Estate Settlement Templates

Estate settlement is the process of distributing the assets and closing the affairs of a deceased person. This important legal procedure ensures that all debts and taxes are properly paid, and that the remaining assets are transferred to the rightful beneficiaries.

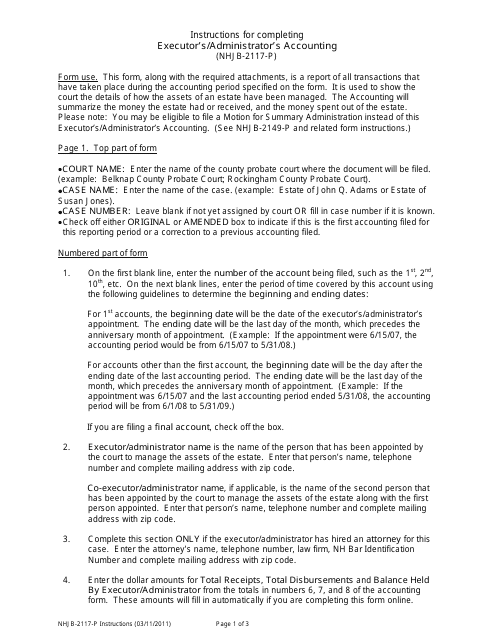

At times, estate settlement can be complex and requires the completion of various forms and documents. These documents, also known as estate settlement forms or estate settlement documents, help to streamline and formalize the process. They provide a comprehensive record of the deceased person's assets, debts, and beneficiaries.

