Employers Withholding Templates

Employers Withholding (also known as employer withholding or employers withholding form) is a crucial aspect of the tax system that every employer must understand and comply with. This group of documents aims to provide employers with the necessary information and forms to properly withhold taxes from their employees' wages.

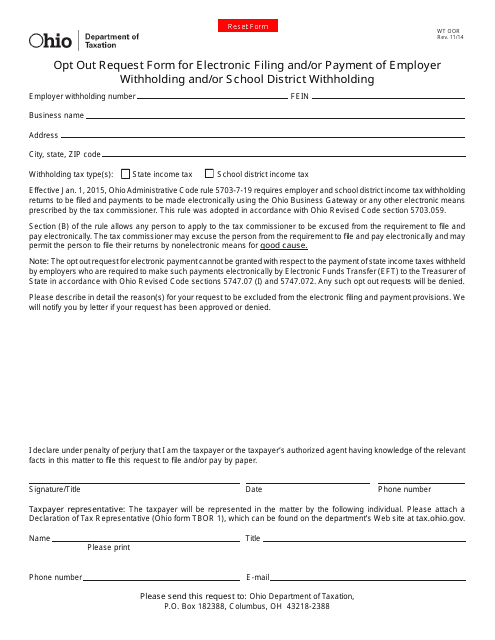

One important document in this collection is the Form WT OOR Opt out Request Form for Electronic Filing and/or Payment of Employer Withholding and/or School District Withholding in Ohio. This form allows employers to request an opt-out from electronically filing and/or paying their withholding taxes, providing an alternate method for compliance.

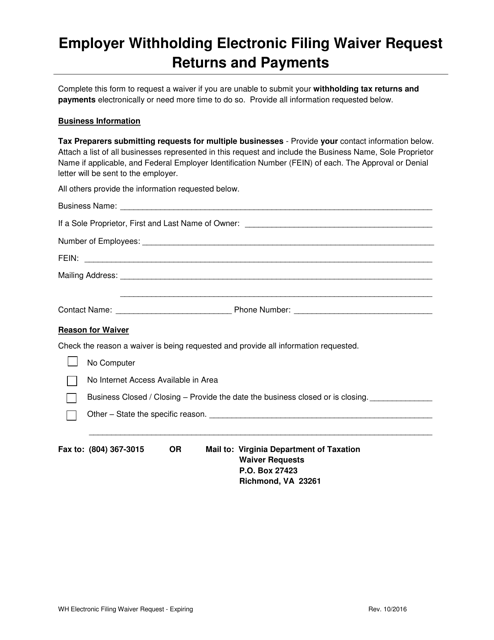

Virginia employers, on the other hand, can utilize the Employer Withholding Electronic Filing Waiver Request - Returns and Payments form. This document enables employers to request a waiver for electronic filing and payment of withholding taxes, offering a convenient solution for those who may not have access to electronic resources.

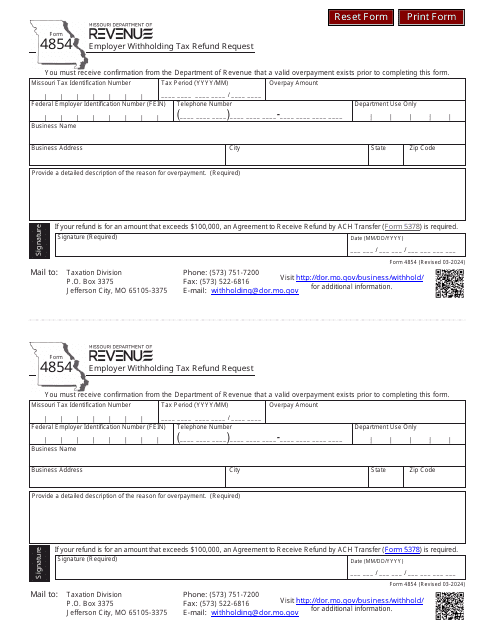

In Missouri, employers have access to Form 4854 Employer Withholding Tax Refund Request, which allows them to request a refund of excess withholding taxes. This document ensures that employers are able to reclaim any overpaid taxes and maintain accurate financial records.

