Import Duty Templates

Looking to import goods into the country? Understanding the import duty process is crucial. Import duty, also known as import duties or duty-free importation, refers to the taxes and fees applied to imported goods. These charges are collected by customs authorities to protect domestic industries, regulate trade, and generate revenue for the government.

Whether you're a business owner or an individual looking to bring goods into the country, it's essential to navigate the import duty process correctly. Failure to comply with the regulations and pay the required fees can result in penalties, delays, or even seizure of your goods.

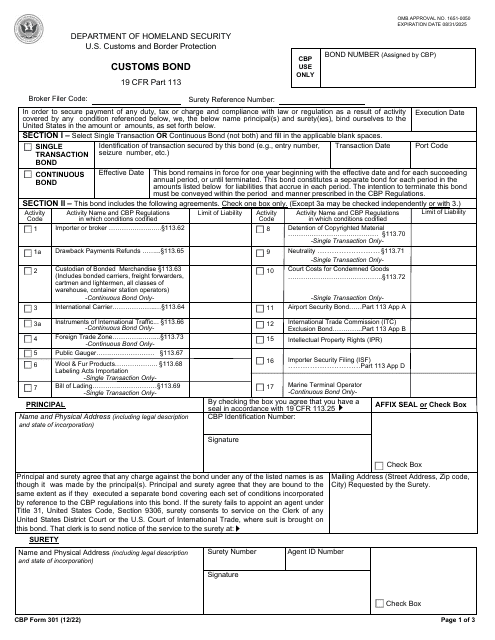

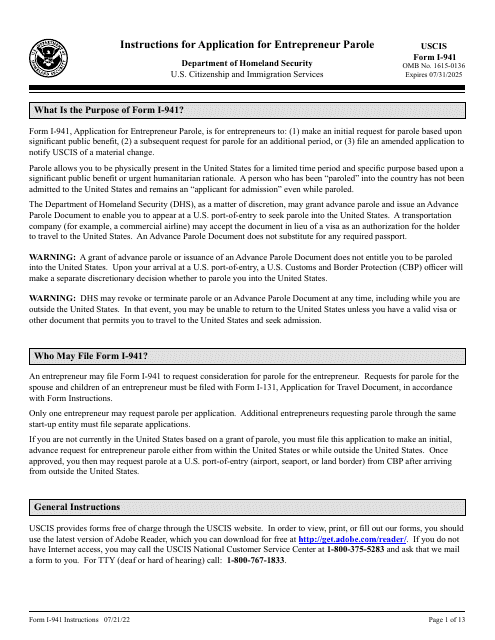

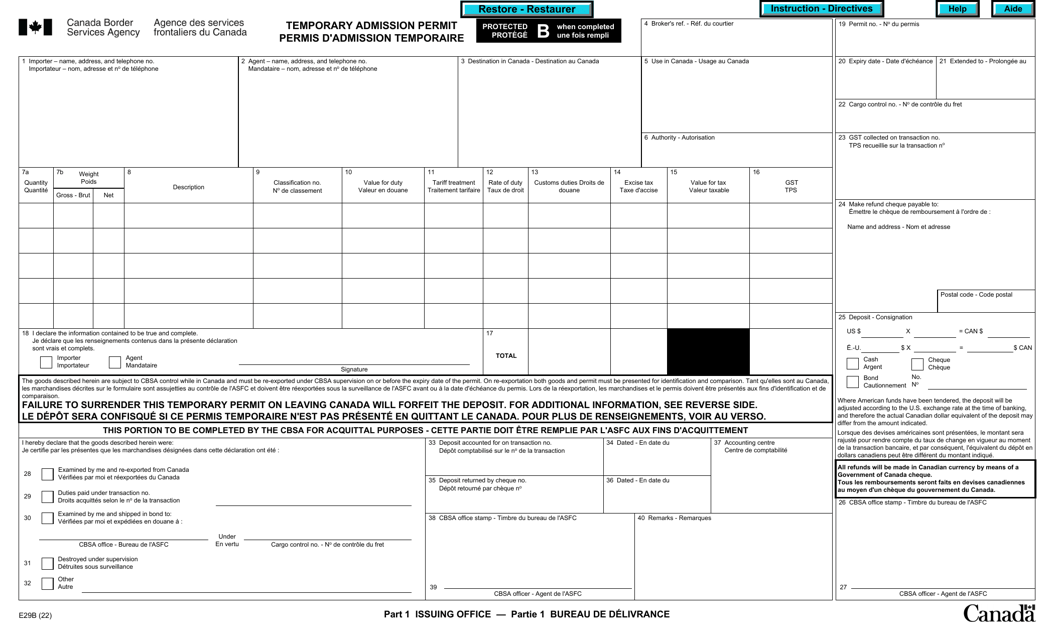

To ensure a smooth import process, it's important to familiarize yourself with the various documents and forms involved. Some of these include the CBP Form 301 Customs Bond, which serves as a guarantee for payment of import duties, and the Instructions for USCIS Form I-941 Application for Entrepreneur Parole, which may be required for certain visa categories.