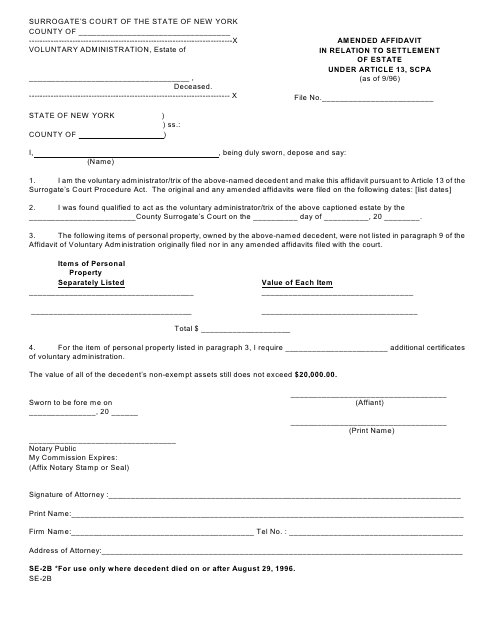

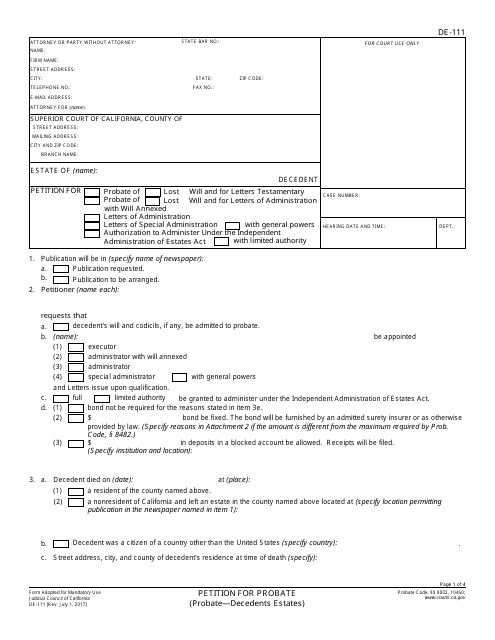

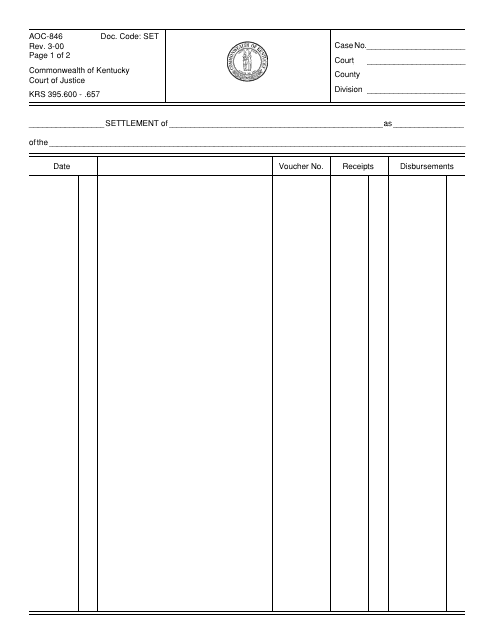

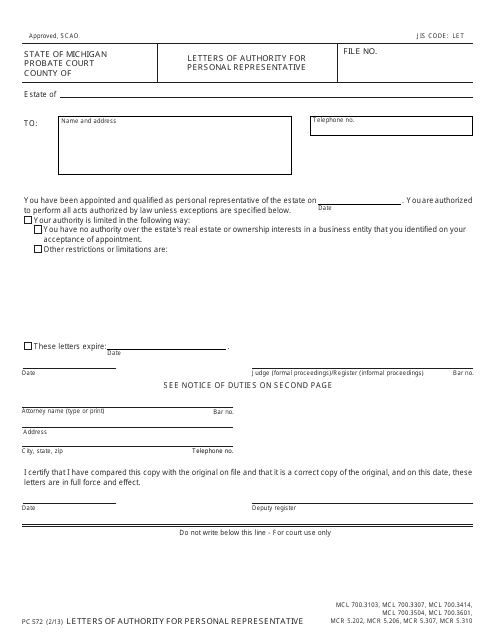

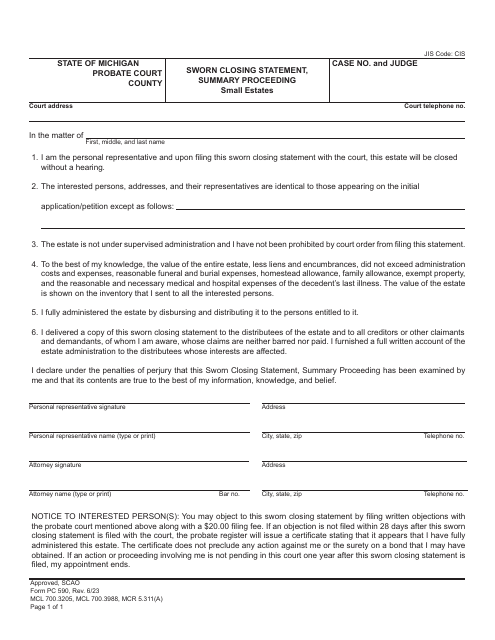

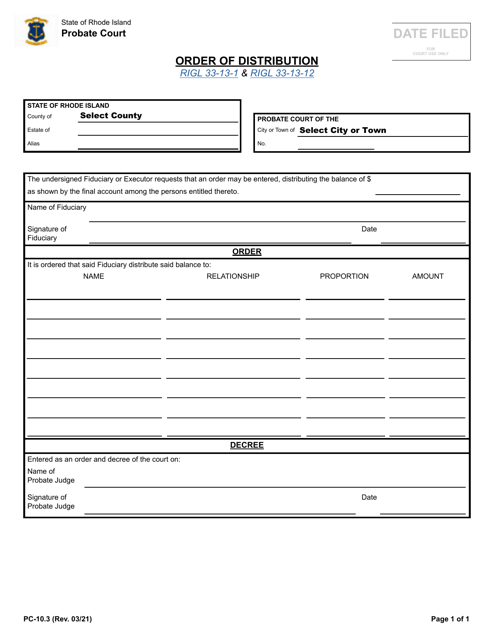

Some of the common forms used in estate settlement include the Petition for Complete Estate Settlement, Small Estate Affidavit for Nonresident Decedents, Amended Affidavit in Relation to Settlement of Estate, and Personal Representative's Statement to Close Estate. These documents are specific to different states and jurisdictions, ensuring compliance with local laws and regulations.

Completing these estate settlement forms accurately and efficiently is essential to avoid delays and potential legal issues. They require careful attention to detail and documentation of all relevant information. These forms can be obtained from the appropriate state authorities or legal service providers, and should be completed with the guidance of an attorney or estate planning professional.

Whether you are a personal representative or an heir, understanding and properly executing the estate settlement process is crucial. By utilizing the appropriate forms and documents, you can ensure a smooth and efficient settlement of the estate, providing peace of mind to all parties involved.

Documents:

34

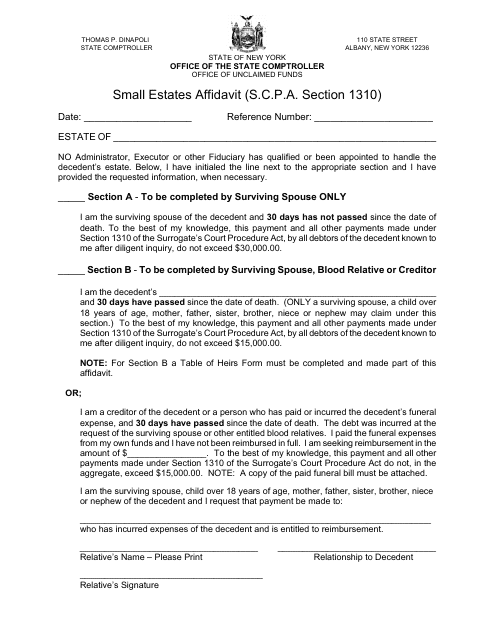

This form is used for declaring the assets and debts of a deceased individual in New York when their estate is small.