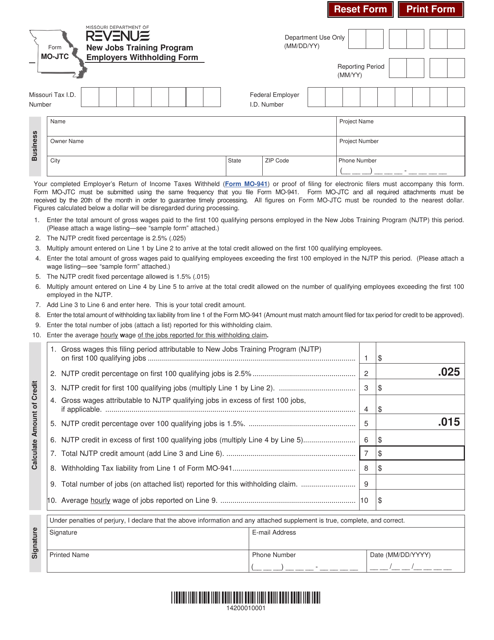

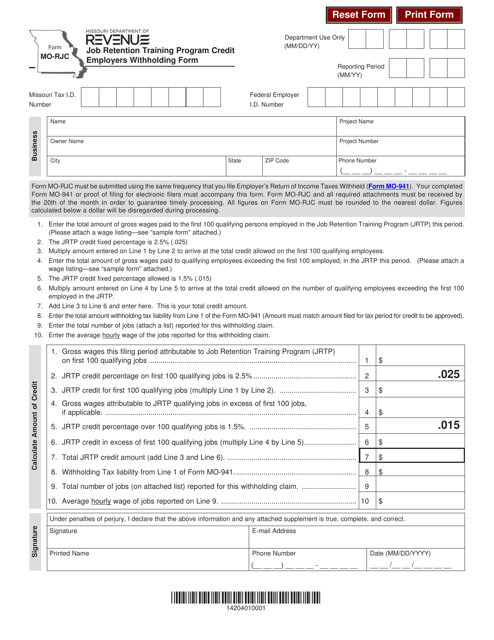

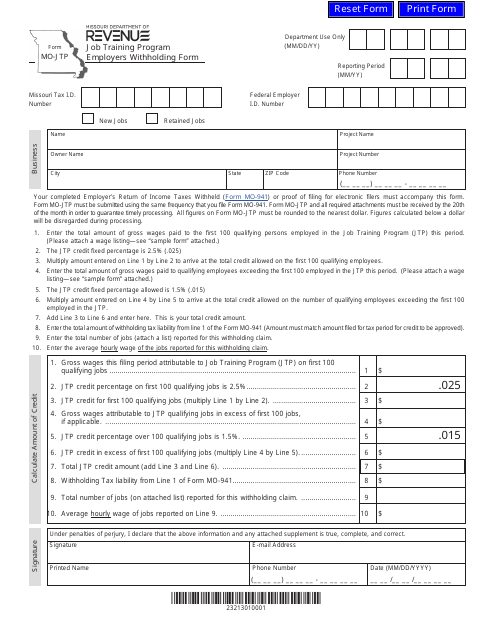

Furthermore, Missouri employers can also make use of the Form MO-JTC Employers Withholding Form for the New Jobs Training Program and the Form MO-JTP Job Training Program Employers Withholding Form. These forms are specifically designed for employers participating in job training programs, streamlining the withholding process and ensuring compliance with program requirements.

Employers Withholding is a critical component of a responsible and compliant tax system. These documents serve as useful resources for employers to understand their obligations, request waivers or refunds as necessary, and maintain proper records. By staying up to date with employer withholding requirements, businesses can avoid penalties and maintain a harmonious relationship with tax authorities.

Documents:

11

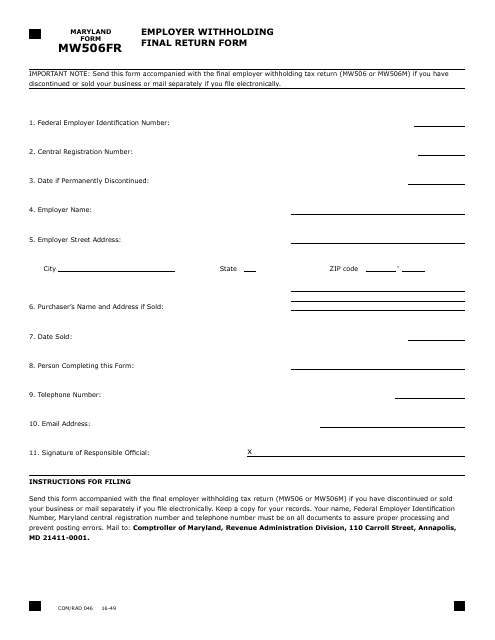

This form is used for filing the final employer withholding return for businesses in the state of Maryland. It is specifically for employers to report and remit any final withholdings from employee wages.

