Tobacco Bond Templates

Are you in the tobacco business? Do you require a tobacco bond? Look no further! Our comprehensive collection of tobacco bonds is here to meet your needs. Also known as tobacco surety bonds or nicotine bond collections, these bonds are essential for complying with state regulations and ensuring the payment of taxes related to the tobacco industry.

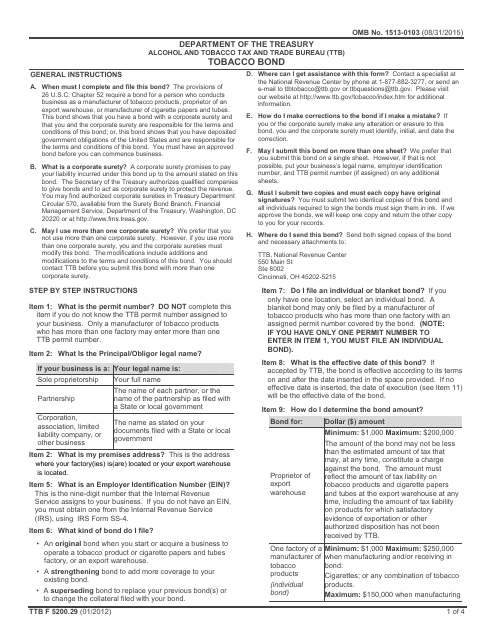

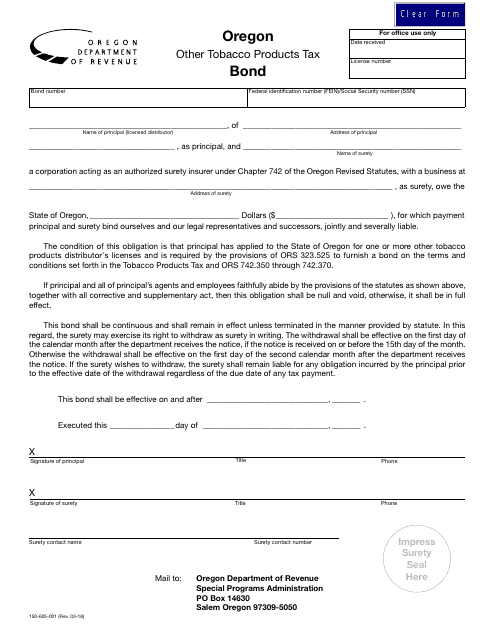

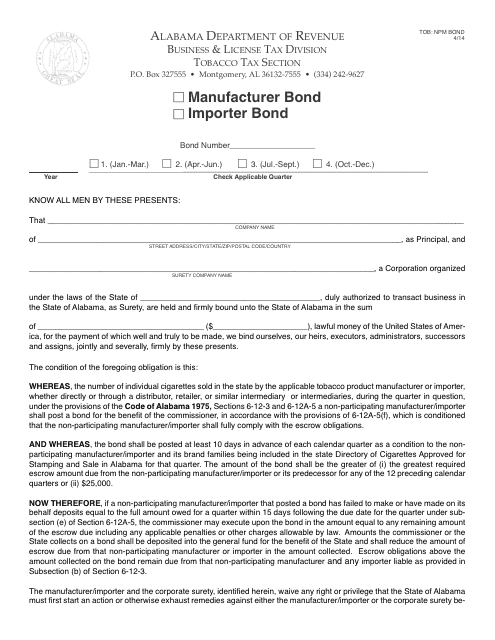

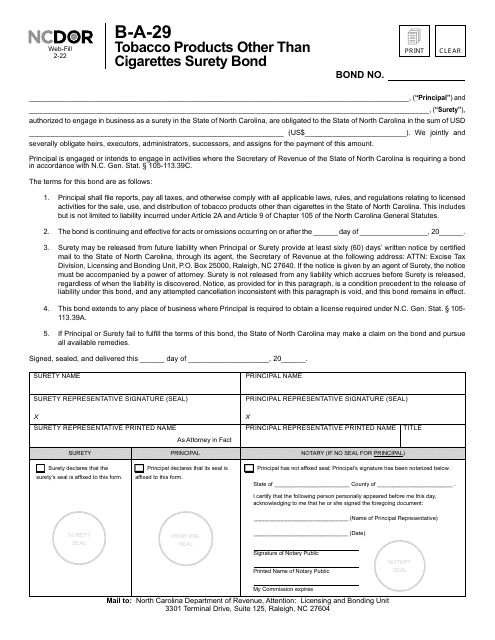

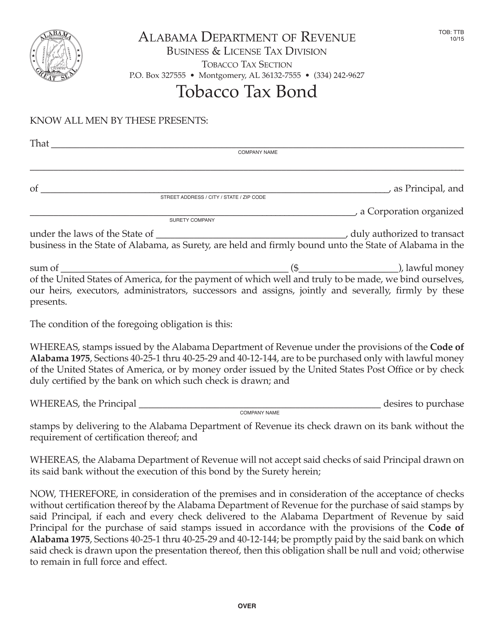

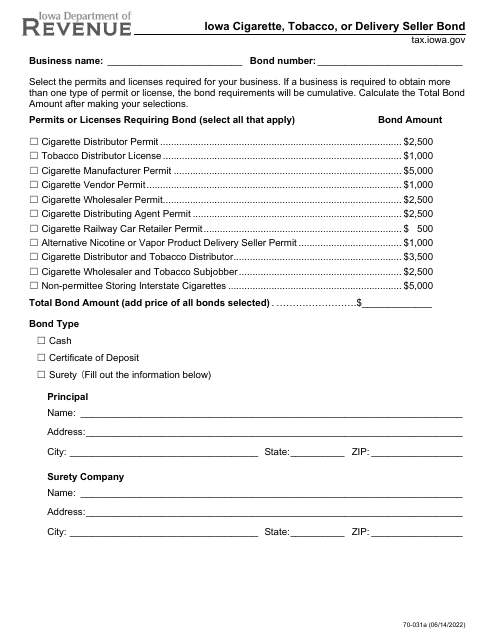

Our vast assortment of tobacco bonds includes the TTB Form 5200.29 Tobacco Bond, Form TOB: NPM BOND Non-participating Manufacturer/Importer Tobacco Bond, Form B-A-29 Tax Bond for Tobacco ProductsOther Than Cigarettes, Form TOB: TTB Tobacco Tax Bond, and Form 70-031 Iowa Cigarette, Tobacco, or Delivery Seller Bond, among many others.

Applying for a tobacco bond can be a complex process, but our expert team is here to guide you every step of the way. Whether you're a tobacco manufacturer, importer, or seller, having the appropriate bond is crucial for meeting your legal obligations and protecting the interests of your business.

With our extensive selection of tobacco bonds, we strive to make it easy for you to find the specific bond that suits your needs. Our user-friendly platform allows you to browse through different bond options, compare their features, and select the one that aligns with your requirements.

Don't let the complexities of tobacco regulations overwhelm you. Explore our diverse tobacco bond collection today, and ensure compliance with the necessary legal requirements. Rest assured, our bonds are trusted and recognized by regulatory authorities across various states.

Documents:

6

This document is a Tobacco Bond form used by the Alcohol and Tobacco Tax and Trade Bureau (TTB) to ensure compliance with regulations related to the production and distribution of tobacco products.

This document is for obtaining a bond for the taxation of other tobacco products in the state of Oregon.

This Form is used for Non-participating tobacco manufacturers or importers to post a bond in Alabama.

This form is used for obtaining a tobacco tax bond in Alabama.