Monthly Taxes Templates

Are you looking for information on monthly taxes? Look no further! Our Monthly Taxes page is here to help you navigate the complex world of tax reporting on a monthly basis. Whether you're an individual or a business, understanding your monthly tax obligations is crucial for staying compliant with the law.

Also known as monthly tax returns or monthly tax documents, these reports are required by various tax authorities, such as the IRS in the United States. They serve as a way for you to calculate and submit your tax liability on a monthly basis.

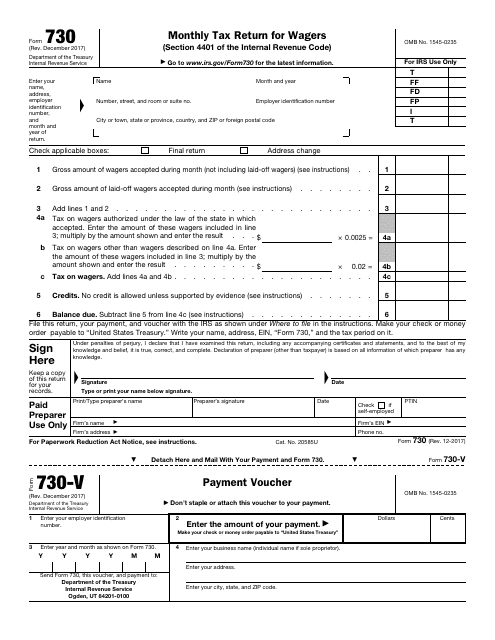

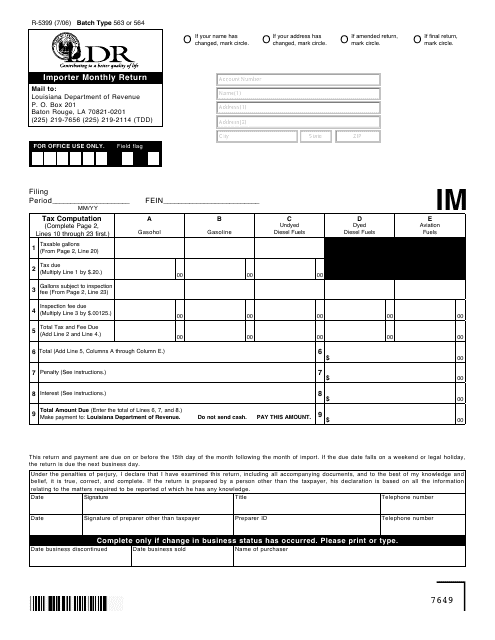

For example, if you're a wage earner, you may need to file IRS Form 730 - the Monthly Tax Return for Wagers. This form helps you report and pay any taxes owed on your gambling winnings. Similarly, businesses that import goods into Louisiana must submit Form R-5399 - the Importer Monthly Return, which calculates and reports the taxes due on these imports.

