Debt Settlement Templates

Are you struggling with overwhelming debt and searching for a solution? Look no further than our comprehensive collection of debt settlement resources. Our document templates and forms are designed to help you navigate the complex process of debt settlement and find relief from your financial burdens.

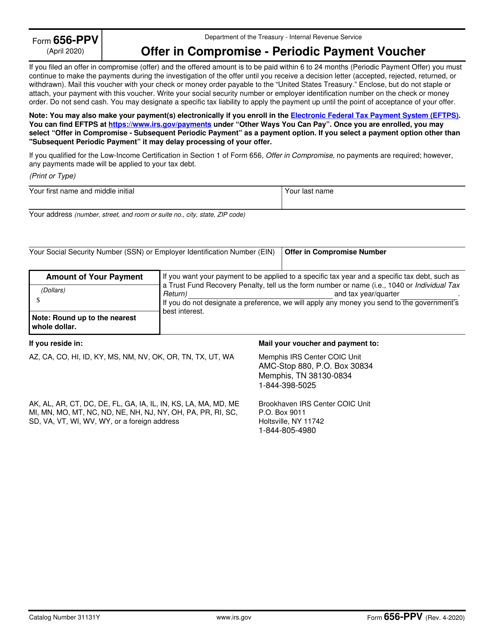

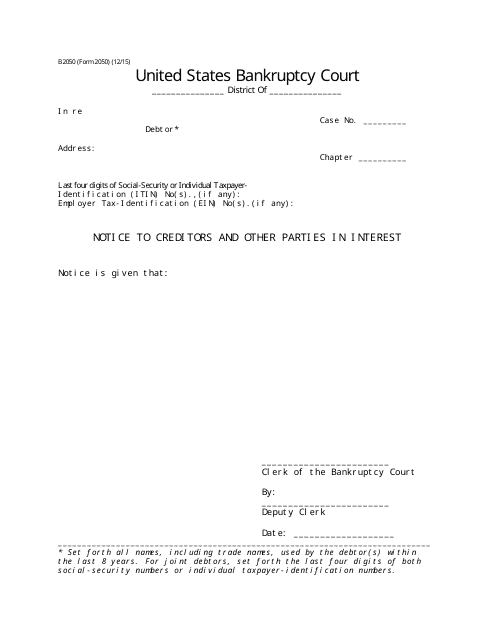

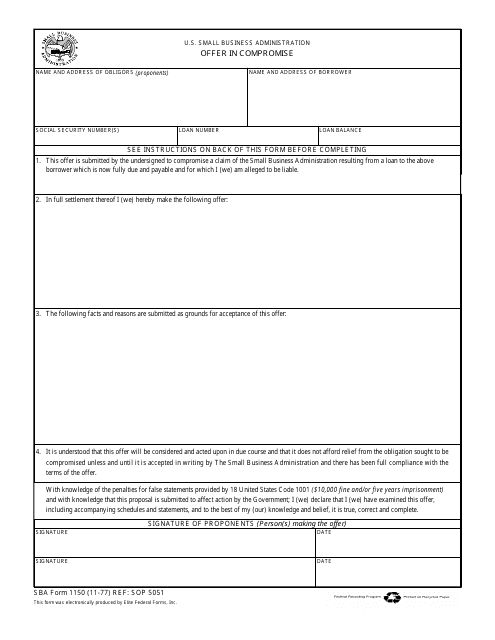

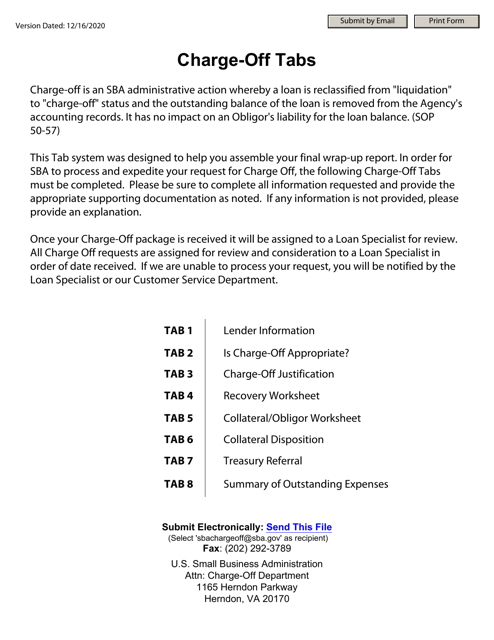

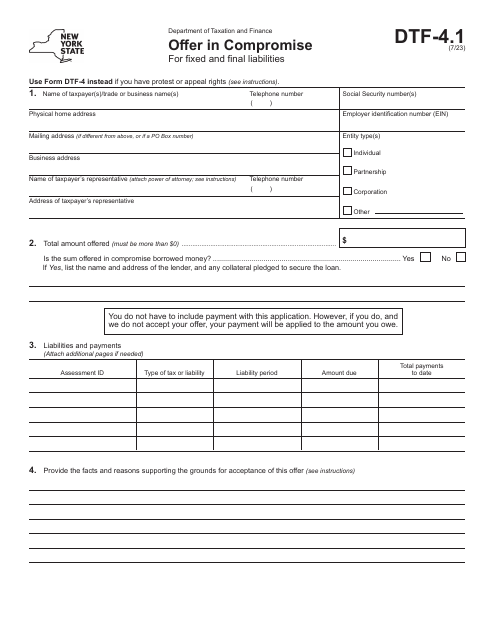

Our debt settlement documents provide a range of options suited to various situations. Whether you are considering a deed in lieu of foreclosure, negotiating an offer in compromise, disputing a debt, or looking to establish an installment agreement, we have the resources you need. Our documents are carefully crafted to meet legal requirements and provide you with a structured approach to resolving your debt.

