Tax Collection Templates

Are you looking for information on tax collection? Look no further! Our webpage provides comprehensive details on tax collection, including various forms, guidelines, and processes involved. Whether you are a taxpayer, tax professional, or government official, understanding tax collectability is crucial. Our website covers a wide range of topics related to tax collection, such as tax collection forms, taxes collected, and the necessary documentation for filing and reporting. With our user-friendly interface, you can easily access the information you need. Stay informed and compliant with tax collection regulations by exploring our dedicated webpage. Discover the latest updates and guidelines, so you can navigate the tax collection process smoothly.

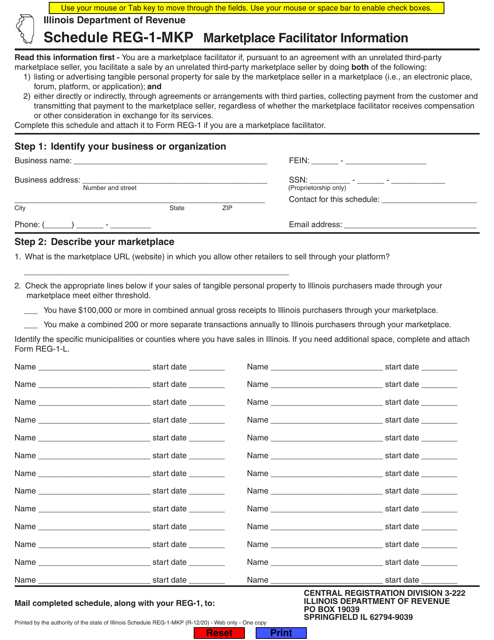

Documents:

22

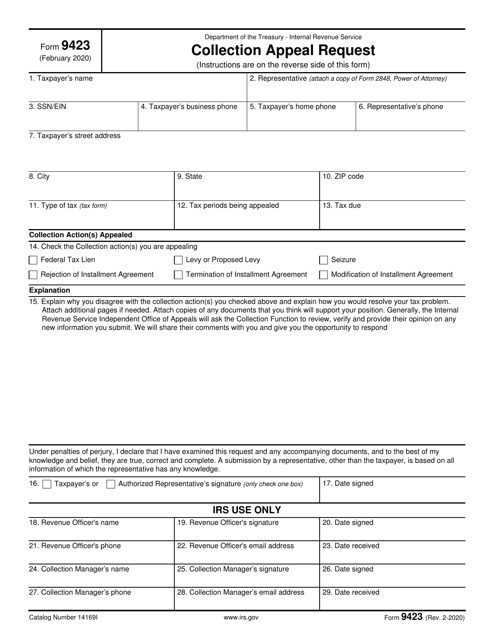

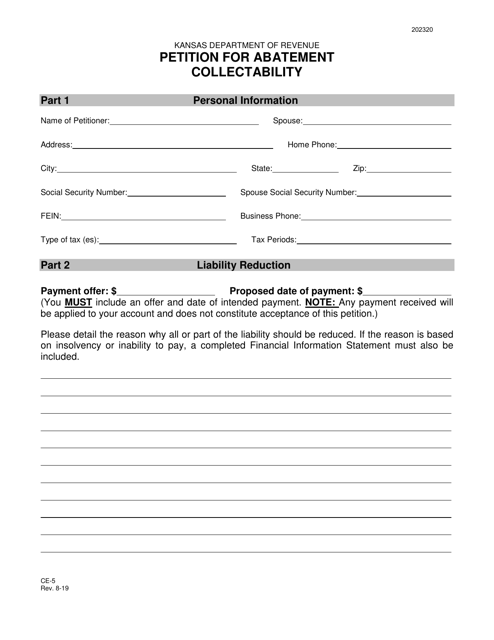

This is a written document prepared by a taxpayer with a tax debt, if they want to prevent or stop certain fiscal enforcement actions against them due to their failure to pay tax on time.

