Loan Originator Templates

A loan originator, also known as a loan origination, plays a crucial role in the lending process. They connect borrowers with lenders, assisting individuals and businesses in securing the financing they need. Loan originators ensure that borrowers meet the necessary qualifications and guide them through the application and approval processes.

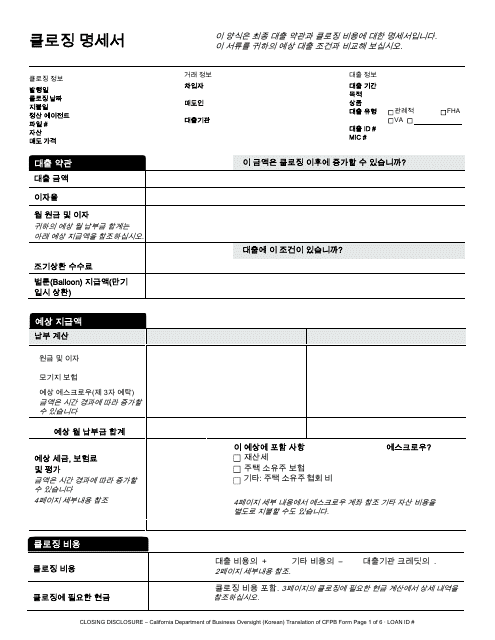

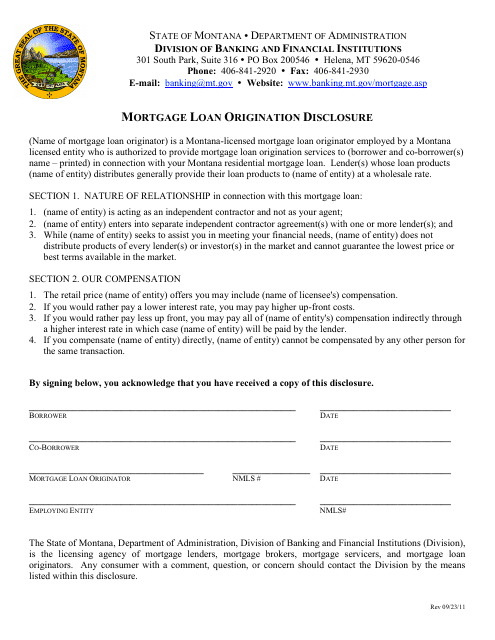

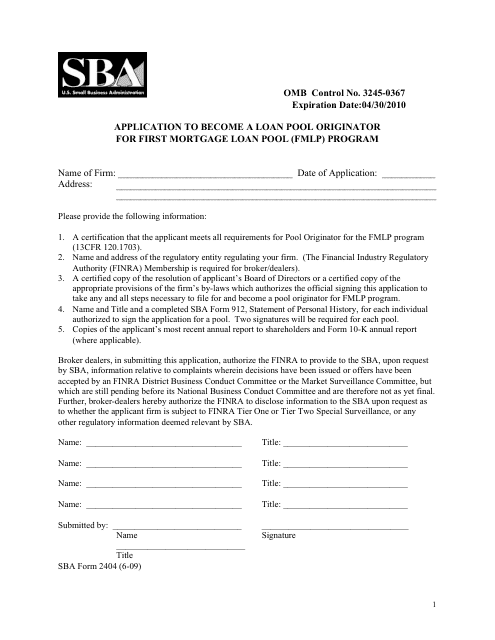

At the heart of the loan origination process are vital documents and forms that must be completed accurately and thoroughly. These essential documents include the Mortgage Loan Origination Disclosure Form, which provides borrowers with important information about their loan terms and conditions. Additionally, the SBA Form 2404 Application to Become a Loan Pool Originator for First Mortgage Loan Pool (FMLP) Program allows loan originators to participate in SBA-backed loan programs that contribute to economic growth and development.