Don't let the stress of debt overwhelm you. With our debt settlement resources, you can take control of your financial future and start rebuilding your life. Our user-friendly templates and forms make it easy to initiate the debt settlement process and ensure you have all the necessary paperwork in order.

Explore our collection of debt settlement documents today and take the first step towards a brighter financial future. It's time to leave the burden of debt behind and move towards financial freedom. Let our resources guide you through the process and help you achieve the debt relief you deserve.

Documents:

39

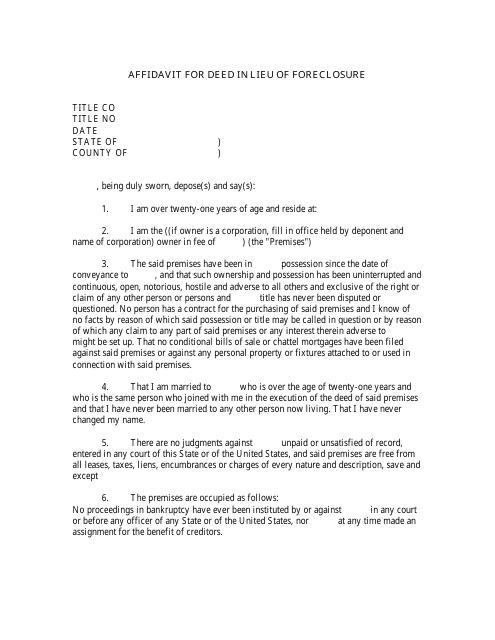

This document is used when a homeowner chooses to transfer their property to the lender instead of going through foreclosure.

This Form is used for reporting fraudulent, abusive, and deceptive practices in debt settlement that pose a risk to consumers.

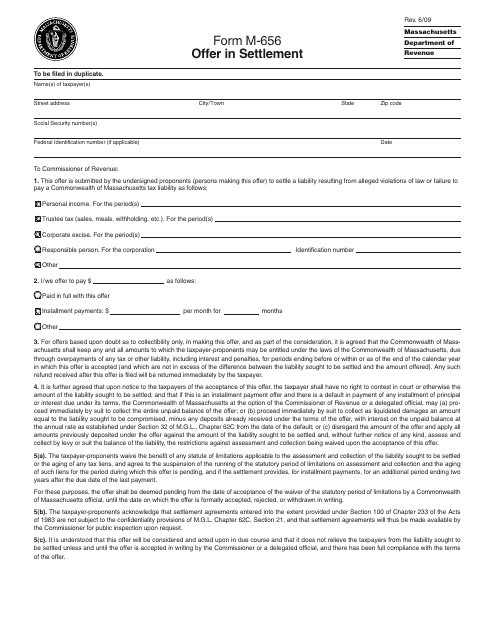

This form is used for making an offer in settlement in the state of Massachusetts.

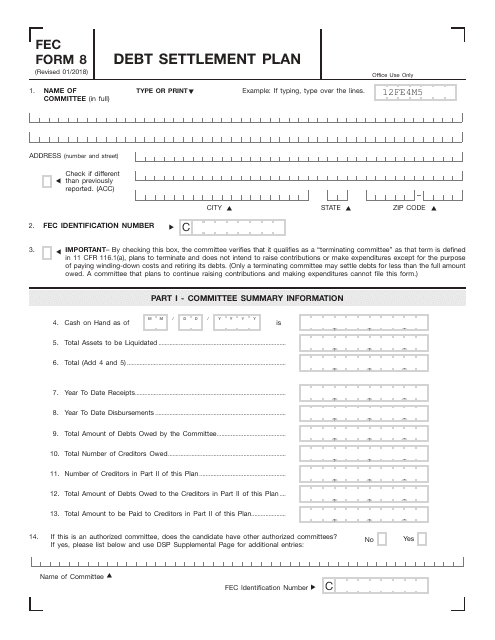

This document is used for reporting a debt settlement plan to the Federal Election Commission (FEC). It outlines the details and terms of the plan for resolving outstanding debts.

This form is used for notifying creditors and other parties in interest about an important matter.

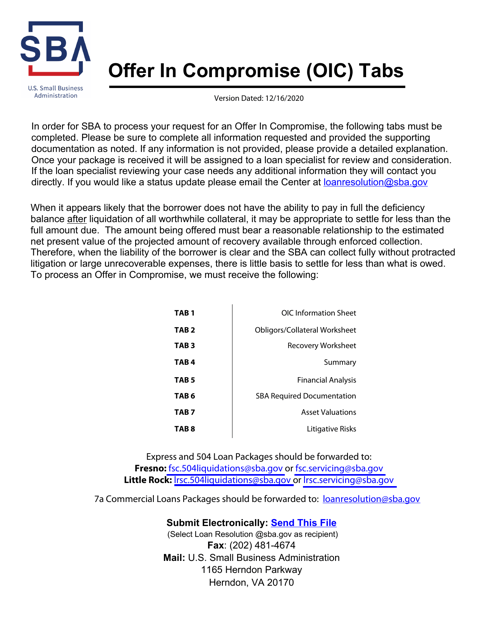

Download this form if you are a borrower who is unable to repay a loan after liquidation and agree to settle with a lender for less than the full amount due.

