Fuel Refund Templates

If you have purchased fuel for a specific purpose and are eligible for a refund, you've come to the right place. Our fuel refund documents collection provides you with the necessary forms to apply for a reimbursement on fuel expenses. Whether you're a motorist, an aviator, or in the forestry industry, we have the forms you need to simplify the refund process.

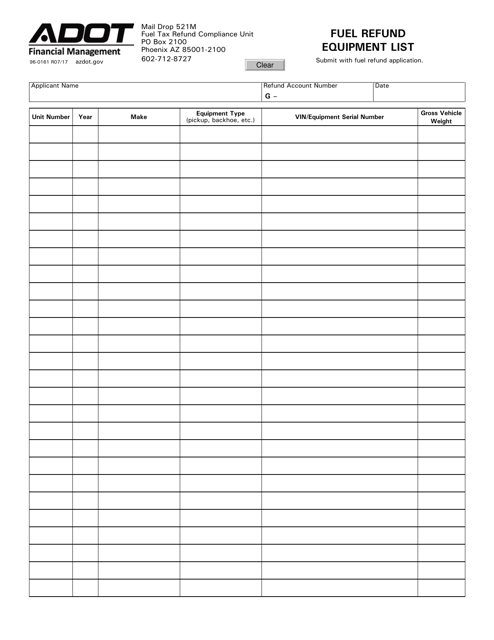

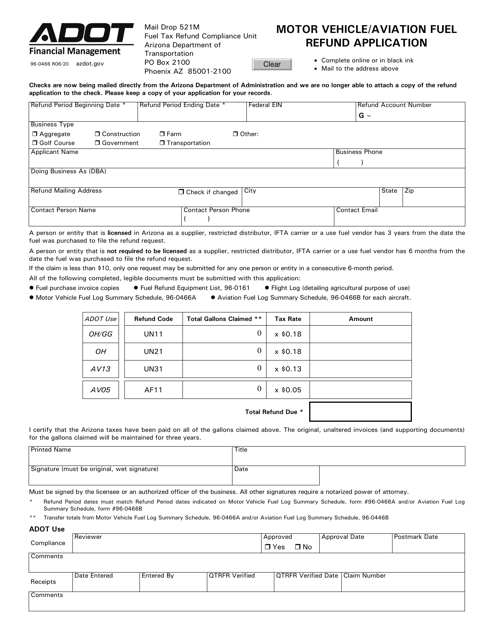

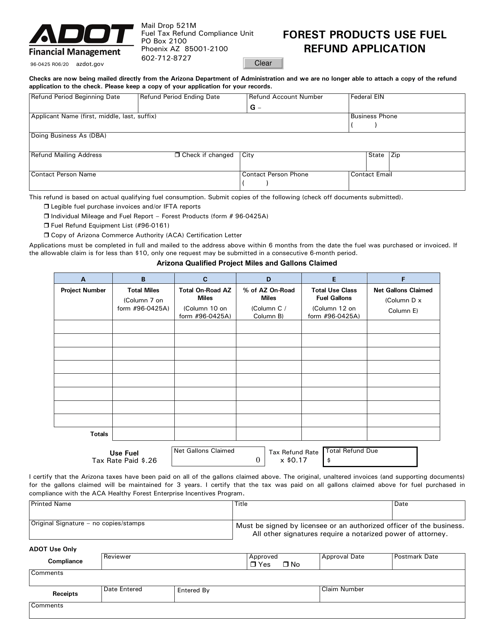

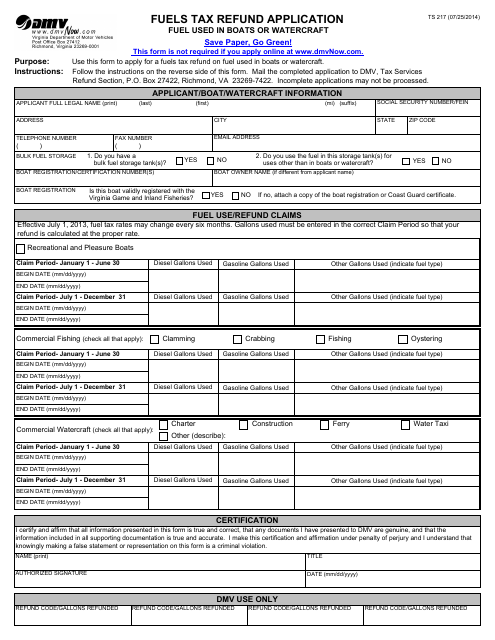

Our collection encompasses a variety of forms from different states, such as the Form L-2133 Motor Fuel Refund Application from South Carolina, the Form 96-0161 Fuel Refund Equipment List from Arizona, and the Form TS217 Fuels Tax Refund Application for Fuel Used in Boats or Watercraft from Virginia. With these forms, you can easily apply for a refund on fuel expenses and potentially reduce your overall costs.

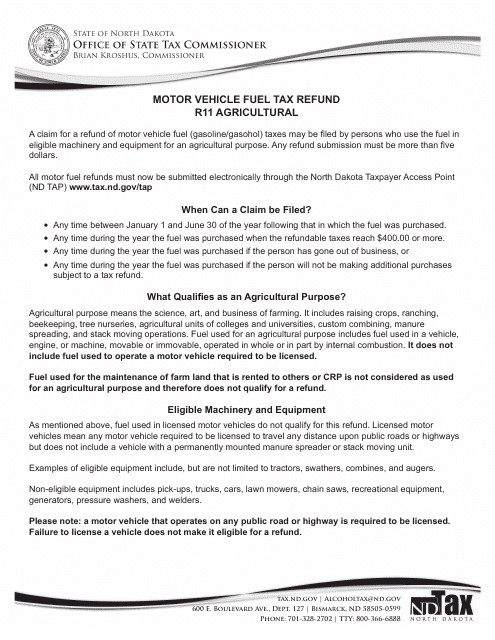

