Federal Tax Liability Templates

Are you a US business owner or employer with federal tax obligations? Stay compliant and keep track of your federal tax liability with our comprehensive collection of documents. Whether you're in the agricultural industry or have annual tax liabilities, we have the information and forms you need to ensure accuracy and minimize penalties.

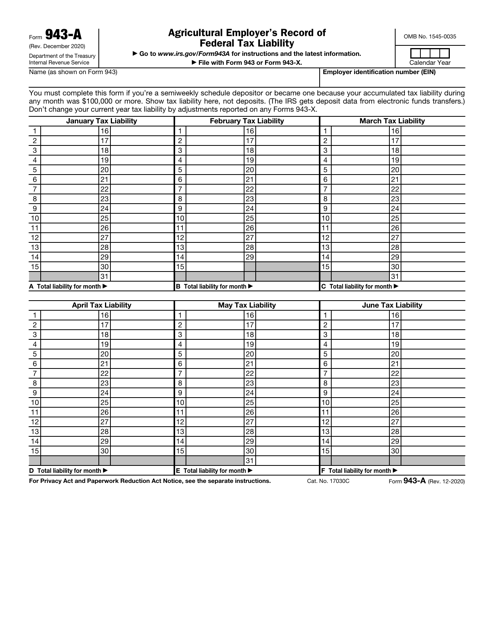

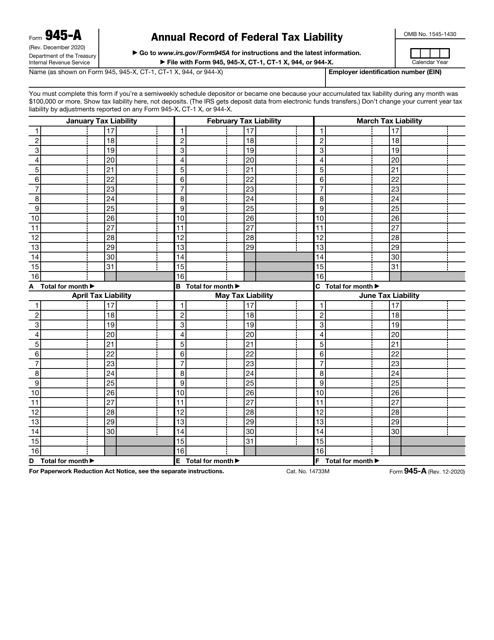

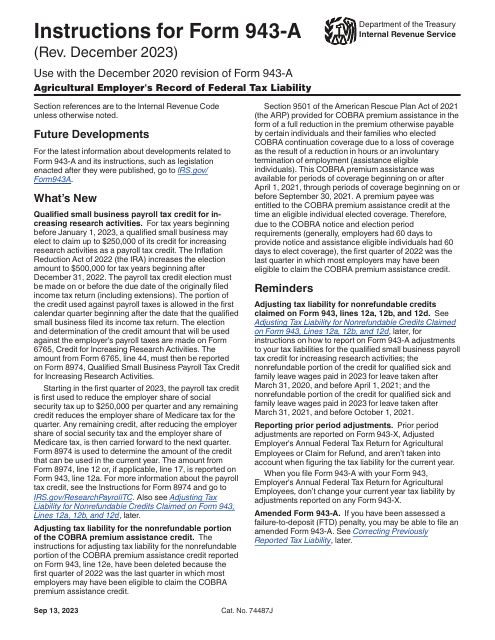

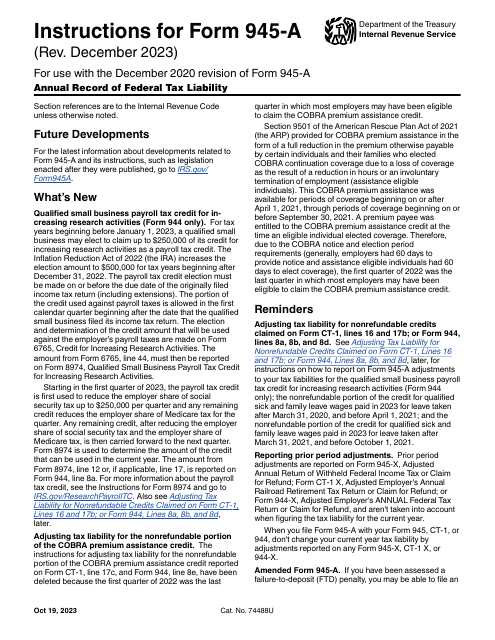

Our Federal Tax Liability documents cover various aspects of your tax obligations. From the IRS Form 943-A for Agricultural Employers to the IRS Form 945-A for Annual Record of Federal Tax Liability, we have you covered. We even provide detailed instructions to help you navigate through the filing process and understand the requirements associated with each form.

Don't risk non-compliance or costly penalties. Access our collection of Federal Tax Liability documents to safeguard your business and stay on top of your obligations. Stay organized, informed, and in control of your federal tax liability with ease. Start using our resources today to simplify your tax reporting process.

Don't let federal tax liabilities become a headache. Explore our extensive collection of federal tax liability forms and resources to ensure accuracy and compliance. With our comprehensive documentation, you can confidently navigate the complexities associated with federal tax liabilities and focus on running your business.

Documents:

9

This is an IRS form used by agricultural employers that deposit schedules every two weeks or whose tax liability equals or exceeds $100,000 during any month of the year.

This is a formal document employers use to reconcile their tax liability over the course of the calendar year.