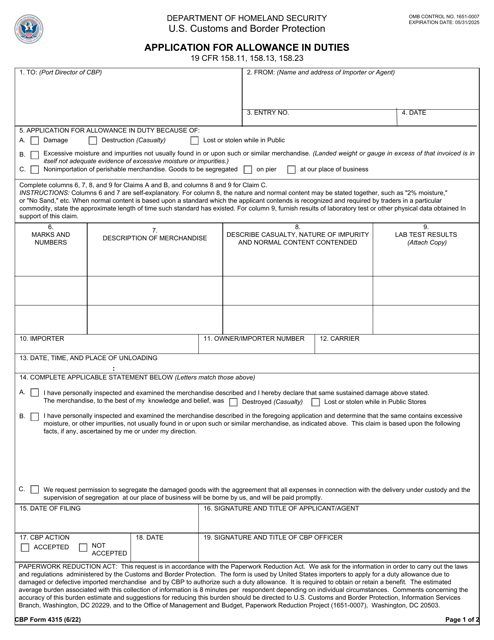

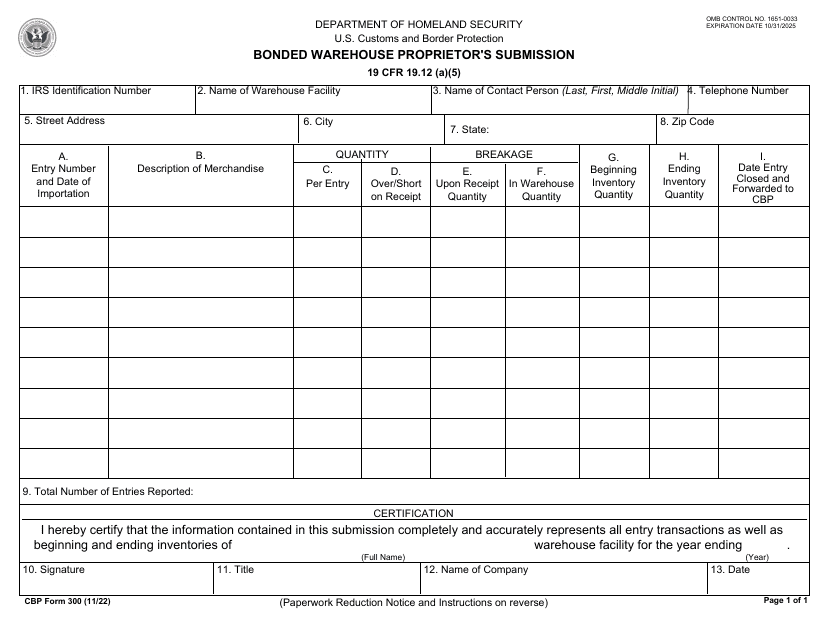

Additionally, the CBP Form 4315 Application for Allowance in Duties is crucial if you believe you qualify for duty exemptions or reductions. This form allows you to request a review of the import duty charges imposed on your goods. Meanwhile, the CBP Form 300 Bonded Warehouse Proprietor's Submission is necessary if you plan to store imported goods in a bonded warehouse before they are released into the country.

Understanding the intricacies of import duty regulations and completing the required documentation can be complex and time-consuming. To ensure a hassle-free import process, it's advisable to seek the guidance of import professionals or customs brokers who can help you navigate the intricacies of the import duty process, ensuring compliance and minimizing costs.

So, if you're looking for information on import duty, import duties, or duty-free importation, this webpage is your go-to resource. Explore our comprehensive guide to understand the documentation required and the steps involved in successfully importing goods into the country. Don't let import duties be a barrier to your international trade activities - equip yourself with the knowledge and resources needed to navigate the process smoothly.

Documents:

12

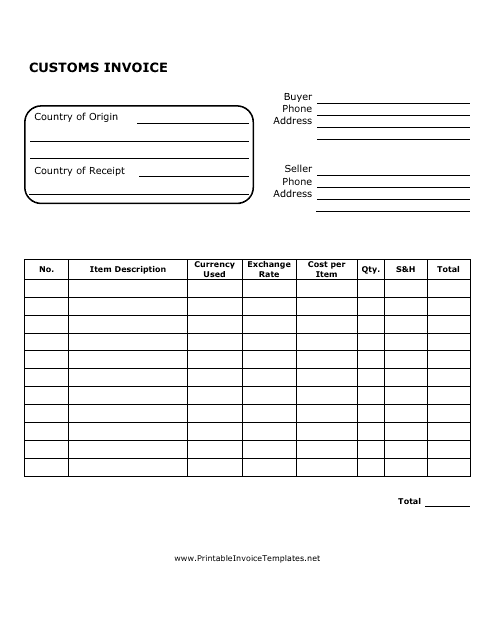

This document is used for recording and reporting the value of goods being imported or exported across international borders. It provides detailed information about the goods, their value, and international shipping details. The customs invoice template helps to ensure compliance with custom regulations and facilitate smooth customs clearance.

This form is an agreement between a principal, obligee, and surety. Fill it out as a proof of payment of fees, taxes, and duties, and to make sure you comply with the law regarding goods and activities.

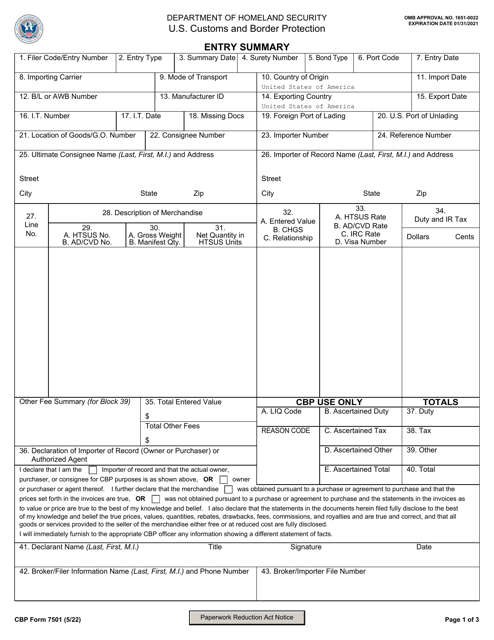

This form serves to describe relevant information about the imported commodity, such as its origin, classification, and appraisement. The information is used to record the amount of tax and duty paid.