We understand that each state may have different requirements for fuel refund applications, which is why our collection is comprehensive and covers various scenarios. Whether you're seeking a refund for motor vehicle fuel, aviation fuel, or even forest productsuse fuel, our collection has got you covered. No matter the industry or purpose, you can find the appropriate forms to apply for your fuel refund.

Don't waste time searching for individual forms or wondering which documents are necessary for your specific situation. Our fuel refund documents collection takes the guesswork out of the process and presents you with all the necessary materials in one place. Apply for your refund with ease and save money on your fuel expenses today.

Documents:

14

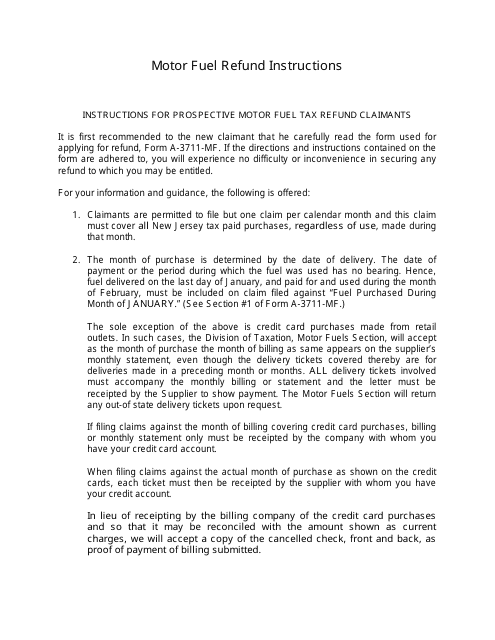

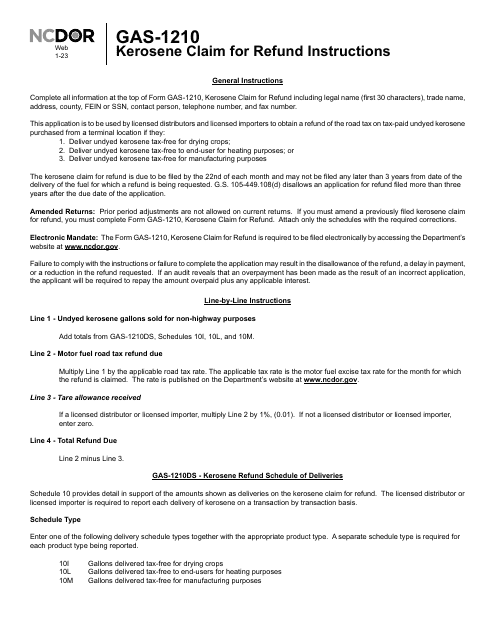

This document provides instructions for obtaining a refund on motor fuel taxes paid in the state of New Jersey. It outlines the process and requirements for eligible individuals or businesses to apply for a refund.

