Meals Tax Templates

Looking for information on meals tax? We've got you covered! Whether you're a business owner looking to comply with the meals tax requirements or a curious individual looking to understand more about it, our comprehensive collection of documents will provide the information you need.

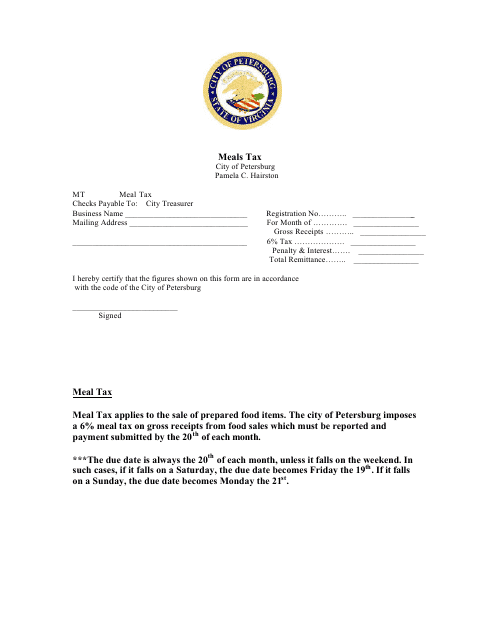

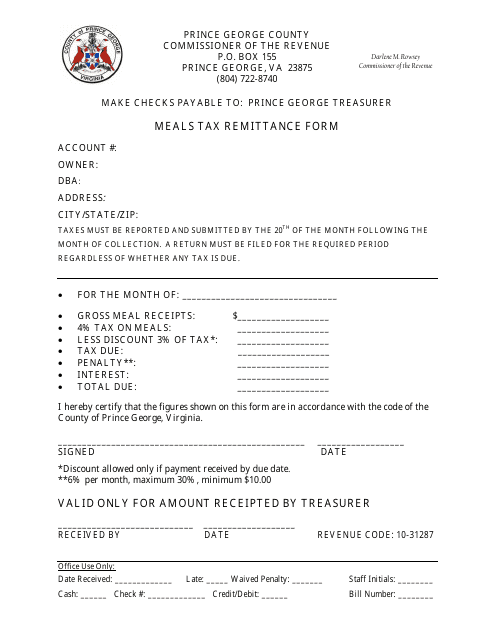

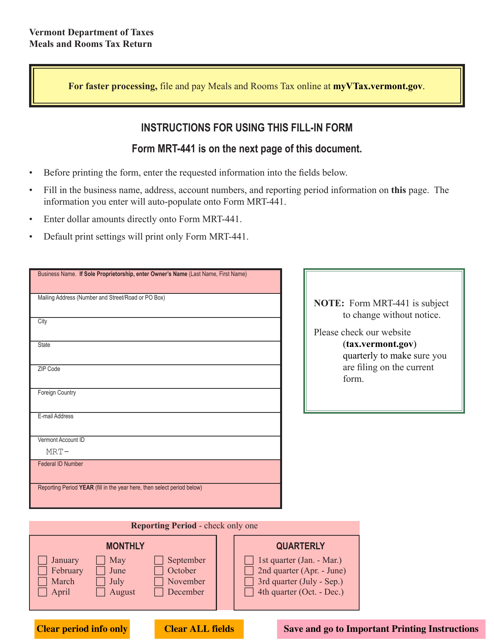

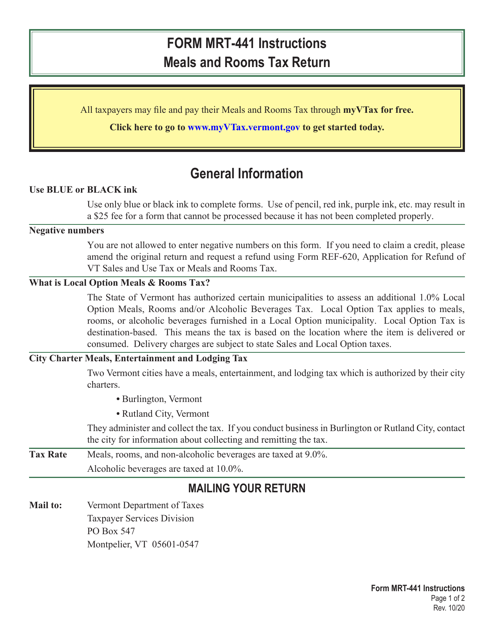

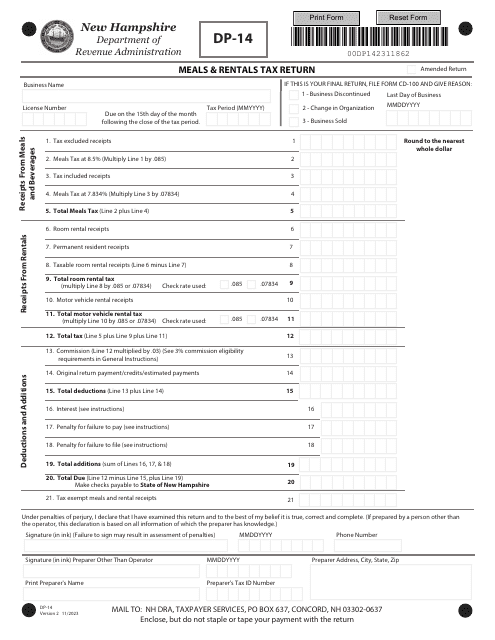

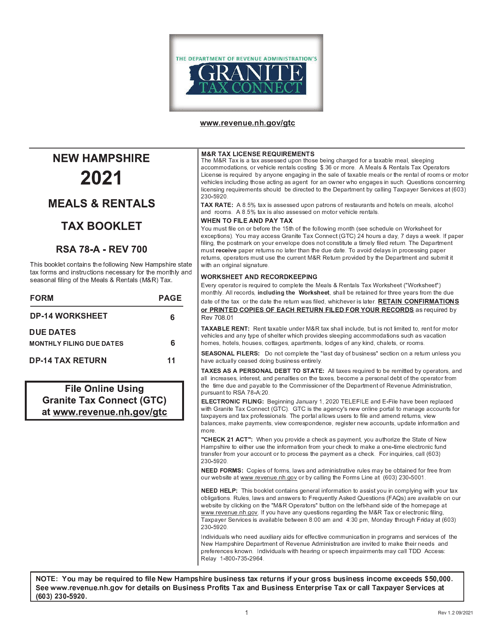

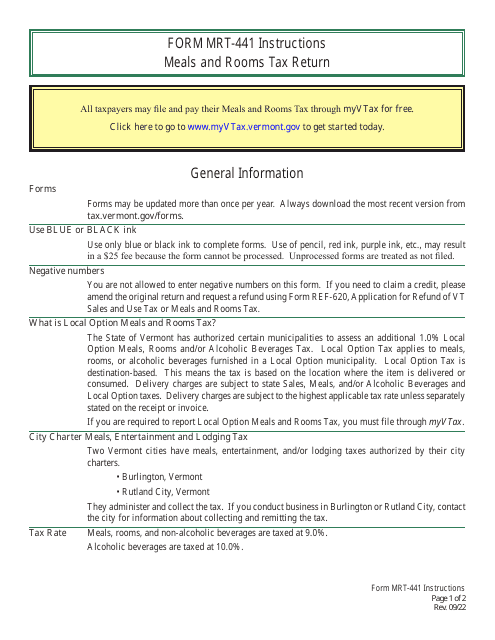

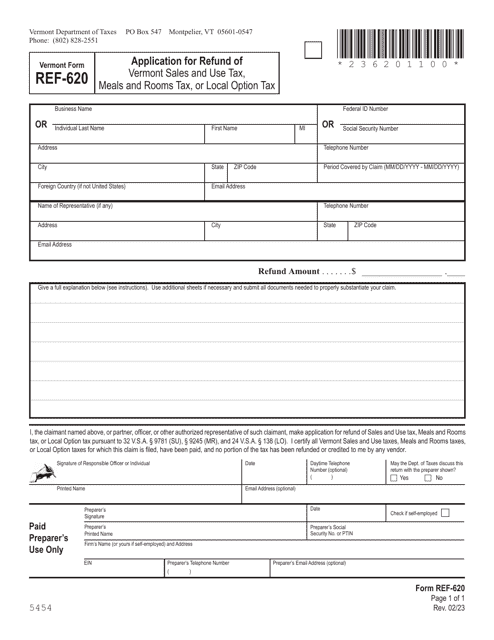

Our collection includes documents such as Meals Tax Forms for different regions like Petersburg, Virginia and Prince George County, Virginia. We also have the VT Form MRT-441 Meals and Rooms Tax Return, along with its accompanying instructions for those operating in Vermont. For individuals or businesses in New Hampshire, we have the handy Form RSA-78A Meals & Rentals Tax Booklet.

The meals tax, also known as the meals and rooms tax, is an important source of revenue for municipalities. These taxes are typically imposed on food and beverages served in restaurants, hotels, and other food establishments. Understanding and complying with meals tax requirements is crucial for businesses in the hospitality industry. Our documents will guide you through the process, making it easier for you to fulfill your legal obligations.

With our extensive collection of meals tax documents, accessing the information you need is both quick and convenient. Stay informed and compliant with our carefully curated resources on meals tax. Browse through our collection today to find the relevant documents for your region.

Documents:

10

This form is used for reporting and paying the meals tax in Petersburg, Virginia. Businesses in the city that sell prepared meals are required to complete and submit this form to the local tax authority.

This form is used for remitting the meals tax in Prince George County, Virginia.

This document provides information about the Meals & Rentals Tax in New Hampshire. It includes instructions on how to calculate and report the tax as well as guidance on exemptions and filing requirements.

This Form is used for reporting and submitting meals and rooms taxes owed by businesses in Vermont. It provides instructions on how to fill out the form and calculate the amount owed.

This form is used for applying for a refund of sales and use tax, meals and rooms tax, or local option tax in Vermont.