Withholding Allowances Templates

Are you an employer or an employee in the United States or Canada? Do you have questions about withholding allowances? We have all the information you need on withholding allowances, also known as withholding allowance forms.

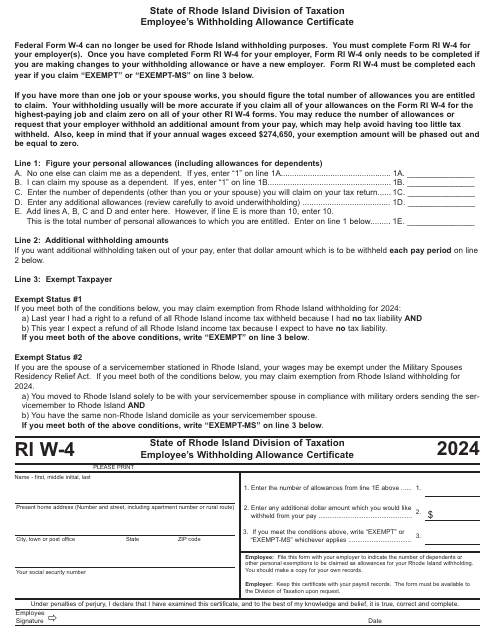

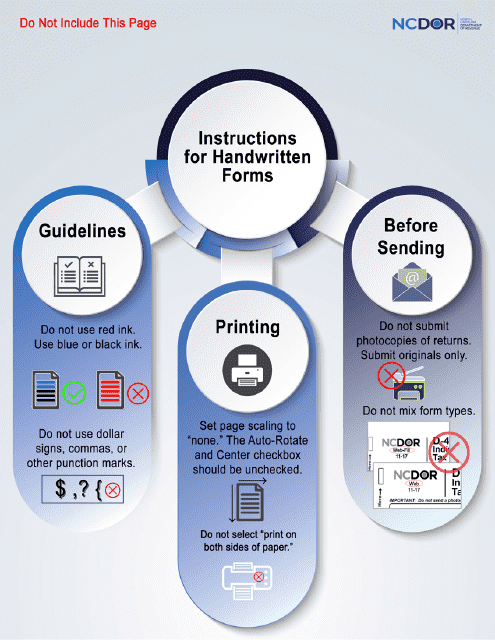

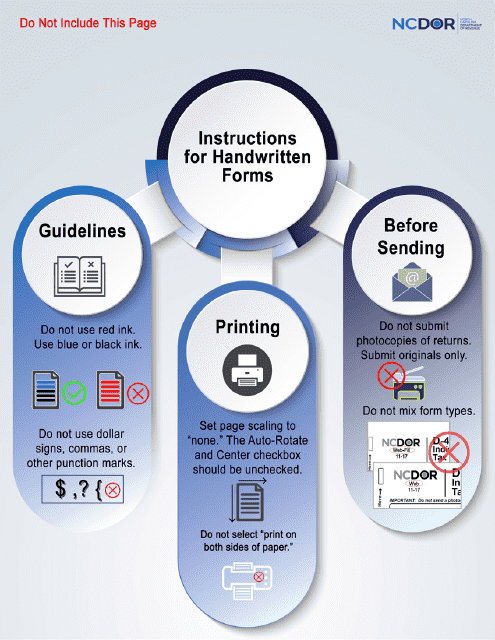

Withholding allowances are an important aspect of tax withholding. By properly completing the correct withholding allowance form, whether it's Form W-4V, Form IL-W-4, Form NC-4 NRA, or any other applicable form, you can ensure that the correct amount of taxes is withheld from your wages or other income.

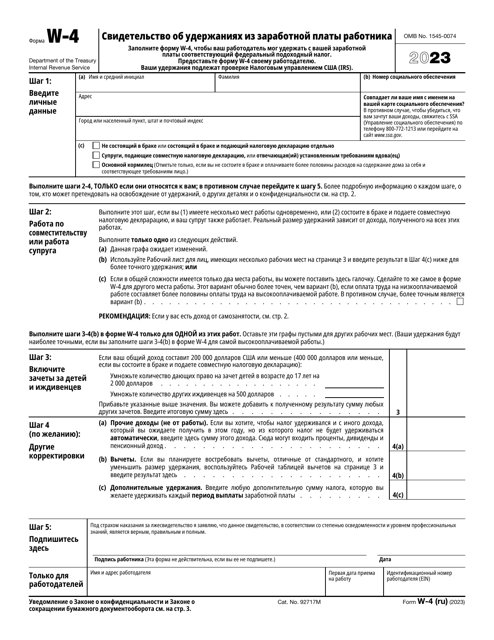

Understanding and correctly completing the appropriate withholding allowance form is crucial in order to avoid overpaying or underpaying your taxes. Our comprehensive collection of withholding allowance forms, including the IRS Form W-4 Employee's Withholding Certificate (Russian), Form IL-W-4 Employee's Illinois Withholding Allowance Certificate, and Form NC-4 NRA Nonresident Alien Employee's Withholding Allowance Certificate, provides you with the necessary resources to ensure your taxes are withheld accurately.