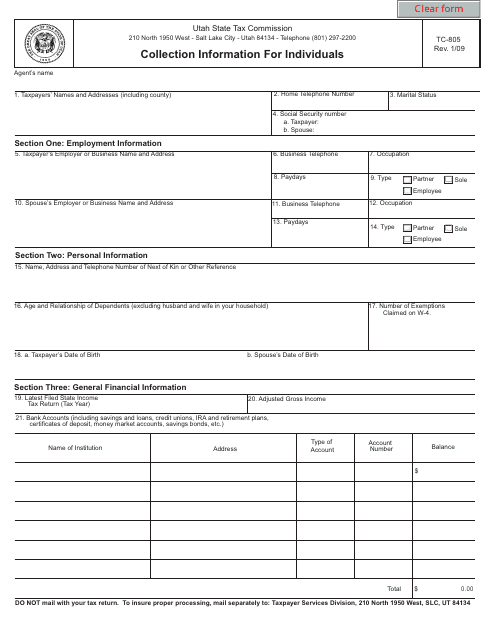

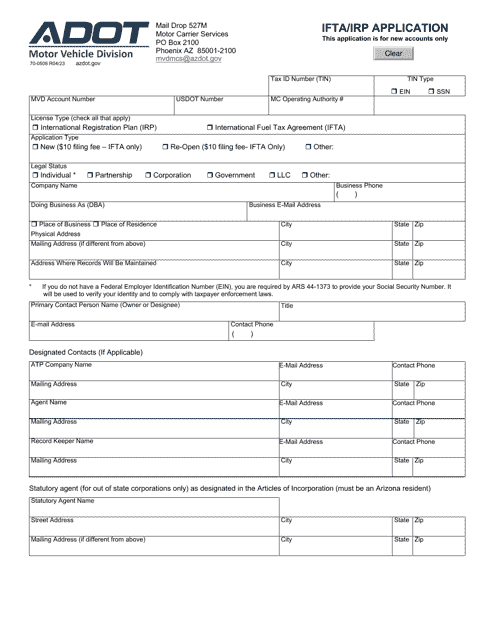

This form is used for collecting information from individuals in Utah for tax purposes. It helps the government determine an individual's ability to pay their taxes.

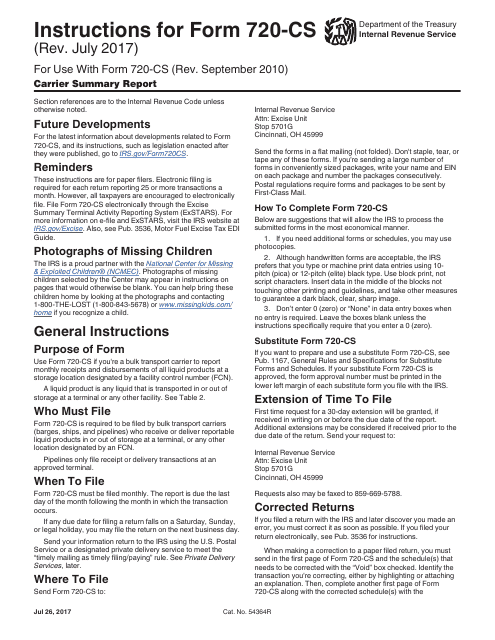

This form is used for providing a summary report of carriers to the Internal Revenue Service (IRS). It includes information such as carrier name, address, and total taxable amounts for various services.