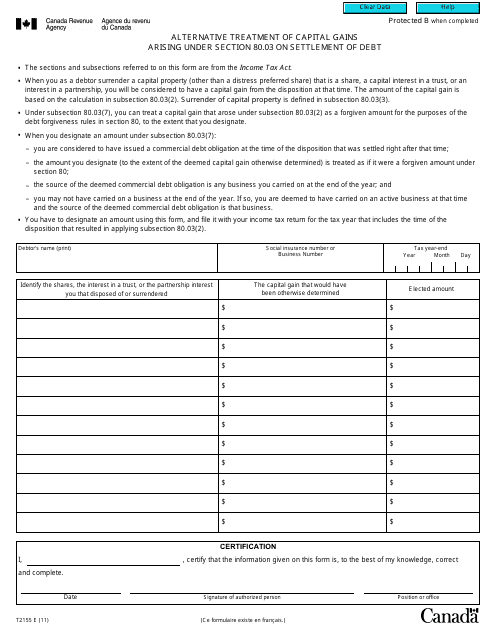

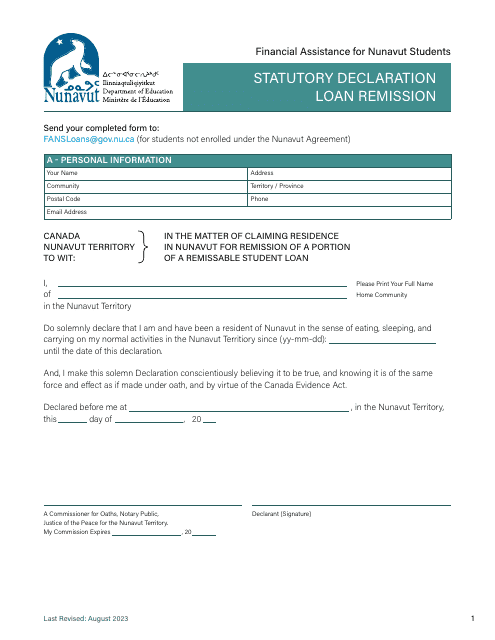

This form is used for reporting alternative treatment of capital gains that arise from the settlement of debt under Section 80.03 in Canada. It helps individuals comply with tax regulations and accurately report their capital gains.

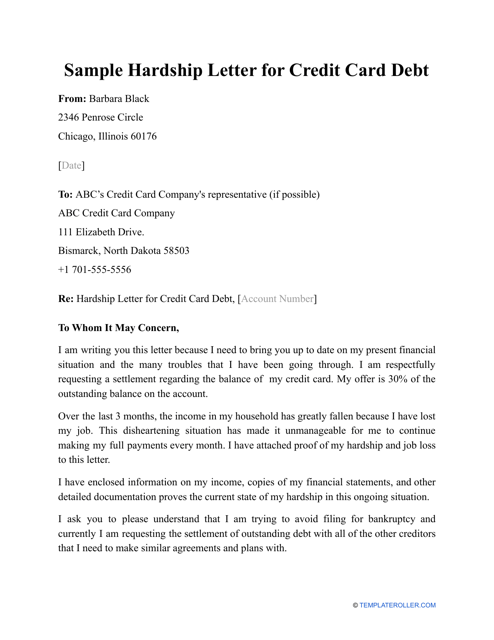

Owners of credit cards can reduce their debt by submitting a Hardship Letter explaining their situation to their credit card company.

This type of debt settlement letter is used by filers who want to decrease the debt on their credit card.

This document's purpose is to help a debtor decrease their debt or change the terms of paying it back in order to make it easier for them.

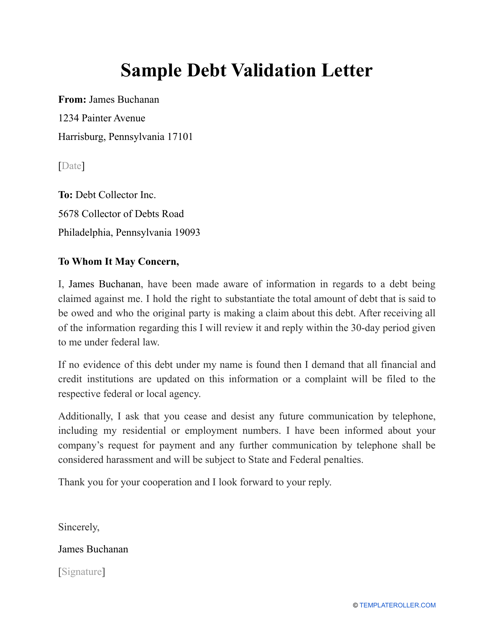

An individual or entity may prepare this type of letter and send it to a financial institution that has notified them about a debt to find out whether this debt is legitimate.

