Sales Tax Deduction Templates

Are you looking for information on how to claim a sales tax deduction? Our webpage has all the details you need to understand and benefit from the sales tax deduction. Whether you are a business owner, a retailer, or a consumer, this deduction can help you save money on your taxes.

Also known as the sales tax deduction, this group of documents provides you with the necessary forms and information to accurately calculate and claim your sales tax deduction. The alternate names for this collection indicate its relevance in different states, as each state has its own specific forms and regulations.

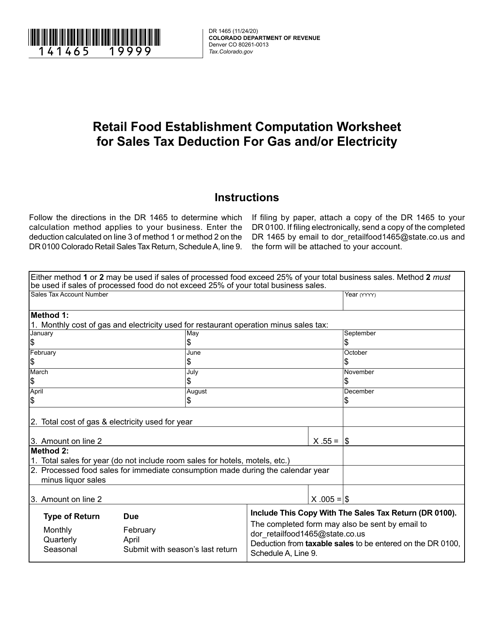

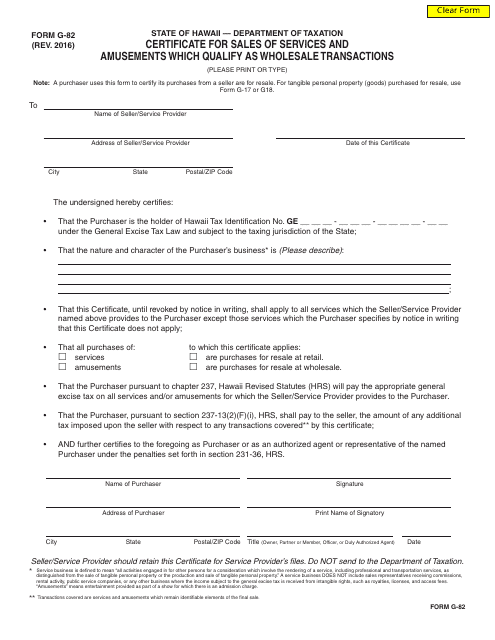

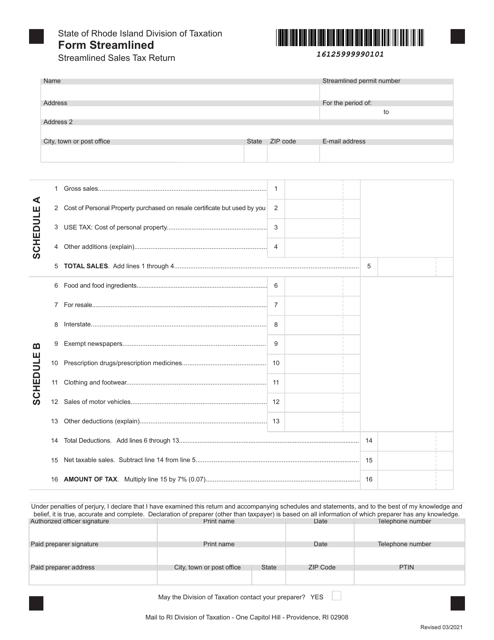

By navigating through our webpage, you will find resources such as the Form DR1465 Retail Food Established Computation Worksheet for Sales Tax Deduction for Gas and/or Electricity in Colorado, the Form G-82 Certificate for Sales of Goods, Services, and Amusements Which Qualify for the Phased-In Wholesale Deduction in Hawaii, and the Streamlined Sales Tax Return in Rhode Island.

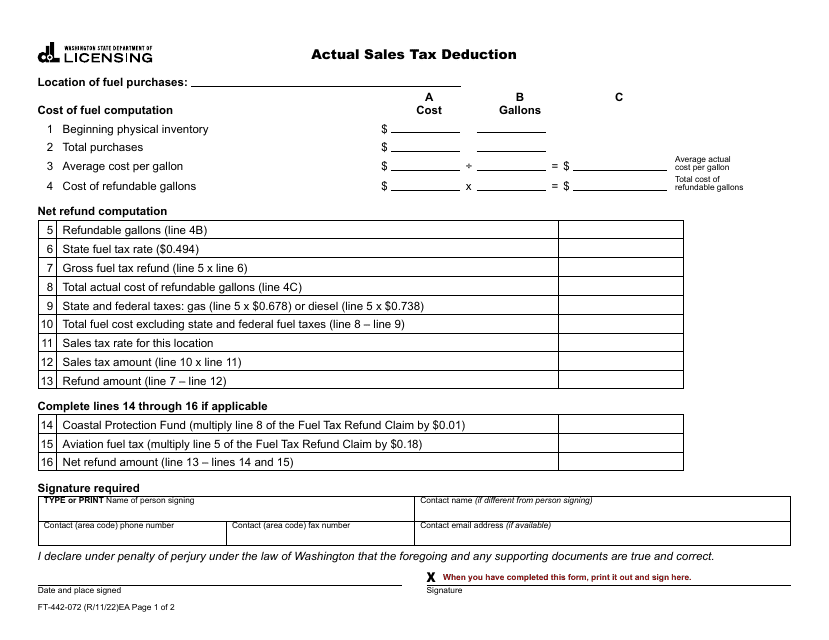

We also have the Form FT-442-072 Actual Sales Tax Deduction in Washington, which provides guidance on how to accurately calculate your sales tax deduction if you are a Washington resident.

Take advantage of the sales tax deduction by using the resources and information provided on our webpage. By accurately claiming this deduction, you can reduce your tax liability and keep more money in your pocket. Start exploring our webpage today to learn more about the sales tax deduction and how it can benefit you.

Documents:

5

This Form is used for certifying sales of goods, services, and amusements that qualify for the phased-in wholesale deduction in Hawaii.

This document is for filing the Streamlined Sales Tax return in the state of Rhode Island. It is used by businesses to report their sales tax collections and remit the taxes owed to the state.

This form is used for claiming actual sales tax deductions in the state of Washington.