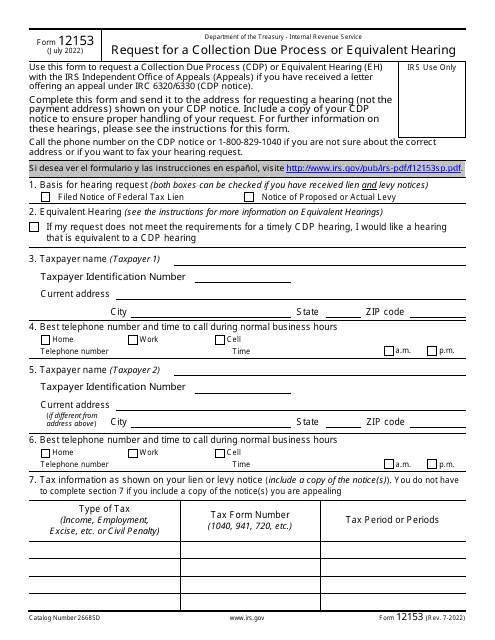

This is a fiscal form filled out by a taxpayer to appeal an upcoming tax levy or lien.

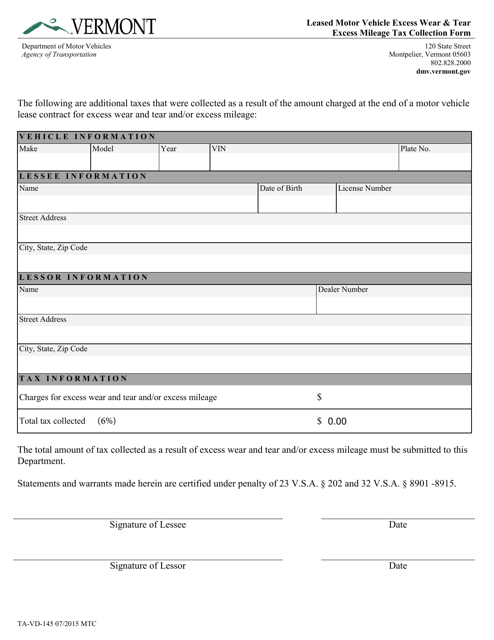

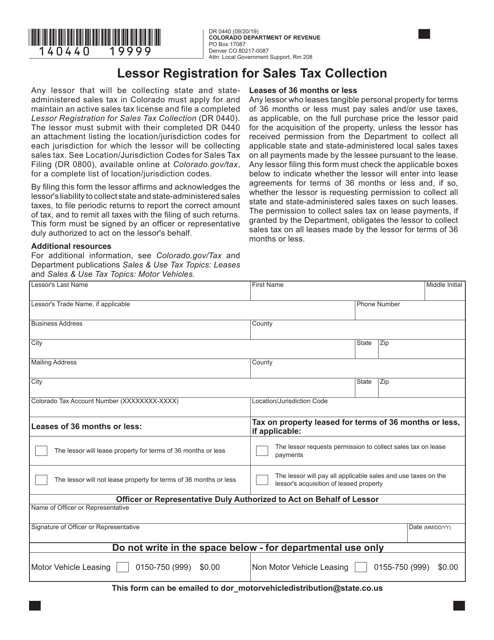

This form is used for collecting taxes on excess wear and tear and excess mileage on leased motor vehicles in Vermont.

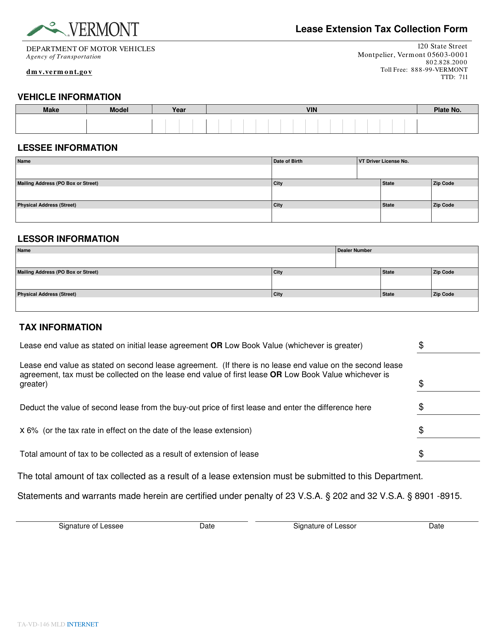

This Form is used for collecting taxes related to lease extensions in Vermont.