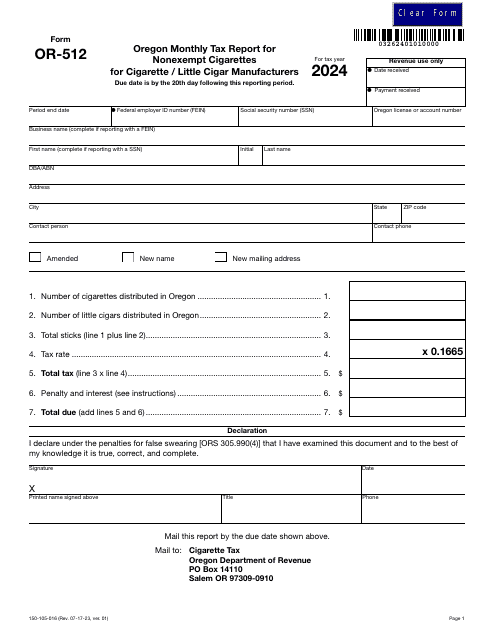

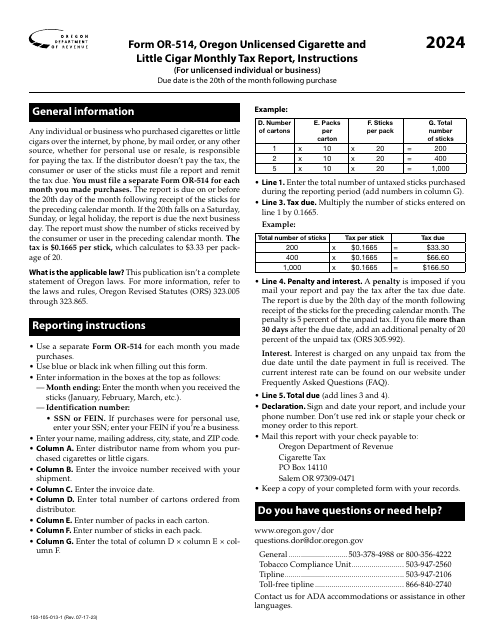

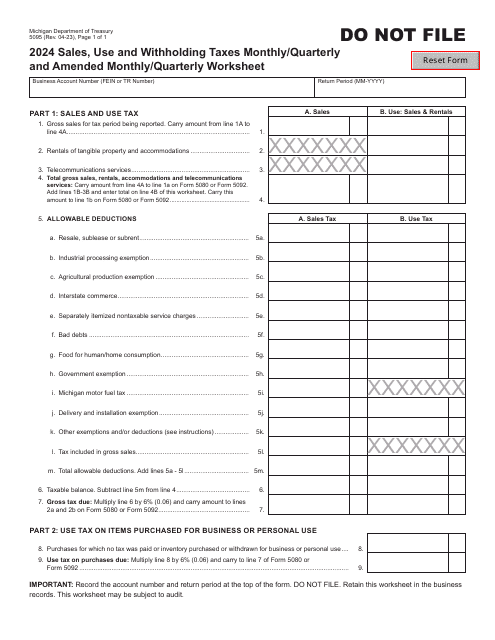

In Oklahoma, Form 105-18 is used by motor fuel suppliers and permissive suppliers to calculate their monthly tax liability. The state of Oregon requires cigarette and little cigar manufacturers to file Form OR-512, also known as the Oregon Monthly Tax Report for xempt Cigarettes. And in Michigan, businesses must use Form 5095 to report and pay their sales, use, and withholding taxes on a monthly or quarterly basis.

As you can see, monthly taxes can vary based on the type of taxpayer and the jurisdiction they're in. It's essential to understand the specific requirements and deadlines for your situation to avoid penalties and stay in good standing with the tax authorities.

If you have questions about monthly taxes or need assistance with your monthly tax returns, our team of experts is here to help. Reach out to us today to ensure your tax compliance and peace of mind.

Documents:

12

This Form is used for filing monthly import data by businesses in Louisiana.

This form is used for monthly tax calculation by occasional importers of motor fuel in Oklahoma.

This document is used for monthly tax calculation for motor fuel tankwagon importers in Oklahoma

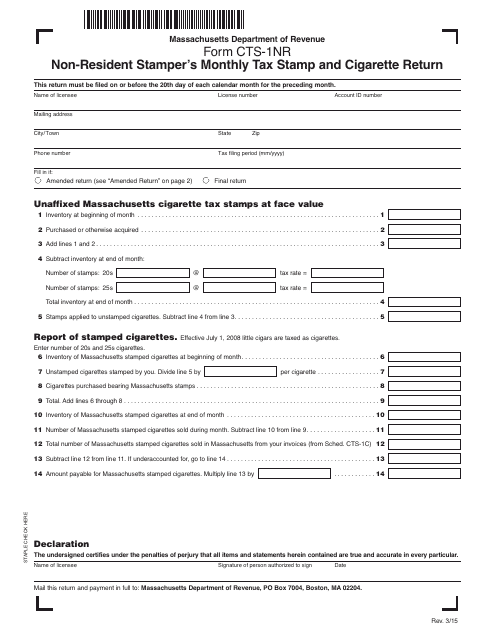

This form is used for non-resident stampers in Massachusetts to report monthly tax stamp and cigarette returns.

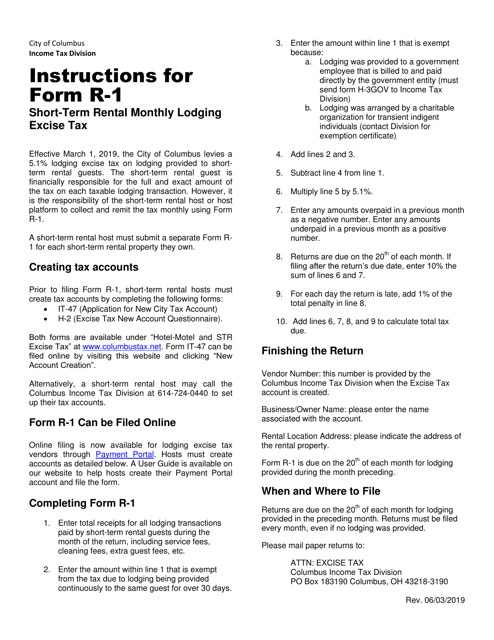

This form is used for reporting and paying the monthly lodging excise tax for short-term rentals in the City of Columbus, Ohio. It provides instructions on how to accurately complete the form and submit the tax payment.

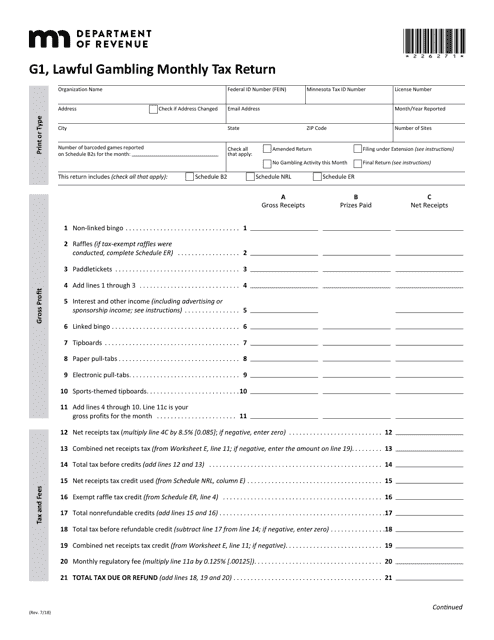

This Form is used for reporting and paying taxes on lawful gambling activities in the state of Minnesota.