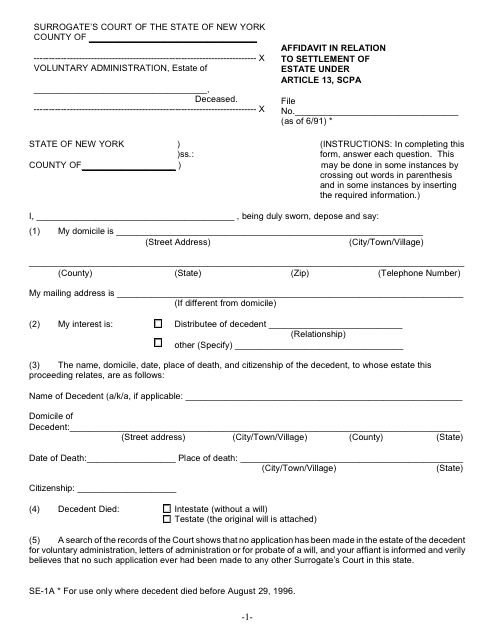

This form is used for providing an affidavit related to the settlement of an estate under Article 13 of the Surrogate's Court Procedure Act in New York.

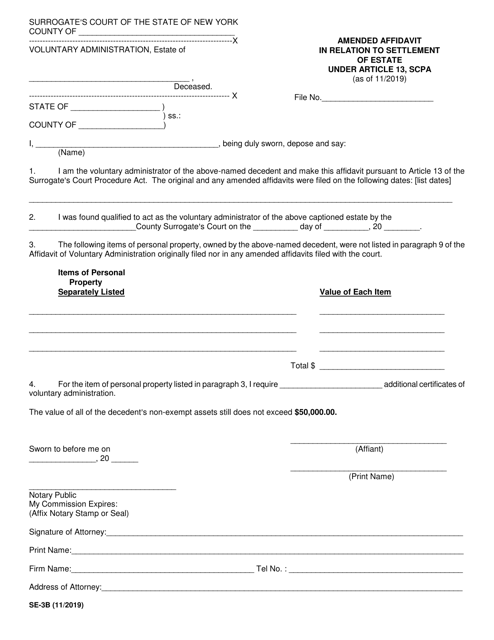

This form is used for filing an amended affidavit in relation to the settlement of an estate under Article 13 of the Surrogate's Court Procedure Act (SCPA) in New York.

This Form is used for filing a petition for probate in the state of California. It allows individuals to request the court to appoint them as the executor or administrator of a deceased person's estate.

This form is used for settling the estate of a deceased individual in the state of Kentucky. It is used to record and distribute the assets and liabilities of the estate in accordance with state laws.

This Form is used for obtaining Letters of Authority as a Personal Representative in the state of Michigan. It grants the individual the legal authority to act on behalf of a deceased person's estate.

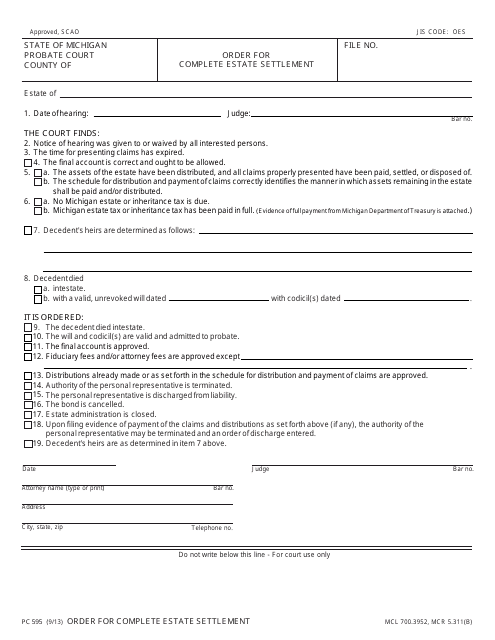

This form is used for ordering a complete estate settlement in the state of Michigan. It is used to facilitate the process of settling an estate, including distributing assets and resolving any outstanding debts or claims.

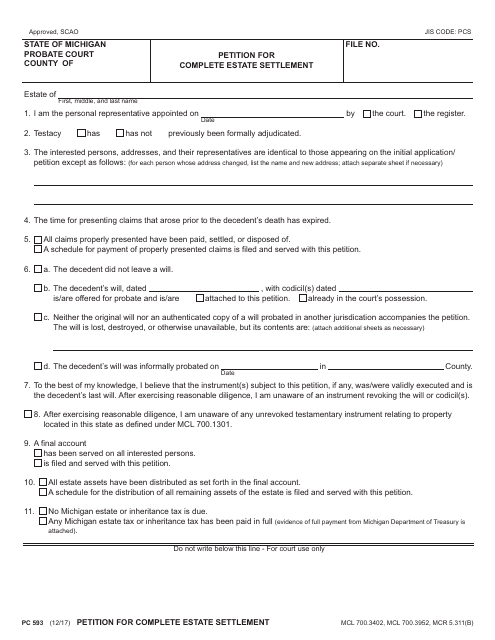

This form is used for petitioning for the complete settlement of an estate in the state of Michigan.

