Energy Credit Templates

Are you looking for ways to save money while investing in clean energy? Look no further! Our energy credit program can help you take advantage of various incentives and tax credits available for clean energy initiatives. Whether you are a biofuel producer, a participant in the Clean Energy Credit Program, or planning to invest in energy efficiency measures or geothermal energy systems, we have the resources and instructions you need to navigate through the process.

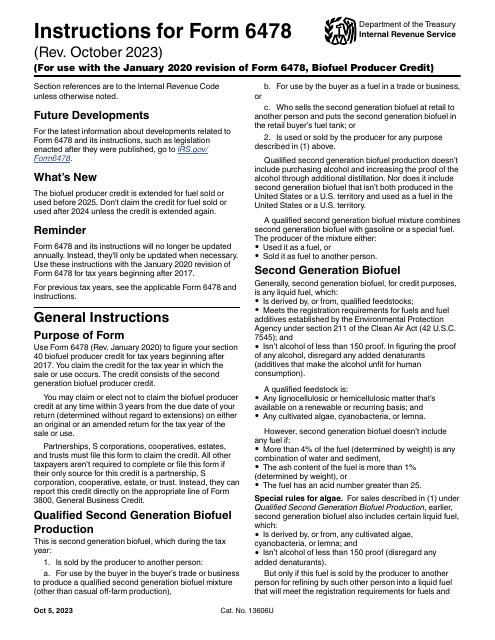

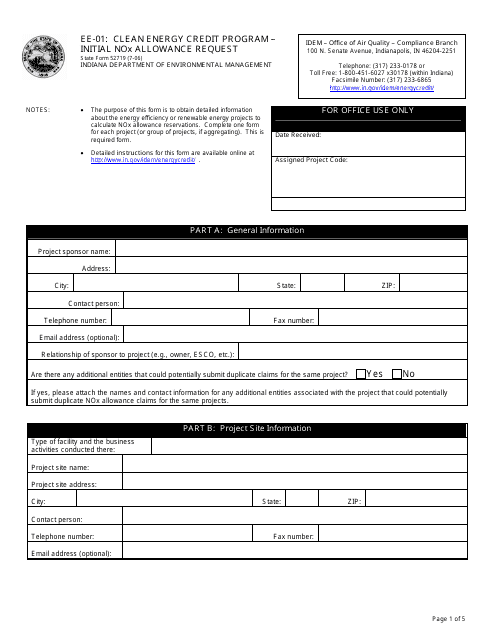

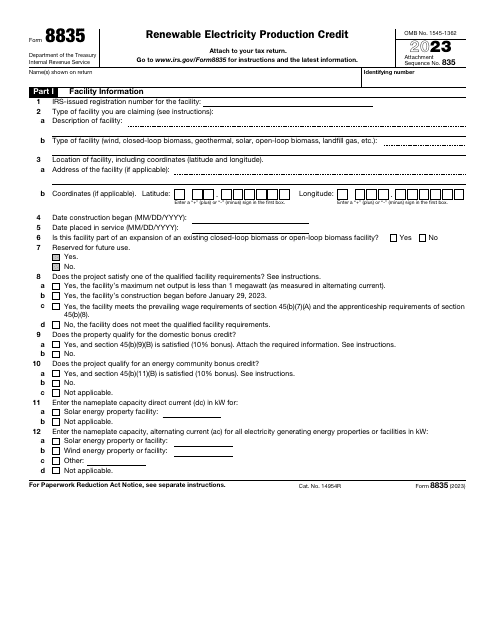

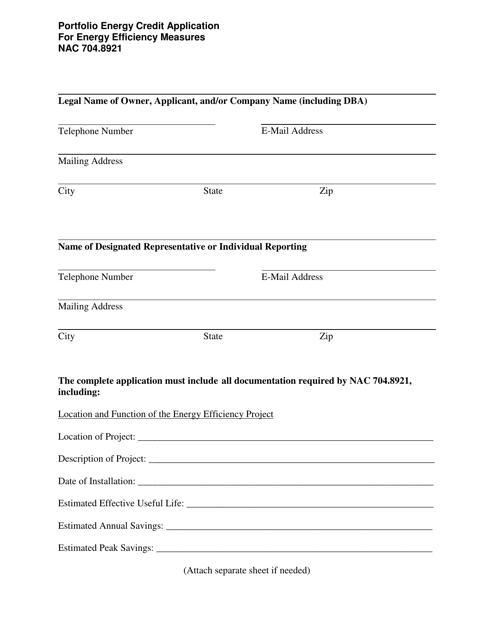

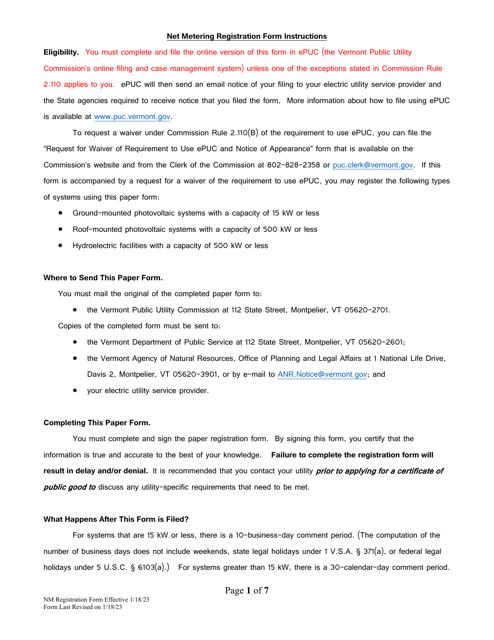

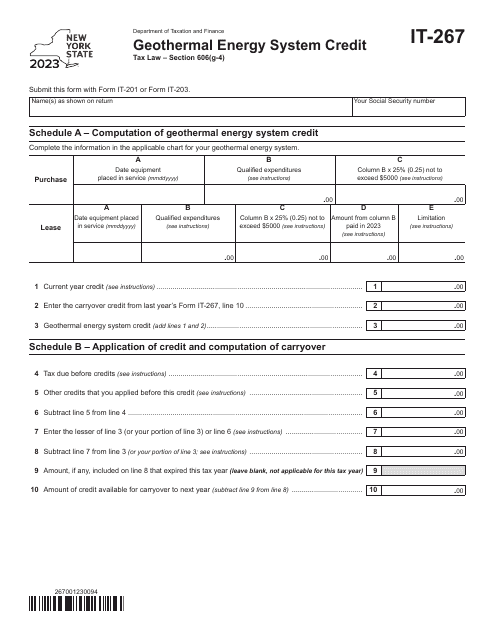

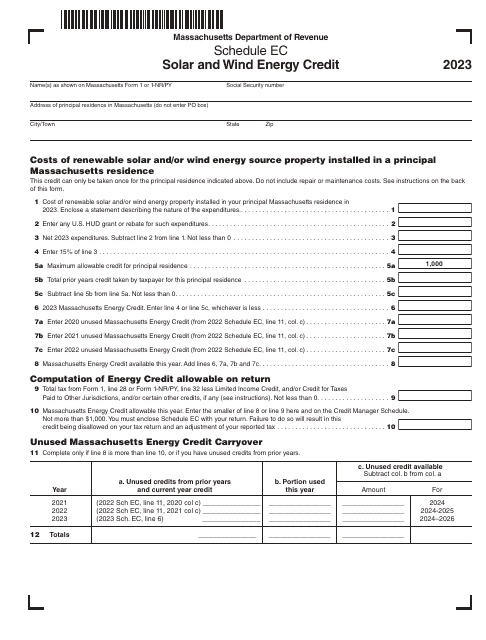

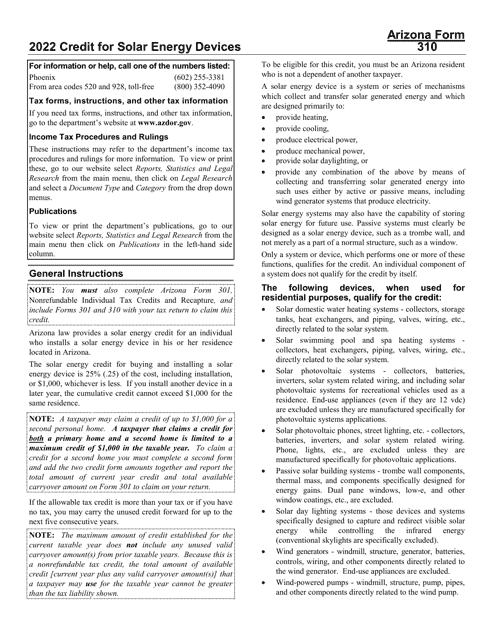

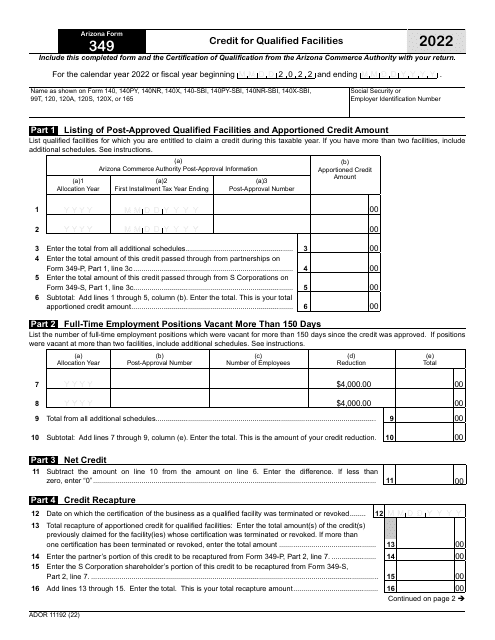

Our comprehensive collection of documents includes IRS forms, state program instructions, and application forms from various states such as Indiana, Nevada, New York, and Massachusetts. These documents provide step-by-step guidance on how to apply for, claim, and maximize the benefits of energy credits.

Also known as energy credits or renewable energy credits, these programs aim to encourage individuals and businesses to adopt environmentally friendly practices by offsetting costs and reducing their carbon footprint. By taking advantage of these credits, you not only contribute to a cleaner and more sustainable future but also enjoy potential financial savings.

Whether you are a seasoned investor or a newcomer to the world of clean energy, our energy credit program has the resources you need to make informed decisions and maximize your benefits. So why wait? Start exploring our collection of documents today and unlock the potential of energy credits for your business or household.

Documents:

9

This Form is used for requesting an initial NOx allowance under Indiana's Clean Energy Credit Program.

This document is an application for portfolio energy credits in Nevada. It is used to apply for credits for energy-efficient measures.