Foreign Trust Templates

Are you looking for information on how to establish a foreign trust or need assistance with filing the necessary forms? Look no further! Our comprehensive collection of documents related to foreign trusts will provide you with all the resources you need.

Also known as foreign trust forms or foreign trusts, these documents include detailed instructions and templates for various situations involving foreign statutory trusts or foreign trust associations. Whether you need to cancel a registration, report transactions, or provide annual information returns, our collection has got you covered.

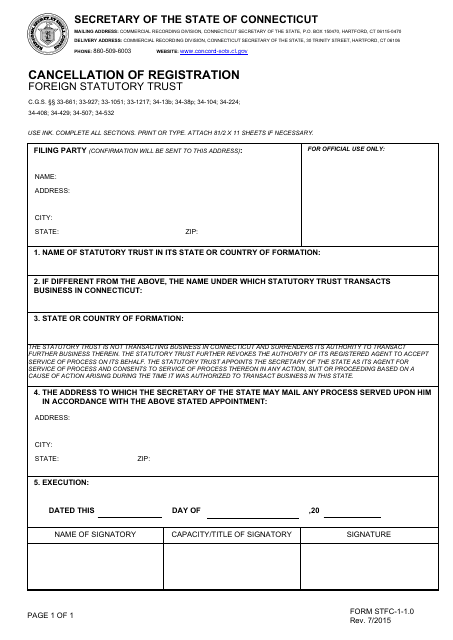

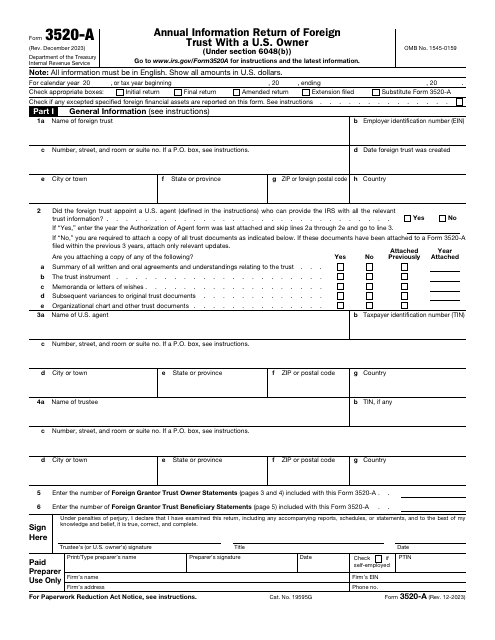

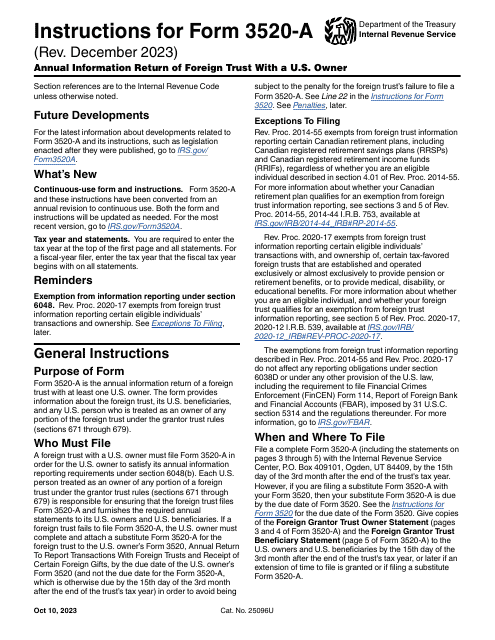

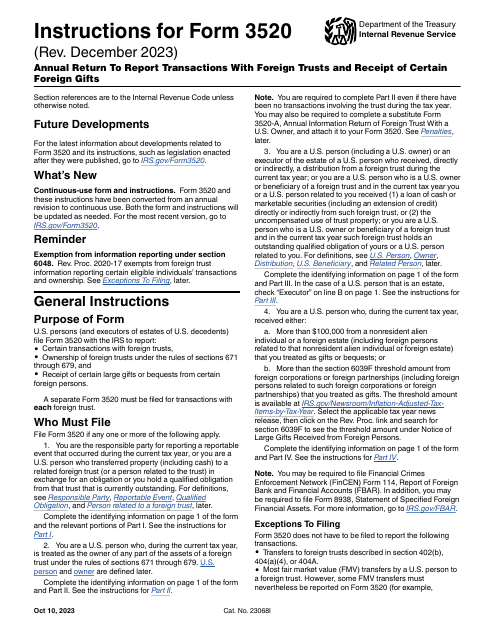

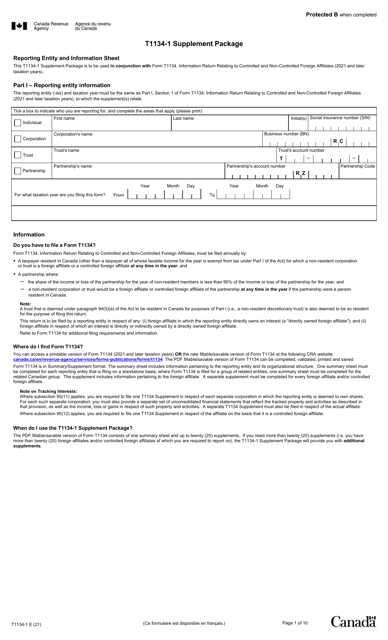

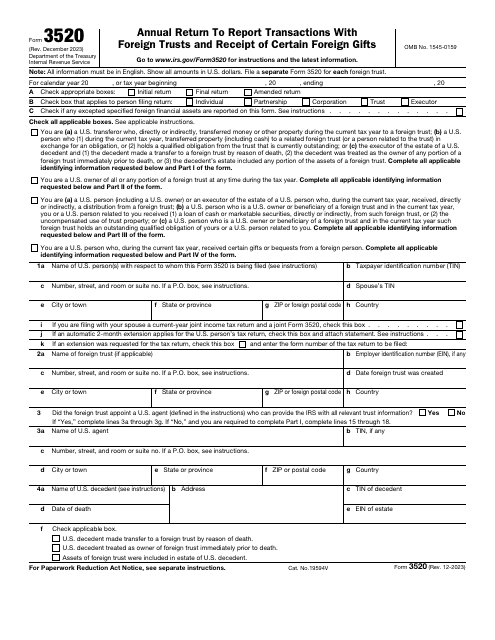

For instance, we have the Form STFC-1-1.0, which provides guidance on the cancellation of registration for a foreign statutory trust in Connecticut. If you're dealing with the IRS, our documents include the Instructions for IRS Form 3520 and Form 3520-A. These forms are essential for reporting transactions with foreign trusts and receipts of certain foreign gifts.

Navigating the requirements and responsibilities related to foreign trusts can be complex, but our collection of documents will simplify the process. We provide step-by-step instructions, ensuring accuracy and compliance with all relevant laws and regulations.