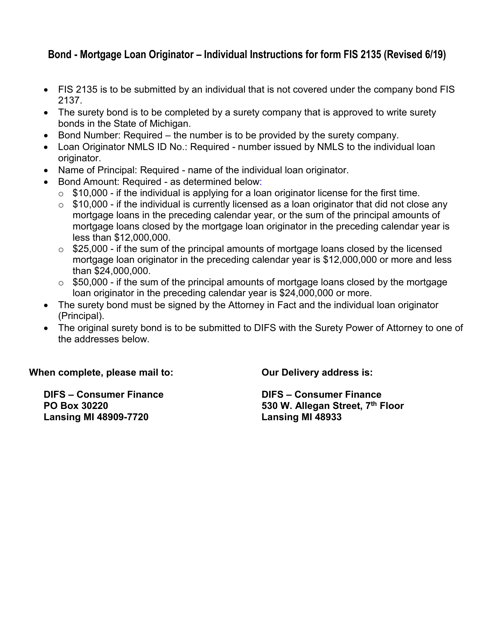

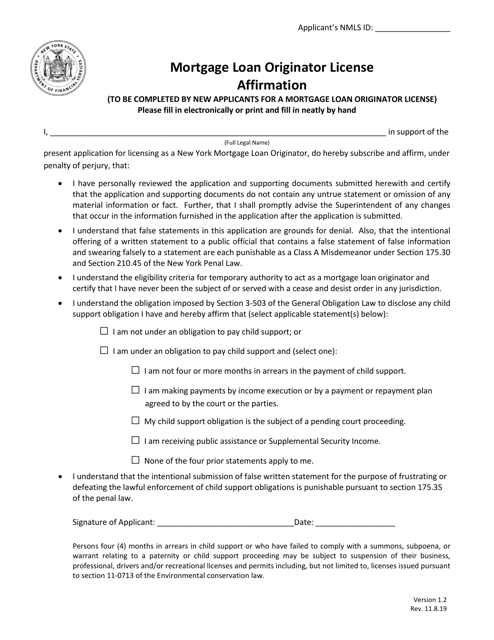

To adhere to state regulations and licensing requirements, loan originators must submit specific forms and bonds. Examples of these forms include the Form FIS2135 Bond - Mortgage Loan Originator - Individual, which ensures compliance with regulations in Michigan. Similarly, the Mortgage Loan Originator License Affirmation is necessary for loan originators in New York to confirm their licensing status.

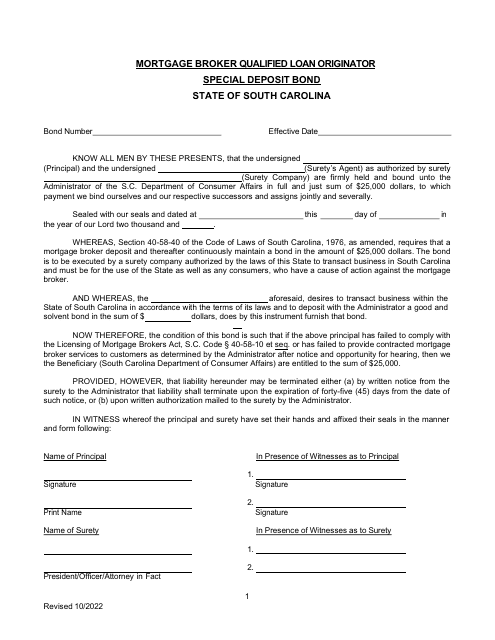

For loan originators operating in South Carolina, the Mortgage Broker Qualified Loan Originator Special Deposit Bond is a critical requirement. This bond protects borrowers by guaranteeing that loan originators handle funds responsibly and ethically.

Loan origination is a complex process that requires attention to detail and knowledge of regulatory requirements. By utilizing the appropriate documents provided by loan originators, borrowers can confidently navigate the loan application process while ensuring compliance with relevant laws and regulations.

Documents:

7

This document is used for providing the final details of a mortgage loan to a borrower in California who speaks Korean. It is required by law and outlines the terms and costs associated with the loan.

This form is used for disclosing important information about the mortgage loan origination process in Montana. It provides details about the terms, fees, and costs associated with obtaining a mortgage loan.

This Form is used for applying to become a Loan Pool Originator for the First Mortgage Loan Pool (FMLP) Program administered by the Small Business Administration (SBA).

This Form is used for individuals in Michigan who are applying for a bond as a Mortgage Loan Originator.

This document is used for affirming the Mortgage Loan Originator License in the state of New York.

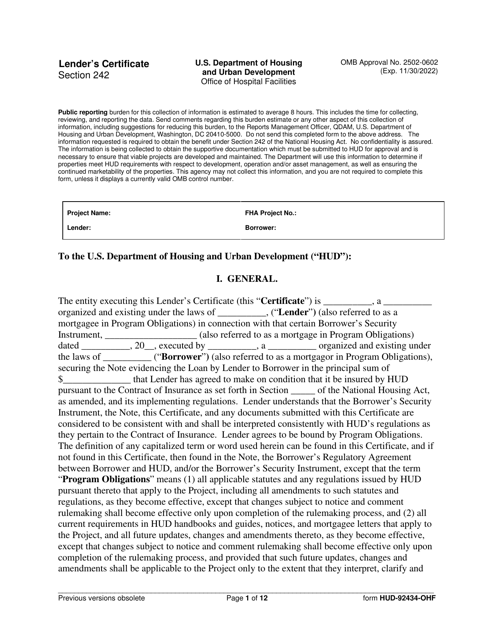

This form is used for lenders to certify compliance with specific requirements for the OneHome Program.