Homestead Tax Credit Templates

Are you a homeowner looking to reduce your property taxes? The Homestead Tax Credit, also known as the Homestead Exemption, is a program designed to provide homeowners with a tax break on their primary residence. This tax credit is available in various states, including Iowa and Maryland.

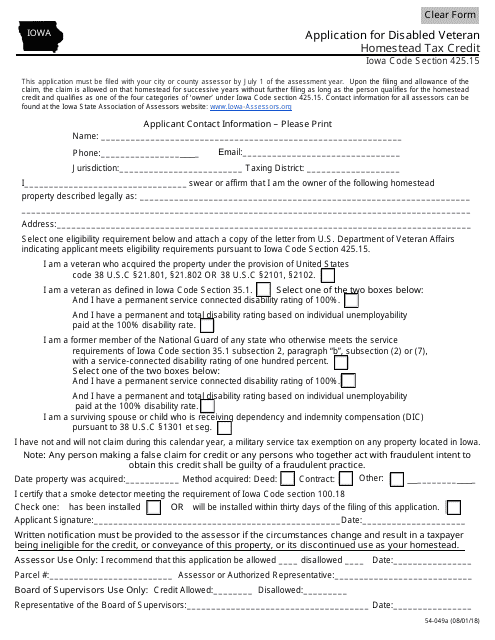

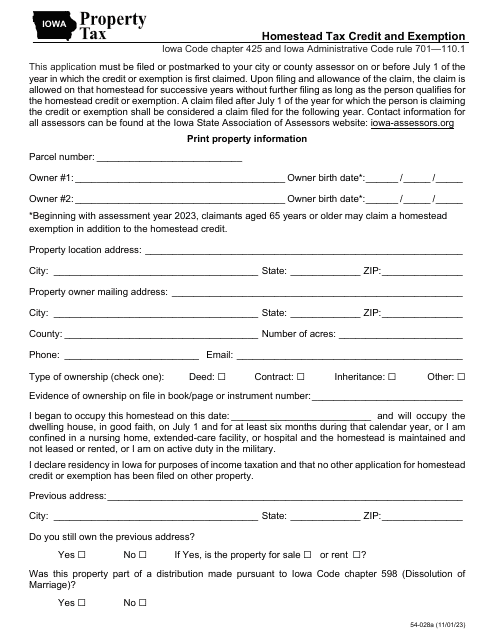

The Homestead Tax Credit offers significant benefits to eligible homeowners. By applying for this credit, you could potentially save hundreds or even thousands of dollars on your property taxes each year. In states like Iowa, you can fill out specific forms such as the Form 54-028 or the Form 54-049A Application for Disabled Veteran Homestead Tax Credit.

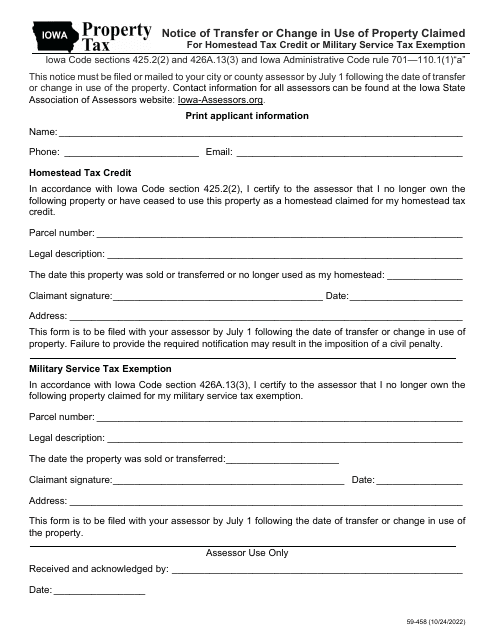

If you are a homeowner planning to sell or change the use of your property, it's important to be aware of your obligations regarding the Homestead Tax Credit. In Iowa, for example, you need to fill out the Form 59-458 Notice of Transfer or Change in Use of Property Claimed for Homestead Tax Credit or Military Service Tax Exemption.

The Homestead Tax Credit is a valuable resource that can help homeowners reduce their financial burdens. By filling out the necessary paperwork, you can take advantage of this program and keep more money in your pocket. Don't miss out on potential tax savings - apply for the Homestead Tax Credit today!

Note: The text provided is a sample and can be modified or expanded to fit the webpage content.

Documents:

7

This form is used for applying for the Disabled Veteran Homestead Tax Credit in Iowa. It is specifically designed for disabled veterans who own a homestead property in Iowa and wish to receive property tax benefits. The form must be completed and submitted to the appropriate local taxing authority.

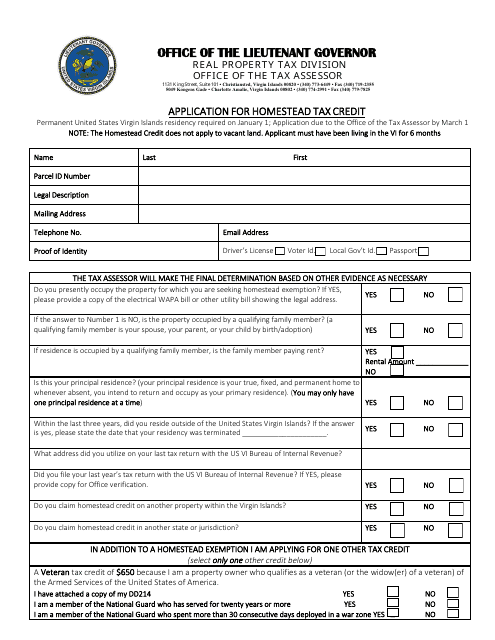

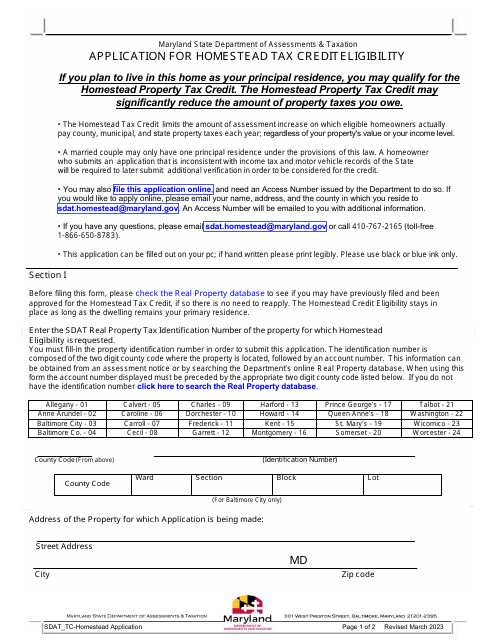

This document is an application for the Homestead Tax Credit eligibility in the state of Maryland. The Homestead Tax Credit is a program that provides property tax relief to eligible homeowners. To apply, you must meet certain criteria, such as owning the property as your primary residence.