Navigating the various forms, eligibility criteria, and special circumstances when it comes to withholding allowances can be complex. However, our user-friendly website makes it easy for both employers and employees to find the information they need. Our documents are categorized in a way that allows you to quickly access the specific withholding allowance form you require, ensuring your tax responsibilities are met efficiently and effectively.

At USA, Canada, and Other Countries Document Knowledge System, we strive to be your go-to resource for all topics related to withholding allowances. Browse through our collection of withholding allowance forms and discover the information you need to make informed decisions regarding your tax withholdings.

Take control of your tax situation and ensure accurate withholding by utilizing our detailed and comprehensive collection of withholding allowance forms. Whether you are located in the United States or Canada, our website is designed to provide you with the relevant information and forms you need for proper tax withholding.

Documents:

20

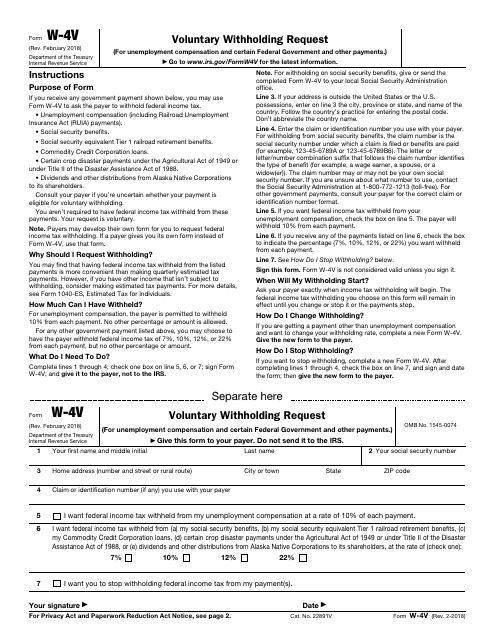

This is a fiscal document used by recipients of government payments to secure tax deductions from those amounts before the payments are sent to them.

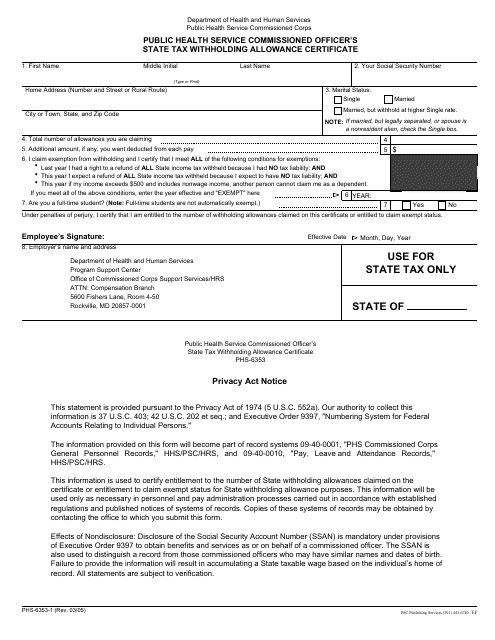

This type of document is used by Public Health Service Commissioned Officers to declare their state tax withholding allowances.