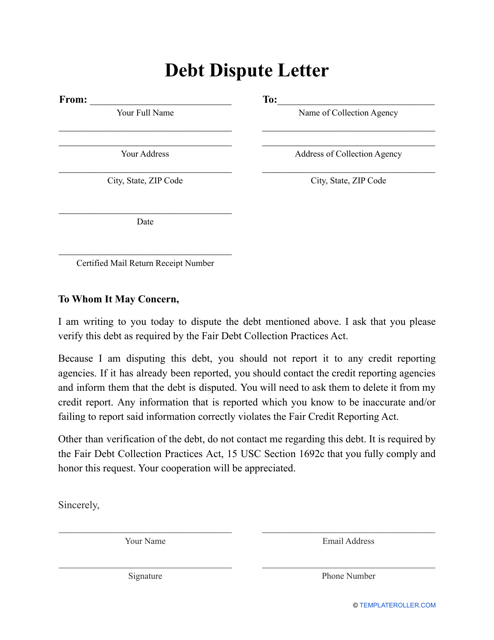

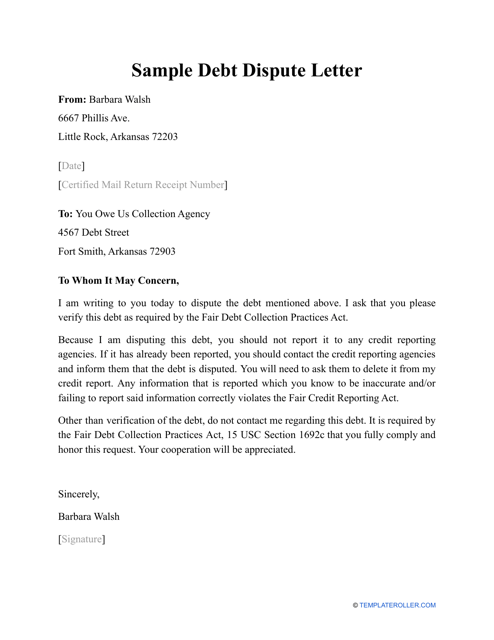

This letter serves as a refusal to accept debt and is written in response to a collector's notice.

This is a written or typed letter that any individual can prepare when they have received a letter from a creditor or debt collector if they do not believe they owe any money or the amount of the debt indicated in the notice is not accurate.

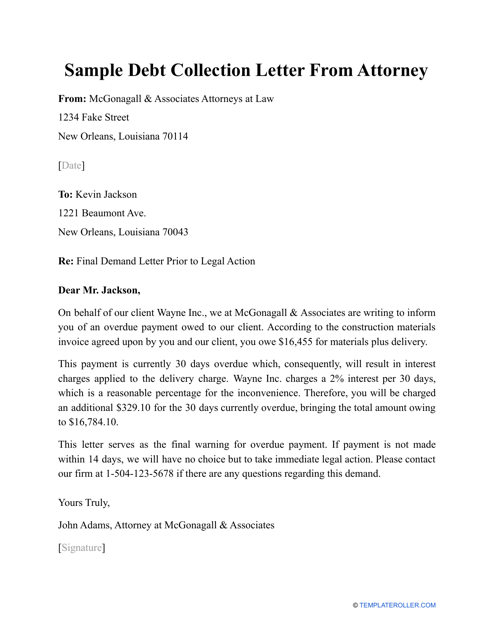

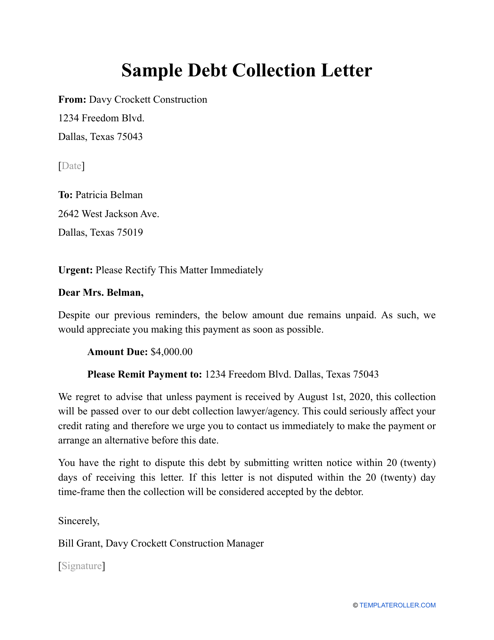

This letter is prepared by the attorney that represents the lender and has a purpose to convince the debtor to pay the money back or face a lawsuit.

A lender can preparer this financial statement and send it to a borrower with the request for them to handle an unpaid debt.

