Allocation and Apportionment Templates

Are you looking to learn more about allocation and apportionment for your business? Look no further! Our comprehensive collection of documents on allocation and apportionment is here to help you navigate the complexities of this crucial process.

Whether you are a multistate business, a pass-through entity, or a unitary group, our documents cover a wide range of scenarios and provide guidance on how to properly allocate and apportion income. These documents are designed to ensure compliance with state-specific regulations and assist you in optimizing your tax obligations.

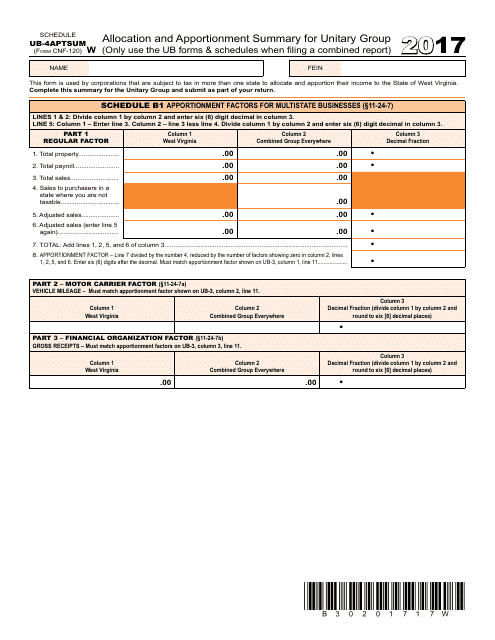

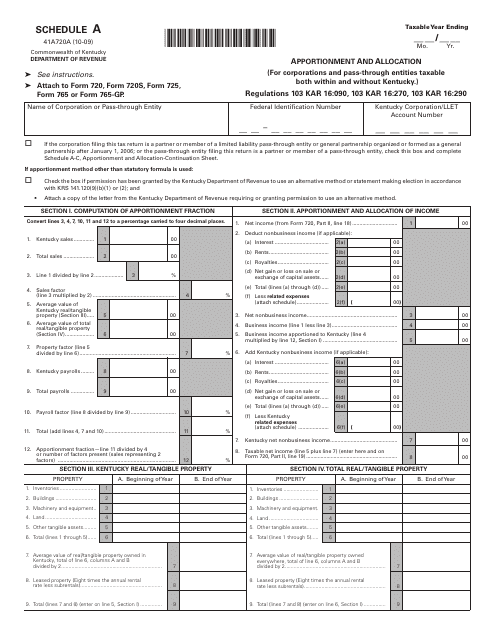

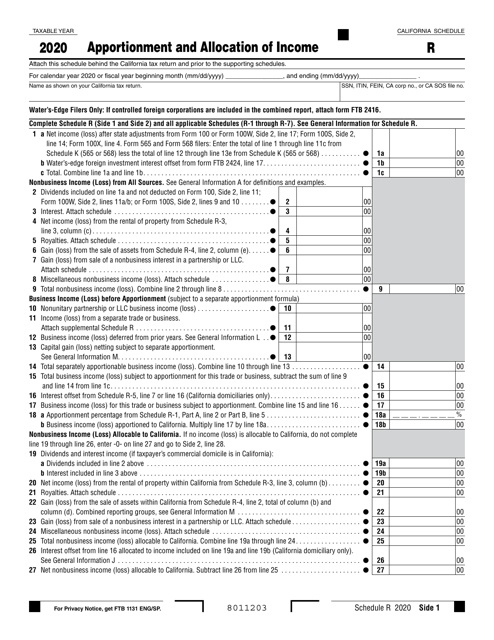

Our collection includes forms such as the Form WV/CNF-120 Schedule UB-4APTSUM Allocation and Apportionment Summary for Unitary Group in West Virginia, the Form 41A720A Schedule A Apportionment and Allocation in Kentucky, and the Schedule R Apportionment and Allocation of Income in California. These forms capture the necessary information to accurately calculate your allocation and apportionment measures.

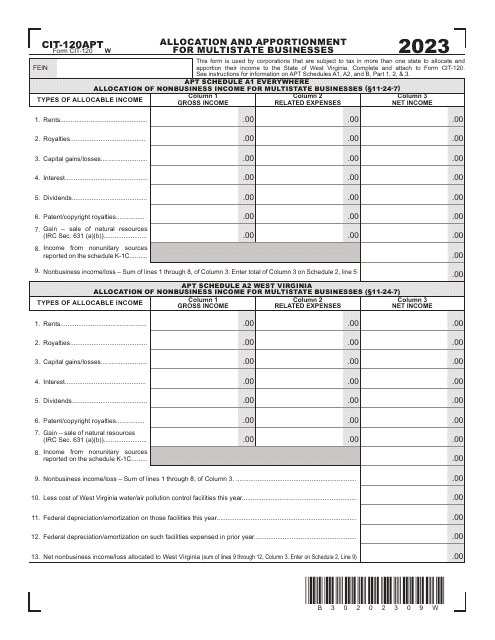

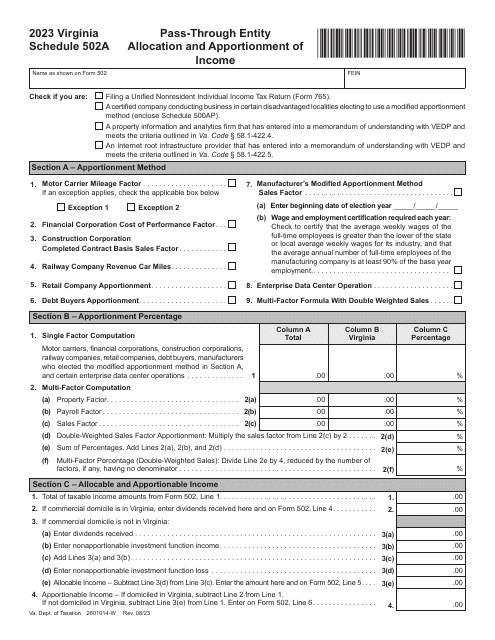

Understanding allocation and apportionment is vital for businesses operating in multiple jurisdictions. The Form CIT-120APT Allocation and Apportionment for Multistate Businesses in West Virginia and the Schedule 502A Pass-Through Entity Allocation and Apportionment of Income in Virginia are just a couple of examples of documents that can help you properly distribute your income in accordance with state laws.

Don't let the complexities of allocation and apportionment overwhelm you. Let our comprehensive collection of documents guide you through the process, bringing clarity and peace of mind to your business. With our assistance, you can ensure compliance, optimize your tax obligations, and focus on what matters most: growing your business.

So, why wait? Explore our collection of allocation and apportionment documents today and gain the knowledge and confidence to navigate this important aspect of your business successfully.

Documents:

5

This form is used for allocating and apportioning income and expenses for a unitary group in West Virginia.

This form is used for apportionment and allocation in Kentucky. It helps determine the percentage of income and expenses that are allocated to the state for tax purposes.

This document is used for apportioning and allocating income in the state of California. It helps to determine how much of a taxpayer's income is attributed to the state for tax purposes.