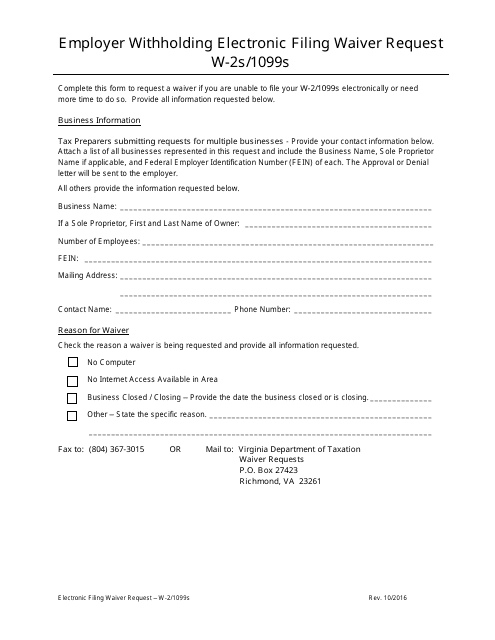

This form is used for employers in Virginia to request a waiver from electronic filing requirements for Form W-2S or 1099S.

This form is used for requesting to opt out of electronic filing and/or payment of employer withholding and/or school district withholding in Ohio.

This form is used for requesting a waiver for electronic filing of employer withholding returns and payments in the state of Virginia.

This Form is used for employers in Missouri to report withholding taxes for the New Jobs Training Program.

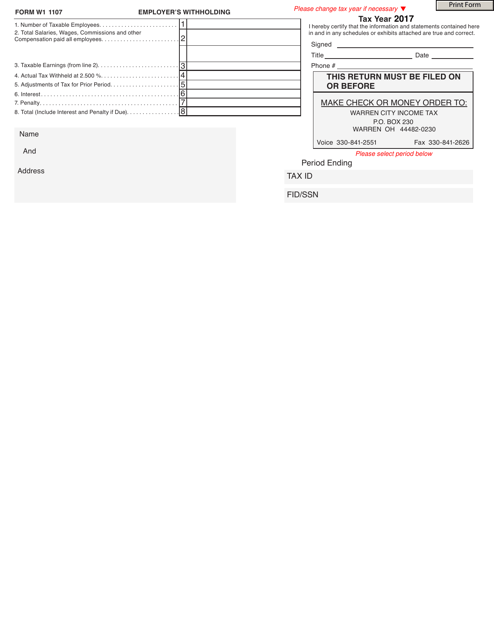

This form is used for employers in the City of Warren, Ohio to report and remit withholding taxes from their employees' wages.

This Form is used for employers in Missouri to claim a tax credit for participating in the Job Retention Training Program.

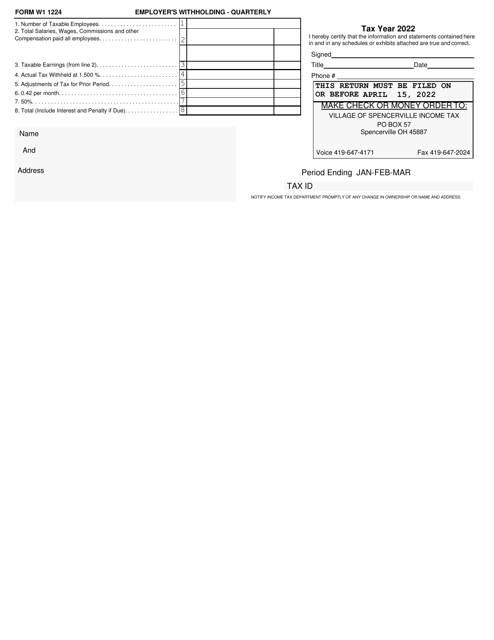

This form is used by employers in the Village of Spencerville, Ohio to report their quarterly withholding taxes.

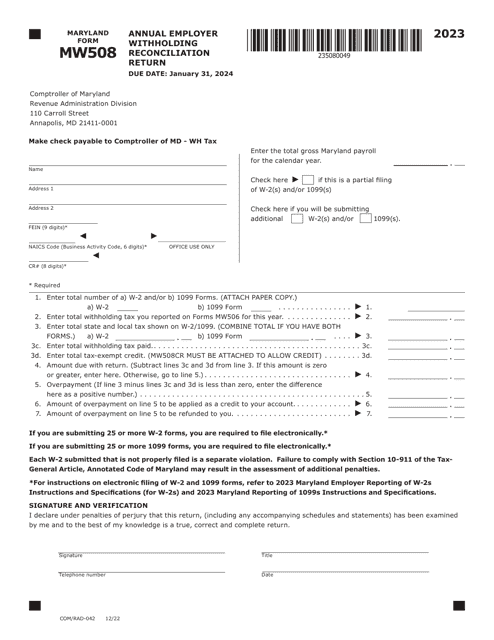

Maryland Form MW508 (COM/RAD-042) Annual Employer Withholding Reconciliation Return - Maryland, 2023

This Form is used for the Annual Employer Withholding Reconciliation Return in the state of Maryland.

This Form is used for employers in Missouri to report and withhold income tax from employees participating in the Job Training Program.