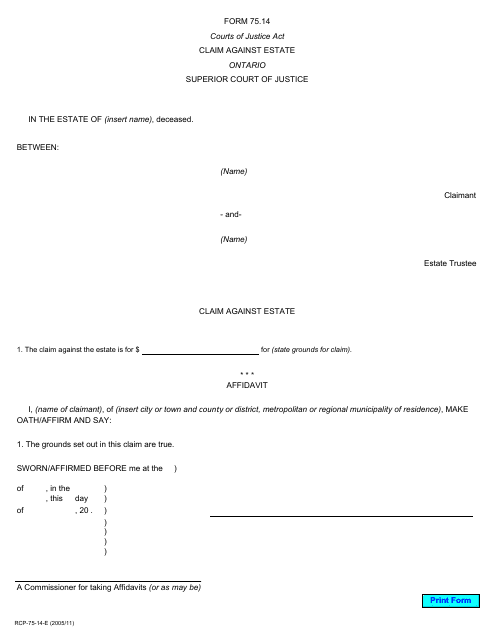

This Form is used for making a claim against an estate in Ontario, Canada.

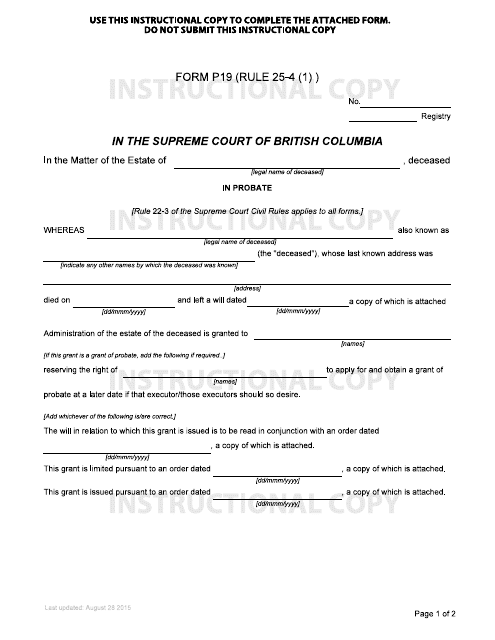

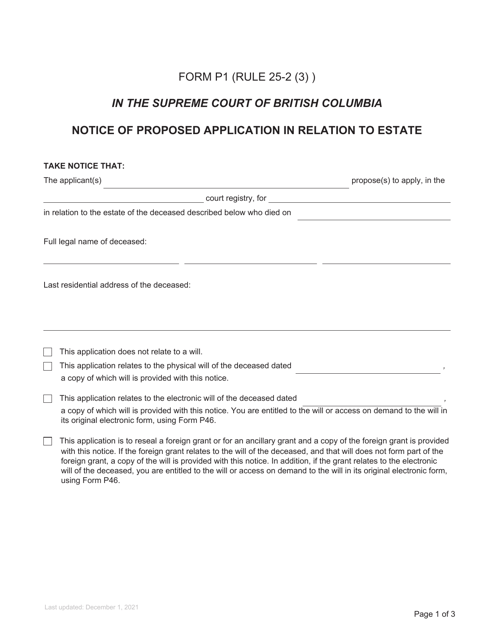

This Form is used for applying for an estate grant in the province of British Columbia, Canada. It is used to establish the authority to administer the assets and property of a deceased person.