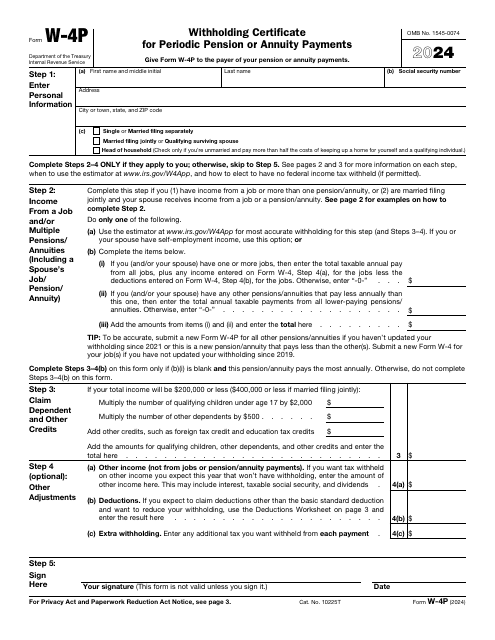

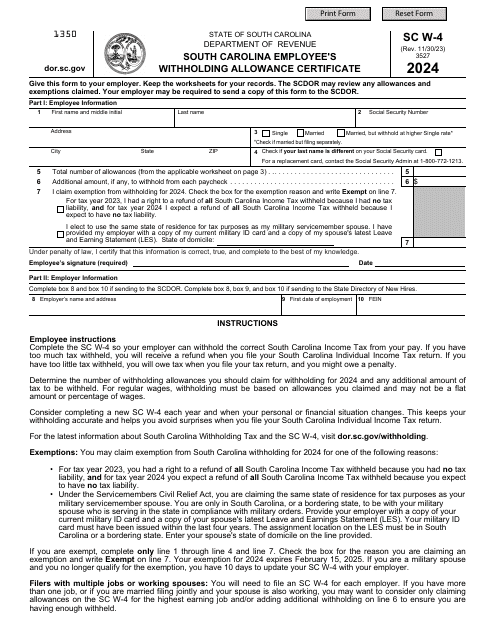

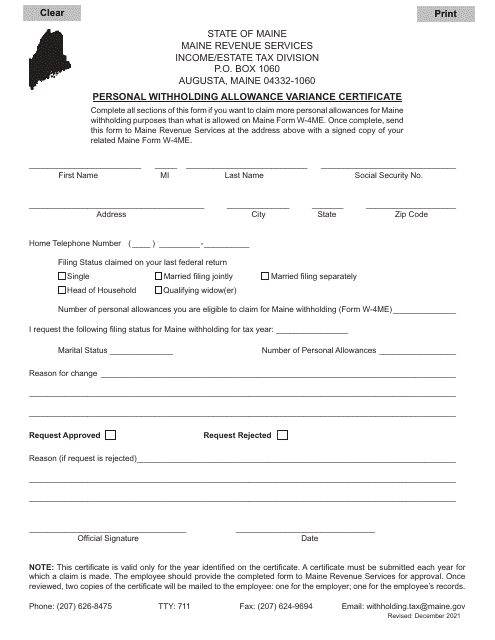

This is a formal document used by taxpayers to figure out the amount of deduction applied to regular payments they are entitled to receive.

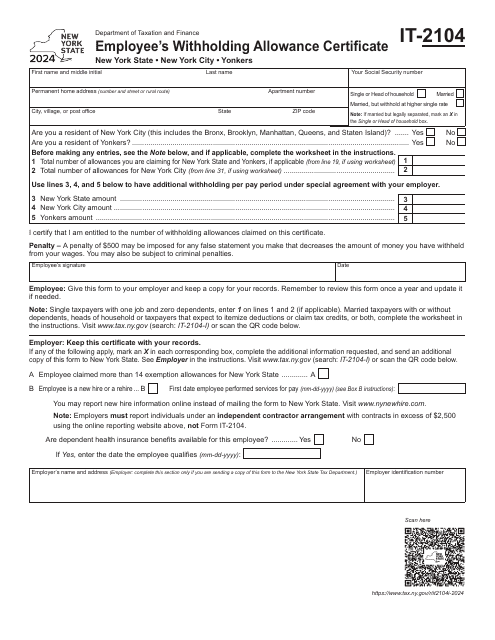

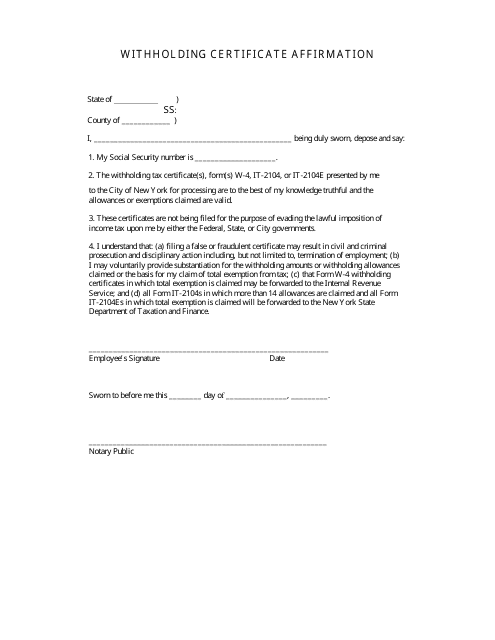

Use this application to specify how much tax needs to be withheld from an employee's pay. It is supposed to be filled out by an individual who works in New York State (New York City and Yonkers) and given to their employer.