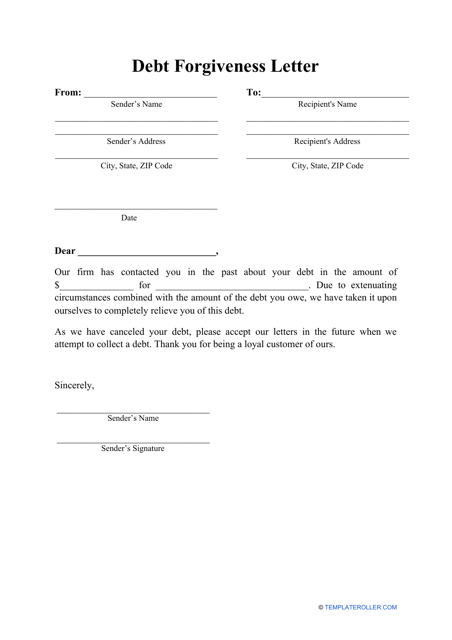

This letter informs the recipient that they no longer have to pay the money owed to their creditor.

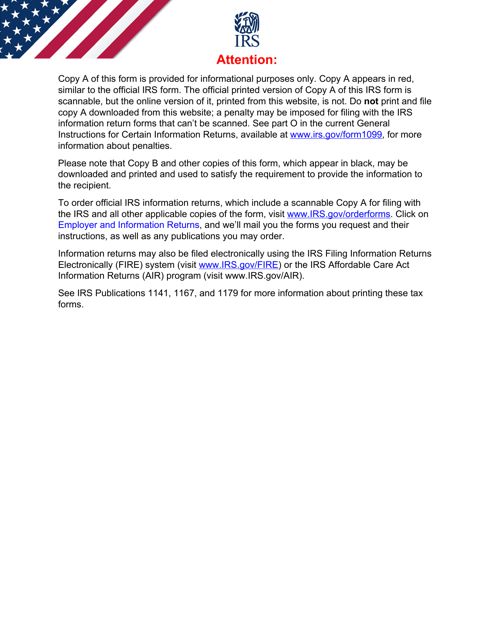

This form is a fiscal instrument used by creditors to inform their debtors about the debts they canceled over the course of the calendar year.

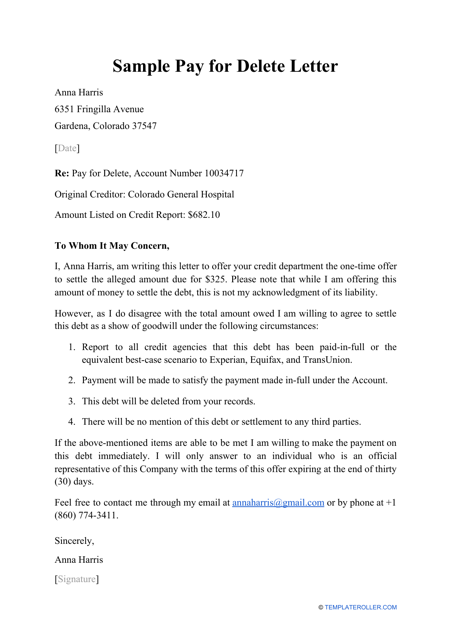

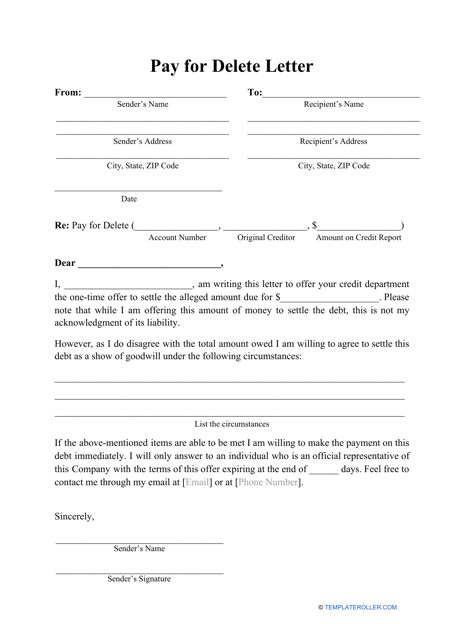

Use this letter to ask a creditor to agree to remove the negative information from your credit report.

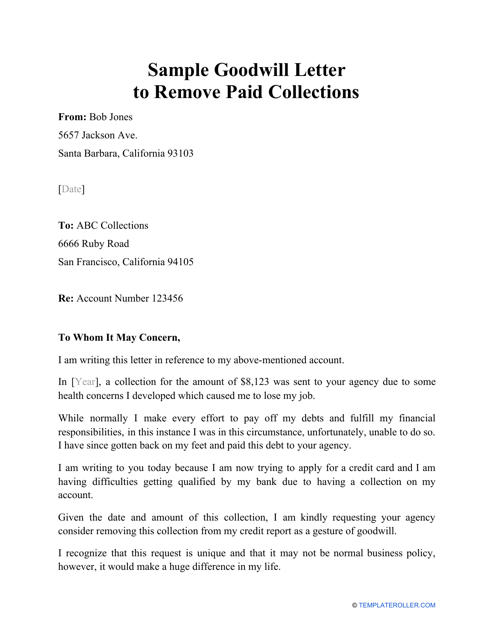

Submit this letter to a collection agency to erase information about debt and improve your overall credit score.

Individuals may use this letter when they would like to remove collection accounts on their credit report.