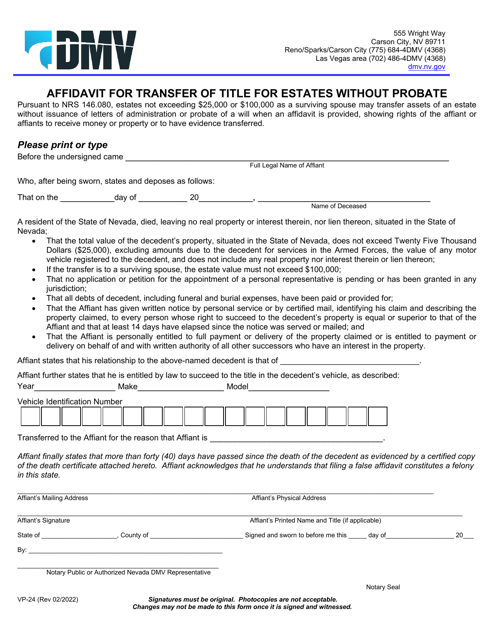

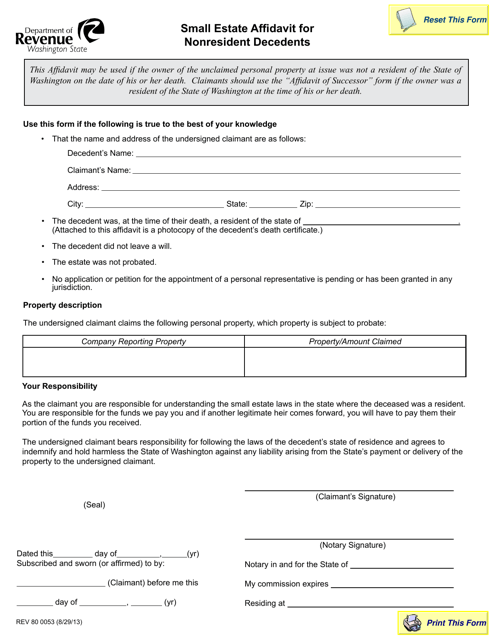

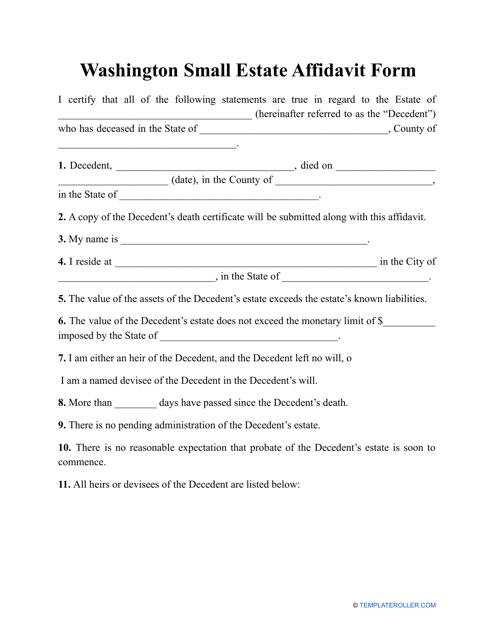

This Form is used for filing a Small Estate Affidavit for Nonresident Decedents in Washington state. It allows nonresident individuals to settle the estate of a deceased person with a smaller value of assets.

This form is used for filing an amended affidavit in relation to the settlement of an estate in New York under Article 13 of SCPA.

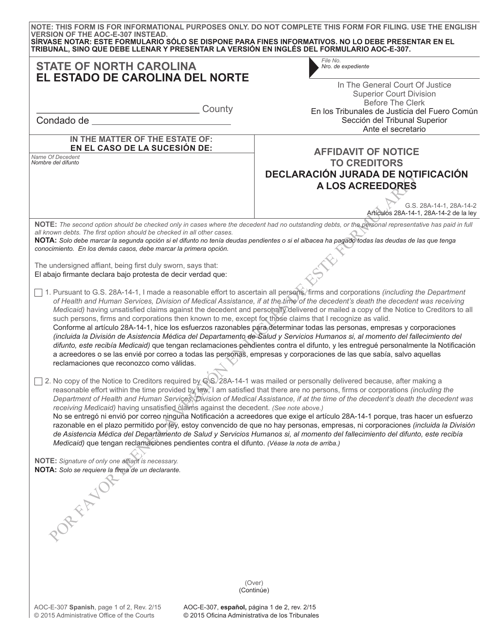

This form is used for filing an affidavit of notice to creditors in North Carolina. It is available in both English and Spanish.

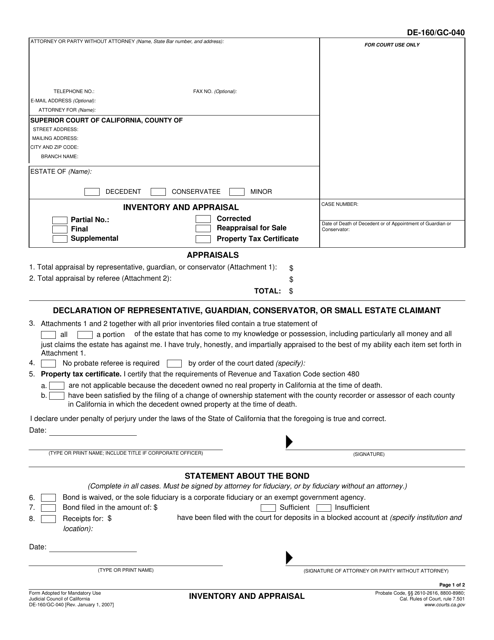

This form is used for inventory and appraisal purposes in California.

