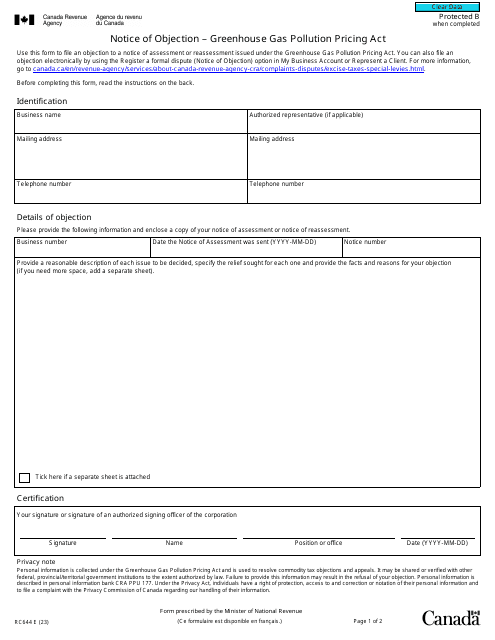

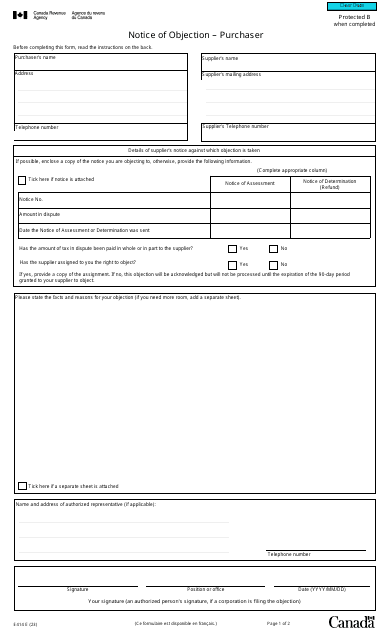

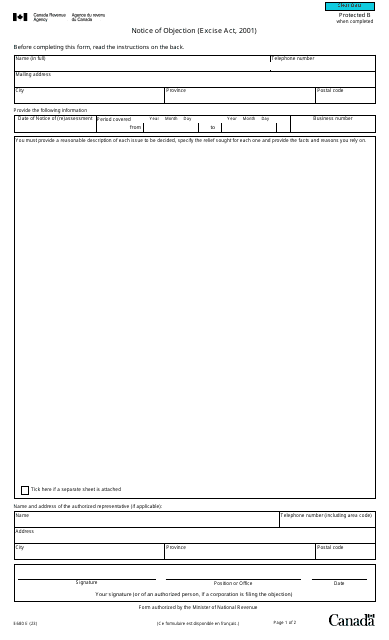

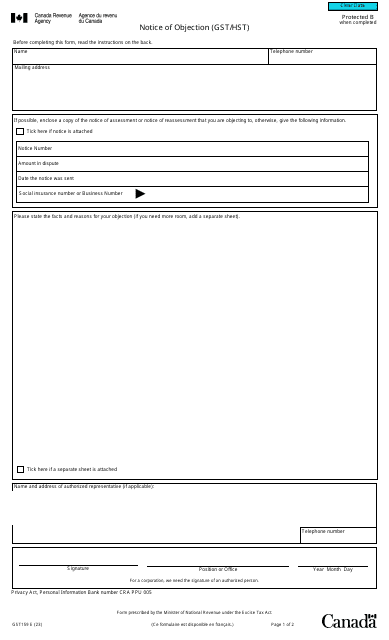

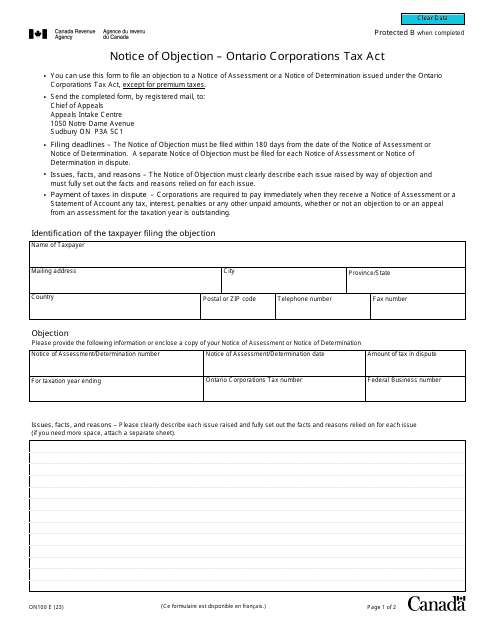

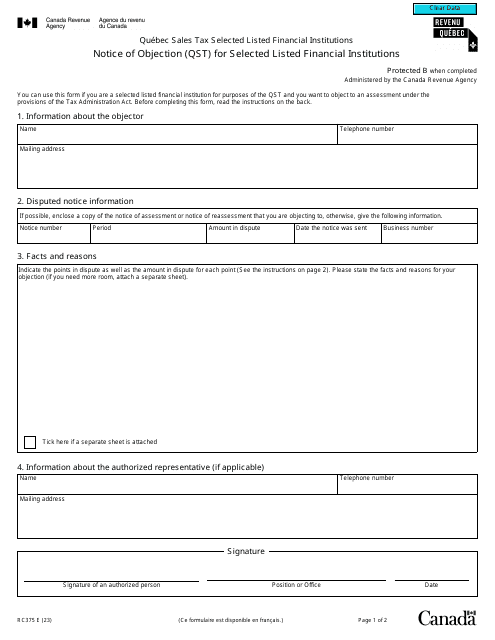

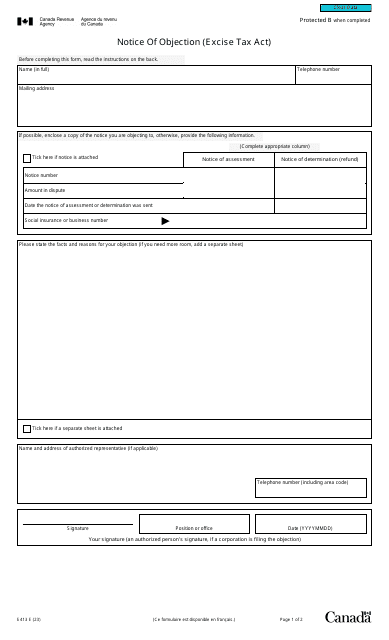