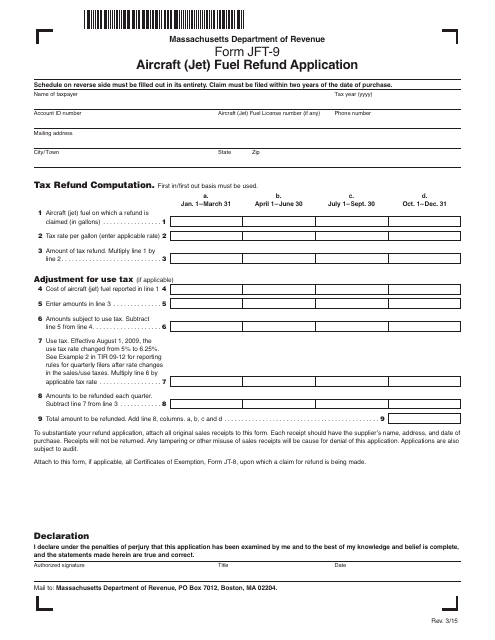

This Form is used for applying for a fuel refund for aircraft (jet) in Massachusetts.

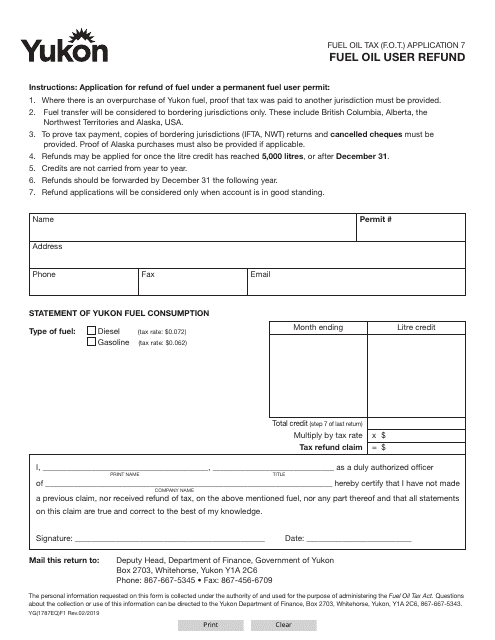

This Form is used for applying for a fuel oil user refund in Yukon, Canada.