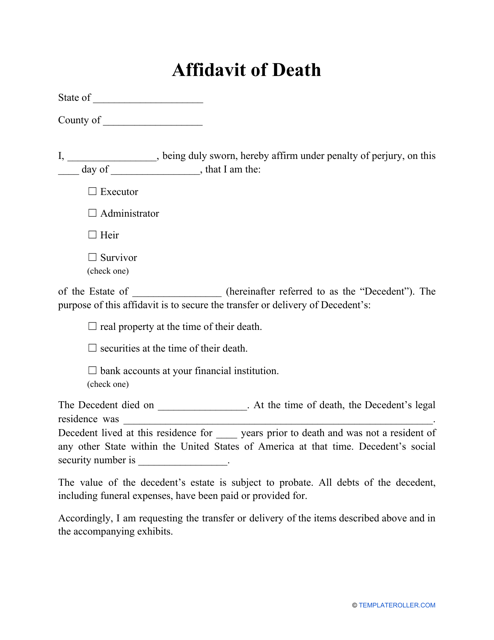

This form is filed by an heir or successor of a deceased person in order to certify under oath that the individual indicated in the affidavit has passed away.

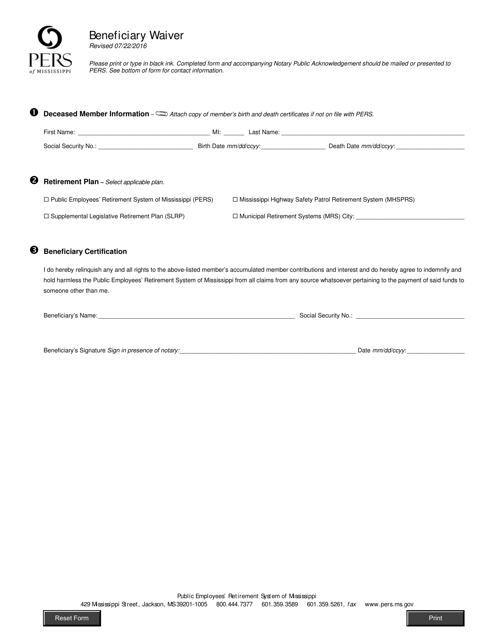

This document is used in Mississippi for a beneficiary to waive their rights or claims to certain benefits or assets.

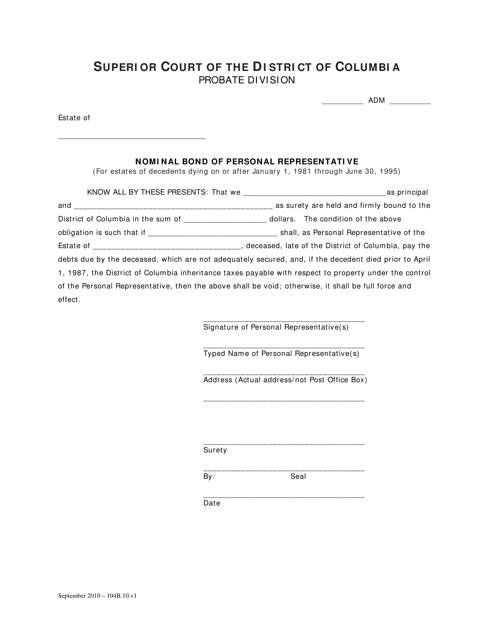

This document is used for obtaining a nominal bond of a personal representative in Washington, D.C. It ensures that the personal representative will fulfill their duties and responsibilities in managing the estate of a deceased person.

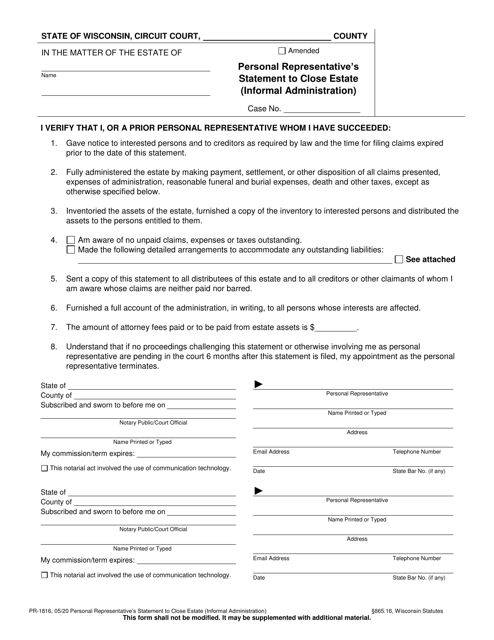

This form is used for a personal representative to provide a statement to close an estate in Wisconsin.

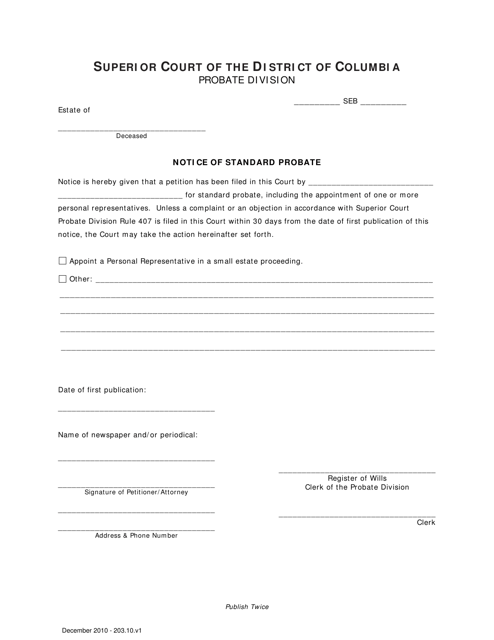

This document is used for informing individuals about the standard probate process in Washington, D.C.