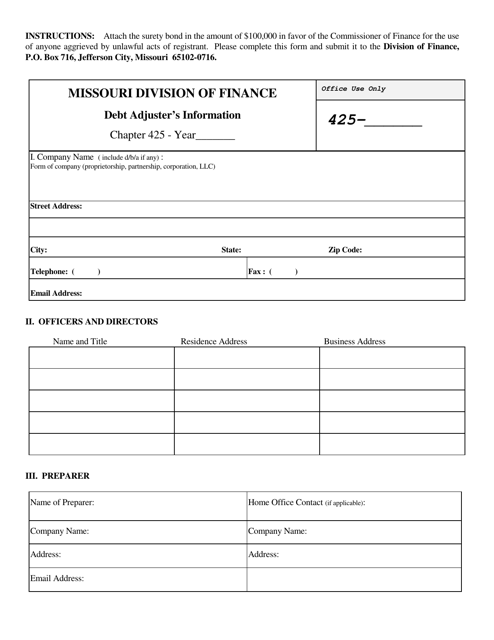

This document provides information about debt adjusters in the state of Missouri.

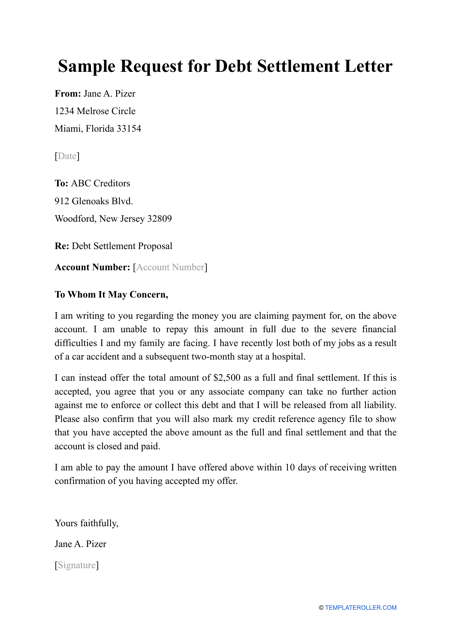

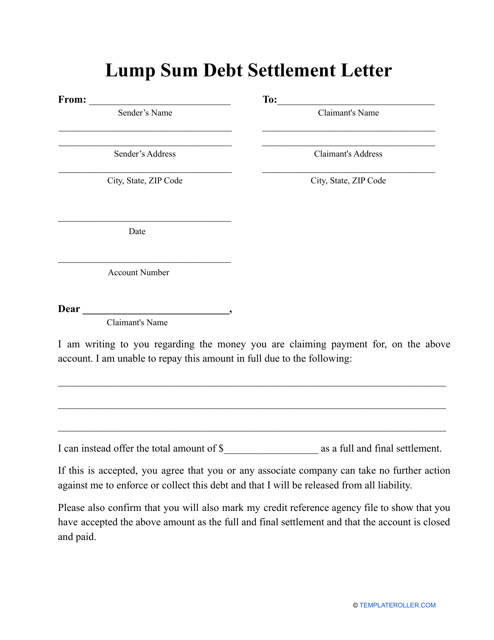

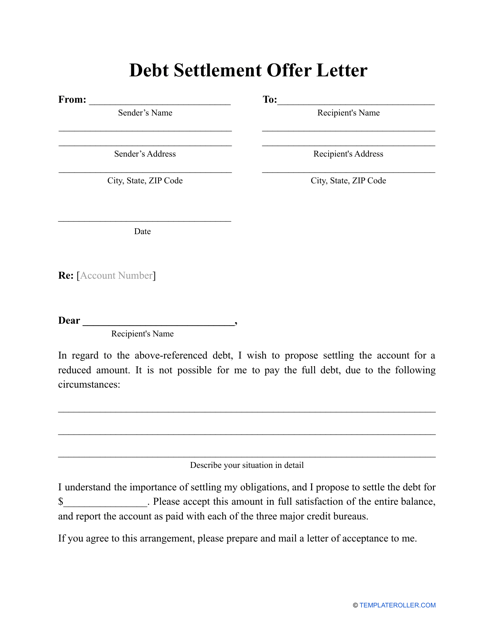

A debtor may use this type of letter as a reference when they would like to offer their creditor a sum of money in exchange for a debt settlement.

A debtor may use a letter such as this and send it to a creditor with the suggestion to pay back a portion of an outstanding debt.