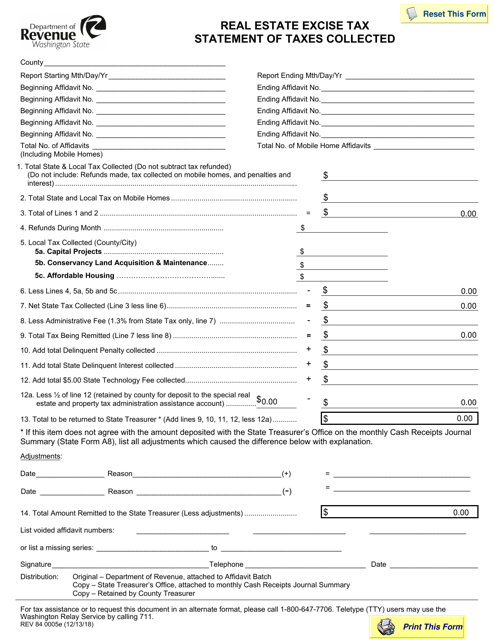

This form is used for reporting and documenting the real estate excise taxes collected in the state of Washington.

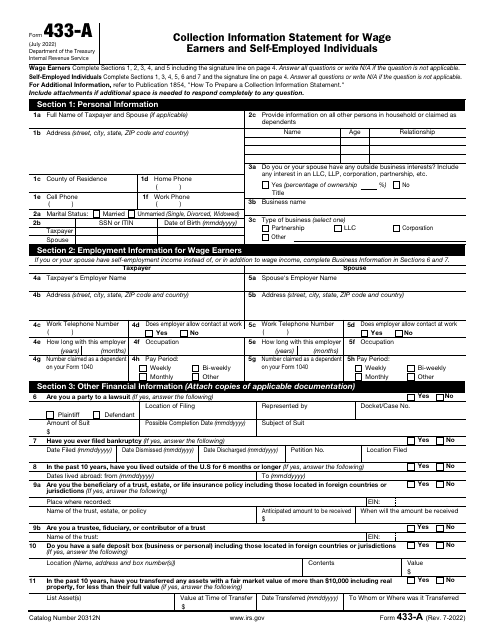

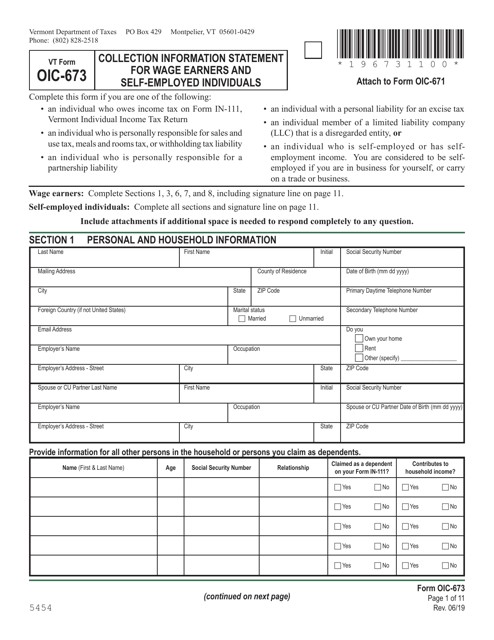

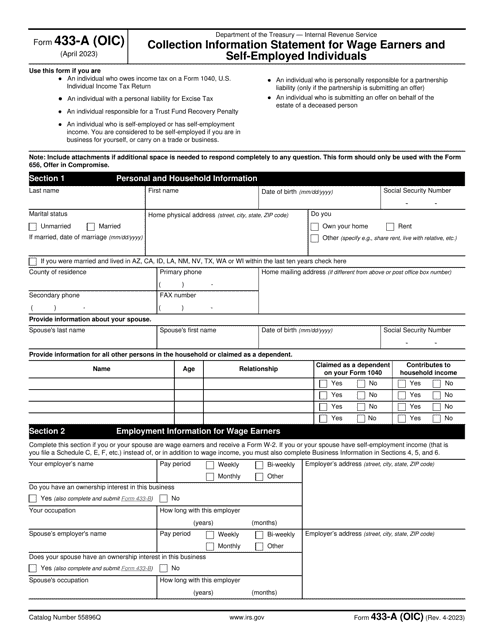

This Form is used for submitting a Collection Information Statement for wage earners and self-employed individuals in Vermont.