With our extensive range of foreign trust resources, you can rest assured that you have access to the information you need to navigate the complexities of establishing and managing a foreign trust. Whether you're an individual, an attorney, or a service provider, our collection of documents will be invaluable in assisting you with your foreign trust-related needs.

Documents:

21

This Form is used for canceling the registration of a foreign statutory trust in the state of Connecticut.

This document is submitted to the Internal Revenue Service (IRS) annually by foreign trusts with a U.S. owner to inform the IRS about the trust, its American beneficiaries, and any U.S. trust owner.

This form is a formal statement used by people and entities obliged to tell the fiscal authorities about the transactions they have had with foreign trusts throughout the year.

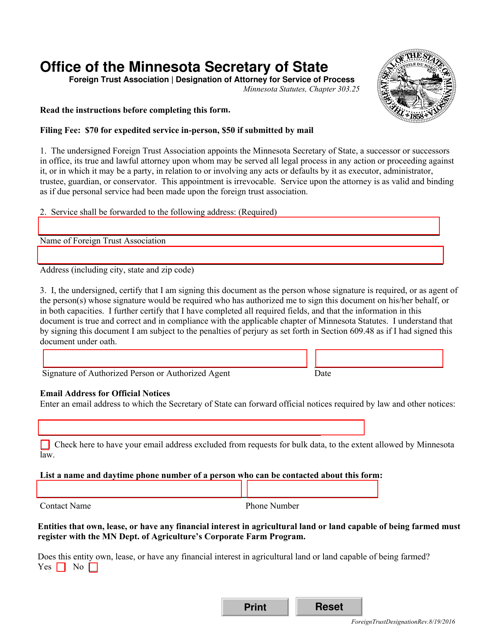

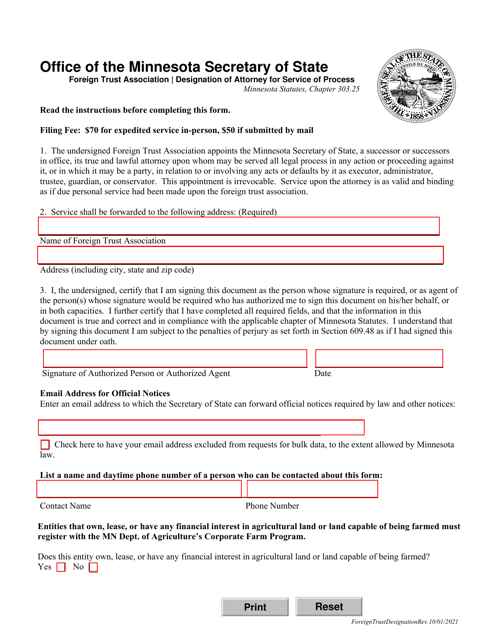

This document is used for designating an attorney to receive legal documents on behalf of a foreign trust association in the state of Mississippi.

This document is used for designating an attorney to receive legal documents on behalf of a foreign trust association in the state of Minnesota.