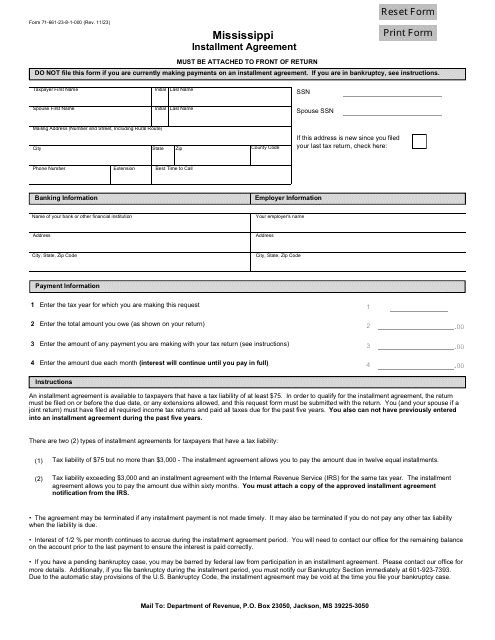

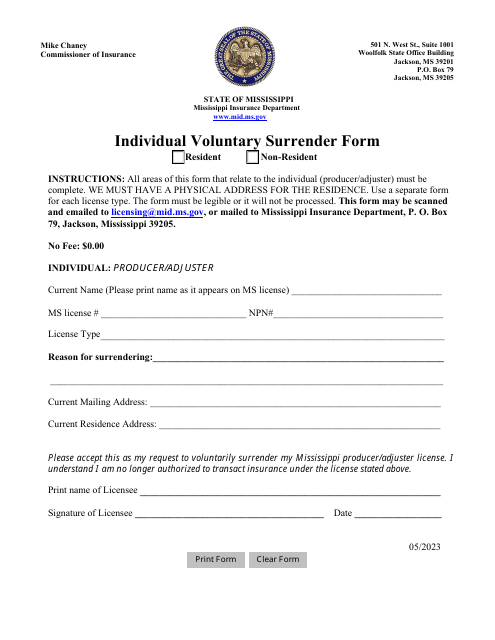

This Form is used for individuals in Mississippi to apply for an Offer in Compromise, which is a potential solution for taxpayers who are unable to pay their tax debt in full.

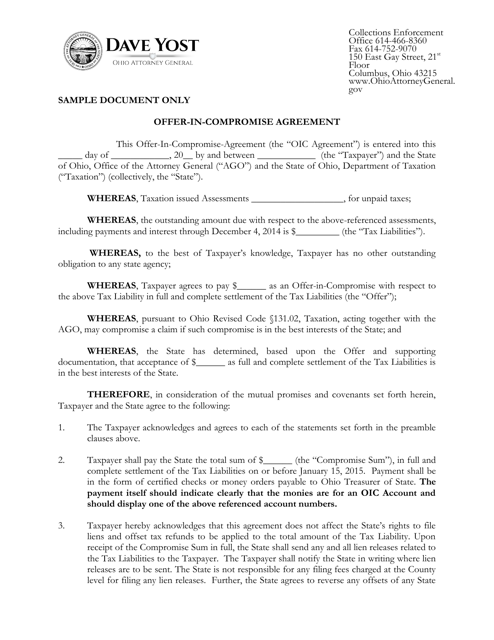

This document is a sample agreement for an offer-in-compromise in the state of Ohio. It outlines the terms and conditions for settling a tax debt with the Ohio Department of Taxation.

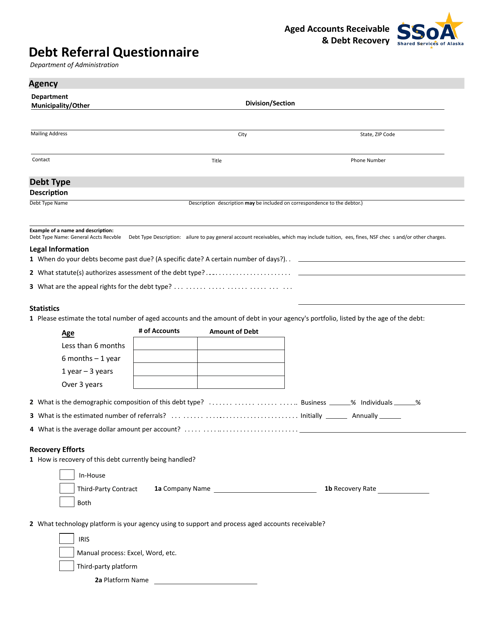

This questionnaire is used to assess the financial situation of individuals in Alaska who are seeking assistance with their debt. Answering the questions will help identify the best referral options available to help manage and reduce their debt.

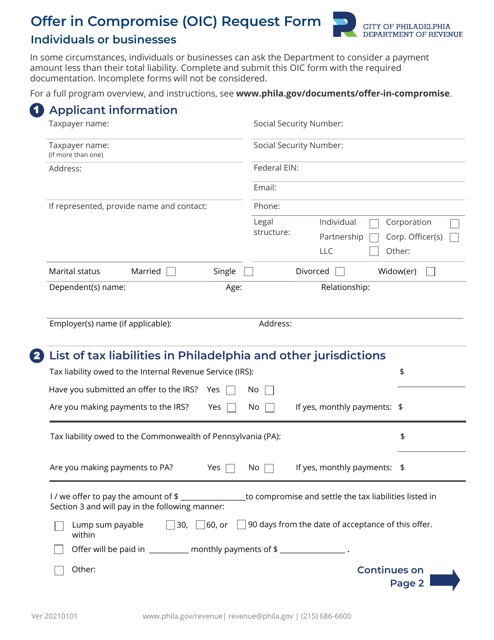

This form is used for requesting an Offer in Compromise (OIC) from the City of Philadelphia, Pennsylvania. An OIC is a way for taxpayers to settle their tax debt for less than the full amount owed.