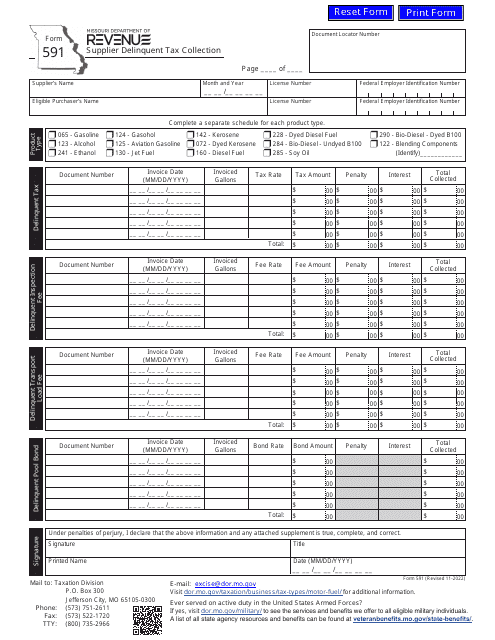

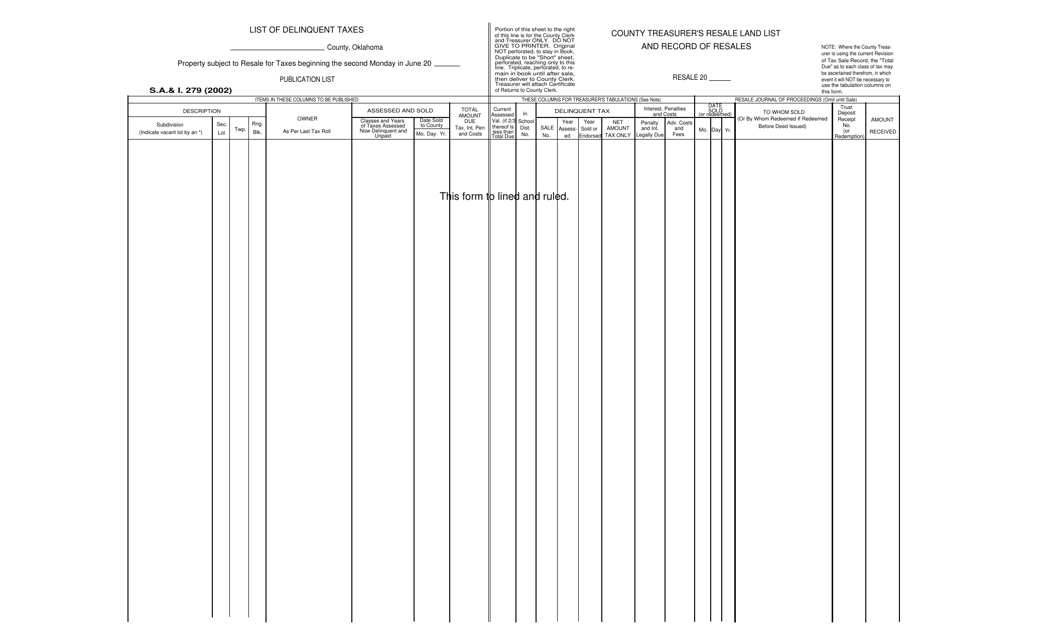

This form is used to list delinquent taxes in the state of Oklahoma. It provides information on individuals or businesses who haven't paid their taxes on time.