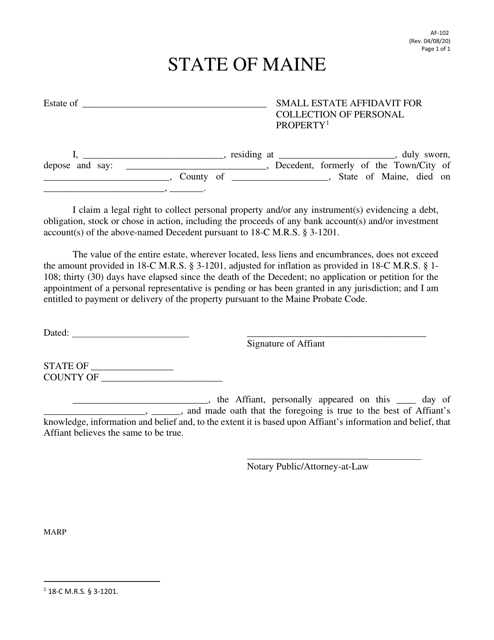

An individual that lives in Maine may use this form when they want to distribute assets, tangible and intangible property, of an individual that has died and left no instructions regarding their possessions if the estate is small enough.

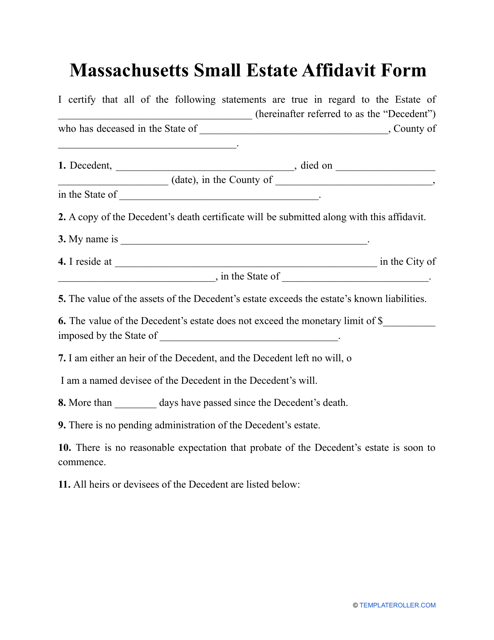

This is a written form used in Massachusetts to accelerate the settlement of a small estate and avoid a time-consuming probate procedure.

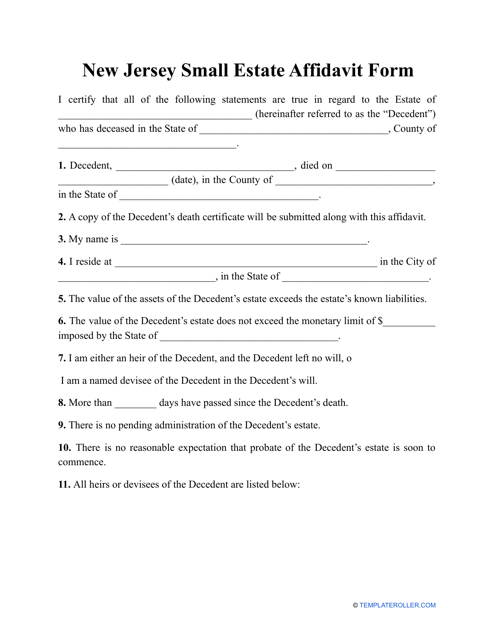

This type of template legally allows an individual to collect a property that they have legally inherited from a decedent in the state of New Jersey.