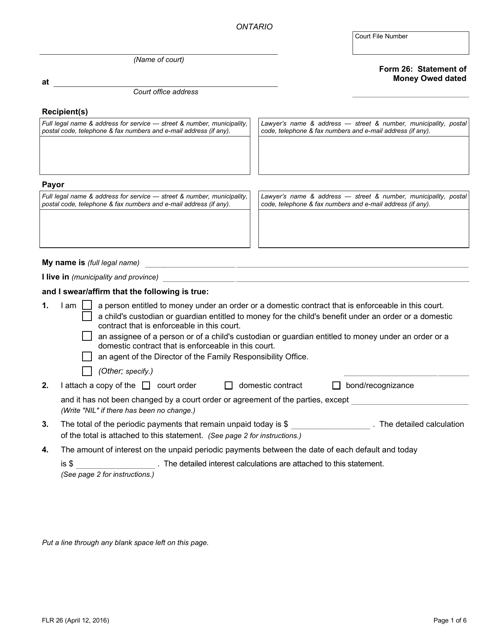

This type of document, Form 26 Statement of Money Owed, is used in Ontario, Canada to disclose any outstanding debts or loans.

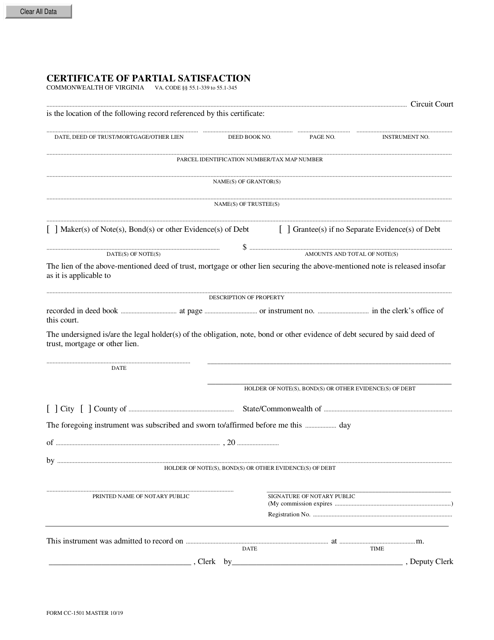

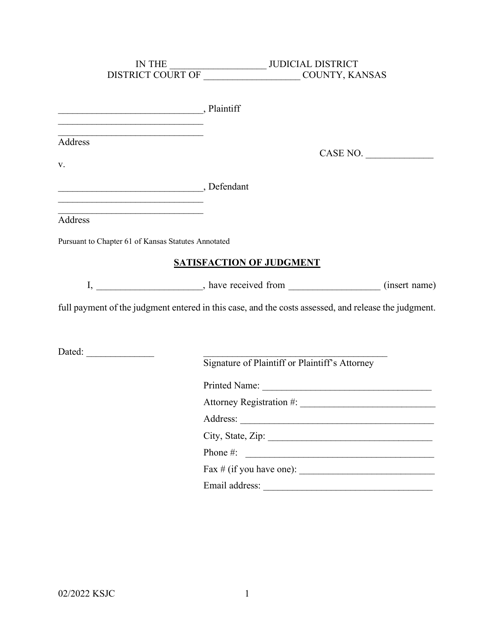

This form is used for certifying the partial satisfaction of a debt in the state of Virginia.

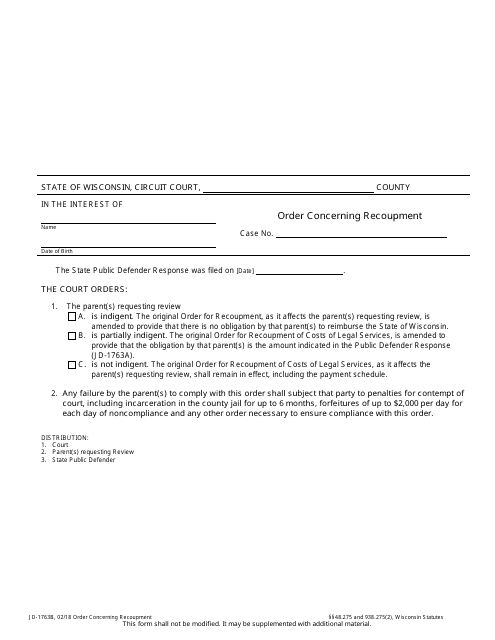

This form is used for obtaining a court order in Wisconsin regarding the recoupment of funds.

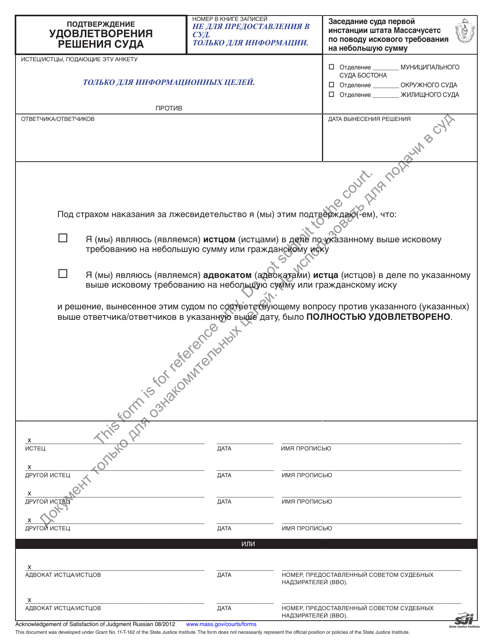

This document is used to acknowledge the satisfaction of a judgment in Massachusetts. It may be written in Russian.