Tax Deposit Templates

Are you looking for information on tax deposits or tax deposit requirements? Our webpage provides comprehensive details on tax deposit processes and guidelines, helping businesses and individuals understand and fulfill their tax obligations.

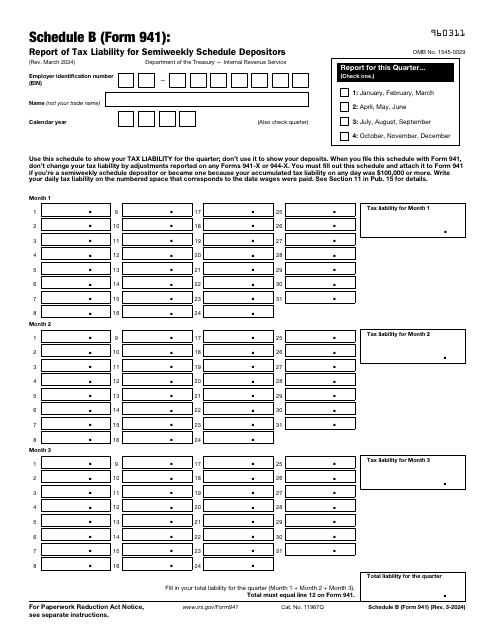

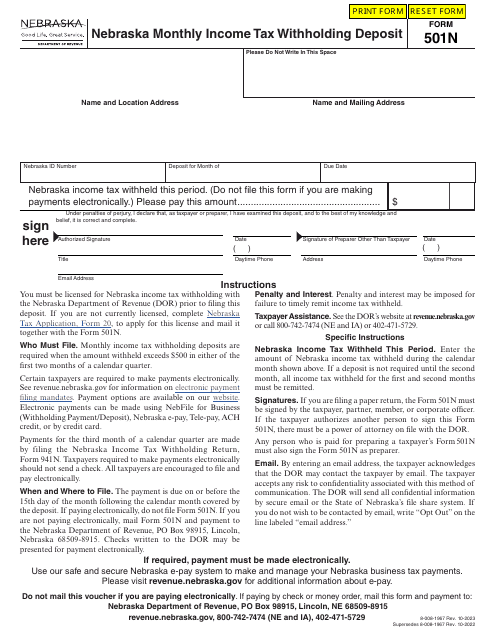

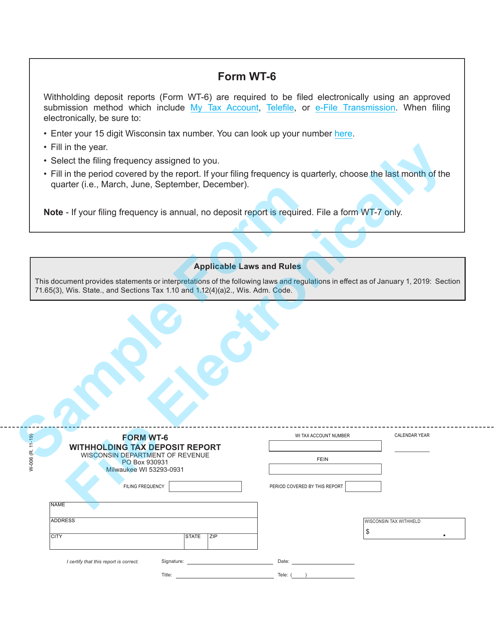

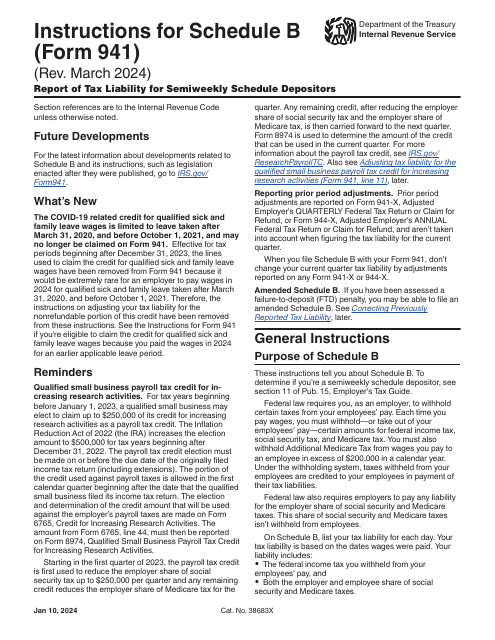

Whether you are required to make tax deposits on a monthly, quarterly, or semiweekly basis, our webpage has all the information and resources you need. We cover various tax deposit forms, such as IRS Form 941 Schedule B and Form 501N Nebraska Monthly IncomeTax Withholding Deposit, along with their corresponding instructions.

Understanding the intricacies of tax deposit requirements can be complex, but our webpage simplifies the process. We explain the purpose of tax deposits, how to calculate the deposit amounts, and the deadlines for submitting deposits. Additionally, we provide helpful tips to ensure compliance and avoid penalties.

Tax deposits serve as a crucial part of maintaining financial responsibility and meeting your tax obligations. Our webpage offers all the necessary details and resources to ensure you have a clear understanding of your tax deposit requirements.

Documents:

9

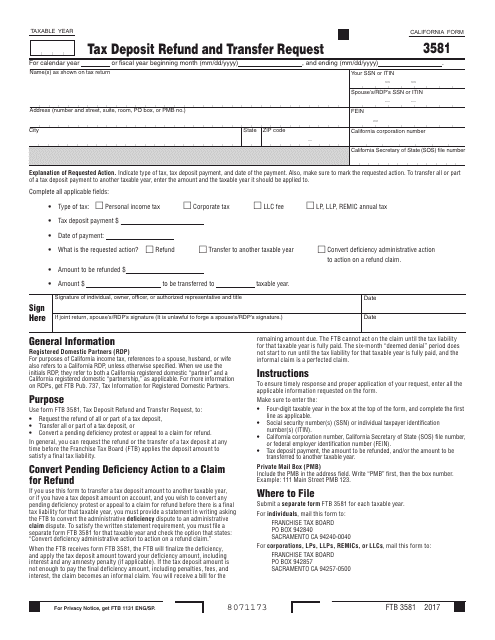

This Form is used for requesting a refund or transferring tax deposits in the state of California.

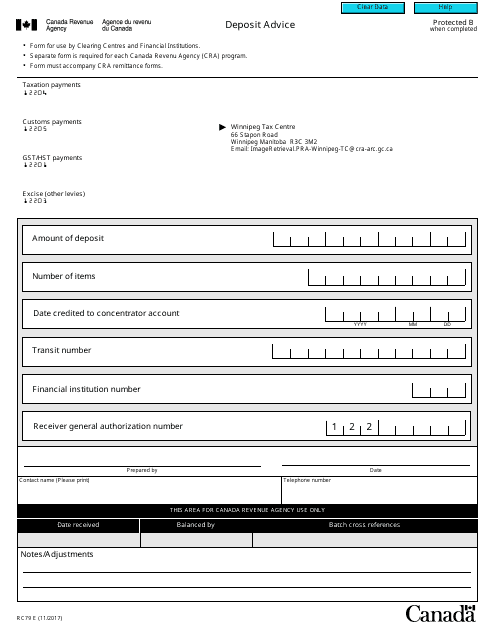

This form is used for providing a deposit advice to individuals or organizations in Canada. It contains information about the deposited amount, the recipient, and other relevant details.

This form is used for reporting withholding tax deposits in the state of Wisconsin.