State Tax Exemption Templates

Are you a charitable organization or homeowner's association that is looking to obtain a state tax exemption? Look no further! Our state tax exemption documents collection, also known as state tax exemption or state tax exemption forms, is the perfect resource for you.

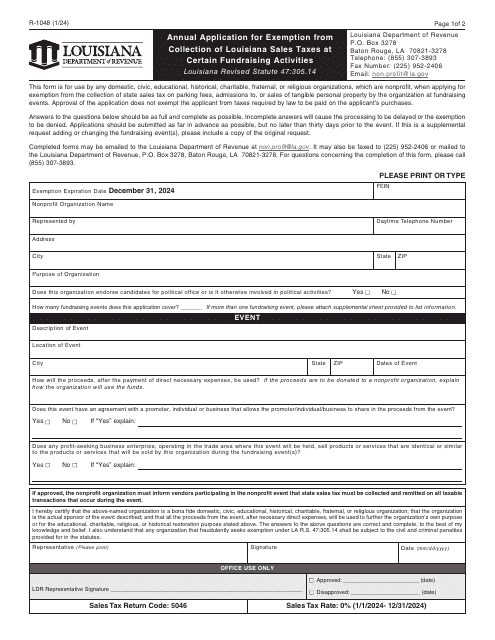

With our collection of forms and applications from various states such as Mississippi, Louisiana, Michigan, and Texas, you can easily apply for exemptions from state sales tax or property tax, depending on your specific situation. Whether you are a charitable organization, credit union, or a member of a federally recognized Indian tribe, our documents will guide you through the exemption process.

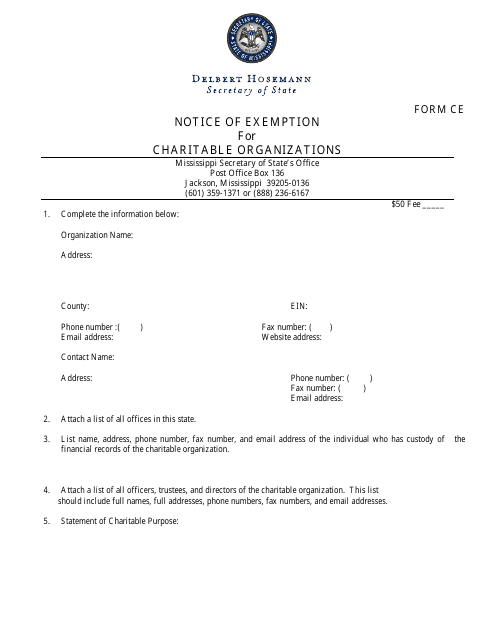

By utilizing our state tax exemption documents, you can navigate the complex state tax laws with ease. These forms are designed to help you save money by exempting you or your organization from paying certain state taxes. For instance, if you are a charitable organization, the Form CE Notice of Exemption for Charitable Organizations in Mississippi will inform the state that you qualify for a tax exemption.

Our state tax exemption documents collection is an invaluable resource for anyone seeking to reduce their tax burden. Don't miss out on the opportunity to save money and streamline your tax filing process. Explore our collection now and take advantage of the various forms available to you.

Note: The given examples of specific documents in the group are not an exhaustive list. Please refer to the collection for a complete list of available forms and applications.

Documents:

5

This form is used for charitable organizations in Mississippi to apply for an exemption from certain taxes.

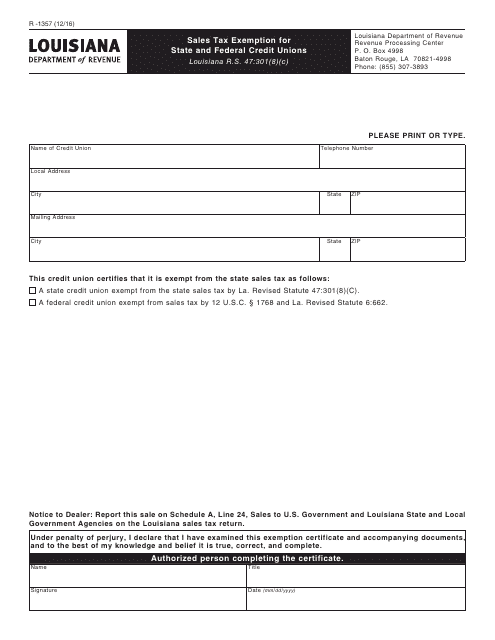

This form is used for state and federal credit unions in Louisiana to claim an exemption from sales tax.

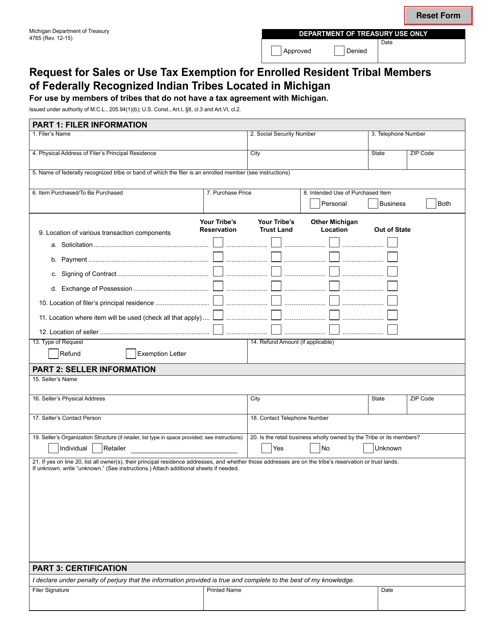

This form is used for requesting sales or use tax exemption for enrolled resident tribal members of federally recognized Indian tribes located in Michigan.

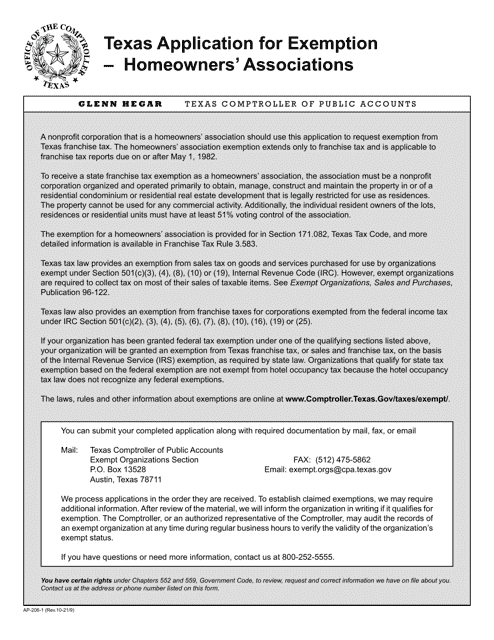

This form is used for homeowners' associations in Texas to apply for a state tax exemption.