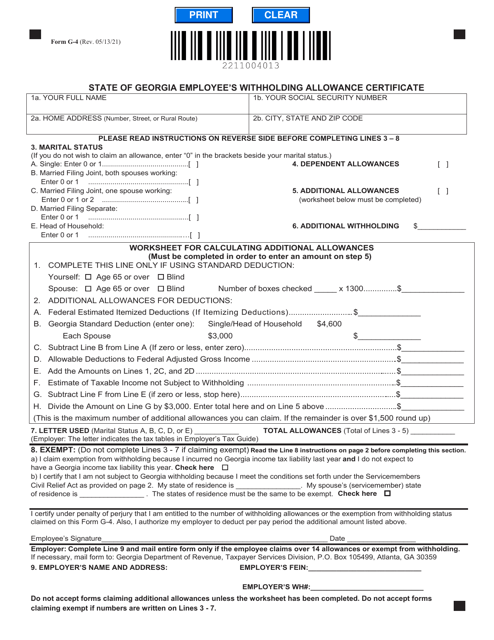

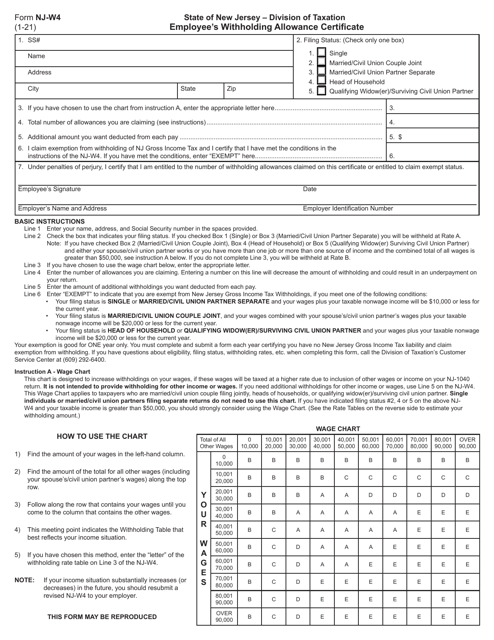

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.

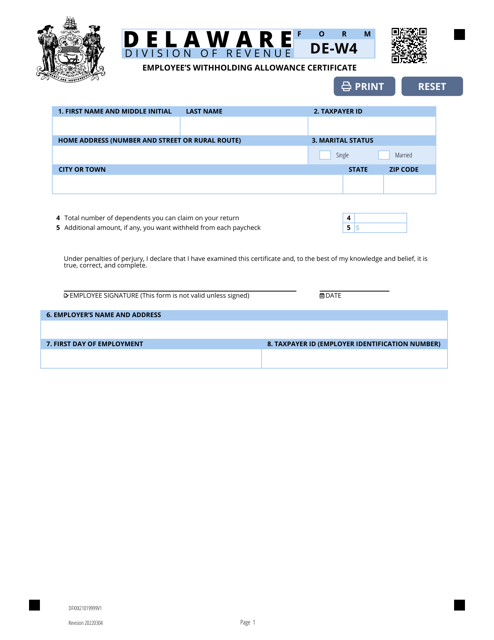

This form is used by employees in Delaware to determine their withholding allowances and calculate the correct amount of federal income tax to be withheld from their wages.

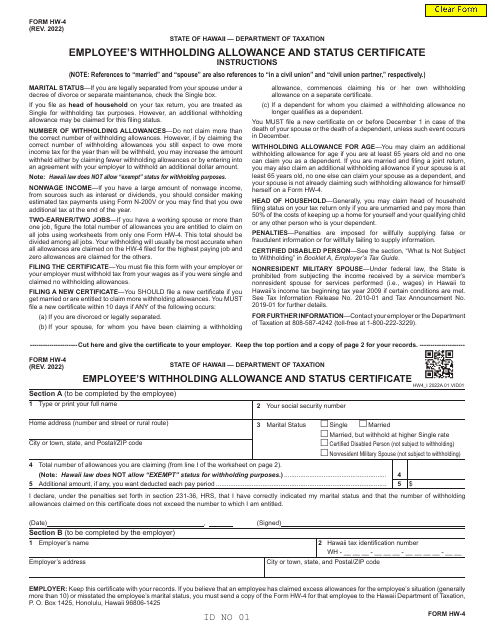

This is a state of Hawaii legal document completed by an employee for their employer's records to provide information about withholding allowances.