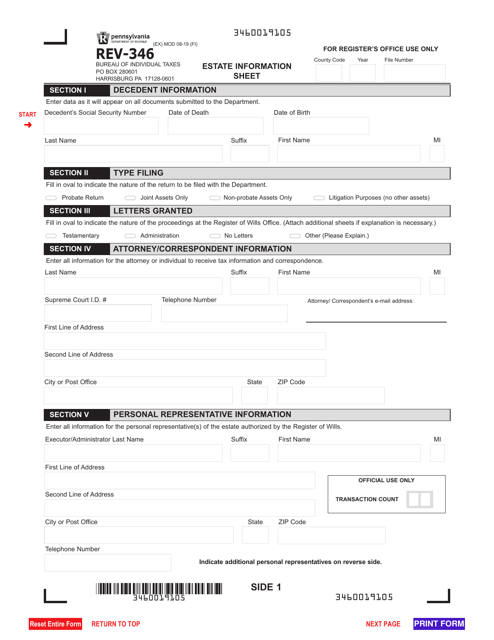

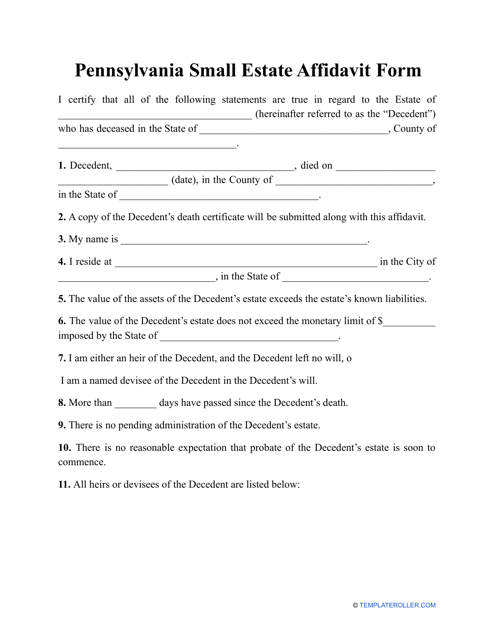

This form is used for declaring a small estate in Pennsylvania and avoiding the probate process for smaller estates. It allows the appointed person to distribute the assets of the deceased without going through a lengthy court process.

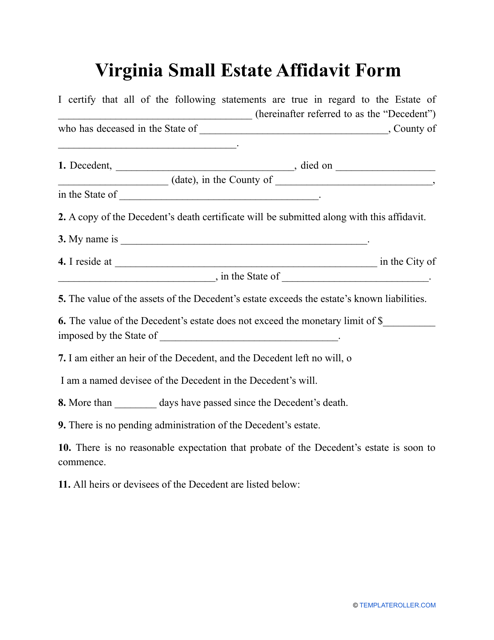

By completing this form in Virginia, an individual is legally allowed to collect an inherited estate and this document will give them the legal authority to become the new owner of the estate.

This form is used for handling small estates in Washington state. It allows heirs to claim a deceased person's assets without going through the formal probate process.

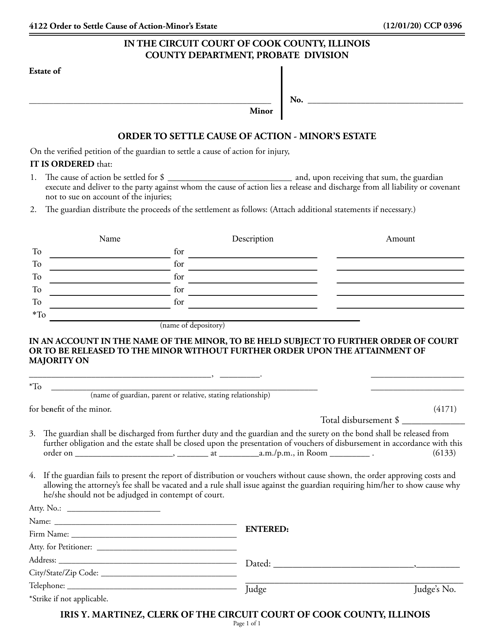

This form is used for ordering the settlement of a cause of action involving a minor's estate in Cook County, Illinois.

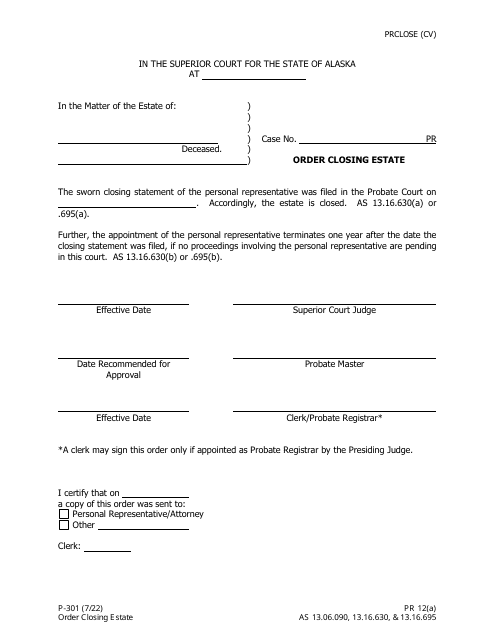

This Form is used for closing an estate in Alaska. It is used to finalize the distribution of assets and settle any outstanding debts or obligations.