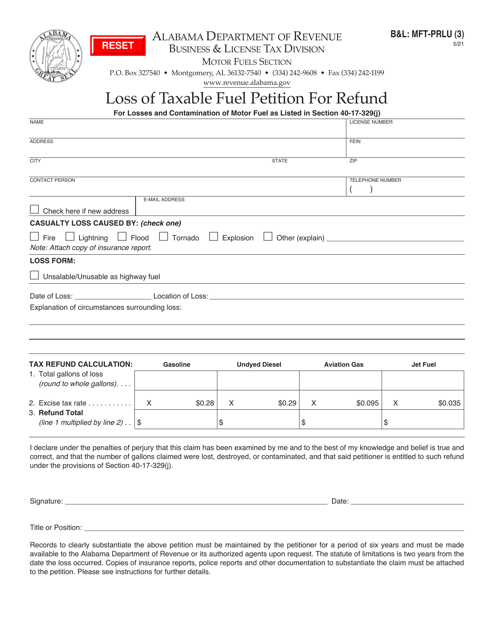

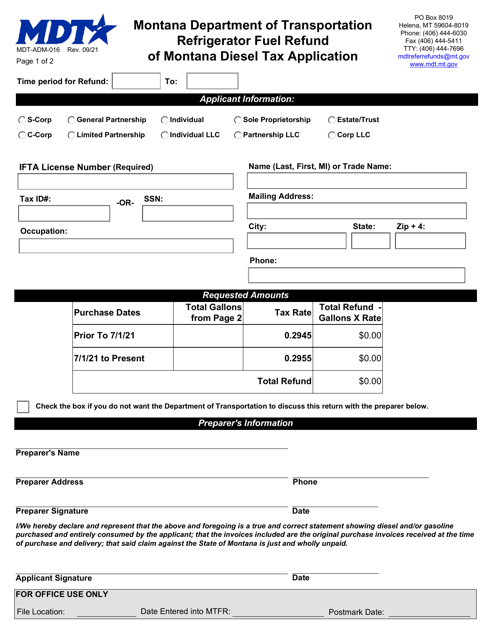

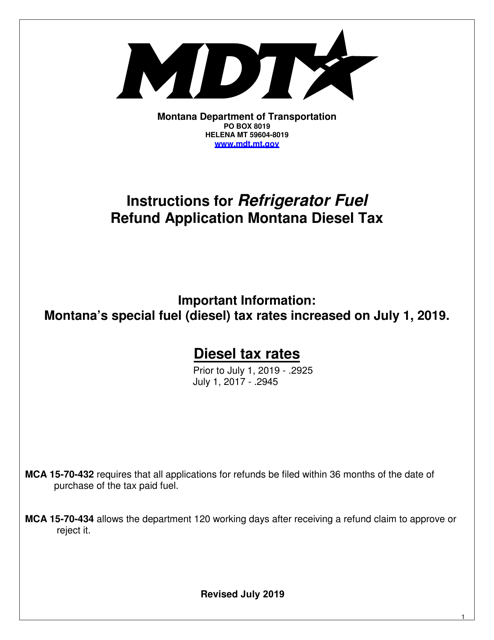

This Form is used for applying for a refund of Montana diesel tax paid on refrigerator fuel in Montana.

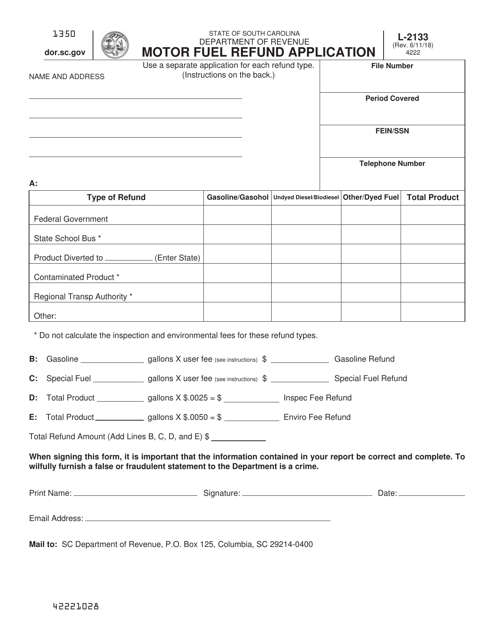

This form is used for applying for a motor fuel refund in the state of South Carolina. It is used by individuals or businesses who are seeking a refund on the taxes they have paid on motor fuel.

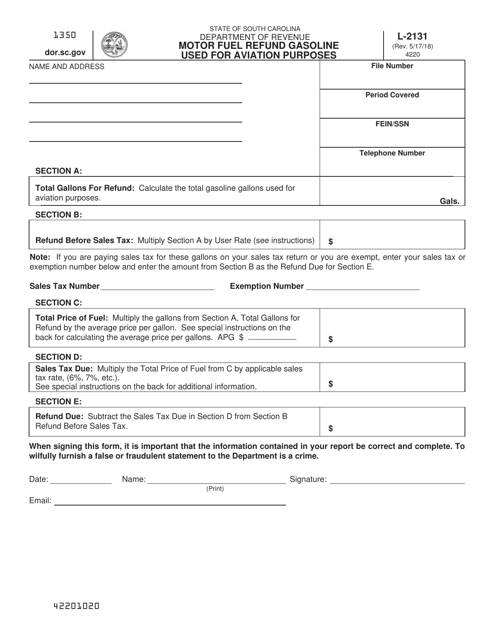

This form is used for claiming a refund for gasoline used for aviation purposes in South Carolina.

This Form is used for providing a list of equipment for a fuel refund in the state of Arizona.

This Form is used for applying for a refund of motor vehicle or aviation fuel tax paid in Arizona.

This Form is used for applying for a refund on fuel used for forest product transportation in Arizona.