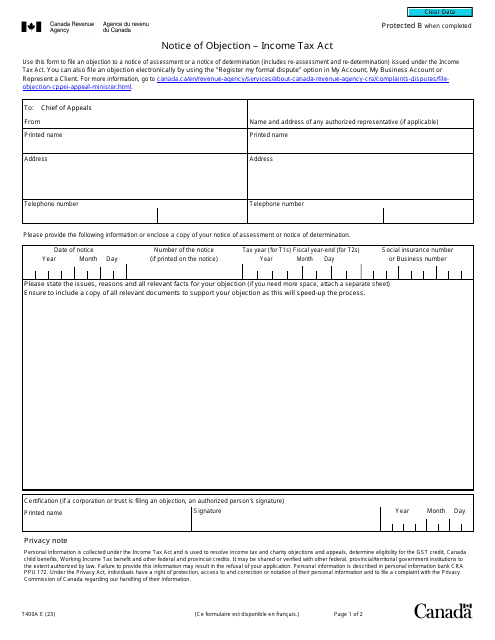

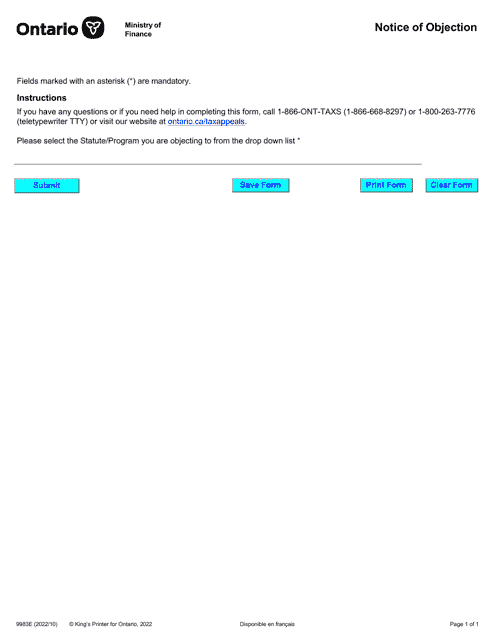

This Form is used for filing a Notice of Objection in Ontario, Canada. It allows individuals to formally dispute a decision made by the Canada Revenue Agency (CRA) regarding their taxes or benefits.